Börsipäev 25-26. september

Kommentaari jätmiseks loo konto või logi sisse

-

Tere hommikust!

Selline teade siis täna Hansapangalt, aastane kasumi kasvu eesmärk poole väiksemaks - niipalju kui mina aru saan puudutab juba ka käesolevat aasta tulemust.

Koduturule investeerijad, olge valvsad, :)

-

Lihtne matemaatika näitab, et see tähendab sellisel juhul dividendimaksete olulist kasvu. Kui kogu tegevuskasum reinvesteeritakse säiliva 20% omakapitali tootluse juures kasvaks ka kasum 20% aastas.

-

Kui kasvuaktsiast on saamas väärtusaktsia, siis see ei pruugi sobida kõigi seniste aktsiasse investeerinute plaanidega.

Vastust ootav küsimus: kui suur osa aktsiaid erinevate taotlustega investorite vahel ümber mängitakse ja mis juhtub selle käigus aktsia hinnaga? -

Lihtne matemaatika: uudis väljas-> aeg osta HP-d :)

-

Mõned teemad tänaseks päevaks:

- JP Morgan tõstab täna hommikul SonicWALL (SNWL)-i reitingu Neutraalse pealt Overweight peale. Analüütikute sõnul kaupleb see tulemüüride ning VPN (virtual private network)-de ehitaja 50% allpool sektori keskmist valuatsiooni (EV/S). Uued tooted, möllavad viirused ning uus juhtkond võivad olla just need katalüsaatorid, mis aktsiad praeguse $6 juures järgmise 12 kuu jooksul $10 hinnasihini viivad. Aktsiad lisatakse ka JP Morgani Fookusnimekirja.

Samas alandatakse teise konkurendi Netegrity (NETE) reitngut Overweight pealt Neutraalse peale. NETE on viimasel ajal palju tõusnud ning kaupleb 20% preemidaga võrreldes ülejäänud sektori tegijatega.

- UBS Warburg tõstab M-Systems (FLSH)-i reitingu Osta peale varasema Neutraalse juurest. Hinnasihiks $20.

- Goldman Sachs tõstab Disney (DIS) reitingu Outperform peale varasema In-Line juurest. Nend arvates võiksid Disney aktsiaid siit 30% tõusta. Seda järgmise aasta jooksul.

- Juba paar viimast nädalat on meil olnud päevi, kus aktsiad ei ole headele uudistele suutnud reageerida. Siis on aga jällegi olnud ülieufoorilisi kauplemissessioone, kus ostetakse isegi halbu uudiseid. See on olnud märgiks, et turuosalised on valmis müüma, kui leitakse piisavalt hea põhjus. Eile oli selleks OPEC-i uudis. September on ajalooliselt halb kuu aktsiate ostmiseks ning üheks põhjuseks selle taga võib olla see, et paljude suurte fondide rahandusaastad lõppevad just siis. Keegi ei taha enam kvartali lõpus (hoiatuste hooaeg lisaks sellele) riskida ning kasumid, mida sellel aastal on päris palju, võetakse välja. Mõned kogenumad turuosalised oleksid oma sõnade järgi ostmas alles järgmise kuu keskpaigas ehk ca 3 nädala pärast. Sinnani oodatakse kukkumist.

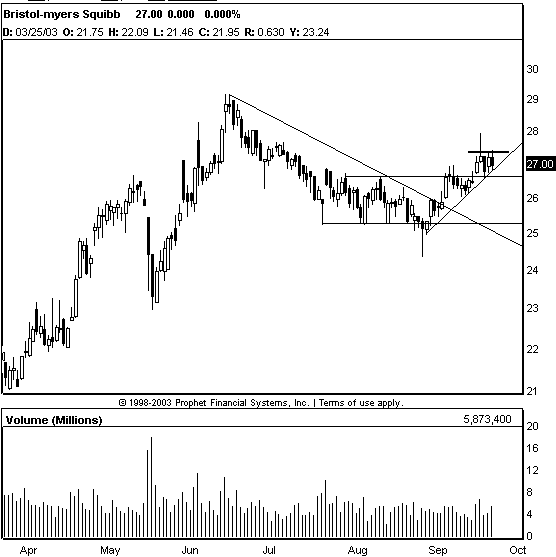

- Bristol-Myers (BMY) avaneb täna hommikul ilmselt poole dollari jagu allpool eilset sulgemishinda. Nimelt teatas firma, et annab välja $1 mld eest vahetusvõlakirju. See toob firmale raha juurde, kuid samas ka lahjendab veidi tulevasi kasumeid aktsia kohta. Kuna firmal on juba enam kui $4 mld eest lühiajalisi vahendeid bilansis, siis tekitab see $1 mld hankimine küsimuse, et mida selle rahakuhjaga peale hakatakse?

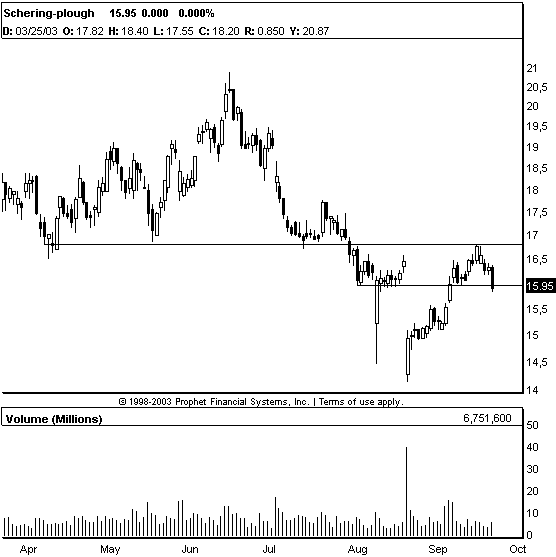

- Ma usun, et Schering-Plough (SGP)-d saab järgmise nädala-paari jooksul veel madalamalt osta.

- Wedbush Morgan (väike analüüsifirma) võttis Vitesse (VTSS) oma Fookuslistist maha ning asendas Maximiga (MXIM).- Deutsche Bank alandas Red Hati (RHAT) reitingu varasema Osta pealt Hoia peale. Aktsiad kauplevad 60x järgmise aasta kasumit aktsia kohta ning ületasid firma $10 hinnasihi.

- UBS alustas Nvidia (NVDA) katmist Neutraalse reitingu ning $17.50 hinnasihiga.

- Gary B. Smith arvab:- Revshark arvab:

Good morning. No one is disputing that yesterday's action was a change for the worst. It was the most powerful selloff we have seen since June. Volume rose sharply, breadth was broadly negative and a number of significant technical breaches occurred.

The market has had a huge run, many stocks are at peak valuations, speculative action has been very high and we are now in the midst of the seasonally weakest time of the year. If you aren't at least a little concerned about some further downside, you aren't paying attention.

It was interesting to see how the popular media attributed the weakness yesterday to OPEC's decision to cut oil production. The logic is that higher oil prices will hurt the economic recovery, which means that stocks are too expensive. That's a nice, simple direct correlation that is easy to understand and explain to Joe Sixpack as he sips his morning coffee.

The truth of the matter is that the OPEC action was simply a convenient excuse for a market that was ready to correct. The media likes to think that news drives the market mood. Actually, it's the mood of the market that drives the way in which news is perceived. Identical news will have a dramatically different impact depending on the prevailing market sentiment. Bad news when the market is downtrending is treated much differently than bad news when there's a market rally.

Technically, this is a market that needs a rest, and sooner or later it was going to find an excuse to do so. Don't be surprised if the market finds other negative news to focus on while it corrects and digests this huge six-month rally.

One of the most troubling aspects of the selloff yesterday was that the hardest-hit stocks tended to be the recent highfliers. Biotechnology issues were particularly weak and the biotech indices suffered major technical damage. Chip stocks, small-caps and Internet issues also saw some severe selling. The fundamentally inclined will tell you that most of these socks should have never traded as high as they did anyway, so a correction is not only appropriate, but overdue.

There is no arguing with that point, but the problem is that these stocks are the best measure of speculative momentum. When the momentum traders are scared out of the highfliers, the repercussions flow through the entire market. If the aggressive risk-takers who trade the most volatile stocks decide to take a rest, how can we be comfortable that more risk-averse average investors are going to support the market by buying the more conservative issues?

In the early going, we are seeing a little bounce but investors look cautious. We have some economic news coming up, which may produce a spike or two. We may see this market bounce, but the risk is now to the downside. After their success yesterday, watch for the bears to become aggressive into any strength today.

Futuurid: Naz SP -

Chat on täna taas üsna aktiivne.

-

Hmm, turuülevaade mailiga viitas täna hommikul avalöögile "Pullid endiselt ülekaalus". Pisut eksitav vist viimaseid börsipäevasid vaadates:) Üldse on kuidagi vanad uudised tihtipeale sinna sattunud..

-

Mõned teemad tänaseks päevaks:

- JP Morgan tõstab viimaks Inteli (INTC) reitingu Neutraalse peale varasema Underweight pealt. Analüütikute sõnul peaks Inteli aktsiaid kõrgest valuatsioonist hoolimata järgmise paari kuu jooksul tõusma.

- Veel tõstis JP Morgan Motorola (MOT) reitingu Neutraalse pealt Overweight peale. Eelturul on aga aktsia 4-5% miinuses. See on üpris halb märk, kui aktsiad heade uudiste peale kukuvad.

- JP Morgani teadetele lisaks tõstis CF First Boston Lam Researchi (LRCX) reitingu Outperform peale varasema Neutraalse pealt. Samas aga langetati konkurendi Novelluse (NVLS) reitingut Outperform pealt Neutraalse peale. Kokkuvõttes siis 3:1 pooljuhtide sektori kasuks.

- Prudential alustab Microsofti (MSFT) katmist Outperform reitingu ning $35 hinnasihiga. PC upgreidi-tsükkel koos MSFT-i uute toodete tsükliga võivad analüütikute sõnul tekitada "täiusliku tormi".

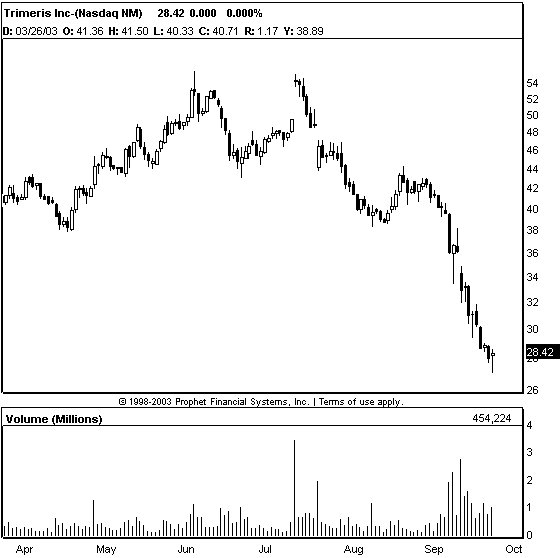

- Trimeris (TRMS) teatas eile, et nende HIV-ravim Fuzeon ei müü nii hästi kui oodatud. Siiski, kui vaadata aktsiate käitumist viimase kuu-paari jooksul võib päris kindlasti öelda, et uudist oodati ammu. Sell the rumor, buy the news. $22-24 võib olla tase, kust esimesed põhjapüüdjad algust teevad.

- Goldman Sachs tõstab täna China Unicomi (CHU) reitingu Overweight peale varasema In-Line pealt. Põhjuseks firma 3G strateegia.

- Bristol Myers (BMY) tegi läbi 4% kukkumise eile. Ühelt poolt põhjuseks tuleviku tulemusi lahjendav vahetusvõlakirjade emissioon, teiselt poolt kuulujutud, mida firma selle rahahulgaga peale hakkab. Palju räägitakse firma soovist osta suurem osalus Imclone System (IMCL)-s (milles praegu omatakse 20% osalust). IMCL poolt arendatav Erbitux peaks saama müügiloa järgmisel aastal ning BMY tahab saada senisest suuremat osa kasumist.

- Gary B. Smith arvab:

- Revshark:The major indices have now experienced their worst two-day period since this powerful rally began back in mid-March. We have had two days of decline on heavy volume with poor breadth, which indicates not just a lack of buyers, but active profit-taking and a bit of fear.

The three major indices have taken out their September lows, and both the Dow and S&P 500 are testing their 50-day simple moving averages. Important trend-line support has been broken in all the major indices.

On the surface, things look pretty grim. Unfortunately, when we dig a bit deeper it's still difficult to find any comfort. The most worrisome thing is that this decline is being led by the stocks that have been the best performers recently. The high relative-strength stocks are falling hard and giving back some big gains. Small-cap stocks, which have been a source of some major winners, are also disproportionately weak.

There are a lot of negatives out there right now, but in the longer run, this is the sort of adversity that will make for a better market in the days ahead. A solid correction that creates some fear and skepticism will help establish a more solid foundation for another up leg in the future. Adversity will serve to make us stronger in the days ahead. There are many folks on the sidelines who missed the rally and are anxious to buy at some point.

In the early going, things are shaky once again. European stocks are weak, and futures are struggling. The analysts have a few upgrades on the wires this morning, but so far it isn't having much impact. J.P. Morgan upgraded Intel (INTC:Nasdaq), Motorola (MOT:NYSE) and Amgen (AMGN:Nasdaq). 3M (MMM:NYSE) and Marvell (MRVL:Nasdaq) also have upgrades.

The University of Michigan sentiment poll numbers for September are due out at 9:45 a.m. EDT and will attract some attention.

There is no question that the last two days have produced a major change in character in the markets. We obviously have to be anticipating further downside in the weeks ahead. However, the likelihood of a strong bounce is very high. We have the end of the month coming up, which is also the end of the fiscal year for many big funds. This will probably lead to some window-dressing in the next day or two.

We also have a lot of folks who have underperformed this market for many months, and they're anxious to boost their performance They're going to be very interested in trying to catch reversals in some of the high-beta (i.e., highly volatile) stocks that have pulled back recently.

At the moment I'm contemplating covering some of my Semiconductor HOLDR Trust (SMH:Amex) and Nasdaq 100 Trust (QQQ:Amex) short into this morning's weakness in anticipation of a bounce later in the day. That is my preliminary thought, but we'll see how things develop as the open approaches.

Short SMH and QQQ

Futuurid: Naz unch SP unch -

motorola kohta oli ju mingi uudis et kaameraga telefon hilineb usa turul ja jõulumüük jääb kehvaks seetõttu ja seega ka kaotus konkurentidele suureneb