Börsipäev 6-7. okt

Kommentaari jätmiseks loo konto või logi sisse

-

Mõned teemad tänaseks päevaks:

- Ericssoni (ERICY) juht andis täna hommikul investoritele lootust sõnadega:

"I believe that we are beginning to see the end of the tough period. There are many signs that the downturn in the market will soon be over."

Esimese hooga hüppasid Ericssoni aktsiad Rootsis 3%, kuid sellega ka liikumine piirdus. Ilmselt on sama lugu liiga mitu korda kuuldud.

- JP Morgan avaldab oma positiivseid emotsioone seoses oodatavate kolmanda kvartali tulemustega telco seadmete sektoris. Lemmikuteks Motorola (MOT) ning Nortel (NT). Oodatakse ka pos. prognoose seoses neljanda kvartaliga.

- First Bostoni analüütikud tõstavad EMS tegijate Sanmina (SANM) reitingu Neutraalse peale varasema Underperform asemele. Lisaks sellele tõstetakse konkurendi Celestica (CLS) reiting Outperform peale varasema Neutraalse pealt.

- Banc of America langetab veidi Applied Materialsi (AMAT) selle kvartali käibeprognoosi ning mainib et nende arvates on tegemist küllaltki kalli aktsiaga.

- Turutegija Knight Trading (NITE) teatas, et kolmanda kvartali kasum aktsia kohta tuleb 13 sendi asemel 16-21 senti. Tegemist on märkimisväärse uudisega ning aktsia on eelturul enam jui 10% plussis. See uudis võib huvi tekitada a) ka maaklerites nagu AMTD ja ET b) Instinetis (INET), mis omab sarnast kauplemismahtudel põhinevat mudelit.

- Motorola (MOT) teatas, et kavatseb oma pooljuhtide operatsioonid ülejäänud firmast eraldada. Aktsiad on selle uudise peale 50 senti tõusnud.

- Barronsi intervjuu on täna hommikul Neal Goldman-ga, kelle riskifond on sellel aasta 60% plusspoolel. Mees on spetsialiseerunud väikestele ning üliväikestele ettevõtetele ning soovitab selliseid nagu LCUT (köögivahendite tootja) ning Industrial Distribution Groupi (IDG).

- Peoplesoft (PSFT) teatas, et kavataseb ületada oma varasemaid kvartaliprognoose. Aktsia on 3-4% eelturul plussis.

- Ei maksaks unustada, et reedene ralli oli paljuski põhjustatud lühikeste positsioonide katmisest. Paljud riskifondid ootasid, et tööjõuturu numbrid on just selleks päästikuks, mis järgmise kukkumise vallandab. Müüjad tulid (tagasi) turule tegelikult juba reede õhtul

- Revshark

A powerful bounce last week left the bears a bit stunned but the hard-core pessimists are now focusing on the historic dangers of the month of October. Five of the 10 worst days for the market have occurred in October, including the infamous crashes of 1929 and 1987. The overall results for the month aren't all that bad but the potential for drama is high.

So do the bulls have cause for worry? Should they be especially cautious right now? We always have to be vigilant but there is nothing in the technical health of the market that should cause undue alarm. We have good breadth, aggressive buyers and a nice dose of momentum. Two week ago it looked like we were ready to crack but the Nasdaq halted its breakdown right at the 50-day simple moving average and bounced with vigor.

The indices have stiff resistance now at the recent highs. The S&P 500 demonstrated this when it hit almost exactly the highs of two weeks ago before selling off in the final hour of trading on Friday.

After the big bounce last week we have some very clear support and resistance levels. Key support levels are the lows from last week and key resistance levels are the highs from two weeks ago. For the S&P 500, that gives us a trading range of 1000 to 1040; for the Nasdaq the range is 1785 to 1913; and for the DJIA it is 9230 to 9686.

Which way are we most likely to resolve the trading range? The big trend since March is still up so we have to respect that and watch for the potential of an upside resolution. The best thing the market could do for the bulls is base out a bit and digest last week's big bounce before attacking the highs.

Today is likely to be particularly choppy. It is the Yom Kippur holiday, which means the ranks of market participants will be thinned. The ability for program trading and macro moves by big funds to jiggle the market will be higher today as overall volume slows.

We have a little carryover this morning of Friday's surge. Asian stocks were generally high overnight but Europe is mostly flat at the moment. News is generally positive and analysts continue to be upbeat.

The key dynamic to watch for as the market plays out is the aggressiveness of the dip buyers. They have been rewarded consistently for buying weakness and they will be inclined to pounce quickly on pullbacks. As long as they are lurking about, it is going to be very tough for this market to produce any sort of sustained pullback.

It should be a tricky day and I'm going to fortify myself with an extra cup of java.

Futuurid: Naz 0.40%, SP 0.16%sB

-

Euroopa aktsiate kohta käivaid uudiseid sirvides jäi veel silma, et Merill Lynch andis osta soovituse SAP aktsiale varasema hoia asemel ja Deutsche Bank ning E-Trade avaldavad arvamust AstraZeneca kohta: esimene näeb võimalust aktsia reitingu tõstmiseks lähemal ajal, teise arvates kaupleb ettevõtte 25% odavamalt sektori keskmisest valuatsioonist, hetkel jäädakse siiski hoia soovituse juurde kuna oodatakse suuremat selgust 1 võtmeravimi Crestor müügiedu osas.

-

Mõned teemad tänaseks päevaks:

- JMP Securities alustab täna pisikese chipitootja Transmeta (TMTA) katmist Strong Buy reitingu ning $5 hinnasihiga. Kuigi TMTA jäi AMD ja Inteliga võisteldes alla on firma suutnud oma operatsioone piisavalt restruktureerida ning välja tulla Efficeon PC protsessoriga, millega firma võiks võita kuni 5% turuosa. Samas peaks aga firma peamine toode Crusoe protsessor oma kasvu jätkama.

- Piper Jaffray alandas LookSmarti (LOOK) reitingu Underperform peale varasema Mkt Perform pealt. Põhjuseks eile õhtul tulnud uudis selle kohat, et MSN (MSFT) ei soovi enam firma otsingusüsteeme kasutada. Viimases kvartalis moodustas aga MSFT 2/3 firma käibest. LOOK sulgus eile õhtul $3 peal, kuid täna kaubeldakse juba $1.3 ümber. Põhja püüdma pole erilist mõtet minna, kuna aktsiad võivad veelgi kukkuda.

- UBS Warburg tõstab täna hommikul Advanced Micro Devices (AMD) reitingu Neutraalse peale varasema Vähenda asemel. Hinnasihiks $5 asemel $12. Analüütikute arvates läheb flash mälu äri hästi ning investorid keskenduvad Athlon 64 protsessorile ning mitte turuosa kaotustele. Minu isikliku arvamuse kohaselt on peamiseks

- Barrons kirjutab suhteliselt neg. maiguga artikli telco eq. tootjast ADTRAN (ADTN). Kõrge valuatsioon, 18% short interest ning sellele aastal tekkinud insaiderite müügisurve näitavad nii mõndagi. Veel 2002. aastal ei müünud firma aktsiaid ükski insaider.

- Tänane päev peaks näitama kas eilsetel ostjatel oli ka tõsi taga. Ise usun, et mitte aga eks õhtul oleme targemad.

- Gary B. Smith

- RevsharkAfter hitting a top on Sept. 19, the market suffered five heavy days of selling out of seven. It looked like the massive rally that started back in March was ready to crack or at least pull back fairly sharply. But the bulls were hungrier than many realized. The Nasdaq found support at its 50-day moving average and bounced back up sharply.

Four straight days of gains have now taken the indices back to within shouting distance of the September highs. The big question to contemplate this morning is whether the bulls still have sufficient motivation and drive to crack the overhead resistance.

Clearly there are buyers out there who want to be in this market, but after the big jump over the last four days, the indices are extended. We are suddenly back near the top of the trading range, and without more of a base it may be difficult to gather the momentum needed to drive to new highs.

The most effective breakouts don't occur when the market has moved straight up like we have done for the last four days. They occur when there is a launching pad of good support. Markets that move up in a "V"-type fashion are more susceptible to quick, hard reversals than ones that have clear, strong support.

The most bullish thing this market could do right now is build a base before making a run at new highs. A few days of pullbacks and/or flat action would help digest the recent move and give the bulls time to gather strength for another leg up.

It looks like we are seeing some digestion of those recent gains this morning. The main culprit looks like the weak dollar, which is hitting a multi-month low. European markets are weak, and Asian markets are mixed.

The economic calendar contains little, and the news flow if fairly quiet in front of third-quarter earnings reports, which kick off in earnest next week. One positive for the bulls so far is that there have been very few preannouncements of earnings shortfalls. We still could see some in the next few days, but overall it looks like expectations are low enough already to prevent major problems.

So we have a shaky start to the day after four days of gains. The dip-buyers will have another opportunity to do their thing. They have been continuously rewarded for buying weakness and have been quick to pounce on even shallow pullbacks. Will they continue that behavior, or will they stand aside and let a pullback develop further?

We have a market that could use a bit of a rest, but plenty of dip-buyers with little fear are anxious to take advantage of weakness. The market should be back at full strength today. The battle lines are drawn. It should be an interesting day.

Futuurid: Naz -0.75% SP -0.55%

sB -

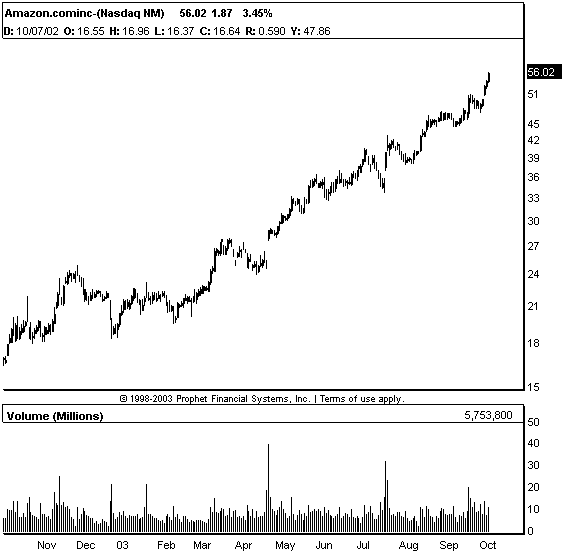

Amazon.com (AMZN) uus 52 nädala kõrgeim tase:

-

sB

-

- Aktsiad ronisid päeva alguse kahjumitest välja ning üritavad 5. järjestikust päeva rohelises sulguda.

- Dollari kukkumine 3 kuu madalamatele tasemetele vs euro hoiab surve all Euroopa turgusid kuigi ka need sulgusid päeva madalamatest kõrgemal.

- Turuosalised toovad välja, et 9-l teisipäeval viimasest 14-st on turud leidnud ostuhuvi just päeva keskel.

- Kuld tõusus ning dollar languses

- Kasiinoaktsiad (MGG HET PPE MBG STN BYD PENN AGY ASCA AZR MNTG) näitavad toibumise märke pärast kahepäevast kukkumist.

- Disney (DIS) näitab tugevust üldiselt nõrgas meediasektoris

- Rambus (RMBS) jätkab tõusu peale eilset kohtuvõitu Infineoni (IFX) üle.

- WEBX, POWI, NFLX, AMZN, FCEL on potentsiaalsed short-squeeze aktsiad. Kõrge short interest näitab, et liiga palju karusid on aktsias sees.

- Kõik alternatiivse energia aktsiad (BLDP; FCEL; SATC; IMCO; PRTN; CPST jt) on üleval, kuna Schwarzeneggeri võitu nähakse pot. pos. katalüsaatorina uue energiapol. juures.

- Eksootilised internetimängud (SINA; CHINA; NTES jt) näitavad üles suhtelist nõrkust. Kas mo-mo aktsiad ei peaks praegu eesrinnas olema?