Börsipäev 10. okt - põhja esimene aastapäev

Kommentaari jätmiseks loo konto või logi sisse

-

Mõned teemad tänaseks päevaks:

- Täpselt aasta aega tagasi leidis viimane karuturg oma põhja.

- Alates 1942. aastast on oktoobris turg (SP) tõusnud keskmiselt 4.9%. Muude kuude keskmine on kokku 4.1%. Eile näitas turg oma tipus 5% kuu tootlust.

- Juniper Networks (JNPR) ületas eile õhtul analüütikute prognoose. Esimene reaktsioon turuosaliste poolt järelturul oli "sell-the-news", kuid peale firma prognooside tõstmist tulid ostjad jälle turule ning viisid hinna dollari jagu põhjast üles ($19 juurde). Analüütikud on täna hommikul reitingute osas päris lahked - hetkel on neid tõstnud vähemalt 3 maja. Eriti tuuakse välja tugevust kõigis geograafilistes regioonides.

Siiski kauplevad maailma 2. suurima ruuteritootja aktsiad ca 10x 2004. aasta prognoositud käivet ning üle 100x kasumit. Väga raske on maksta $7-8 miljardit firma eest, mis teenib järgmisel aastal $70 mln kasumit.

- Merrll Lynch lisab suurima pooljuhtide tootmiseks vajaminevate seadmete tootja Applied Materialsi (AMAT) oma Fookusnimekirja. Hinnasihiks $27.5 järgmise 12 kuu jooksul.

- Deutsche Bank tõstab nii Inteli (INTC) kui ka Texas Instrumentsi (TXN) reitinguid. INTC läheb OSTA peale varasema HOIA asemel ning TXN tõuseb HOIA peale varasema MÜÜ pealt. Tegemist oli ühe suurema karude kantsi langemisega.

- Täna räägib BusinessWeek sellistest aktsiatest nagu RDWR, IMNR ning BYD.

- Piper Jaffray tõstab Ericssoni (ERICY) hinnasihi varasema $16 pealt $22 peale. Analüütikud usuvad, et võrguturg 2004/2005 aastal toibub ning ERICY saab sellest peamise kasu.

- CIBC tõstis RF Micro (RFMD) ning Triquit Semi (TQNT) reitingud Sector Underperform pealt Sector Perform peale. Põhjuseks hea müük mobiilisektoris. Mõlemad firmad toodavad mobiilikomponente. Lisaks sellele on hea mob. sektori elavnemisele mängida selliste aktsiatega nagu REMC, UTSI ning ARXX.

- Gary B. Smith:

- RevShark:

One year ago on Oct. 9 the market hit its bear market low. Yesterday, following strong retails sales reports and lower-than-expected unemployment claims, we broke to new highs before pulling back rather sharply into the close. Despite a 72% move in the Nasdaq over the past year many folks have simply refused to believe in the upside. They have consistently found reasons to be skeptical and cautious.

The fact that so many folks have been waiting on the sidelines for exactly the right conditions before they declare the death of the bear market has helped create a huge group of investors who have underperformed. They are now faced with either sticking to the convictions that have caused them to be left out of the rally or finding a way to catch up. This performance anxiety puts a huge cushion under the market.

Fund managers generally can only catch up by buying long. For most that means that they buy on any weakness. There are funds that chase momentum but many more that want to buy their favorite stocks at lower prices. These dip buyers are the bulls' best friends and have helped prevent any lasting downtrend for many, many months now.

Yesterday's action kicked off the start of earnings season. As I've said a number of times lately we have to be particularly sensitive to the emotional dynamic that develops as the reports roll in. Are expectations such that investors are likely to sell good reports, or buy them?

We saw a very positive reaction to the Yahoo! (YHOO:Nasdaq) report yesterday, which held most of its gains despite the reversal in the overall market. Perhaps that's a sign that while investors are cautious about the health of the overall market they are still anxious to find good individual stocks to buy. They have cash and want to get it into play -- some how, some way.

Lots of folks are uncomfortable about buying this market after the huge run it's had, but they still want long exposure and so they are willing to chase certain stocks that are making solid progress and saying the right things, like Yahoo!. This attitude should eventually lead to a narrower market, which places a premium on good stock picking. Stocks with good growth and reasonable valuations should be a very hot commodity.

The big question we face this morning is whether the intraday reversal yesterday is a sign of more profit-taking to come. Technically the big giveback after all of the good news is not particularly promising. However, earnings season complicates matters greatly. Investors are generally expecting solid reports over the next couple of weeks and are unlikely to sell or short aggressively until the numbers actually hit. Expectations for more reports like Yahoo! are likely to keep this market from rolling over for now. After the earnings reports hit, all bets are off. The only guarantee is that earnings season is likely to be very tricky.

I sold down a lot of long positions yesterday (probably more than I should have, because of the problems I was having with my quote service). There is nothing like unreliability of trading technology to motivate you to move out of the way. In any event I have a lot of cash on hand and I'm going to stick with some shorter-term trades for now. I don't expect to become heavily long again quickly but am very willing to buy when I find the right setups.

We have a positive open shaping up. Intel (INTC:Nasdaq) has an upgrade and Juniper (JNPR:Nasdaq) helped to drive technology stocks. Will the morning strength build, or will investors become cautious as the day progresses?

Futuurid: Naz 0.18% SP 0.06%sB

-

Muuseas, üks turuosaline pakkus välja nn. mirror image e. peegelpildi mõtte - kui 2002. aasta oli üsna halb ja turg leidis 10. okt. oma põhja, siis see aasta on turg olnud väha hea - ehk tuleb 10. okt. tipp?

Väga kauge hüpotees, aga nendest kaugetest hüpoteesidest peab investor või kaupleja oma tervikpildi maalima. -

Aastasele tõusule oleks loogiline jätk pikem kui mõne nädalane langusperiood.

3 kv. tulemuste avaldamise järgne periood enne päris aasta lõppu tundub

selleks igati sobivat. -

- Turg on suhteliselt vaikne, kuna nädalavahetus on juba lähedal. Indeksid püsivad nulli ümber pärast eilselt päeva lõpu kukkumist.

- Suureks uudiseks on General Electricu (GE) 1. Tulemused ning allpool ootusi tulnud prognoosid. 2. Uudis selle kohta, et ostetakse Amersham (AHM).

- Intel (INTC)-i ning Applied Materials (AMAT)-i reitingu tõstmine ning fookuslisti lisamine hoiavad pooljuhte (SOX) kenasti plussis.

- Eriti tugev on storage ning sektori sees eriti tugev NTAP

- Lennusektor annab eilsed võidud tagasi (XAL, -1.8%), kuna UBS alandas JBLU ning AAI, AWA reitinguid.

- Kuld on tugev, kui kaupleb allpool eelmise reede kukkumise tasemeid

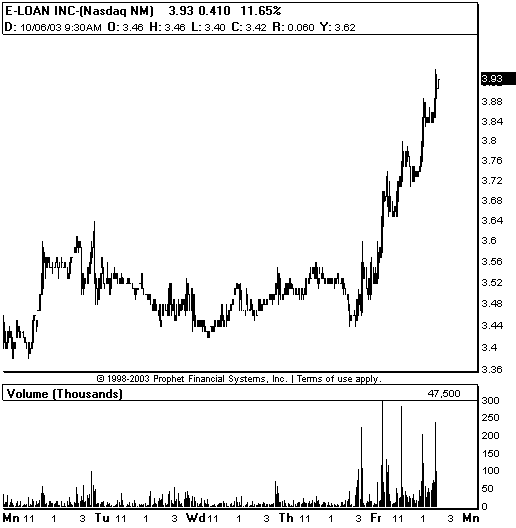

- Hüpoteeklaenudega tegelevad ettevõtted on täna tugevad juhituna kuulujuttudest, et CFC ostetakse ära. Ilmselt on tänu sellele märgata tugevust ka E-Loani (EELN) juures. LEND ka üks väljapaistvamaid.

- Naftaaktsiad on üleval, kuna nafta hind maailmaturul on tõusmas. Täna võeti viimase 6 nädala kõrgeimad tasemed.

- Mõned turuosalised on mures, et kasumivõtmine võib täna õhtul veel aktsiaid allapool tuua. -

Üks mõte:

Dr. Vernon Smith, the 2002 Nobel Prize winner in Economics, is perhaps best known for his work in experimental economics related to investment bubbles.He has shown that new participants in his experiments consistently produce a bubble and a subsequent crash even when the value of the traded asset is well known by all participants. After experiencing the bubble in the first round of trading, participants then trade during a second session. Again, they produce a bubble and a crash, but the second version is smaller than the first. He subsequently asks participants why they took part in the second bubble given their experience with the first. Their response, according to Dr. Smith, is uniform. Participants thought they could make money in the rally, but would be able to get out in time to avoid the losses. -

E-Loan (EELN) alustas koos ylejäänud hypoteeklaenude andjatega rallit. Kuigi näen, et mitmed teist on juba firma aktsiaid ostmas soovitaksin tulemused ära oodata. Ralli p6hjuseks on Countrywide (CFC), mis t6stab oma prognoose 2003. aastaks. Tundub, et laenuäri ei ole veel läbi..

James J. Cramer:

Oops, forgot to cover that Countrywide (CFC). Didn't think it would hurt me that much. Thought it couldn't move like this. Darn it all. Yes, that's what's happening behind this incredible move in CFC, short-sellers who figured, naturally, that the mortgage-origination business has dropped off and therefore CFC must be a goner. To me, this one was always a tough short. You are shorting a company trading at six times earnings with the key variable being interest rates, something you don't control. If rates kept going up, the short might have been an OK one. Once rates started going back down, every short should have covered. It looks like most didn't. -

sB

-

Tõesti vahva päev - mul on 7 kauplemispositsiooni üleval ja ükski neist pole üle 1% liikunud - ilmselt kõik turuosalised passivad tulemusi järgmisel nädalal.