Börsipäev 12 -13. november

Kommentaari jätmiseks loo konto või logi sisse

-

Mõned teemad tänaseks päevaks:

- Smith Barney kuuldavasti tõstis Nokia (NOK, NOK1V) reitingu Hoia pealt Osta peale. Nokia on USA eelturul 2-3% plussis.

- Merck & Co (MRK), üks USA ning maailma suurimaid farmaatsiafirmasid sai Prudentiali käest täna hommikul uue ning märksa kõrgema reitingu. Varasema Underweight asemel soovitavad analüütikud MRK-i portfellis Overweight (Ülekaalus) hoida.

Samas teatas aga firma ise, et katkestab III katsefaasis oleva MK-0869 (depresiooniravim) edasised katsed, kuna ravimikandidaat ei näidanud piisavat efektiivsust. Selle peale on aktsia täna hommikul paar-kolm protsenti all.

Usun, et Prudentali analüütikud tegid väga õigesti, et MRK-i reitingut tõstsid. Usun, et mida aeg edasi, seda rohkem hakkame selliseid uudiseid nägema.

- Wall Street Journal kirjutab aktsiatest, mis võivad investeerimisfonde viimasel ajal tabanud skandaalide tõttu müügisurve alla vajuda. Selliseid fondifirmasid nagu näiteks Putnam, Janus, Strong ja Alliance Capital süüdistatakse keelatud tehingute tegemises ning investorid on nendest fondidest oma raha välja võtmas. Kui raha vooldab fondist välja, peab fond oma positsioone müüma. Ülalpool nimetatud fondifirmad omavad suuri osalusi sellistes firmades nagu CMCSA, LEA, ATN ning JNPR (kõigis üle 19% osalus).

- Banc of America analüütikut teatavad täna hommikul, et EchoStar (DISH) on nende Top Pick. Aktsia kukkus eile päris suurelt kui tulemused ei vastanud turuosaliste ootustele. Täna näeme tõenäoliselt põrget.

- Lexicon (LEXG) teatas, et on leinud geeni, mis kontrollib kõrgenenud vererõhku. $5 aktsiast on selle uudise peale saanud kiiresti $6 aktsia.

- Täna õhtul tuleb oma tulemustega välja Applied Materials (AMAT) ning tundub, et turuosalised ootavad konsensusest märksa paremaid numbreid. Ei maksa unustada, et turg on viimased paar päeva alla tulnud.

"That is why you'll never be a great detective, Cato. It's so obvious that it could not possibly be a trap."

--Chief Inspector Jacques Clouseau

- Gary B. Smith:

- ReVshark:After hitting a high last Friday morning on better-than-expected unemployment news and job creation, the market has been dealing with adversity. The obvious explanation is that the good news had been anticipated and already priced into the market. Since the indices were already somewhat extended it was an opportune time to take some profits.

After three days of struggling, is the market ready to find a plateau and resume its rally? The S&P 500 has not had four down days in a row since the end of March, which is a very clear illustration of how consistently the dip buyers have acted throughout this rally. Is it different now? Have the dip buyers used up their fire power? Are they losing their ability to turn the tide when we have a bout of profit taking?

I'm very hesitant to count out the dip buyers especially when we are entering a time of the year when the market typically sees an inflow of new capital. This is the time of the year when folks make retirement-plan contributions, collect end-of-the-year bonuses and put new capital into the market. Seasonality as well as consistent success favors the continuation of active dip buying.

Even though we had a sell-the-news reaction to good economic news, the bigger picture certainly is brighter. In fact, the concern now is that things are improving so rapidly that interest rate increases are on the horizon. Although the market has been anticipating an economic recovery for some time, that isn't true of a great many individual investors. There still are many who were badly burned three years ago and have been hesitant to embrace the emerging bull market.

There is cash sloshing around out there waiting for an opportunity to join the party. That is the primary reason I feel the recent weakness is simply profit taking and consolidation rather than the slippery slope of a dramatic correction. Perhaps we are seeing the start of a top but it will be a process that unfolds over a fairly lengthy period of time. The dip buyers who have been so tenacious have to taste failure several times before they will give up on what has been working.

Despite three days of selling, the major indices have yet to incur any major technical damage. Pull up a chart going back six months or so and you can clearly see that we remain firmly within an upward sloping channel. There were near-breakdowns in early August and late September but the dip buyers did their thing and produced dramatic V-shaped bounces. I see no reason to assume that it is different this time until there is some clear evidence to the contrary.

In the early going we have a slightly positive open shaping up. Asia was mixed overnight and Europe is struggling primarily because of weakness in financial stocks. The dollar fell to a one-week low against the euro. The gold bugs are getting excited about spot gold making a run at new annual highs. Spot gold is up 80 cents to 388.4 x 388.9.

The economic calendar is light but weekly unemployment claims data tomorrow will be important. We have some important earnings reports in the next couple of days including Applied Materials (AMAT:Nasdaq) tonight, Target (TGT:NYSE) and WalMart (WMT:NYSE) tomorrow morning and Dell (DELL:Nasdaq) tomorrow night.

Momentum stocks took some hits over the last couple of days and traders are feeling a bit skittish. We'll see if they can regain their confidence and pick up the speculative pace once again.

Futuurid: Naz 0.18% SP 0.12%

sB

-

Mõned teemad tänaseks päevaks:

- Applied Materials (AMAT) tuli üle ootuste hea. Käive kasvas võrreldes eelmise kvartaliga 12% 1.22 miljardi dollari peale. Järgmiseks kvartaliks oodatakse 20% tellimuste kasvu. Analüütikud täna hommikul reitinguid ei tõsta (kuna need on juba parimad võimalikud) ning ka järelturu reaktsioon (+3%) oli üpris kesine. Siiski ilmselt piisav, et liiga enesekindlaks muutunud karusid veidi ehmatada.

- Maailma suurima jaemüüja Wal-Marti (WMT) kolmanda kvartali kasum aktsia kohta tuli 46 senti, mis oli 1 sendi võrra madalam analüütikute konsensusest. Käibeks $62.48 miljardit, mis oli vastavuses ootustega. Neljanda kvartali kasumiks näeb WMT 63-65 senti aktsia kohta, konsensuse olles 65 sendi juures.

Lisaks sellele teatas WMT, et avab online muusikapoe, kus hakatakse müüma lugusid odavama hinnaga kui Apple seda teeb oma iTunes-i all.

- Barrons kirjutan, et ka LHV klientidele tuttav Barnes & Noble (BKS) võiks lähiajal veelgi tõusta. Analüütikute sõnul peaksid jõudlud tulema firma joks väga rõõmsad (tulemuste poolest) ning lisaks sellele peaksid inimesed vananedes rohkem lugema. Viimase väitega püüavad analüütikud vihjata Ameerika rahvastikku ees ootavale vananemisele, mis järgmise paarikümne aasta jooksul aset leiab.

"The stock price catalyst could be the Christmas season, since they are going against weak (-3%) comparisons from a year ago." While the stock hit a new 52-week high of $31 on Wednesday, it is still about 35% off its 1998 all-time high of $48.

Mina müüsin oma BKS-i juba $23 kandis.

- Warren Buffetti poolt juhitud Berkshire Hathaway teatas oma SEC-i aruannetes, et on kokku ostnud veel 1.3 mln HCA Healthcare (HCA) aktsiat. Nüüd omatakse neid juba 17.9 mln-t. Tuletan meelde, et tegemist on Tenet Healthcare (THC) suurima konkurendiga. Tundub, et ka Buffett panustab tervishoiule.

- Lazard langetab täna oma reitingut Dell Computer (DELL)-i aktsiatele varasema Osta pealt Hoia peale ning ei soovita kauplejatel neid tänasesse õhtusse hoida. Täna õhtul avaldab DELL oma kvartalitulemused. Hinnasihiks $37.

- Sept trade deficit widens to $41.3 bln vs $40.2 bln consensus

- Initial Claims 366k vs 364k consensus

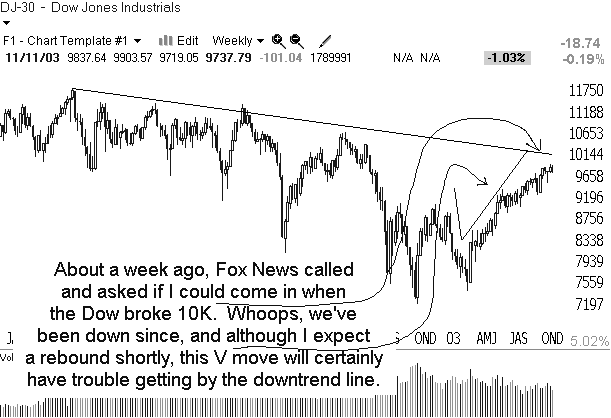

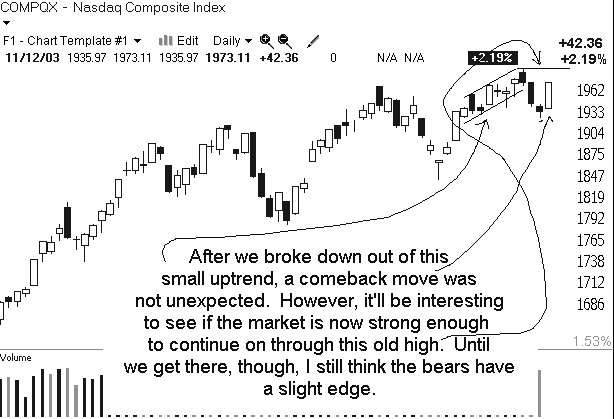

- Gary B. Smith

- ReVsharkThere is no man living who isn't capable of doing more than he thinks he can do. -- Henry Ford.

One thing that makes trading and investing so difficult is that markets have a way of doing more than you think is possible. When they go down, they sink further than seems reasonable. When they go up, they go further than seems logical.

The simple lesson to be learned is that markets are not logical or reasonable; they are emotional and unstable. Markets are nothing more than a crowd of people. As we all know from attending sporting events or concerts, the normal rules of human behavior do not apply when we are in large groups. If we try to predict what a crowd will do based on the reasonable and logical behavior of a single person in isolation we will most likely be mislead. The shy and soft-spoken fellow who lives next door has the potential to turn into a raving maniac when in an excited crowd.

And so it goes with the stock market. You can sit and do cold and hard calculations on valuation levels and the reasonableness of gains but it is as futile as predicting what a teenager might do at a rock concert. The market is not an exercise in calculus. It is primarily an experiment in crowd psychology. One of the most important observations about the stock market ever made was attributed to the economist John Maynard Keynes: "The market can stay irrational far longer than you can stay solvent."

The above is my long-winded way of making the point that if you think this market is going to roll over and go straight down because it's expensive or has already made a big move, you are wrong. It will indeed go down at some point but it will be because of a shift in psychology, not a sudden recognition of the correctness of mathematical calculations.

The action on Wednesday made it quite clear that there are some hungry bulls out there with untapped buying power who want to be in this market. They did a nice job of biding their time for a couple days before pouncing on the dip and driving us straight up all day long.

We had an impressive show of buying momentum Wednesday and the indices are in good shape to make a run at new highs. The three days of losses we saw prior to Wednesday may have been just enough of a consolidation to shake out weak holders and help us build a base that will allow more upside.

The earnings report from Applied Materials (AMAT:Nasdaq) Wednesday night was sufficiently positive to keep the positive mood intact. The big news there is that management expects first quarter orders to jump by 20%. On the other hand, Wal-Mart (WMT:NYSE) missed by a penny and that is tempering enthusiasm a bit.

Overseas markets took their cues from the U.S. and are trading higher. Gold made a big move Wednesday and broke out to new multi-year highs. It is up again this morning, 1.70 and is hitting 395.9 x 396.4.

We have the weekly unemployment report coming up at 8:30 am EST which should move us around prior to the open. At the moment things are fairly sedate, but I have the feeling that the buyers are lurking out there and ready to go to work.

Futuurid: Naz -0.28% SP -0.23%

sB -

Dell Computer reports in line, guides Q4 EPS in line, revs above consensus (35.83 +0.18)

Reports Q3 (Oct) earnings of $0.26 per share, in line with the Reuters Research consensus of $0.26; revenues rose 16.2% year/year to $10.62 bln vs the $10.52 bln consensus. Company sees Q4 EPS of $0.28 vs consensus of $0.28 on revenues of $11.5 bln vs consensus of $11.2. -

Ma juba kontrollisin oma kella ja vaimse tervise korrasolekut, aga jah, Dell avaldas kogemata tulemused enne börsipäeva lõppu.

Ilmselt mingi tehniline viga maailma ühel suurimalt arvutitootjalt (sic!).