Börsipäev 17. nov - paanikat veel ei ole

Kommentaari jätmiseks loo konto või logi sisse

-

Mõned teemad tänaseks päevaks:

- Jaapani Nikkei 225 Average kukkus esimest korda kolme kuu jooksul allapoole 10 000 punkti taset. Põhjusena tuuakse globaalse majanduse elavnemisega seotud probleemid ning geopoliitilised pinged (Türgis lasti õhku paar sünagoogi ning Saddami häälega lint tekitab järjekordset furoori Iraagis). Ükski neist ei tundu eriti tõese põhjusena ning sellepärast tasub seda kukkumist Jaapanis ning Euroopas vaadata kui pigem tehnilist laadi liikumist.

- CIBC World Markets alandab PMC-Sierra (PMCS) reitingu Sector Underperformer peale varasema Sector Performeri asemel. Põhjuseks valuatsioon. PMCS on viimase 3 kuuga üle 90% tõusnud samal ajal kui Pooljuhtide liikumist kajastav SOX on tõusnud "vaid" 30%. P/E suhtarvu järgi kauplevad PMCS aktsiad tasemel 160x järgmise aasta kasumit aktsia kohta. Peamine konkurent AMCC võib saada oma osa tänasest kukkumisest.

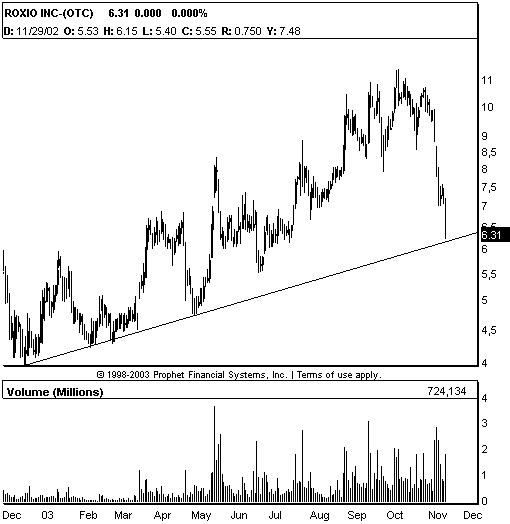

- Wall Street Journal kirjutab, et Microsoft (MSFT) kavatseb internetis muusikat müüma hakata, konkureeridas Apple (AAPL) iTunesi ning Roxio (ROXI) sarnase teenusega. Mäletatavasti teatas ka Wal-Mart (WMT) paari nädala eest, et kavatseb online-muusika ärisse sukelduda.

Siiski vaadates ROXI graafikut, kipun arvama, et halvim on viimasel ajal hinda sisse arvestatud. Mõnikord on nii, et aktsia teeb peale analüütikute reitingu alandamist hoopis põrke, sest hind on juba turuosaliste poolt reitingualanduse ootuses alla aetud. Usun, et $6 kandist tuleb ka põrge.

- Barrons kirjutab, et kleepekatootja Avery Dennsion (AVY) võib olla hea ost. Aktsia on olnud viimasel ajal vägagi nõrk, kuna firma on olnud konkurentsi ning kukkuvate tellimuste pärast sunnitud prognoose alandama. Lisaks sellele on USA Justiitsministeerium firmat uurimas seoses hinnakujundusega. Artikli järgi siiski võib juurdlus olla jooksmas liiva. Samal ajal on juhtkond aktiivselt kulusid kärpinud ning välja tulnud uute toodetega. Aktsiad kauplevad 17x järgmise aasta kasumit aktsia kohta, mis on allpool firma ajaloolist keskmist (21x).

- Homme toimub Schering-Plough (SGP) analüütikute päev, millelt võib oodata positiivse sisuga uudiseid uute toodete kohta. Kuigi ülejäänud turg on miinuses, kauplevad farmaatsiaaktsiad veidi kõrgemal reedestest sulgemistasemetest.

- Vastuvoolu ujuvad veel täna hommikul sellised tech-sektori esindajad nagu CY, ALTR ning XLNX, mis kõik said Lehmani käest uued ning kõrgemad reitingud.

- Kuigi futuurid on miinuses, siis paanilist müümist ma täna hommikul täheldanud ei ole. Siiski näen ja kuulen mitmeid turuosalisi valmistumas kukkumiseks.

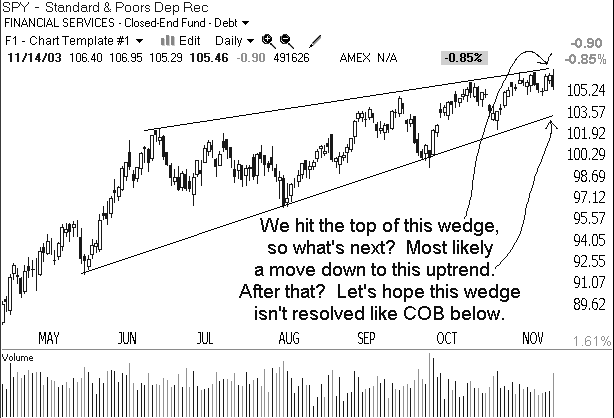

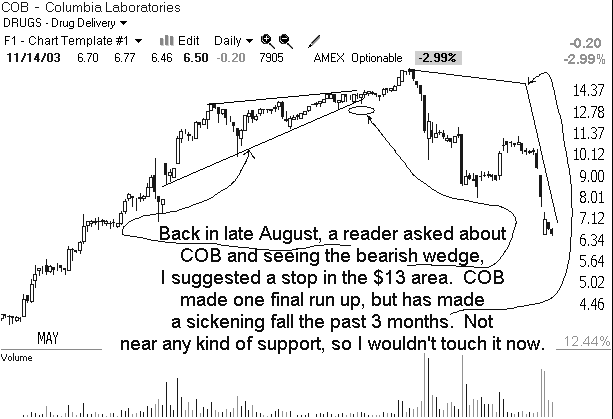

- Gary B. Smith:

- ReVShark:After the Nasdaq sank four of five days last week and finished on a particularly sour note Friday, there is heightened concern about the danger that may be lurking out there. The indices have made a tremendous run over the last year, with few meaningful corrections. They even did a nice job of shrugging off the seasonal weakness that so many expected this fall.

But recently it has become tougher to keep the upside momentum going. The markets have failed to act favorably to the most recent positive economic and earnings news, and last Friday's retail sales and PPI numbers look a bit troubling. Gold has been ramping, the dollar falling. The Tokyo Nikkei has cracked the 10,000 level and is back to where it was in August. There are lots of profits to protect and plenty of concerns about valuations and the high level of speculative trading.

Anxiety about the possibility of a rather severe pullback has increased dramatically after the struggle last week. There was more talk this weekend about a correction than there has been in some time. We are on the verge of cracking important technical support, and the bears are starting to anticipate a descent into the fires of hell that they have been waiting for since October of 2002.

Are we ready to fall apart and end this year-long rally? Is the beginning of the end upon us? It certainly is a possibility, but it is also very possible that this is simply consolidation and profit-taking that will set us up for another run at the upside. This dangerous-looking market can provide some very nice opportunities if your timing is good.

An increase in the level of worry and concern is a definite positive for the bulls. When there is skepticism out there, folks hold back some of their capital. That unused buying power has the capacity to reignite momentum at some point.

Yes, danger is definitely lurking out there, and we have to be careful. However, if weakness plays out and we see some pullbacks, it will offer up some great trading opportunities. I continue to believe that the dip-buyers are out there waiting for the chance to jump on better prices. When we are actually going down, the dip-buyers often become skittish and hesitate. They want to see someone else step up and buy before they do. However, if they are as big of a group as I think they are, then when they make a stand, it is going to create a very quick upward spike.

In the early going we are trading firmly in negative territory. Terrorist actions over the weekend are helping to keep the tone negative. Japanese stocks fell sharply as exporters sold off on concerns about the recent strength in the yen. European stocks are also down across the board as technology stocks struggled.

The pullback in chip stocks last week provided an opportunity for some analyst action today. Merrill upgrades the semiconductor sector to overweight from equal weight, and Dan Niles at Lehman upgrades the sector to positive from neutral. This looks like classic dip-buyers' action. They have watched this group run without them and now are jumping on the first pullback to join the party.

Gold continues to be on the radar of many traders. Spot gold hit 399 this morning but has now pulled back to flat at 397.4. A break through the 400 level looks like just a matter of time.

We have the market equivalent of the Michigan-Ohio State game this week. Good play selection, great execution, tough defense and a little luck will win the game.

Futuurid: Naz -0.82% SP -0.63%

sB

-

Iga uus on unustatud vana - värske kauplemisidee LHV Pro all.

-

remc kukub tugevalt, kas stoptaset võiks langetada või mitte?

-

Poolteist tundi hiljem, ikka reedesed hinnad. Oli kuulda, et varsti on võimalik kaubelda reaalajas.

-

kõigil juhtub

-

Hinnad on välispartneri tõttu portfellis viivitusega, kauplemine toimub endiselt probleemideta (seega reaal-ajas).

-

tänase päeva teemale lisaks

fondiskandaalis mainitud morgan stanley (MWD) lühikeseks müüad said taas vett oma veskile kuna MWD sai kaela veel lisaks ka kohtuasja

Stanley, accusing the bank of biased analyst research during its attempt to acquire the Gucci Group NV in 1999-2001, opened this afternoon in the Paris Commercial Court.

LVMH is asking for 100 mln eur in damages, while Morgan Stanley has responded with a countersuit, claiming 10 mln eur compensation. -

vabandust kirjavea pärast müüjad oleks õige