Börsipäev 26. november - AMTD upgreid

Kommentaari jätmiseks loo konto või logi sisse

-

Mõned teemad tänaseks päevaks:

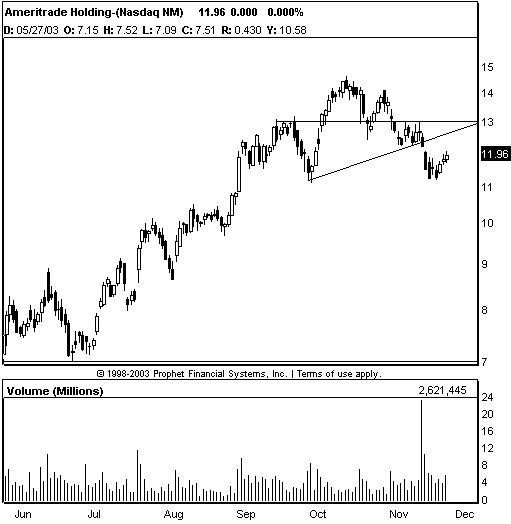

- Merrill Lynch tõstab internetimaakleri Ameritrade (AMTD) reitingu Neutraalse pealt Osta peale. Aktsiad on oma viimase aja tipust 20% kukkunud, kuid analüütikute arvates peaksid kõrgem kauplemisaktiivsus, tõusev varade maht ja klientide arv olema piisavaks põhjuseks, et aktsiaid osta. Hinnasihiks $14.25, mis saadi rakendades firma 2004. aasta kasumiprognoosile 25x kordaja. Konkurendid kauplevad järgmiste kordajate juures: SCH 25x ning ET 15x.

Kui pullid ajavad AMTD aktsiad $13 taseme alla, peaksid karud oma jagu saama tulema:

- JP Morgan tõstab SAN (storage area networks) tarkvara tootja Veritas Software (VRTS) reitingu Neutraalse pealt Overweight peale. Firma aktsiad kauplevad 39x järgmise aasta kasumit aktsia kohta.

- Ultimate Electronics (ULTE), üks Ameerika suuremaid olmeelektroonika jaemüüjaid, tuli täna hommikul välja Q3 tulemustega, mis jäid alla isegi juba 17. oktoobril antud kasumihoiatuse tasemetele.

- Barrons kirjutab täna hommikul ehitusfirmadest. Arikkel on suhteliselt negatiivse maiguga, kuna tõusud selliste firmade aktsiates nagu LEN, TOL jne. on kogu sektori liikumist kujutava SP Homebuilder indeksi viimase 12 kuu jooksul kahekordistanud. SP500 on sama aja jooksul tõusnud vaid 13%. Kuna majandusel tundub minevat paremini võivad tõusvad intressimäärad ehitajate siiani ilusad kasumid ära rikkuda. Võibolla aasta pärast polegi raha enam sama odav kui praegu. Siis võivad need aktsiad päris tubli kukkumise läbi teha.

- CE Unterberg tõstab täna hommikul RF Micro (RFMD) reitingu Short-Term Buy/Long-Term Buy peale varasema Mkt Perform pealt. Peamiseks põhjuseks madalad mob. telefonide laoseisud Aasias ning Ameerikas. Positiivne uudis ilmselt ka Nokia (NOK) jaoks, mis on firma suurimaks kliendiks. RFMD hinnasihiks $15.

- Personal Income +0.4% vs 0.4% consensus; Spending unch vs 0.0% consensus

- Initial Claims 351K vs 360K consensus; Durable Orders 3.3.% vs 0.7% consensus

Turu reaktsioon valdavalt positiivne. Tundub, et vähemalt turu esimene tund tuleb roheline.

- RevShark:

The economic reports out this morning look very solid, particularly the durable goods orders, which were up 3.3% vs. 0.7% consensus. Unemployment claims continue to inch lower but are not reflecting the same sort of strength seen in other economic statistics.The market has been rather sanguine about good economic data lately. We are not seeing particularly strong reactions even though the numbers have been consistently good. The bears will tell you it is because we've already priced in all of the good news. Perhaps we have anticipated this improvement but it certainly helps put a floor under the market when the numbers are this good.

Be ready for a tricky day. Trading will be thin and there is going to be some sharp action in a number of individual stocks.

The past misfortunes of the bear market have been steadily forgotten as we enjoy the present blessings of a stronger economy and a nine-month-long rally. Investors are now struggling with the question of how much longer we can expect the good times to last. The major worry of investors is whether it is too late to join the party. Am I going to miss out if I do nothing, or am I going to catch the top if I chase this market at this point?

As always, we can find compelling arguments for both the bullish and bearish viewpoints. One thing that makes the market so difficult is that very logical but unprovable arguments can always be made for both sides. We can easily find ourselves swayed back and forth as we listen to the arguments.

Rather than become paralyzed by the gurus with their macro arguments, the easiest thing to do is to simply pay extremely close attention to the action that is in front of us. Rather than try to overanticipate what will happen next week, enjoy the blessings of the present but be prepared to act quickly as the picture changes.

Regardless of what worries and concerns there may be about the future, the present is looking pretty bright. The indices have bounced sharply off their 50-day simple moving averages and are closing in on new highs. Small-cap stocks have been leading the charge, and the Russell 2000 is at a new closing high. We have a couple days of trading coming up that tend to be positive, and there is no major negative news to impede that at present.

Yesterday we had a very clear divergence between smaller stocks and the big-caps. The indices were little changed, but breadth was heavily positive, and that was a reflection of the buying in small-caps. Look for that tendency to continue. Investors who feel they are late to this rally are wary of chasing big-caps that they view as expensive. They'd rather bargain-hunt in lesser-known names. It makes for a good trading environment if you are so inclined to play that game.

A lot of traders are looking to play the traditional strength surrounding Thanksgiving, and the early indications are for a positive start. Major overseas markets are positive across the board, with Japan and Germany leading the way.

Today is the busiest travel day of the year, and volume is likely to slow as the day progresses. That may make for some spiky action as programs and big macro funds find it easier to push the market around.

Futuurid: Naz0.81% SP0.40%

-

Koos turu avanemisega ka üks Kiire Idee LHV Pro all.

-

Turul liikus uudis, et 6 New Yorgi metrootöötajat on mingi kummalise aine tõttu haiglasse viidud, ilmselt see viis ka turud miinusesse.

Ehk on müügihuvi taga ka see, et pika nädalavahetuse ajal kardetakse terrorirünnakuid. Kui neid ei tule, siis pärast pühasid võib tulla tubli põrge.