Börsipäev 2. jaanuar

Kommentaari jätmiseks loo konto või logi sisse

-

Mõned teemad tänaseks päevaks:

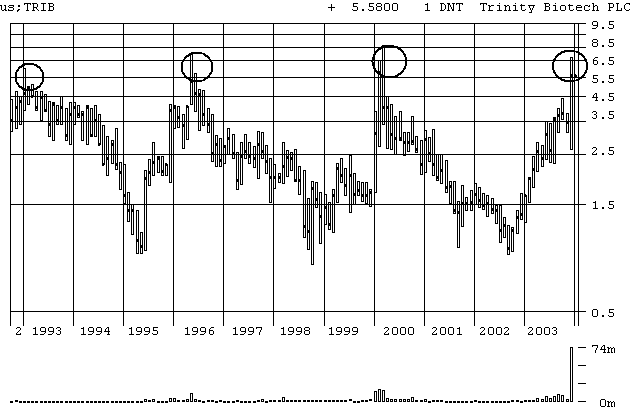

- Viimastel kauplemispäevadel on tõsine ostuhuvi tabanud Trinity Biotech (TRIB) aktsiad. Aktsiad tõusid $3-4 vahelt $7 ligimaile peale seda, kui firma teatas, et FDA on heaks kiitnud nende arendatud HIV-testi. Tegemist on uuelaadse testiga, mis annab tulemused juba 10 minuti jooksul. Varem tuli vastust oodata päevi või iseginädalaid.

Siiski tundub mulle selline aktsia hinna tõus veidi järsuna. Nimelt olid analüütikud FDA uudist juba varem oodanud, mis tähendab, et üllatusena see ei tulnud. Pigem oli tegemist aktsiaid omavate fondide meeleheitliku katsega enne aasta lõppu oma positsioone veelgi veidi "aidata". Ülejäänud turuosalised aitasid asjale loomulikult rõõmuga kaasa.

Vaadates graafikut selgub, et aksiad on $6.5 tasemelt viimase 10 aasta jooksul mitmeid kordi tagasi pidanud pöörduma. Huvitav, kas ka seekord saavad võidu (lühikeseks) müüjad? LHV klientide hulgas neid igal juhul juba tundub olevat.

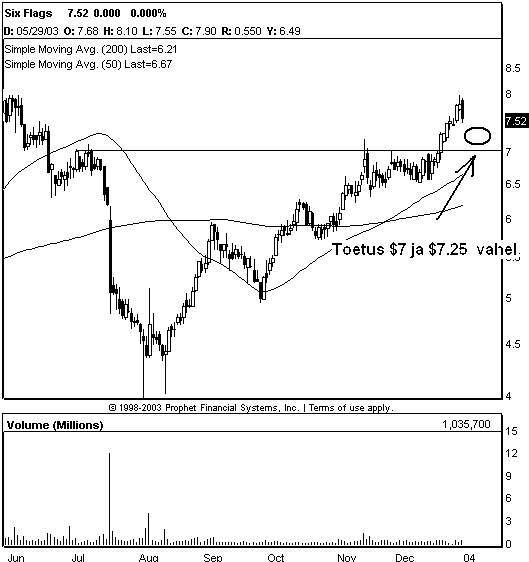

- Six Flags (PKS) peaks leida toetuse $7 ja $7.5 vahelt. Ma usun, et ka praegustelt tasemetelt on aktsiad väga soodsaks investeeringuks. Tegemist on LHV Pro valikuga.

- New York Stock Exchange (NYSE) on välja tulnud uuelaadse jälgimissüsteemiga MarkeTrac, mida saab proovida siin (http://marketrac.nyse.com/detector/detector.html). Efektne näeb välja, kuid kasuteguri kohta kommentaare ei oska vähemalt veel praegu jagada.

- Ajalooliselt on olnud Ameerika presidendivalmiste aasta hea eelkõige väärtusaktsiate jaoks.

- Miks E-Loan (EELN) viimastel päevadel jõudu on näidanud? Peamiseks põhjuseks ilmselt see, et 23. detsembril alustas firma aktsiate katmist üks pisike Sandler O'Neill & Partners nimeline analüüsifirma. Nende reitinguks on Hoia ning hinnasihiks $2.8. Mitte just eriline põhjus ostmiseks.

- Netflix (NFLX), mille short-interest on ligemale 70% väljas olevatest aktsiatest, teatas, et neil on praeguse seisuga ligemale 1.5 mln klienti (kasv 70% 2002/2003). Aktsiad loomulikult 5% plussis. Iga karu õudusunenägu.

- BusinessWeeki aktsiad on täna hommikul QDEL ning EDLG.

- Goldman Sachs tõstab täna hommikul Yahoo (YHOO) neljanda kvartali EBITDA prognoose. Erilist ostusurvet pole selle peale tekkinud.

- RevShark:

So is everyone fired up and raring to go? Are you chomping at the bit and trying to control your burning enthusiasm?

I didn't think so. The exchanges really need to be more generous with holidays, but I guess commissions generated by increased market hours outweigh other considerations. Next year when January 1 falls on a Saturday there is no market holiday at all, which is downright disgusting.

In any event, it looks like we have a generally positive open on the way. A lot of folks are anxious to start off the year with some gains, so they are inclined to jump in and do some buying in the hopes that they will catch some momentum. It is tough for fund managers who start off the year immediately lagging and then have to find ways to catch up.

The mentality this time of year is often "the best defense is a good offense," especially when there is cash flowing into retirement accounts and mutual funds. Watch for the ISM number at 10:00 a.m. EST. I'm seeing some early strength in small-caps, which were laggards on Tuesday. Let's see how that theme progresses once we open. I see plenty of interesting charts out there and will be happy to do some buying if buyers can generate some upticks on decent volume.

Good morning and Happy New Year. 2003 is history and the battle begins anew. For the next few days we will have to contend with summaries of what happened during the last year and predictions of what will occur over the next 12 months. Neither history nor predictions will make us much money, but they make for convenient journalism.

There are two things I am sure about as 2004 begins. The first is that the market Cassandras and Pollyannas will be offering their prophecies. The second is that they will be wrong. The fact that no one has ever been able to consistently make accurate long-term predictions won't stop them from trying. The folks most compelled to predict are always those who have held the same general view for many years. The pessimists will envision the world being engulfed in the flames of hell, while the optimists will continue to predict Utopia and Camelot.

I have no idea what will occur in 2004, but I am optimistic and positive that we will be able to profit. I'm always prepared to deal with the worst should that be the case. The biggest mistake most investors and traders make is being overly anticipatory about what lies ahead. They buy into a particular viewpoint about the future and they ignore what is in front of them. It is nice to think we can count on fortune telling and the stock market equivalent of the Psychic Friends Network to make us money, but the truth is that consistent profits come only when you study and consider the market on a daily basis.

Despite the inclination of so many to make predictions, markets generally don't crash without warning. Terrorist events and natural disasters can surprise us, but changes in longer-term trends and corrections of things such as overvaluation and unreasonable expectations came with plenty of indications and warnings for us to act upon.

So consider the 2004 market predictions, but stay focused on the hard evidence that is on your screens. Don't allow yourself to be caught up in the emotionality of market pundits. If you find yourself being sucked into their arguments, consider how many of them are perma-bulls or perma-bears and have been saying the same things for many years.

It looks like we have a positive start shaping up to the new year. Overseas markets were strong in Hong Kong and Europe with technology stocks leading the way. We have the ISM Purchasing Manager's Index data due out at 10:00 a.m. EST, which is likely to be a market mover.

The primary question for the market as the new year begins is whether investors held off taking gains until 2004 in order to delay tax consequences. There has been a lot of talk about that phenomenon and we will have to watch last year's biggest gainers to see if that is indeed the case. I suspect that those concerns are a bit overblown. There are always big winners in the prior year and they don't tend to immediately succumb to profit-taking.

The indices are a bit extended and we could use some consolidation, but overall there is nothing in the technical patterns suggesting that a major correction is forthcoming.

We should have another light day of trading as folks finish up their holiday vacations. Don't expect a lot of meaningful action today. Once trading desks are back at full strength next week, we should have some better indications of what themes and trends are likely to emerge.

Futuurid: Naz0.54%, SP0.35%sB

-

Ajal, mil laenudest elamine on Eestis kuum teema, on mõistlik refereerida bankrate.com nupukest kümnest parimast viisist ennast krediitkaardi abil majanduslikult laostada. Erinevalt Postimehest, kes soovitab presidendil elu läbi roosade prillide vaadata, leiab Bankrate artikkel, et krediitkaardi puhul see soovitus ei kehti ja plastikrahaga koos tuleks konservatiivsem prillivalik teha. Kes aga tahab täispangale mängida, järgigu järgmisi nõuandeid:

1. Vali kallis krediitkaart kõrge intressi ning halva klienditeenindusega. Milline kaart valida, tuleb otsustada suvaliselt, mitte mõelda kui palju ja mismoodi krediiti võtma hakatakse.

2. Hiline tagasimaksmisega

3. Vali minimaalsed maksed Väga efektiivne viis raha tuulde loopida, on valida kuine maksesumma mitte oma maksevõime järgi, vaid võimalikult väike ja pikema aja peale. Nii on võimalik lõpuks pangale tasuda ostetud toote kahekordne hind.

4. Võta endale niipalju kaarte, kui võimalik ja kasuta kogu nende krediidilimiiiti

5. Kuluta täna, maksmise pärast muretse homme! Suurepärane viis finantsraskustesse sattuda on kulutamise hetkel mitte teada, kust võetakse raha tagasimakseteks. Kui sa mõne eseme ostul ei tea, kuidas seda lähiajal tagasi maksta, siis osta see kindlasti, et kiiremini laostuda. Tee krediitkaardiga impulssoste!

6. Jaga kaarti tuttavatega, kel seda ei ole. Kuigi pank arvab, et nad ei ole tagasimakseteks suutelised, siis sa tead ju paremini.

7. Kasuta kaarti kui lisasissetulekut. Loomulikult ei tule sul kunagi seda raha tagasi maksta, krediidilimiit on su lisasissetulek, mida võid lahedalt kulutada.

8. Maksa ühe kaardiga teise võlgu! Parim viis oma võlad likvideerida, on need maksta krediitkaardiga!

9. Varja oma kaardivõlgu elukaaslase eest. Sest kui naine(mees) su võlgadest ei tea, siis pole neid olemas!

10. Nähes probleemi, ignoreeri seda. Alati parim viis kõikide probleemide lahendamiseks, eriti finantsmurede.