Hiina võimas tõus

Kommentaari jätmiseks loo konto või logi sisse

-

USD/CNY tõusnud 7,5650-ni

Food price spike pushes CPI to pass 4% in June

Last Updated(Beijing Time):2007-07-10 14:45

(chinadaily)

China'sconsumer price index(CPI) in June may have exceeded 4 percent from a year earlier due to higher food prices, making it the strongest inflation reading since October 2004, said China Business News today, citing domestic securities analysts.

According to statistics from the Ministry of Agriculture, the price of agricultural products rose by a further 4.9 percent month-on-month in June, which means the CPI rose more than 0.3 percent, said Yang Yonguang, an analyst with Guohai Securities.

Given that the CPI last June fell 0.5 percent and grew by 3.4 percent in May, the figure for June may stand at 4.2 percent despite a seasonable decline in vegetable prices, explained Yang.

Koos rekordsuure väliskaubandusülejäägiga juunis tundub, et Hiina majandus liigub edasi ülekuumenemise poole. -

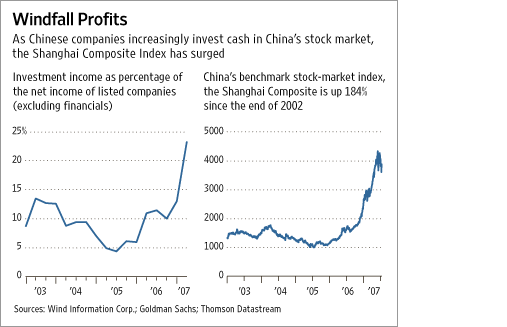

Hiina aktsiaturgudele ei paiguta raha mitte ainult traderitest grannyd, vaid põhitegevuse kõrvalt ka ettevõtted. Suured korporatsioonid toidavad pulliturgu, kuid sellise optimismi tulemusena kardetakse suurt kukkumist tulevikus. Wall Street Journal on olukorrast ülevaate teinud.

Hiina indeks on kahe aasta jooksul neljakordistunud ning aasta algusest tõusnud 46%, mis suurendab ettevõtete soovi kasvatada oma kasumeid läbi aktsiaturgude. Näitena tuuakse China Yangtze Power Company, mille põhitegevuse kasumist 30% investeeritakse kiire kasumi lootuses tagasi turule. Investeeringute seast võib leida näiteks China Construction Banki, Air China ja Industrial & Commercial Bank of China. Tegemist on ainult ühe näitega ning 2007. aasta esimeses kvartalis tuli väljaspoole finantssektorit jäävatest börsiettevõtete kasumitest 23% investeeringutest finantsturgudele. See number oli võrreldes eelmise kvartaliga 13% kõrgem. Kasumi ajalooline kujunemine on kujutatud alloleval graafikul.

Kõige tipuks eiravad osad ettevõtted seaduseid ning panustavad aktsiate tõusule laenurahaga. Ühe kurioosumina tuuakse esile China Shipping Group, kes paigutas turgudele eelmise aasta jooksul üle 300 miljoni dollari laenatud raha. Pankade poolt on aga raha laenamine aktsiate ostuks keelatud ning kuus panka said karistatud. Oleks päris huvitav, kui esimesed ettevõtted seetõttu pankrotti läheksid. Raske tööga teenitud kasum kaotatakse lühikese ajaga börsil või mis veel hullem, kaotatakse lisaks veel laenuraha, mille järel tuleb uksed kinni panna.

Ettevõtetele heidetakse ette lisaks tähelepanu hajumisele põhitegevusest hoolimatust oma investorite suhtes. Ei suudeta lasta rahal lihtsalt seista ega maksta kasumit välja dividendide kaudu investoritele. Kuni kasumid kasvavad, ei oska Hiina kogenematu erainvestor selles midagi halba näha, aga korporatsioonide juhtide suurem ettevaatlikkus ei teeks paha.

Kuni kasumid tänu turgude tõusule suurenevad, annab see veelgi julgust edasisteks sammudeks. Turgudele lisandub uut raha ja uusi tegijaid ehk toimub tüüpiline mulliefekt. Aga kõik võib toimuda ka tagurpidi – kukkuvad hinnad söövad ettevõtete kasumeid ning nende päästmine paneb aktsiahindadele topeltsurve. Stsenaariumile on ajaloost eeskuju olemas, näitena tuuakse Intelit ja J.P Morgani eelkäiat (Chase Manhattan Bank), kes tehnoloogiamulli ajal raporteerisid investeeringute tõttu aktsiatesse suuremaid kasumeid, mis hiljem hindade kukkudes muutusid kahjumiteks.

Valitsuse arvates on Hiina tööstusettevõtete kasumid maikuu lõpu seisuga 42% kõrgemal võrreldes eelmise aastaga. Loomulikult tuleneb see kõrgest majanduskasvust ning efektiivsuse tõusust, kuid oma osa on kahtlemata aktsiaturgudel. Sellist olukorda ei peeta jätkusuutlikuks.

Mõned ettevõtted on läinud juba nii kaugele, et loonud eraldi üksused tegelemaks investeeringutega turgudel. Üks farmaatsiaettevõte paigutab pidevalt raha Hiina IPOdesse, kuna viimased on siiani pakkunud reeglina suurepärast tootlust. Ettevõte küsis ka investoritelt luba ning viimased olid sellega nõus. Sellist variant vist ei leia isegi suurte ja tunnustatud USA hedge-fondide seas, et spekuleeritakse ainult IPOde tootlusele.

Üheks võimalikuks turulanguse katalüsaatoriks võivad saada karmimad regulatsioonid. Arvataks, et turgude viimase aja kehv esinemine on tingitud just karmistuvatest tingimustest maaklerfirmade aadressil, et need säilitaksid tehingute ajalugu ning seetõttu tõmmatigi turult osa raha lihtsalt välja.

Hiina mullist on nüüdseks räägitud juba pikka aega ning tõesti oleks huvitav teada, millega see kõik lõppeb. Ühelt poolt kiiresti kasvav majandus, mis vähemalt pikas perspektiivis peaks tähendama kasumite järelejõudmist aktsiate hindadele. Teiselt poolt muidugi selged mullitunnused ning Lääne vaatlejate suur skepsis. Selge on ka see, et sarnased mullid võivad kesta oluliselt kauem, kui oodatakase ning et Hiinas on küll omaks võetud arusaam kõrgest volatiilsusest, aga mitte krahhist enne Bejingi olümpiamänge. Eks paistab…

-

Ühelt poolt mullistuv aktsiaturg, kuid samas RealMoney.com (James Altucher) toob esile näiteks Netease.com-i:

Chinese online gaming company Netease (NTES) has $438 million in net cash. So with a $2.2 billion market cap and $200 million in cash flow, it trades at only nine times cash flows. Analysts expect earnings to go to $1.23 per share in 2008 from $1.15 in 2007.

Analysts have not been correct often in the past. Netease beat analysts' expectations the past four quarters in a row, and if it beats again in 2008, then the forward P/E will be 13, or even lower.

Ei tundu just meeletult kallis, kuigi tuleb tunnistada, et valdkond on riskantne ja arengud ettearvamatud. -

Hiina teatab oma SKP numbrid ülehomme, 19. juulil. Majandust oodatakse teises kvartalis kasvavat 11,1%. Kaubavahetus USAga on Hiina rahaga üle ujutanud, tööstus rokib ja inflastioon on 2,5 aasta kõrgtasemel, ulatudes juunis 3,6%-ni. Inflatsioonilt oodatakse lähiajal edasist kasvu, millele peaks piirangu panema monetaarpoliitika karmistamine. Igal juhul on soodus pind intresside tõstmiseks loodud ning seda ka Bejingilt peagi oodatakse.

-

Signs point to an imminent rise in China's interest rates

Last Updated(Beijing Time):2007-07-17 13:32

The special bills issued last week by the central bank may signal an interest rate hike in the near term if history is a guide, industry experts said yesterday. The People's Bank of China said on Friday that it had placed 101 billion yuan (US$13.3 billion) worth of three-year bills with commercial banks in a special issue to mop up excess liquidity. The bonds carried an annual yield of 3.6 percent.

It was the first special bond issue since a 101-billion-yuan sale of three-year bills on May 11. A week later, the central bank raised the benchmark one-year deposit rate by 27 basis points.

In an earlier move, the PBOC increased the savings rate by the same amount on March 18 after placing 101 billion yuan in three-year bills on March 9.

"The possible explanation for the coincidences is that the central bank hopes to lower the cost of recouping money from the market by issuing the bills ahead of interest-rate hikes," said Dong Dezhi, a senior debt analyst at the Bank of China. "It seems the rate hikes always accompany the issuance of special central bank bills, although it's only our guess."

Dong noted the apparent connection also occurred with a 27 basis-point deposit rate rise on August 18, 2006, after the central bank had sold a combined 200 billion yuan in special bills to commercial lenders over the previous three months.

Analysts and traders also believe austerity measures are within sight after a string of strong economic data that were unveiled recently or are set to be released soon.

China's top statistics bureau said last week that the country's trade surplus hit a record monthly high of US$26.9 billion in June. Annualized growth in China's M2 money supply was 17.06 percent last month, up from 16.7 percent in May.

A majority of market observers have predicted that the June Consumer Price Index, to be announced late this week, will exceed four percent, compared with the three percent target set by the government for the entire year and the 3.06 percent one-year deposit rate.

"As a result of the June CPI figure, public pressure for the government to address the issue of negative real interest rates will intensify," said Ma Jun, a Deutsche Bank economist.

Source:Shanghai Daily -

Juuni SKP +11,9%, THI +4,4%, jaekaubandus +16%, tööstustoodang +19,4%. Jaekaubandus nagu oodatud analüütikute poolt, teised kõrgemad.

-

SKP +11,9% siis Q2-number.

-

Palgatõus Hiinas siis orienteeruvalt 14% viimasel aastal. Protsess inflatsioon->palgatõus->inflatsioon peaks kiirenema.

Incomes rising, food up more

Last Updated(Beijing Time):2007-07-20 09:43

The cost of living for the Chinese has been on a steady rise as the pace of income growth has been far outstripped by the soaring cost of what's in their food bowls.

The National Bureau of Statistics (NBS) yesterday announced that egg prices have risen by 27.9 percent and that of meat increased by 20.7 percent last month compared with the same period a year ago. The wholesale price of pork in June soared by 74.6 percent year-on-year due to the increased cost of feed and the contagious blue ear disease.

Despite incomes for both urban and rural residents, which have grown at record rates, the increases lag far behind the costs of pork and eggs.

At a press conference yesterday to deliver a report on the nation's economic performance over the past six months, NBS spokesman Li Xiaochao said that per capita monthly disposable income of urban residents reached 1,175 yuan, a year-on-year growth of 14.2 percent, and that of rural residents rose to 352 yuan, a 13.3 percent increase.

Yet, even if wages are rising, Yang Jun, a farmer in Sichuan Province, said his family has paid fewer visits to the meat market recently.

"I have been scared away by the rising pork prices," said Yang, who earns about 40 yuan a day working on a road project in the province's Tongjiang County.

"I can buy pork only once every week," he said.

Source:China Daily -

Hiina keskpank juba täna tõstis oma intressid 0,27pp. Nende laenuintress nüüd siis 6,84%. Vaadates USD/CNY ja Ameerika intress 5,25% peaks arbitragesurve olema meeletu. Lahendus ilmselt et Hiina lubab USD/CNY langeda kiiremini - kusjuures aga inflatsioonieksport tõuseb. Kui langust ei lubata, siis CNY-printimine kasvab veel ja koos sellega suurem inflatsioonisurve Hiina sees.

Kuidas iganes - ees ootab tõusev maailmainflatsioon ja tõusvad maailmaintressid. -

Hiina valuutareservid on Morgan Stanley andmetel juba $1,33 triljonit. Pole ka midagi imestada, eksport kasvas aasta baasil juunis 27% (poolaastas 28%), samal ajal import kasvas juunis oluliselt vähem, ulatudes 14%-ni.

-

Shanghai Composite on hetkel +3% hoolimata intressitõusust reedel. Ilmselt surve valuutale ja hindadele jätkub või tugevneb.

-

Sügis tuleb, ja eelmisel aastal oligi Hiinal vaja müüa oma viljavarudest et hinnatõusu ohjeldada (ei mäleta kas riisi ka).

China begins import of Japan rice

Last Updated(Beijing Time):2007-07-26 10:23

China has started import of Japan's rice and meanwhile Japan resumed its import of China's straws, sources with the General Administration of Quality Supervision, Inspection and Quarantine (AQSIQ) said Wednesday.

The quality watchdog said two famous brands of Japanese rice will be available in the supermarkets of some big cities in China in the next few days, primarily targeting high-income consumers.

Xinhuanet -

Ei lähe kaua intresside ja reservnõuete tõstmiste vahel. Ilmselt progleemid ülekuumenemisega, ehk siis pikemalt vaadates inflatsiooniga.

China raises reserve requirement ratio

(Xinhua)

Updated: 2007-07-30 18:41

China will raise the reserve requirement ratio by 0.5 percentage points for commercial banks beginning from August 15, the People's Bank of China (PBOC) announced on Monday.

It is the sixth time the Chinese government has opted to raise the reserve requirement ratio to curb excess liquidity.

The central bank said the move was aimed at "strengthening management of liquidity in the banking system and rationalizing lending growth".

PBOC statistics show that China's foreign exchange reserve reached 1.33 trillion US dollars at the end of June, up 41.6 percent on the same period last year.

A total of 266.3 billion US dollars were added to the country's foreign exchange reserve in the first half of 2007, 144 billion US dollars more than a year ago, said the central bank.

The six-month rise is higher than the whole-year rise of 247.3 billion US dollars in 2006. -

Jälle inflatsiooniteemal, ja karta võib, et läheb aina problemaatilisemaks:

Gov'ts warned against price intervention

Last Updated(Beijing Time):2007-07-31 09:20

Local governments have been told not to intervene directly in market prices unless it is "necessary".

The National Development and Reform Commission yesterday said on its website that any price intervention would need the approval of provincial governments or central authorities.

Some prices, such as those of resource products, power, education, medical services and pharmaceuticals, are subject to government controls, but those of most other commodities are set by the market.

The NDRC said the role of the market should be respected unless "there is remarkable price growth due to emergencies or natural disasters".

Last month, the government of Lanzhou in Northwest China's Gansu Province capped the price of beef noodles, the most popular local dish, following public complaints about the price rise.

"The government should respect the role of the market, even if it wants to help the poor," said Xia Yeliang, economist with the School of Economics at Peking University.

"The capping would lead to decreased supply or dented quality of products or services, which in turn damages consumer interests," he said.

In Lanzhou, many people have reportedly found less beef or noodles after the price cap, although the price remained unchanged.

...

(China Daily) -

Veel Hiina inflatsiooniteemal

(mis ma arvan on üks olulisimaid teemasid maailmaturgudele)

China's fast food chains to raise prices

By Jiang Jingjing (China Daily)

Updated: 2007-07-31 08:51

Over 20 Chinese fast food chains will raise their prices on Wednesday because of mounting raw material costs.

Senior officials of enterprises such as Malan Noodle, Hehegu, Lihua Fast Food and Daniang Dumplings gathered in Beijing over the weekend to discuss the measures to combat the surging costs, a Beijing Times report said.

Jiang Jianping, president of Lihua Fast Food, said the company will raise prices by an average of 15 percent. Hehegu will raise the price of pork dishes by 1 yuan, company president Zhao Shen was quoted by the newspaper as saying.

Skyrocketing prices of meat, the main raw material for Chinese food chains, has dealt the severest blow, said Bian Jiang, deputy secretary-general of China Cuisine Association.

Belly pork, for example, was yesterday wholesaling at around 22 yuan a kilogram in Beijing, according to www.foodqs.com, China's leading online food trading service provider, a year-on-year increase of 13 yuan.

... -

Stefan, kas saaksid lihtsale tarbijale (minule) veidi lahti seletada, mida Hiina inflatsioon tähendab USA, Euroopa, Eesti, Jaapani jaoks?

-

Ma ei ole küll Stefan ega ka muul viisil temaga võrreldav makrokunn, kuid oleks loogiline, et inflatsioon Hiinas tähendab ühest küljest kallinevaid ekspordikaupu (ja muule maailmale kallimaid sisseveokaupu Hiinast) ja teisalt Hiina tarbija suurenevat soovi oma säästud ära tarbida, mis tähendab Hiina veelgi suurenevat sisenõudlust. Hiina nõudlus on aga oluline tegur praeguse tooraineralli taga, mis mõjutab juba inflatsiooni kogu maailmas.

-

Viimane Economist kajastab ka inflatsiooniteemat Hiinas, kuid pisut vaoshoitumalt, kui Stefani poolt viidatud artiklid.

China's economy

It doesn't add up

Jul 26th 2007 | HONG KONG

Fears that China's economy is overheating are exaggerated

CHINESE students may come top of the world league in mathematics, yet the country's economic numbers are notoriously dodgy. New figures showing that China's GDP growth quickened to 11.9% in the year to the second quarter, its fastest since the mid-1990s, while inflation jumped to 4.4% in June from 3.4% in May, have fuelled concerns that its economy is now seriously overheating. However, a closer inspection of the numbers suggests there is no need to panic—yet.

[...]

So what are Chinese number-crunchers up to? Mr Anderson suggests that the reported faster growth may partly reflect a move to correct previous inaccuracies. In the past, official GDP figures have been much lower than his own estimates, but now the gap has disappeared. In other words, the acceleration in growth may be largely illusory.

Other classic symptoms of overheating are also absent: bank lending and imports have slowed in recent years, and reports of surging wages due to labour shortages are misleading. Average wages in manufacturing have indeed risen by 15% over the past year. But HSBC reckons that labour productivity in manufacturing rose even faster, by 20%, so unit labour costs are still falling. Even inflation is not as bad as it seems. The recent jump was mainly due to the prices of pork and eggs. Excluding food, consumer prices have risen by only 1% over the past year. That is not to say that rising food prices (one-third of the consumer-price index) do not matter, but they are due to supply-side shocks, such as a pig disease, rather than excess demand.

This may help explain why the People's Bank of China has not slammed on the brakes.

[...]

Rates are still too low for such a fast-growing economy, but few expect the bank to lift rates aggressively to quash inflation. Higher rates would do little to dampen food prices. A better solution would be to let the yuan rise more quickly, which would curb the prices of imported foods. Hong Liang at Goldman Sachs reckons that a 10% rise in the yuan's trade-weighted value would knock 1.5 percentage points off inflation over two years.

The yuan's appreciation has already quickened this year, rising by an annual rate of 9% since April, compared with only 3.4% in 2006. Goldman Sachs predicts a further 9% rise over the next 12 months. This would not only help to squeeze inflation, it would also help to ease trade tensions with America, which complains that China's currency is too keenly priced.

[...] -

see, et hiinlased sel aastal juba mitmel korral hindu on kergitanud, pole enam mingi ime,

aga viimased sõnumid ühelt hankijalt on sellised, et on probleeme tööjõu hankimisega ning sellest tulenevalt on viivitusi tarnetega -

TaivoS, aitäh komplimendi eest, kuigi ausalt öeldes olen ma vist pigem olnud contra-indicator oma ennustustega. td- teema on minu jaoks praegu äkki kõige põnevam, püüan hiljem rohkem kirjutada.

-

China's short-term foreign debt hits new high

Last Updated(Beijing Time):2007-08-01 10:30

China's short-term foreign borrowing as a proportion of its total outstanding foreign debt has hit a record 57.5 percent by the end of March.

At the same time, the country's total outstanding foreign debt increased by 8.57 billion U.S. dollars to 331.56 billion U.S. dollars, according to the State Administration of Foreign Exchange(SAFE).

Meanwhile, China's short-term foreign borrowing jumped by seven billion U.S. dollars to 190.63 billion U.S. dollars, rising as a proportion of total debt by 0.65 of a percentage point in three months.

Experts warned the short-term debt growth and the proportion growth indicated an active trans-border capital flow and may bring more pressure to bear China's fast-growing economy.

The country's gross domestic product (GDP) rose 11.5 percent in the first half, after it grew 11.9 percent in the second quarter.

Despite a series of measures to curb excess liquidity, such as interest rate hikes and reserve requirement ratio rises, China's benchmark Shanghai Composite Index on the Shanghai Stock Exchange continues to surge.

Due to the yuan's continuous appreciation and the booming stock and property markets, speculators were pouring cash in, said Ding Zhijie, vice director of the School of Banking and Finance of the University of International Business and Economics.

By the end of March, trade credit, a channel speculators prefer to use to maneuver trans-border capital flow, amounted to 108.6 billion U.S. dollars, a rise of 4.6 billion U.S. dollars from the end of last year.

"It is difficult to identify how much idle capital has come in, but there's no doubt that speculative funds remain unabated in entering China," said Ding.

...

Xinhuanet -

Hiina aktsiaindeksid isegi täna tõusuteel. Raske on tõlgendada seda teistmoodi kui et CNY väärtus on langemas, ehk inflatsioon tõusmas. Hiina jooksevdefitsiiti ülejääk võib päris kiiresti hakata langema lähikuudel, ma pakun.

-

Inflatsiooniteema jätkub:

Gasoline retailers cautioned against hoarding, profiteering

Last Updated(Beijing Time):2007-08-06 15:46

The Chinese government Saturday cautioned gasoline retailers about hoarding and profiteering, while urging its major gasoline producers to do their best to increase supplies of gasoline and other finished oil products.

Apparently in responses to short supplies of gasoline as reported in some southern Chinese cities, the National Development and Reform Commission, the government's major social and economic development affairs department, said in a circular that all companies engaged in wholesale and retailing business of finished oil should not board and profiteer.

The commission also urged China National Petroleum Corp and China Petrochemical Corp, the country's gasoline producers, to make their utmost efforts to increase supplies and control exports of finished oil in order to meet domestic market demands.

...

Oil is one of the very few products whose prices are strictly controlLed by the Chinese government. The government has not raised gasoline prices in the past few months despite rising oil prices on the international markets as part of its efforts to control inflation.

Xinhuanet

China to crack down on price-hiking producers, sellers

Last Updated(Beijing Time):2007-08-07 13:51

Chinese local pricing authorities have been told to crack down on food producers and sellers that attempt to raise food prices to an unreasonable level, said sources with the National Development and Reform Commission (NDRC) on Monday.

Describing the nationwide campaign as a major political task, the top economic planning agency urged pricing departments at all levels to work hard to stabilize the food market.

...

Xinhuanet -

Daily Telegraph reports the Chinese govt has begun a concerted campaign of economic threats against the U.S., hinting that it may liquidate its vast holding of U.S. Treasury bonds if Washington imposes trade sanctions to force a yuan revaluation. Two Chinese officials at leading Communist Party bodies have given interviews in recent days warning, for the first time, that Beijing may use its $1,330 bln of foreign reserves as a political weapon to counter pressure from the U.S. Congress. Shifts in Chinese policy are often announced through key think tanks and academies. Described as China's "nuclear option" in the state media, such action could trigger a dollar crash at a time when the U.S. currency is breaking down through historic support levels. It would also cause a spike in U.S. bond yields, hammering the U.S. housing mkt and perhaps tipping the economy into recession. It is estimated that China holds more than $900 bln in a mix of US bonds.

-

Mingi / kellegi osaline ülevaade Hiina aktsiatest: http://www.allchinastocks.com/52wk_performance.html

Kui keegi peab neid arvestus- ja hindamispõhimõtteid õigeks, siis need võivad ju kätt proovida... -

Hiina väliskaubandusülejääk on endiselt suur, aga pakun et suur osa on peidetud investment-raha, eelkõige rahvusvahelised firmad kes maksavad oma Hiina tütarfirmadele kõrgendatud hinnad, et võimaldada investeeringuid Hiinas. Arvan et valuuta-voolud võivad pöörduda, kuigi turul valitseb endiselt "one-way bet" CNY suhtes.

Aug. 10 (Bloomberg) -- China's trade surplus surged 67 percent in July to the second-highest on record, bolstering U.S. Treasury Secretary Henry Paulson's case for a faster appreciation of the yuan.

The gap widened to $24.4 billion from $14.6 billion a year earlier, the General Administration of Customs said today on its Web site. That was more than the $23.1 billion median estimate of 18 economists surveyed by Bloomberg News. -

Veel info mis viitab sellele, et Hiina ei saa oma ülelikviidsusest jagu. Intressitase+valuutapoliitika on rahapakkumisele kasvuhooneks. Ennustan endiselt, et CNY oodatust kiiremini võib hakata väärtusest kaotada ja Hiina kaubandusülejääk järsult langeda.

Liquidity looms behind excess deposit reserve ratio

Last Updated(Beijing Time):2007-08-11 10:33

By the end of June, the ratio of excess deposit reserves, or money from commercial banks parked at the central bank above requirements, grew much higher than expected, indicating a setback in the financial authorities' tightening measures against excess liquidity, according to the China Securities Journal.

...

In June, the country's trade surplus reached 203 billion yuan (US$26.9 billion), 90 billion yuan higher from a year earlier, adding heaps of cash to the domestic market.

In addition, open market operations, generally considered an important tool of the central bank in dealing with excess liquidity, didn't work because of poor central bank note sales.

Because of a wide inflation expectation after the release of a soaring Consumer Price Index (CPI) in May, the yield of bonds grew greatly in June, making the market reluctant to accept notes with lower yields from the central bank. On the other hand, in order to prevent an influx of hot money, the central bank refused to raise bank note yields, impacting sales.

As a result, nearly 30 billion yuan flooded the market in June. In comparison, during the same month last year, the central bank successfully withdrew 95 billion yuan through open market operations. The difference is 125 billion yuan.

chinadaily.com.cn

-

Et hetkel puudutavad hinnatõusud Hiinas suuresti toidukaupasid, pole paljude arvates trend märkimisväärse tähtsusega.

Samal ajal on aga just toidukaubad need, mis tavainimese rahakotti kõige enam mõjutavad. Kõrval üks WSJ-st saadud tabel Hiiina THI muutusest, kust võib näha, et kõige enam on tõusnud liha, munade ja värskete juurviljade hinnad. Suureneb ka Hiina eksporditav inflatsioon, USAs on aastasel baasil Hiinast impoditud kaupade hinnad tõusnud 4,1%.

Samal ajal on aga just toidukaubad need, mis tavainimese rahakotti kõige enam mõjutavad. Kõrval üks WSJ-st saadud tabel Hiiina THI muutusest, kust võib näha, et kõige enam on tõusnud liha, munade ja värskete juurviljade hinnad. Suureneb ka Hiina eksporditav inflatsioon, USAs on aastasel baasil Hiinast impoditud kaupade hinnad tõusnud 4,1%.Lõhe rikaste ja vaeste vahel suureneb niigi ning inflatsiooniteema võib poliitiliselt üsna tundlikuks osutuda.

Kõrgeim inflatsioon aastast 1997 eeldab ka kõrgemaid intresse, analüütikud ootavad, et hetkel 6,84% tasemel olevaid intresse tõstetakse selle aasta jooksul veel korra, mis tähendaks neljandat tõstmist aasta sees.

-

China's inflation sparks fears for economy

By Richard McGregorin Beijing

Published: August 14 2007 03:00 | Last updated: August 14 2007 03:00

China's inflation rate hit a 10-year high of 5.6 per cent in July, raising expectations of further tightening measures and increasing concerns about a knock-on impact on the real economy.

...

"Anecdotally, some local governments are said to be underestimating various price trends, and there is scepticism that service sector inflation is being accurately captured."

...

http://www.ft.com/cms/s/9da27416-49fe-11dc-9ffe-0000779fd2ac.html -

Toiduainete hinnatõus Hiinas tundub olevat lugu, mis kestab. Äkki nad on selle piiri lähedal, kus inimesed hakkavad oma kodudes varuma, ja sel juhul oleksid tagajärjed ettearvamatud. Parem on lubada hinnatõusu, kontrollida rahapakkumist, tõsta intresse, lõpetada dollarite tugioste. Huvitav kuidas hiinlased edasi teevad.

Rules on meat reserves to stabilize prices

Last Updated(Beijing Time):2007-08-15 14:23

The Ministry of Commerce (MOC) and the Ministry of Finance (MOF) Monday jointly issued management measures on the central meat reserves in an effort to stabilize meat prices in case of emergency, the Beijing Times reported today.

Effective beginning September 15, the rules authorize the MOC to release the central meat reserves after consulting with the MOF in times of large price fluctuations due to serious natural disasters or public health emergencies.

The two ministries will also work out a plan for determining the amount, category, and prices of meat released and arrange distribution.

Relevant government agencies should treat central meat reserves as a long-term solution and rotate their stock periodically, according to the rules.

In a related move, the State Council issued an emergency circular on Monday calling governments of all regions to ensure ample supplies of subsidiary foods like pork and keep their prices stable.

The recent surging meat prices have concerned both the government and individual residents. Central bank statistics yesterday showed that the wholesale price for live pigs saw a year-on-year increase of 85 percent last month.

Soaring food prices are believed to have fueled a steep increase in the consumer price index - 5.6 percent last month, the highest in 10 years.

www.chonadaily.cn -

Huvitav kuidas on lood nüüd Eesti riigi strateegilise viljavaruga?

-

China isn't a country - it's a different world

http://www.youtube.com/watch?v=YDatMaKK6Ns -

Hiinas nüüdsest väikeinvestoritel lubatud Hong Kongi börsil olevaid aktsiaid osta. Kuna korraga nii Hong Kongi kui Shanghai börsil listitud ettevõtted on reeglina Hong Kongis odavamad, võiks olla oodata Hong Kongist tõusu.

Väidetavalt on tegu veel nn pilootprojektiga, kuid arvatavasti see nii olema saabki. Valitsusel on pikalt Shanghai börsile investeerivate väikeinvestorite pärast kartus olnud kõrgete valuatsioonide tõttu koduturul ning nüüd avanevad uued võimalused madalamate hindadega.

Ehk ka väike täiendav motiiv tarbimise asemel investeerida, mis ehk aitab kaasa võitluses inflatsiooniga. Tõsi, see efekt ilmselt siinkohal suhteliselt väike.

USA turul kaubeldav Hong Kongi indeks peaks olema EWH (iShares MSCI Hong Kong Index) -

China's central bank said it is raising benchmark lending rates by 18 basis points and deposit rates by 27 basis points, effective tomorrow

-

Kas soovitate Hong Kongi indeksisse investeerida?

-

Kas USA turul Hong Kongi H-aktsiate (dual listing mainlandi turuga) indeksit vms instrumenti kaupleb?

-

TaivoS, üldiselt häid instrumente selleks ei ole, et seal arbitreerida, kuid iShares FTSE/Xinhua China 25 Index Fund (FXI) peaks olema iseenesest indeksfond, mis jäljendab FTSE/Xinhua China 25 Indexit. Indeks ise peaks koosnema 25st suurimast ja likviidsemast Hiina ettevõttest (that are available to international investors) , mis kauplevad Hong Kongi börsil.

iShares FTSE/Xinhua China 25 Index Fund (the Fund) is an index fund that seeks investment results that correspond generally to the price and yield performance of the FTSE/Xinhua China 25 Index (the Index). The Index is designed to represent the performance of the largest companies in the Chinese equity market that are available to international investors. The Index consists of 25 of the largest and most liquid Chinese companies. Securities in the Index are weighted based on the total market value of their shares. Each security in the Index is a constituent of the FTSE All-World Index. All of the securities in the Index trade on the Hong Kong Stock Exchange. The Fund invests in a representative sample of securities in the Index, which have a similar investment profile as the Index. From its inception, on October 5, 2005, through July 31, 2005, the Fund returned 14.57%, while the Index returned 15.3% -

OK, FXI-d oled jälginud pikemalt. Seni arvasin, et tegu on mainlandi börsi indeksiga. Ettevaatlikuks teeb see, et nii EWH-l kui FXI-l on finantssektori exposure suhteliselt suur. Muidugi Hong Kongi indeksit ilma olulise finantssektori osakaaluta raske ette kujutada ka.

-

Allpool ma ei ütleks et China Daily on pannud kõige adekvaatsemat pealkirja (ei tea missugused hooajalised muutused praegu on, aga 0,5% nädalainflatsioon tundub hirmutavalt kõrge):

MOC: Pork wholesale price keeps dropping for two weeks

(chinadaily.com.cn)

Updated: 2007-08-22 14:52

Statistics from the Ministry of Commerce (MOC) showed that although the edible agricultural products price index remained high at 113.29 points and the general price level rose by 0.5 percent since last week, wholesale pork prices have dropped in the last two weeks, shedding 1.4 percent in the last week alone, China Business Times reported.

Among the 40 products monitored by the MOC, 31 products or 77.5 percent of all products became more expensive since last week. Only eight products or 20 percent sold cheaper, while one product or 2.5 percent broke even with a week ago.

Despite the two-week drop in pork prices, some vegetables soared almost 50 percent due to increased costs in harvesting crops and transport through flooded areas.

Nationwide production materials have increased 0.43 percent in prices since last week. Of the 100 products, 36 products or 32.1 percent became more expensive; 51 products or 45.5 percent remained unchanged in prices; and 25 products or 22.3 percent sold cheaper compared to a week ago.

The US subprime credit crisis led domestic nonferrous metal prices to a 0.92 percent decline, while the increasing iron ore cost pushed steel prices up 0.38 percent.

www.chinadaily.cn -

Choking on Growth Hiina enda mõtteviisi kasutades võiks küsida, et ehk on viimased kolmkümmend aastat veel liialt tühine aeg, et "majandusimele" hinnangut anda. Igatahes, pole ime, et venelased sealpool toimuva suhtes üha närvilisemaks muutuvad.

President Hu Jintao’s most ambitious attempt to change the culture of fast-growth collapsed this year. The project, known as “Green G.D.P.,” was an effort to create an environmental yardstick for evaluating the performance of every official in China. It recalculated gross domestic product, or G.D.P., to reflect the cost of pollution.

But the early results were so sobering — in some provinces the pollution-adjusted growth rates were reduced almost to zero — that the project was banished to China’s ivory tower this spring and stripped of official influence.

-

Üha selgem, et inflatsioon on Hiina peamine probleem. Greenspan/Bernanke on printinud neile raha, võimas Greenspan/Bernake-raha sissetoomine tundus magus, niikaua kui reaalkasv oli pidevalt suurem, ja krediidisüsteem ei tootnud Greenspan/Bernake-rahast piisavalt uut raha. Hiina tõstab praegu intresse, aga kui tegijad laenavad Bernanke käest ja vahetab reguleeritud kurssiga, ja maksavad tagasi parema kurssiga, siis Hiina oma intressitõstmised on vähem tõhusad. Väga huvitavaks saab siis, kui CNY on hoopis ülehinnatud, ja Hiina hakkab USD müüma, eksportides Ameerikasse inflatsiooni tagasi.

Stiff penalties for price rigging

Last Updated(Beijing Time):2007-08-29 10:13

Mounting inflationary pressure and public concerns about further price rises have led the government to impose tougher punishments on price manipulators.

The economic planners have warned against manipulating market prices, saying the revised regulation against price irregularities is ready for the approval of the State Council.

"To punish such wrongdoings, we plan to increase the fine," said Zhang Manying, deputy director of pricing supervision department of the National Development and Reform Commission (NDRC) yesterday at an online discussion.

But Zhang didn't reveal the ceiling of penalty in the revised regulation. Currently, the maximum fine is 300,000 yuan (US$39,735) in a single case.

The new regulation, when approved, will impose tougher punishments on industrial associations if they illegally increase prices.

The fresh warning to industry associations comes after the China branch of the International Ramen Manufactures Association was found to have colluded to manipulate prices of instant noodles. The NDRC ordered the association to undo the damage and issue a public explanation on the impact of its action.

Urging them to find a balance between helping member companies to earn bigger profits and protecting the interests of the industry as well as the consumers, the NDRC had earlier said some industry associations had abused the power vested in them by member companies.

Zhang said local pricing authorities should continue efforts to crack down on food producers and sellers who try to raise food prices to an unreasonable level, and urged pricing departments to work hard to stabilize the food market.

The campaign, mainly targeting food manufacturers, wholesale and retail firms, will overhaul prices for daily foods like grain, cooking oil, meat, poultry, eggs and milk.

As prices of consumer goods, especially food and meat, hit 10-year highs last month, the central government is treating inflation as the biggest obstacle to sound development.

"We won't tolerate any price manipulation and irregularities," said Zhang.

Zhang did not forecast when the rising pork and other meat prices could be brought down to normal levels. They are widely expected to be reined within this year.

But meat demand will go up as weather gets cooler, students go back to campus and festivals and celebrations such as Mid-Autumn Festival and National Day holiday approach.

www.chinadaily.cn -

Hiina aktsiamütoloogia õnnelikud linnad: Tianjin, Shanghai ja Shenzhen!

Iseenesest päris kole selliseid asju lugeda, vast isegi hullem, kui poolakate pensionifondide regulatsiooniga kokkukeeratud käkk. -

Sain ma nüüd õieti aru, et Hiinas antakse Hong Kongi börsile investeerimise õigust LINNADE kaupa sest kogu riigile korraga vastava õiguse andmine lihtsalt oleks samaväärne kui mäslevale rahvahulgale anda ülesandeks vedada teise linna otsa kast nitroglütseriiniga ehk sellele üritusele on kiire fataalne lõpp juba eos sisse prorgammeeritud? Jah, kõlab igal juhul nagu rämedalt võimendatud Poola variant.

-

minuteada pole Hiina seda kastivedamise varianti veel ametlikult tutvustanud, see leiab heakskiitmist alles peatselt algaval parteikongressil osana plaanist "Kuidas rahustada rahvahulki siis, kui plaanitav söekaevanduste sulgemine koos kohese kaevuritele väljapääsuteede sulgemisega - Hiina vaste võitlusele struktuturaalse tööpuudusega" tekivad rahva seas ootamatult tagasilöögid.

-

Hiina CPI nüüd jõudnud 6,5%-ni, sealhulgas toiduainete inflatsioon 18,2%. Ma pakun, et sellise toiduainete inflatsiooniga hakkavad inimesed toiduaineid varuma (niivõrd kui saab). Mis oleks parem investeerimistoode kui toit, mille hind tõuseb ligi 20% aastas. Varumine->veel kiirem inflatsioon->veel varumine->veel kiirem inflatsioon.

Ühesõnaga on väga oluline, et Hiina tõsiselt hakkab piirama oma rahapakkumist. Kuna Hiinal on hiiglaslik dollarreserv on neil alati võimalik dollareid müüa ja CNY osta. Kui nad seda ei tee tekib risk, et CNYst saab hüperinflatsioonivaluuta ja säästmine kukub. Risk ilmselt laieneb ka dollarile, miille väärtus võib koos CNY-ga kukkuda. -

http://www.telegraph.co.uk/money/main.jhtml?xml=/money/2007/09/05/bcnchina105.xml

Üks huvitav artikkel selle kohta! -

Juba täna uus intressitõstmine People's Bank of China poolt.

-

Hiinlastel ei lasta tõenäoliselt vabalt Hong-Kongi aktsiaid osta: Analysts first estimated that more than $100bn would flow to Hong Kong’s market during the next 12 months but the government’s quota will limit overall investment to much less than that.

http://www.ft.com/cms/s/0/95645888-67a3-11dc-8906-0000779fd2ac.html -

paluksin linki Hiina Shanghai B (välismaine) indeksi vaatamiseks

ette tänades!