Börsipäev 1.-2. juuni - suured tegijad turul tagasi

Kommentaari jätmiseks loo konto või logi sisse

-

-Eelmine nädal oli turgude jaoks kiire põrke nädalaks, kuid pikk nädalavahetus tähendas, et olulises tegijad olid turult eemal, seega on see nädal edasise tõusu osas kriitilise tähtsusega. Turud alustavad kerges miinuses S&P 500 futuurid on 2,8 punkti miinuses, Nasdaq on 9 punkti miinuses.

-Nafta hind on taas kerkinud turgude jaoks ohtlikult kõrgeks üle 41 dollari barreli eest. Peamiseks põhjuseks on Saudi Araabias toimunud pantvangidraama.

-Semiconductor Industries Assotsiation teatel kasvas aprillis pooljuhtide müük 37% võrrelduna aastataguse perioodiga ning 4,1% võrrelduna eelmise kuuga. Kogumüük küündis 16,94 miljardi dollarini. Tugeva numbrini aitas suurenenud nõudlus mobiiltelefonide, koduarvutite ja digitaalkaamerate järele.

-Suure tähelepanu all on Inteli (INTC) aktsia, firma avaldab neljapäeval peale turgude sulgemist oma kvartali vahearuande.

Rev Shark:

Good morning. I hope everyone enjoyed the weekend respite and is refreshed, rested and ready to rumble. We have some tricky trading in front of us.

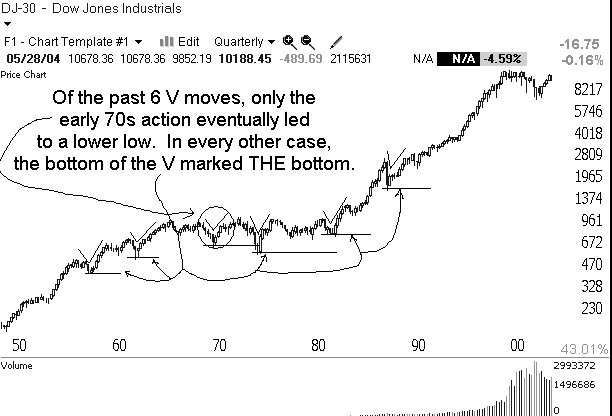

After a solid bounce over the past week, the issue we must now ponder is whether this market has the drive and persistence to move even higher. The S&P 500 bounced almost perfectly off its 200-day simple moving average. It even managed to cut through its 50-day moving average and has the highs of April in sight. The Nasdaq pulled off a similar bounce after finding support near the lows of last November and December.

There are some major headwinds to contend with and it won't be an easy task to keep the recent upward move going. The first obstacle to consider is technical health. The move last week came on lighter-than-average volume. When the market rallies, we like to see some proof that the big institutions are behind the move. The best way to gauge that is to look at volume. If the big money is putting cash to work, they should leave some tracks in the form of higher volume. That was not the case.

The second technical problem is that we are running into overhead resistance from April. Folks who bought stocks in April are now back close to even. After a gut-wrenching drop in early May, they may be happy to exit positions and break even. That is what overhead is all about -- the inclination to sell at close to break-even after sitting through an ugly drop.

A low-volume bounce to areas of resistance sets the stage for some sort of basing action at a minimum and, more likely, at least a slight pullback. There are definitely technical issues to contend with here.

Now let's consider that weak technical foundation in conjunction with market sentiment and the news environment. Oil continues to be the major issue out there right now. Crude prices are hitting new highs as terrorist attacks in Saudi Arabia raise concerns about the possibility of supply interruptions. The market has been particularly attuned to the oil patch lately and that looks likely to continue.

The market has momentarily forgotten its interest rate concerns, but we have a major jobs report due out on Friday, which is likely to help bring that issue to the forefront again. Throw in the festering situation in Iraq and we have three good reasons for market participants to move cautiously.

A vulnerable technical pattern and some significant fundamental and geopolitical worries are going to make the upside path very rough going. There has been a lot of improvement in various individual stocks recently, which has made for some good trading, but we need to be very leery of chasing stocks in this environment. A pullback at this juncture would help build some excellent longer-term entry points, if recent lows hold. The bounce last week helped improve the technical picture of many individual stocks, but they are now ripe for consolidation of recent gains before we can be aggressive buyers.

Futures are indicating a weak open as oil weighs on overseas markets. One bright spot this morning is China, which is foregoing interest rate hikes for now and is talking about opening its markets to foreign retailers. China-related stocks look to offer some trade opportunities today. On the downside, regulators in the United Kingdom are requiring cell-phone companies to cut prices, so watch pressure in that group.

Grab another cup of coffee, shake off the weekend excesses and get ready for a very challenging market.

Gary B. Smith:

-

SSPI +70% (platform selected by LMT) - here we go again!

sB -

Kuidas see HEX25 on kukkunud üle 5%, kui Nokia on kukkunud üle 2% ja teised veel vähem ja mõned isegi tõusnud?

Mis matemaatika seal kehtib? -

Tegemist Hex-i 25 indeksaktsia väärtusega, mis kahjuks ei ole nii likviidne kui QQQ ja DIA, st suur spread tekitab ebaloomulikke hüppeid.

-

Nafta peaaegu $42 juba (+5% täna), see suures osas aktsiates müügisurvet tekitabki.

-

Nortel (NT) tuli enne tänast börsipäeva kommentaaridega oma raamatupidamisskandaalide kohta ning kui enne kommentaare oli aktsia +5%, siis peale kommentaare -5%.

Norteli kommentaar oli küll pikem, kuid põhilise võib kokku võtta sellega "väga palju tööd on veel teha, et täpne eksimuse suurus välja selgitada". -

Mulle hirmasasti meeldis Crameri sõnavõtt Norteli (NT) teemal eelmisel nädalal. Ise ma selle firma aktsiaid ei oma.

"....Nortel (NT) shareholders got two pieces of good news Wednesday: Former Canadian finance minister John Manley joined the board; and Paul Sagawa, the Sanford Bernstein analyst and a classic weak hand, downgraded the stock. Lots of irony here: Manley joined the board after doing a thorough check and realizing that the company is going to come out of this jam whole, and Sagawa downgraded it because he thinks the publicity from all of the class-action suits and prosecutions is going to leave things less than whole.

I back Manley. Here's why.

First, Manley didn't need to join the board. He's like a Bob Rubin figure up in Canada; he can do what he wants.

Second, if Manley wanted to, he could have waited to see the results of the audit and then joined the board. I am sure he would have been welcomed then and wouldn't have the risk he faces now that things could turn out badly.

Third, Manley talked to Bill McLucas. There are lawyers who do bogus internal investigations, and then there are lawyers like Dan Webb, who did the Dick Grasso investigation, and Bill McLucas, who did the WorldCom investigation. These guys are tigers. They exist to find bad things and publicize them. They are not "for sale." Their opinions matter. Their investigations matter. These are people who pride themselves on not "whitewashing." When I saw that Bill McLucas was doing the investigation, he of Wilmer Cutler & Pickering and former head of enforcement at the SEC, I realized immediately why Nortel's former CEO Frank Dunn had to go -- McLucas probably demanded it. He has no tolerance for corruption or for those who looked the other way when corruption occurred; they're the same thing to McLucas. He's tough as nails and scary to the bad guys. He's the guy cleaning house.

The Toronto Globe and Mail reports that Manley joined the board after meeting with McLucas. I can tell you that McLucas is Mr. Worst-Case-Scenario. And after hearing the worst case, Manley still joined. That's downright encouraging.

One of the Nortel bears told me Wednesday that he felt Manley might be getting brought in to salvage the company and that it could be "window-dressing." To which I say, "Still, why come in now?" Why not wait until after the investigation and the audit are finished? It isn't like anyone cares; people have written off this company entirely. I asked the bear whether he was going to short more and he said, "No, because Sagawa threw in the towel and that was an important bottoming moment." Unfortunately, if you use that scale, there are four more bottoming moments ahead.

I don't believe it, though. I think this is the real deal. I'm anxious to get my Nortel position to 75,000 shares before the full audit comes out......" -

-Eelhäälestus päeva börsipäeva alguseks on hea, nafta hind on peale 42,45 dollari läbimist suuna taas allapoole võtnud ning indeksite futuurid viitavad turu positiivsele avanemisele. S&P 500 futuurid on 3,9 punkti plussis, Nasdaqi futuurid 5 punkti plussis.

-Neljapäeval toimub Beirutis OPEC-i ministrite kokkusaamine ning lootus, et seal otsustatu aitab nafta hinda stabiliseerida on barreli hinnal lubanud laskuda alla 42 dollari. OPEC-i president Purnomo Yusgiantoro sõnul võivad naftamaad viia tootmise täisvõimsusele, hetkel on kasutatakse ära 88% võimalustest.

-Norteli (NT) teatas, et ei ole veel valmis avaldama oma ülevaadatud majandusaruandeid (kuni 2001. aastani tagasivaadatuna). Aktsia eelturul pea 5% miinuses.

-Prudential otsustas alandada McDonaldsi (MCD) reitingut neutraalseks, leides et kasumi kiire kasv ei võimalda enam tulevikus varasemaid kasumiüllatusi.

Rev Shark:

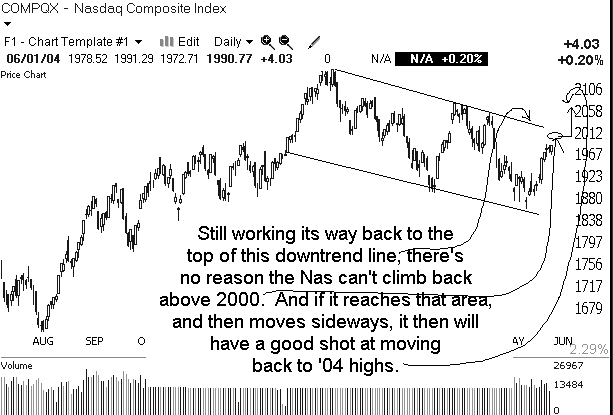

Yesterday the Nasdaq finished higher for the seventh day in a row. After finding support at 1875-1900, the index has been moving steadily higher, but on lower-than-average volume. It has managed to move back up through both the 200- and 50-day simple moving averages.

The ability to recover those important technical levels is clearly bullish, but we also have to consider the manner in which that was accomplished. A low-volume, straight-up move is very different than a high-volume, stair-step move. The former has a weak foundation, which makes continued upside problematic, while the later has a firmer platform, which supports further upside.

It is very important to look beyond just the percentage-point movement in the indices when trying to determine where things are headed. Volume and the underlying chart formation are your best clues as to the sustainability of a move. Price movement alone only tells you part of the story.

Think of volume as fuel for the market. The more volume, the more likely that a move will continue in the same direction. Volume measures the intensity of buying. When it's high, it indicates that the big institutions are putting money to work, which eats up the available supply and makes it easier for things to move up.

The underlying chart formation is also very important. Think of it as a launching pad. The more solid it is, the better the chances we will go into orbit. When a market moves up in a straight line without a good foundation, it becomes more vulnerable to a sharp drop when profit-taking sets in. As the level of unrealized profits grow, the inclination to sell and lock in gains increases once things start to slip.

Now lets look at the current state of the Nasdaq. The point move and action over the last couple weeks has been impressive, but the underlying volume and chart formation are not as encouraging. Volume has been light and the move has been straight up, leaving us in a somewhat overbought state. That questionable technical base can be corrected by a pullback, or by doing little for several days and digesting the recent gains.

In addition to the above, another hurdle that the Nasdaq faces is the downtrend line that connects the January and April tops. That line is around the 2020 area and will be viewed as major overhead resistance by technicians.

Despite those flaws in the current action, there are some encouraging signs, such as the relative strength in small-cap stocks and the return of some healthy pockets of momentum. There also seems to be a decent "wall of worry." Lots of folks are worried and looking for a pullback, which is what prevents it from happening.

We have a positive opening shaping up. There is some slight alleviation of the upward pressure on oil prices and European stocks are acting well. The news flow is rather slow, but we have the Intel (INTC:Nasdaq) midquarter update on Thursday and the big jobs report on Friday, which will garner much attention.

Look for volume to stay light and the action to be random once again. There are pockets of trading opportunities, but the foundation of this market needs work before we can have greater confidence in continued upside.

Gary B. Smith:

-

Tere, olen pikalt aktiivsest kauplemisest eemal olnud, mis on juhtunud LHV Pro soovituse PKS-ga ?