Börsipäev 24. nov

Kommentaari jätmiseks loo konto või logi sisse

-

Gapping Up

GOOG +5.7% (Goldman inits with a $215 target) -- Up in sympathy: INCX +5%, ASKJ +3%, TZOO +3%.... Other News: BIIB +5.2% (MS drug Tysabri gets quick FDA approval), ELN +5% (Tysabri is partnered with ELN), MAGS +5% (gets US$3.4 mln order to protect Correctional Service Canada sites), PCNTF +12% (momentum from 20% move yesterday), DV +7.4% (adopts poison pill), DAL +6.1% (UBS upgrade - says co is not likely to go bankrupt just yet), NT +3.2% (provides accounting update).... Recent momentum names moving: LMIA +7.5%, PACT +6%, BOOM +5.6%, GOAM +4.4%.... Under $3: BCON +19%, DIGL +11.5%, AATK +8%.

Gapping Down

MIK -9% (reports in-line, guides JanQ to low end of previous guidance; Wachovia and BB&T downgrades), POSS -13% (reports Q1), CNCT -10% (gets FDA non-approvable letter for Extina drug, Piper downgrade), QTWW -9% (to acquire StarCraft), SEAC -6.6% (reports OctQ), SIRI -1.6% (JP Morgan downgrade), SPIL -23%.... Under $3: EMRG -16%, SCON -10% (announces offering), LOUD -5.2% (registers 13.9 mln shares to be sold by holders). -

Rev Shark:

Giving Thanks for What the Market Gives Us

"Gratitude unlocks the fullness of life. It turns what we have into enough, and more. It turns denial into acceptance, chaos to order, confusion to clarity. It can turn a meal into a feast, a house into a home, a stranger into a friend. Gratitude makes sense of our past, brings peace for today, and creates a vision for tomorrow."

-- Melody Beattie

Tomorrow is the day we set aside to give thanks for the blessings in our lives. It is very easy to take for granted some of the things we contend with every day, such as the stock market. Quite often the market is a tremendously frustrating beast that seems determined to find a way to separate us from our cash as quickly as possible. We can work for weeks racking up gains only to see them slip away in a blink of an eye when we make one small misstep.

Yes the market can be annoying, irritating and downright cruel at times but the great thing about it, which we often fail to appreciate, is that it provides us with an endless stream of opportunities. Every day there are new possibilities for making profits. We hold the keys to unlocking gains as long as we just keep on trying and don't give up.

I like to think of the market as a baseball game where I can stand at the plate and wait for my pitch -- without being called out, because I have an unlimited number of strikes as long as I don't deplete my capital. Preserving and protecting our capital is key. We can't be reckless and let it slip away, because it is capital that keeps us in the game, so we have to remember to cut those losses fast.

In addition to endless opportunities, the market also allows us to start fresh whenever we choose. Many of us squander that liberating aspect of the market by holding on to stocks that weigh on us emotionally. We trap ourselves in unpleasant circumstances even though the market makes it easy to escape. Many of us fail to take advantage of the ease of selling that allows us to start refreshed and cleansed any time we would like.

Another great aspect of the market is that there are so many ways to approach it. We can use fundamentals, technicals, psychology, behavioral economics, and variations and combinations of these and other approaches. It is a great intellectual chess game. Sure, we lose sometimes but we can always explore new ways to win the next time.

As active market participants we have much to be thankful for but that does not mean that we get a free ride. The blessings of the market are only available if we work to take advantage of them. We can't expect good things to happen unless we are willing to put forth constant and significant effort.

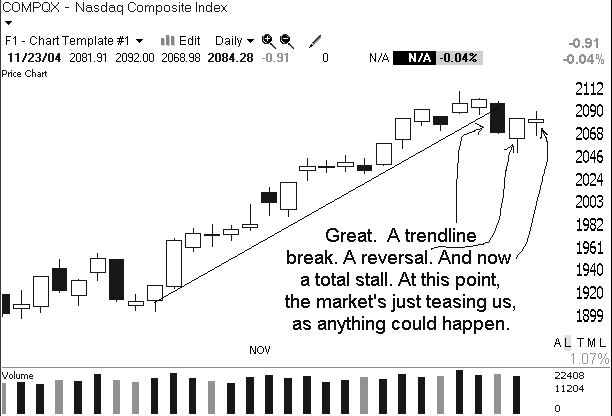

The market is at a particularly interesting psychological juncture right now. Although the major indices are doing little there is some very rewarding trading action in small-cap stocks. Market breadth has been good and there is plenty of momentum for trend-following traders to take advantage of.

To some degree this is driven by good old-fashioned seasonality. The start of the holiday season makes people feel good and when they feel good they have a bigger appetite for risk. That tendency is compounded by traders who have seen this phenomenon in past years and help to make it self-perpetuating.

Another issue affecting the market right now is that so many folks feel as if they failed to take full advantage of the recent rally. They were underinvested and not aggressive enough, and they're determined not to let that happen again. Many of them are far more worried about being left behind than they are about the possibility of incurring losses.

The main thing to keep in mind today and Friday's half-day session is that the ranks of traders will thin, which means the market can be pushed around much easier than usual. Traders will be looking for thin situations that can catch fire and create some big moves. There will be good opportunities but we will need to move quickly and decisively.

In the early going we have the dollar hitting new record lows against the euro but there is little movement. European markets are up slightly and financials are helping out in Asia. Oil is little changed in front of the inventory numbers due out this morning. We have the weekly unemployment claims and durable goods on the agenda as well.

Gary B. Smith:

-

täna YLE 2's 22:05 dokkfilm "Wall Street - A Wondering Trip", kõlab huvitavavat.