Börsipäev 23. veebruar

Kommentaari jätmiseks loo konto või logi sisse

-

Rev Shark:

Know When to Walk Away From the Market

2/23/05 8:21 AM ET"To fear the worst oft cures the worse."

-- William Shakespeare

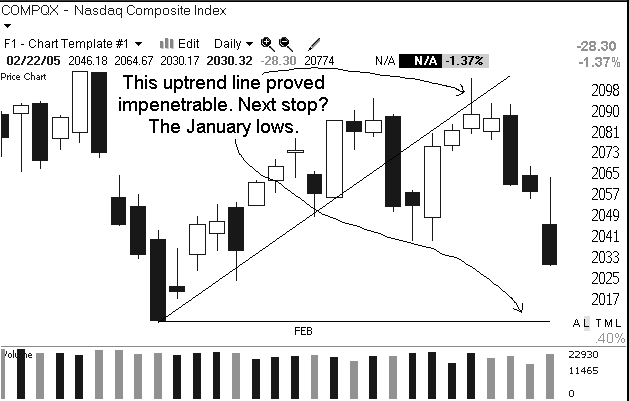

There is no way to view yesterday's action as positive. The selling was broad, heavy and took out important support levels. The Dow suffered its worst day in almost two years, the S&P 500 looks to be forming a double top and the Nasdaq is within shouting distance of its January lows. There are plenty of reasons to be fearful that there is more downside in the near future.

Despite the dangers out there, many investors are timid about taking steps to protect themselves. They have no problem buying aggressively when they feel the market is going to make an upside run, but they are slow to take action when danger lurks. Bold buyers often have difficulty being bold sellers. The same folks who plunge in wildly when the market looks positive find it difficult to be aggressive in protecting themselves when the market looks bad.

Why do investors struggle more with aggressive defense than aggressive offense? A big reason is that institutional Wall Street constantly sends the message that selling is a shameful thing to do. We are constantly told that we need to stay in the market at all times, and that if prices move lower, it is merely an opportunity to buy more.

The hardest thing to do for most investors is to sell, but once you free yourself of the psychological shackles that keep you attached to a particular stock, the strategic advantage of being an aggressive seller at times becomes abundantly clear. Selling is our most strategic tool in approaching the market but we fail to use it. The beauty of selling is that it can so easily be undone. Transactional costs are minimal but the protection is tremendous. Learn to be as bold in your selling as you are in your buying and you will be a better investor for it.

We have a little stabilization in the early going. Kuwait indicated that OPEC may increase production and that has sent oil prices down slightly. The dollar is also showing a little strength this morning, which is helping the mood. Overseas markets were hit hard in sympathy with the poor action in the U.S. yesterday. We have the CPI report coming up and that is going to generate a reaction.

Don't be too quick to embrace a bounce today. We had some substantial damage yesterday and it is unlikely to be overcome too easily.

Gary B. Smith:

-

Gapping Up

ACDO +35% (to be bought by MHS), PFGC +10% (to sell Fresh Express unit to Chiquita Brands), USFC +8.1% (Yellow Roadway in talks to buy USF -- WSJ), ENMD +6.4% (announces presentation of preclinical research results), SMSI +5.8% (announces deal with Alltell), TZOO +4.3%, GERN +3.9% (plans to treat people who have spinal cord injuries - NY Times), OVTI +3.5% (significantly undervalued, reit Overweight - JP Morgan), ASML +3.2% (licenses technology patents to Intel).... Gapping up on strong earnings/guidance: ADSK +2.3%, LCAV +7.6%, CIEN +5.1% (up in sympathy: ALA +3.4%, JDSU +3.2%), MTLG +4.9%, GT +4.5%, NTES +3.4%, TOL +3%.

Gapping Down

Gapping down on disappointing earnings/guidance: APSG -26%, POSS -10.5% (also cut to Sell at Stanford Group), NANO -5.7%, NOVL -4.6%, COGT -3.6% (also downgraded to Hold at Needham), LAMR -2.4%... Other News: MHS -5.4% (to buy Accredo Health), MAMA -5.9% (three shareholder suits filed against the company).