Börsipäev 10. märts

Kommentaari jätmiseks loo konto või logi sisse

-

Hugh Hefneril läheb hästi, Playboy (PLA) tõstis prognoose. Rene, sul oli sealt sektorist vist veel häid valikuid? :)

08:45 PLA Playboy expects Y05 EPS in the range of $0.54-0.59, ex items, Reuters single analyst estimate is $0.48 (13.09 ) -

see lihtsalt financingust tingitud numbrite muutus, erilist huvi premarketil pole, 6 senti closingust kõrgemalt ei taha keegi osta.)

-

Rev Shark:

Makret Surveys a Troubled Playing Field

3/10/05 8:42 AM ET"Well, ya got trouble, my friend. Right here, I say trouble right here in River City. With a capital "T" and that rhymes with "B" and that stands for...."

-- The Music Man -- Meredith Wilson

That "B" might stand for "bonds." The 10-year bond has ticked up a quarter-point this week, which helped spook a market that has already been grappling with higher commodity prices, particualrly oil. Higher interest rates are a natural consequence of an improving economy and the stocks market anticipates them to some degree. However, interest rates also rise because of inflationary pressures, which are a major negative for the stock market because it means costs are going up for many companies without a similar increase in sales or profits.

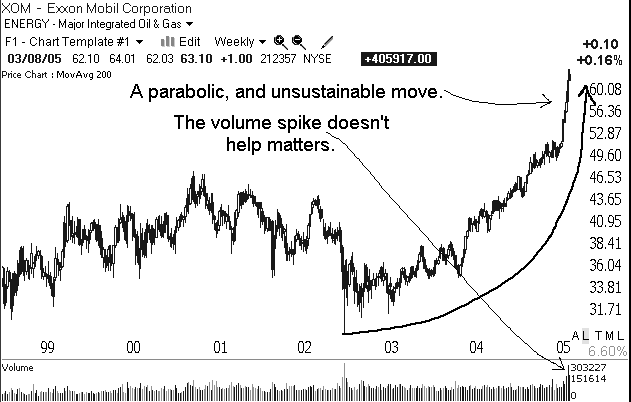

Increases in oil prices are a particularly good example of how inflation is a negative for the market. Higher oil is great for oil companies but for any business that uses oil, it simply increases the cost of doing business and squeezes margins. When inflationary pressures affect other basic materials the stock market has to start pricing in the impact that will take on profits.

If the economy was hot, companies would be able to raise prices and keep their margins intact. However, our economy, while improving, is just plodding along at a slow and steady pace. Most companies do not have the ability to pass along higher prices to their customers so profits are squeezed, PEs contract and stocks prices fall.

Higher oil, higher interest rates and a weak dollar in a so-so economic enviroment are a very troublesome combination for stocks. We have to stay defensive when trouble of this type is brewing. If the trend continues to build, we will see much lower equity prices.

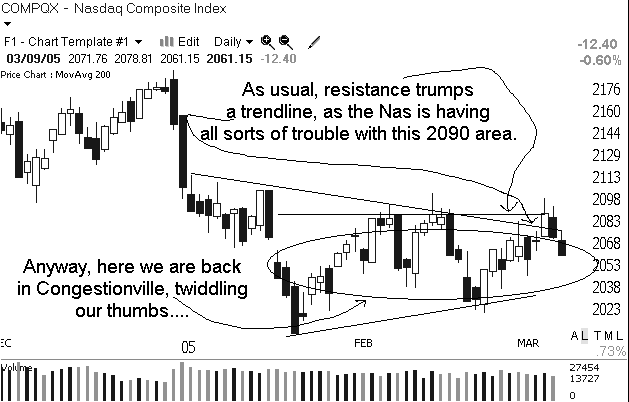

One positive development we need to watch for is a rotation into technology stocks, particularly semiconductors, which I have been yapping about. Technology is less affected by inflationary pressures in basic commodities, and therefore it is often the beneficiary of investors looking for a place to put some cash.

The rotation theme makes sense as money comes out of groups such as steels, oils and deep cyclicals, but the big probem is whether the fundamentals are strong enough to attract the bulls. The valuations of many technology stocks, particularly the bigger-cap tech stocks, are not compelling to value-oriented buyers.

Intel (INTC:Nasdaq) has its midquarter update tonight, which will be very important in determining whether a technology rotation can gain some momentum. The conditions are ripe for technology to show relative strength, but some good news is needed to light the fire. Even if technology stocks do begin to show relative strength, that doesn't necessarily mean they will move up strongly -- they simply may not go down as fast as the rest of the market.

We have some major worries right now and capital preservation should be your priority until conditions improve.

We have a slightly negative open shaping up. Oil has eased a bit and gold is down. Weekly unemployment claims just hit and ticked up a bit. That may take some of the pressure off of interest rates, which will help the market, but if oil doesn't ease up rates are likely to continue to see upward pressure.

Gary B. Smith:

-

Ega PLA polnudki soovitusena, pigem "pehmed" väärtused :) Antud uudis oli jah puhtalt intressimuutusest - nad alandasid oma intressikulusid.

-

Gapping Up

NGPS +11% (reports Q4), MXWL +11% (US Advanced Battery Consortium selects co to develop ultracapacitor-based energy storage module for autos), MJES +6.8% (reports JanQ), IMAX +6.6% (beats by a penny; raises Y05 EPS guidance), MCEL +11.4% (delivers to US Air Force fuel cell power system), TONS +4.8% (co says internet rumors are unfounded), EVST +4.8% (to introduce fitness equipment in UK and Ireland), ADZA +4.1% (reports Q4), NAPS +3.6% (positive Piper note), ELN +3.6% (extension of momentum), RFMD +3.3% (Piper upgrade), ISE +2.8% (IPO momentum continues), BOOM +2.2% (extends yesterday's 8% move), ALTR +1.8% (raises guidance; JP Morgan upgrade).... Small cap energy momentum continues: BDCO +14%, FUEL +12.2%.... Under $3: BIZ +29% (reports Q4), TGC +24% (sale of assets).

Gapping Down

Gapping down on disappointing earnings/guidance: MATK -13%, DAL -11.3%, IDCC -5.7%, QTWW -5.1%, EAT -4.4%, JBLU -3.7%, FARO -4%, EIDSY -13%... Other News: DISH -6.8% (accounting probe -- Bloomberg.com), VVUS -11% (prices offering), FLSH -4.5% (JP Morgan downgrade), RHAT -3.5% (hearing negative broker chatter), ABLE -2% (co says it is not sure why stock is moving), HSIC -3% (downgraded to Sell at BofA), FRO -2.4%, SFCC -2% (downgraded to Sell at BofA). -

TKLC vajus läbi stopi ja positsioon läks sulgemisele.

-

Tänagi turud üsna hõivatud nafta hinna jälgimisega, iga sent langust lisab positiivsust aktsiaturule. Hetkel naftabarrel 53,8 dollarit ning 53,7 dollari taset peetakse oluliseks vastupanutasemeks, mille läbides võib tulla kiire edasine liikumine alla.

-

Lisaks veel üks huvitav anomaalia turult: CEE ehk Ida Euroopa indeksaktsia on miinuses 7%, uudist väga ei olegi, ainult suurem müüja turul.