Börsipäev 30. märts

Log in or create an account to leave a comment

-

Rev Shark:

Stay Defensive, and Keep False Hope at Bay

3/30/05 8:11 AM ET"Give a man health and a course to steer, and he'll never stop to trouble about whether he's happy or not."

-- George Bernard Shaw

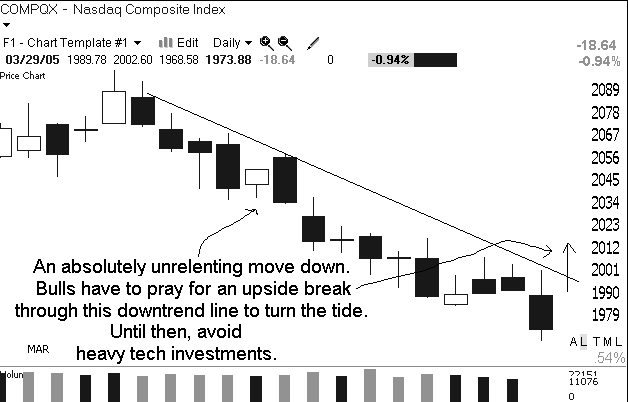

The health of the market is poor, and its primary direction is down. Unfortunately many investors are inclined to struggle against this reality. They search for reasons and justifications on why things are due to change at any moment. Their investment strategy is nothing more than hope.

The best thing an investor can do is acknowledge reality and be prepared for it to continue for a while. Doing nothing but waiting for a change in market conditions is the easiest way to dig a deep, dark hole for yourself that will leave you underground when things really do start to improve.

There are always market commentators and Wall Street professionals who will be happy to give you hope about how good times are just around the corner. They will urge you to keep your money in the market and warn you that if you don't, the market is going to run away without you. Baloney!

When the market regains its health, there will be plenty of time to make money, and it's a whole lot easier if you don't have to make up losses that you incurred while waiting for a market turn. Stay defensive while this market struggles. Hope is a really lousy market strategy.

I know this missive sounds very gloomy and negative, but there is nothing that does more harm to investors than the constant search for a turn in the market. The market is going to offer up a constant supply of false hope. There are going to be some big bounces within a downtrend that will make us think that the worst is over, but that is when the danger is the greatest.

This market looks ripe for some sort of bounce after the intense selling yesterday. With the end of the quarter upon us, crude oil relatively flat and some oversold conditions, the serial bottom callers are likely to flex their muscles at least momentarily. If your time period is short, then go for the long-side trade, but make sure you keep in mind the bigger trend, which is clearly down.

In the early going, futures are indicating a positive open. Micron (MU:NYSE) made some positive comments about DRAM demand that helped matters a bit, but there isn't much other news of import at the moment. We have the final GDP for the fourth quarter coming up. The price-deflator component will be particularly important. Not much else is happening right now, and we'll munch on a bagel while we wait.

No positions in stocks mentioned.

Gary B. Smith:

-

Gapping Up

TZOO +11% (Susquehanna upgrade), KOSP +20% (in settlement talks with BRL), ZOLT +11% (announces large wind energy contract), IMH +11% (REIT announces dividend), MERX +7.6% (beats by $0.11, guides MayQ above consensus), AMR +6.1% (Merrill upgrade), ORCT +5.3% (sets date for 3-for-1 split), INSP +4.1% (JP Morgan upgrade), ANTP +3.8% (bounces after 19% drop yesterday), LEXR +3.3% (prices convertible offering), CTIC +3.2%, JCOM +3.2% (jitters on tax concerns may present an entry point - Rodman; co sends email to analysts), BOOM +3.2% (recent momentum), RTP +2.9%, MU +2.8% (reports FebQ), APOL +1.7% (CSFB upgrade).... Under $3: JCDA +35% (wins contract from large telecom co), DFIB +17% (wins contract), TMTA +10%.

Gapping Down

CGTK -41% (says drug candidate failed to meet primary endpoint), TTEK -20% (guides lower), WAT -16% (gudies lower; Merrill downgrade; Baird downgrade), APN -16%, LANV -11% (profit taking after 71% move yesterday), XPRSA -7.6% (guides Q1 EPS below consensus), ABLTE -7.2% (controller to resign; stock may get delisted), VARI -3.3% (Baird downgrade), RECN -2.4% (reports FebQ), TEVA -1.4% (adverse court ruling).... Under $3: FMDAY -25% (reports JanQ), CNR -9%