Börsipäev 14. juuni

Kommentaari jätmiseks loo konto või logi sisse

-

Cody Willard:

Money Managers Get Edgy as Indices Hug Break-Even

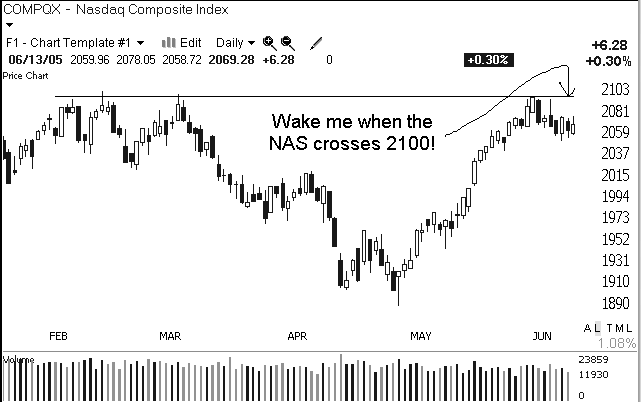

6/14/05 8:10 AM ETTensions are high on the Street. Bulls and long-only investors had a terrible start to the year, as the market tanked from day one, 2005, with the Nasdaq in particular pretty much heading straight down from January to April. The rally off those April lows was swift and furious, with the Nazz moving up about 8% in about six weeks. The Nazz is now back to with about 5% of where it started the year.

The DJIA and the S&P 500 have rallied from a lesser hole and are now back to about even on the year. As those indices flirt with turning positive year to date, the tensions mount, because investors and traders don't want to have to tell their investors that they're negative when the broader indices are positive.

These two indices have spent the last couple weeks churning about those break-even levels; this brings out tensions more so than if the market were churning at levels far from where it started the year. All the money managers are nervous that if the market finally takes off with some magnitude to the upside, they could be left behind.

Compounding that nervousness is that most money managers can't decide what would be the likely leaders. Will it be last year's star, energy? Or will it be the long-derided and still-hated tech sector? Choose the wrong sector's coattails, and if the market does run into positive territory, you'll feel the pain.

The permabears and most hedge funds (most hedge funds are still permabearish, of course -- it's still considered irresponsible to be bullish among the hedge fund cabal) face similar tensions. Do they cover the shorts that they weren't squeezed out of during the last legs of the recent rally? What if the market finally catches real legs and rallies hard into the summer? Those hard-fought gains that most bears had are already cut in half -- do they want to risk not getting paid at year-end if they were to lose the remaining gains? Then again, you don't short a market that in the long run has always paid more to the longs if you don't have conviction about your stance. And with the market churning, setting up for a big move, maybe you want to put those shorts back on in size if and when things look like they're cracking.

With tensions this high, things are likely to be choppy until the market ends up making a real move of magnitude on volume. That said, I expect that we'll see at least one or two fake-out moves before this market finally makes a move that will leave it somewhere away from break-even at year-end. And I think the risk/reward remains most favorable for those nervous and tense bulls.

Those who trade futures have us pointing us toward a flattish open. I'm gonna get a latte (that heat outside can't slow me down!), and I'll be back in a bit.

Gary B. Smith:

-

drugstore.com (DSCM) murdis hommikul $4 taseme hea käibega. Ühtegi uudist ei leidnud, tundub, et M. Gates ostud on andnud suurt tuge aktsiale.