Börsipäev 1. november

Kommentaari jätmiseks loo konto või logi sisse

-

TWX Time Warner reports Q3 (Sep) earnings of $0.19 per share, excluding non-recurring items, $0.01 worse than the Reuters

Estimates consensus of $0.20; revenues rose 6.5% year/year to $10.91 bln vs the $11.05 bln consensus. TWX reaffirms 2006

full-year business outlook.

DVN prelim $1.57 vs $1.52 Reuters consensus; revs $2.72 bln vs $2.65 bln Reuters consensus

GRMN Garmin reports Q3 (Sep) earnings of $0.50 per share, excluding non-recurring items, in line with the Reuters Estimates

consensus of $0.50; revenues rose 62.4% year/year to $408 mln vs the $425.8 mln consensus. Co issues upside guidance for

FY06, sees EPS to exceed $2.04 vs. $2.02 consensus; sees FY06 revs to exceed $1.68 bln, previous guidance called for revs to

exceed $1.6 bln,vs. $1.67 bln consensus.

Jefferies upgrades DreamWorks Animation SKG (DWA 26.45) to Buy from Hold and raises tgt to $31.50 from $27.50, as

they believe near term overhangs and unknowns will soon be resolved, and that investors should focus on 2007, and the

longer term story

Goldman Sachs upgrades Baidu.com (BIDU 87.28) to Neutral from Sell and $93 tgt

Prudential raises Marathon Oil (MRO 86.40) tgt to $79 from $72, based on an incremental earnings increase.

Stifel Nicolaus upgrades Omnicare (OCR 37.88) to Buy form Hold and $45 tgt, based on valuation despite considerable

operating issues and a management that they continue to believe could offer greater transparency to investors on the

co's business model

Bear Stearns upgrades Omnicare (OCR 37.88) to Outperform from Peer Perform

Deutsche Bank upgrades InterActive Corp (IACI 30.98) to Buy from Hold and raises their tgt to $36 from $27 following results.

The firm says they believe investors should accumulate shares at current levels. The firm says steady growth (led by

ticketing, personals, vacations) could benefit from a return to growth in the retail ops. and OIBA margin expansion at

LendingTree in '07.

J.P Morgan initiates Divx (DIVX 22.84) with an Overweight

Merrill initiates Commvault Systems (CVLT 17.87) with a Buy

Goldman initiates Commvault Systems (CVLT 17.87) with a Buy

Thomas Weisel initiates CommVault Systems (CVLT 17.87) with an Outperform, as they believe the co has a defensible

market segment with emphasis on mid-size companies with mixed Unix/Windows environments while the co's highly

regarded QiNetix product line provides a simple, efficient single-console approach to multiple data management tasks

Credit Suisse downgrades Abercrombie & Fitch (ANF 77.41) to Neutral from Outperform and raises their tgt to $83 from

$77 saying they believe there is still upside in the near term, but believe investors should use current strength to take

some money off the table

Credit Suisse downgrades Ann Taylor Stores (ANN 44.02) to Neutral from Outperform and maintains their $48 tgt based

on valuation

Montgomery initiates DivX (DIVX 22.84) with a Buy and $28 tgt, as they favor the co's business model because the bulk

of revenues (~80%) are derived from high-volume digital media applications while profitability remains high -

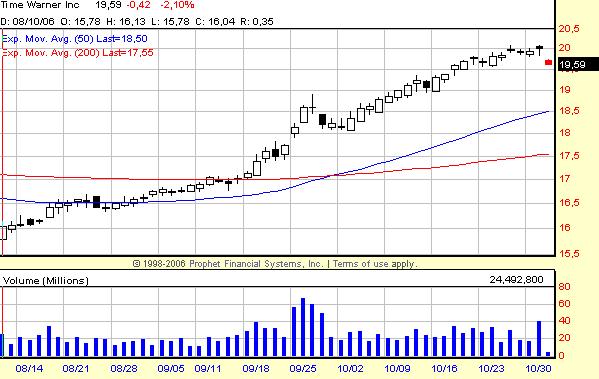

mida arvata TWX-st?

-

Tulemuste kohta midagi väga halba ei saagi öelda (pigem neutraalne), kuid aktsia on praktiliselt püstloodis lennanud viimastel kuudel ning tõenäoliselt kaubeldakse alla. Cable jäi analüütikute ootustele alla, AOL pigem positiivne. AOLi käive ja EBITDA olid tugevad (ad kasv +46% versus +35% ootusi).

-

Investor intelligence pullide protsent on tõusnud kõrgeimale tasemele jaanuarist ehk 53.7%. Karude protsent seevastu kuue kuu madalaim: 28.4%. Party on...

-

Time Warner: Good, but not good enough

-

Oktoobris tõusis Dow +3.4%. See oli viimase 3-aasta tugevaim oktoobri kuu tõus. Viimase 27 aasta jooksul on 1. november Dow jaoks olnud positiivne 22 korral. Hetkel on ka eelturul futuurid kenas plussis.

Suuremad liikujad:

Gapping up on strong earnings/guidance: MA +8.6%, CRDN +8.5%, EXP +7.7%, WTS +7.5%, BRNC +6.6%, CI +5.1%, CEC +4.4% (also Merriman upgrade), PTEN +4.3%, DWA +4% (also Jefferies upgrade), MYL +3.6%, NICE +2.9%, SHOO +2.5%, NEM +2.2%, ACAS +2%, ASF +1.6%, BIDU +1.1% (also Goldman upgrade)... Other News: BN +17% (to be acquired by RRD), CMX +8.7% (in talks with CVS about possible merger), ISPH +6.7% (announces license agreement), CVLT +6.3% (multiple initiations of coverage), DIVX +6.2% (multiple initiations of coverage), MSO +3.8% (Credit Suisse upgrade), ESRX +3.7% (in sympathy with CMX), LMRA +2.3% (extends recent momentum), IACI +1.6% (Deutsche upgrade; also Ask.com announces deal with Lycos), TEVA +1%, Under $3: CHTR +9% (Citigroup upgrade).

Sharki arvamus:

Don't Let the Market Sunshine Blind You

By Rev Shark

RealMoney.com Contributor

11/1/2006 8:54 AM EST

Click here for more stories by Rev Shark

"A subtle thought that is in error may yet give rise to fruitful inquiry that can establish truths of great value."

-- Isaac Asimov

The market uptrend since July remains firmly in place. If you step back and look at the big picture, it seems downright ridiculous to even question the strength of this market. The serial top callers are battered, bloodied and bewildered and their ranks have thinned considerably as the bulls take firm control and refuse to rest.

However, a strong-trending market doesn't relieve us of the responsibility to keep our mind open to potential problems. Although we enjoy a strong trend, we also need to keep measuring the subtle things under the surface that may signal a real change in market character. Even if we are wrong about the true meaning of some of the little issues like the increased intraday volatility we saw yesterday, the technical weakness in semiconductors or resurgence in gold, staying aware of them will help us be better prepared to deal with this market as it unfolds.

This uptrend will come to an end and although we don't want to be too quick to anticipate when, we do what to keep alert to the details and subtleties that will allow us to move quickly to safer harbors when the time is right.

Stay focused on the big picture, which is a clear uptrend, but don't be afraid to explore the little things under the surface. We may be wrong about what they mean but that inquiry may help us develop useful insights that will serve us well in the future.

We have a positive start to the month of November. Overseas markets were strong. Oil is down a bit but gold continues the breakout I discussed yesterday. Keep in mind that the first couple days of November are historically quite strong and that may keep the buyers coming. -

Peale $19.5 toetus 19.3-19.4

-

Construction Spending -0.3% vs 0.0% consensus

ISM Index 51.2 vs 53.0 consensus

Pending Home Sales m/m -1.1% vs Bloomberg consensus -0.9%

Esmane reakstsioon alla -

The E.I.A. reports that crude oil inventories had a build of 1.91 mln barrels (Bloomberg consensus is a build of 2.6 mln barrels); gasoline inventories had a draw of 2.80 mln barrels (Bloomberg consensus is a draw of 925K barrels); distillate inventories had a draw of 2.72 mln barrels (Bloomberg consensus is a draw of 1.175 mln barrels).

Esmane reaktsioon: nafta hind teeb kiire hüppe üles -

Bensu hind kallines Eestis 30 senti liitri kohta :-(

-

Käid nüüd jala? (-:

-

Joel, mida Cramer PTEN-i kohta arvab pikemas perspektiivis?

-

Minu silmis on Cramer muutumas üha enam ja enam šõumeheks, mis on ka põhjus, miks teda enam pidevalt ei jälgi. Tegu on mehega, kes minu jaoks muudab ettevõtte koha pealt liiga tihti oma arvamust. Hiljutiseim kord, mil ta PTEN-i mainis, oli 25. september, mil ta oli ettevõtte suhtes karune. Pealegi, tihti käitub turg vastupidiselt tema 'soovitustele'.

Ja 28. septembril saabus maagaasihinnas praegune põhi... -

Jah, eks Cramer käitub nii, nagu seda eeldab ja ootab tal't USA keskmine investor.

Näiteks ka Äripäev on ju tegelikult tugevalt meelelahutusliku kallakuga leht - seda ootab Riks ja see suund on ka majanduslikult edukam, kui kuiv majandusinfo edastamine.