Börsipäev 23. märts

Kommentaari jätmiseks loo konto või logi sisse

-

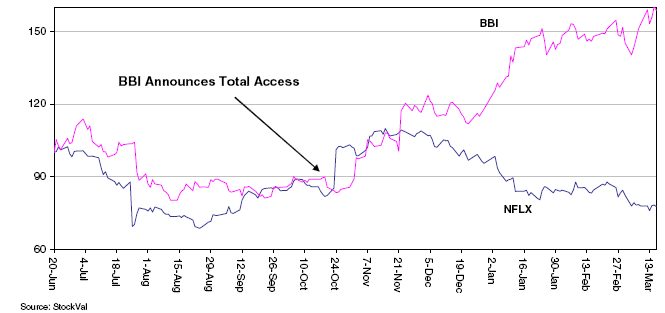

Täna kommenteeris meil juba varem jutuks olnud Netflixi(NFLX) käekäiku Citigroup. Peale Blockbusteri (BBI) teadet nende Total Access programmist 2006. aasta oktoobris, on BBI aktsia oluliselt outperfomin’ud NFLX-i, kes kaupleb ca 16-kordsel 2008. aasta kasumil, kui raha välja jätta. Citi enda prognoos on, et ettevõte suudab järgmise 5 aasta jooksul näidata tugevat 25% kuni 30%-list kasumikasvu. Pikaajaliseks hinnasihiks on Citigroup ettevõttele andnud $30. Väga kiire tõusu läbi teinud Blockbusterile (BBI) on hinnasihiks pandud $7 ja reitinguks ‘hoia’.

Konkurendi Blockbusteri (BBI) Total Access programmist annab hea ülevaate järgmine joonis:

Kliendil on võimalik internetis koostada endale soovitud nimekiri DVD-st, mida näha tahetakse ning soovitud filmid saadetaksegi koju. Käes võib neid hoida nii kaua kui tahad ning kuni 3 DVD-d korraga. Tagastamine käib mugavalt postiga või ise poodi ära viies ning võimalik võtta endale kohe mõni uus film. Kuutasu $17.99+ maksud on samuti igati mõistlik. Ning tegelikkuses sama skeemi ja hinna kohaselt käib ka Netflixist filmide laenutamine.

Citigroup on jälginud ‘veebiliiklust’ nii BBI kui NFLX lehtedel ning 2007. aasta 1. kvartali näitajate põhjal on huvi olnud tugev mõlema ettevõtte puhul. NFLX on viimase 4 päevaga 10% rallinud, kuid juhul kui aktsiahind peaks allapoole tagasi langema, võib pakkuda huvitavat võimalust sisenemiseks ning enne tulemusi positsiooni realiseerimiseks. Lühikesi positsioone on samuti ca 20% jagu sees ning nende katmine enne tulemusi on see, mille peale võimalik panustada. Hetkel oodatakse Netflixilt tulemuste teatamist 25. aprillil.

-

Briefing.com tehnikud kommenteerivad turuolukorda. Lühiajaliselt on nad optimistlikud, keskmisest perioodist rääkides neutraalsed, kui üldiselt olles pikaajalises ülestrendis.

AG Edwards initiates Electronic Arts (ERTS 50.26) with a Buy and sets a $65 tgt, as they believe the co is poised to continue its dominance throughout the console cycle and will have a solid, diversified lineup in 2007 capable of fending off tough competition...

Goldman Sachs upgrades Dreamworks Animation (DWA 29.60) to Buy from Neutral

ThinkEquity initiates Divx (DIVX 19.47) with a Buy and a $26 tgt.

AG Edwards upgrades Western Union (WU 21.68) to Buy from Hold and sets a $26 tgt, as revenue and earnings growth should show some acceleration as the co moves past the last of its difficult comps in the Mexican market

Polo Ralph Lauren (RL) upgraded to Buy from Neutral at Goldman

Citigroup kommenteerib suhteliselt oodatud Palmi (PALM) tulemusi. Üldiselt viitavad prognooside konservatiivsusele:

➤ Palm reported solid results but guided slightly below consensus for FY4Q.Given the level of fundamental concern around the company, this was notunexpected. Furthermore, the solid near-term performance suggests thisguidance could be an act of conservatism.➤ While Palm's smartphone channel inventories edged up, this area of concern isoffset by declines in previous quarters and a sharp increase in sell-through.➤ Mgmt voluntarily opted not to purchase any stock this quarter. Given they werenot restricted from purchasing stock, it suggests no M&A transaction isimminent.➤ Were a deal to occur, we think that it would be much more likely to be a privateequity player. We see little value between a PALM-MOT or NOK combo.➤ Our target increases to $18 and we remain at a Hold/High Risk rating

Stockpickr.com toob välja mõningad veetööstusega seotud ettevõtted (Water Utilities: Old Companies, New Opportunities)

-

Naftat toetab eelturul teade, et 15 Suurbritannia Mereväe koosseisu kuuluvat liiget on Iraani poolt kinni peetud.

There have been headlines crossing the wires regarding an incident between Iran and British Naval personnel. Reuters.com is reporting that British forces said on Friday there had been "an incident" in the northern Gulf after an Iraqi fisherman reported seeing up to seven British or American military personnel being seized by an Iranian ship. "There has been an incident somewhere in the north of the Persian Gulf," British military spokesman Major David Gell said in the southern Iraqi city of Basra, without elaborating. He said he did not know whether any British or American servicemen were involved. The fisherman, who asked not be named, said six or seven foreign military personnel were on two small boats that stopped to check Iranian ships in the Siban area of the waterway, near the al-Faw peninsula that leads into the northern Gulf. When they boarded one ship, at least two Iranian vessels appeared on the scene and the military personnel were detained. There was no sign of any violent confrontation he said.

The British Ministry of Defense confirmed that 15 Naval personnel were seized by Iran.

-

NFLX enda kasumikasvu eesmärgid on tunduvalt kõrgemad - ca. 50%,

seda on nad ka igal tulemuste kõnel kinnitanud, et kasumi sellisel tasemel igaastaselt kasvatamine on jätkuvalt nende peamine eesmärk ning seda kavatsevad ja suudavad täita ka tulevikus

Citigroupi target on selles kontekstis minu jaoks konservatiivselt hinnatud ning teeb ainult rõõmu -

Eilses börsipäevas kommenteerisin mõningaid sub-prime kindlustajaid, mis tegutsevad suhteliselt riskantsetel Florida ja California turgudel. Täna kommenteerib Prudential sub-prime mortgage turgu, viidates, et 40-60% laenajatest ei oleks suutnud nõudeid järgides oma laenusid müüa. See näitab, kui suured probleemid võivad veel tööstusharul ees seista.

Pru: Firm's primary takeaway is that the credit quality of subprime mortgage is likely to continue deteriorating near term. Mortgage lenders at the hearing testified that they estimate that 40% to 60% of subprime mortgage borrowers would have failed to qualify if their mortgages were underwritten at fully-indexed interest rates, suggesting a widespread vulnerability to material rate resets. At the same time, the industry is still in the midst of implementing more restrictive regulatory guidelines on non-traditional mortgage, suggesting to Prudential that the availability of subprime credit could get curtailed further

-

Bulls Hold Their Ground

By Rev Shark

RealMoney.com Contributor

3/22/2007 4:15 PM EDT

Click here for more stories by Rev Shark

The bulls did a nice job of holding on to yesterday's gain but didn't deliver much upside follow-through. The anxiety to rush in and buy that we saw after the Fed interest rate decision yesterday quickly came to an end today, but there were still plenty of folks willing to nibble at slight weakness, and that kept any pullback very contained.

This is the sort of action that is needed after a big move to set the stage for further upside. However, given the way that the market mistreated the bears when they had a favorable technical setup, I'm not so sure that the bulls are going to be treated much better. We shall see how it plays out.

There certainly continues to be very tenacious buying interest, and I don't want to fight that, but I find it troubling that the market is treating the Fed news as a major positive. I don't believe that the Fed's willingness to be less hawkish bodes well for the economy. Perhaps it is going to take some economic reports or news for that fact to become clear, but for now the market is in hear-no-evil and see-no-evil mood.

You have to trade them to the upside here, but that doesn't mean you don't stay disciplined and a bit cautious.

-----------------------------

Ülespoole avanevad:

Gapping up on strong earnings/guidance: COMS +3.4%... M&A: PXR +22.8% (to be acquired by AVY for $30.50/share), OPWV +5.6% (guides Q3 below consensus, announces it will explore strategic alternatives), DCX +4.0% (Daimler shares jump on speculation of Chrysler sale - Bloomberg.com)... Other news: IMCL +23.6% (AMGN halts PACCE trial for Vectibix, which was rival to IMCL's Erbitux; also two broker upgrades), HOKU +12.8% (signs 99-year ground lease in Pocatello, Idaho), AGIX +9.4% (short-covering continues ahead of presentation next week), ASTI +6.3% (SC-13D filing out today with details on previously-announced Norsk Hydro investment; also continued momentum in solar plays), DNDN +4.8%, URBN +4.1% and CWTR 3.4% (Goldman recommends stocks), PICO +3.7% (Cramer positive on stock), DSTI +3.4% (continued momentum in solar stocks), HLF +3.3% (co and AEG announce a 5-yearr multi-mln dollar expansion), Q +3.1% (Cramer says co could win a $20 bln govt contract), ADLS +1.6% (profiled in BusinessWeek Online).

Allapoole avanevad:

Gapping down on weak earnings/guidance: CECE -13.9%, JBL -9.8% (also downgraded at BMO), SRSL -7.3%, NKE -2.4%, PALM -1.9%... Other news: HNAB -24.2% (provides pipeline update, co no longer pursuing Special Protocol Assessment with FDA for Marqibo), AMGN -3.4% and DNA -2.2% (AMGN halts PACCE trial due to poor survival in patients that used Vectibix along with DNA's Avastin and chemotherapy to treat colorectal cancer; DNA also reaffirms), TWW -3.6% (prices 11 mln share offering at $8/share), BEAV -3.1% (prices 10.5 mln share offer at $32/share), AGP -3.0% (prices $240 mln in convertible senior notes), RRI -2.6% (downgraded to Sell at BofA), RACK -2.4% (profit-taking after yesterday's takeover rumor-fueled move), STP -2.4% (downgraded to Neutral at Goldman), BKHM -2.1% (announces private placement). -

Valero Energy(VLO) sai eile õhtul positiivsed kommentaare Barronsi Weekday Trader’is. Autosõiduhooaeg, mil naftast rafineeritud mootorkütust kõige rohkem vaja läheb, on lähenemas suure hooga. Päikselistel kevad- ja suvepäevadel ajavad oma autod välja ka need, kes seni libedat peljanud ning pealegi on suve näol tegu ajaga, mil sõidetakse puhkusele mere äärde, mägionnikesse puhkama või tutvuma riigi vaatamisväärsustega. Ameeriklane armastab oma autot ning eriti ilmneb see nende suvistes reisides, mil mootorkütuste nõudlus tugevalt suureneb. Siit ka mõiste “summer-driving season” ehk “suvine autosõidu hooaeg”, millest rafineerijad vaid rõõmu tunnevad.

Barronsi loo põhipunktideks ongi lähenev suvi, piiratud rafineerimisvõimsused ning võimalikud segajad – tormid, jaamade ebakorrapärased hooldustööd ning toornafta tarneprobleemid jne. Näiteks Oppenheimeri analüütik on olukorda kirjeldanud sõnadega: “kui kõik läheb rafineerijate jaoks plaanipäraselt, oleks tegu täiusliku tormiga”. Frederick Sturm on nimetanud rafineerija Valero(VLO) oma Ivy Global Natural Resources Fund-i üheks tippvalikuks. Merril Lynchi analüütik Chi Chow peab ise veel võimalikuks, et Valero paneb mõne oma vähem kasumlikest rafineerimistehastest müüki ning saadud raha eest suurendab aktsiate tagasiostmisi.

Eile andis Bear Stearns’i (BSC) director Paul Novelly sisse filing’u, teatamaks, et on otse turult ostnud 10 000 BSC aktsiat hinnaga $150.29. Ost järgneb 20. märtsi 35 000 aktsiapaki omandamisele hinnaga $147.49. Sellenädalased aktsiaostud on suurimad ühe kuu tehingud, mida Novelly on teinud alates BSC juhtkonnaga liitumist 2002. aastal.

-

Võimuvõitlus demokraatide ja respublikaanide vahel USAs jätkub.

US House passes Democrats' Sept. 1, 2008 deadline for withdrawing troops from Iraq - Reuters

Briefing.com note: President Bush has promised that he will veto any bill on Iraq troop removal timeline