Börsipäev 28. aprill

Log in or create an account to leave a comment

-

Langus USA aktsiaturgudel on börsivälise kauplemise ajal hoogustunud ning praeguseks on S&P500 läbi kukkunud olulisest 850 punkti tasemest, olles hetkel -1.9% @ 841 punkti. Nasdaq100 -1.4% @ 1354 ning nafta -2.5% @ $48.9 barrelist.

-

Täna kell 17.00 avalikustatakse aprillikuu tarbijausalduse näitaja - sedapuhku oodatakse sentimendi marginaalset paranemist. Veebruari näitaja oli 25.3 punkti, märtsis 26.0 ning aprillilt oodatakse 29.9 punktilist näitajat.

Enne turgu teatavad oma tulemused teiste seas BMY, PFE, VLO, X ja AG. Pärast turgu MEE, HTZ ja DWA. -

Täna koguneb FED oma järjekordsele kahepäevasele kohtumisele, homsest otsusest midagi erakorralist ei oodata. Samas on Financial Times tutvustanud FEDi analüütikute poolt koostatud raportit, mille kohaselt peaksid intressimäärad praeguses majanduslanguses olema -5% juures. Et neid nullist madalamaks langetada ei saa, ongi kasutusele võetud muud meetmed, mis peaksid ligikaudu andma sama tulemuse.

-

C ja BAC on võimaliku kapitali kaasamise jutu peale eelturul juba 8% miinuses. Ühtlasi kirjutas WSJ, et valitsus soovib stress-testi tulemused avaldada juba selle nädala jooksul, varasem daatum oli järgmine esmaspäev.

-

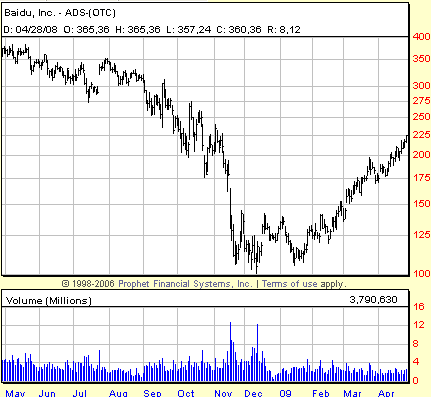

Baidu.com (BIDU) on avanemas eileõhtuste ilusate tulemuste järel paariprotsendilises plussis. Korralikud prognoosid tuleviku osas on hoolimata aktsia enam kui 100%lisest tõusust viimase kolme kuuga analüütikuid veelgi optimistlikumaks muutnud - näiteks Deutsche Bank kinnitab oma ostusoovitust BIDU aktsiatele ja tõstab hinnasihi $241 peale. Citigroup liigutab oma sihi $245 pealt $260 peale ning Sterne Agee poolt antud uueks sihiks $280.

-

February S&P/Case Shiller Composite-20 Y/Y -18.63% vs -18.70%, prior -19.00%

-

Nüüdseks uuendatud ka meie tulemuste tabel tänahommikuste tulemustega. Link siin.

-

USA alustabki päeva indeksite ca 1.5% kuni 2%lise miinusega. Nafta punases pea 3%.

Saksamaa DAX -2.50%

Prantsusmaa CAC 40 -2.07%

Inglismaa FTSE 100 -1.96%

Hispaania IBEX 35 -2.67%

Venemaa MICEX -2.98%

Poola WIG -2.67%

Aasia turud:

Jaapani Nikkei 225 -2.67%

Hong Kongi Hang Seng -1.92%

Hiina Shanghai A (kodumaine) -0.17%

Hiina Shanghai B (välismaine) +0.63%

Lõuna-Korea Kosdaq -5.26%

Tai Set 50 -0.49%

India Sensex 30 -3.25%

-

Choppy Waters Ahead

By Rev Shark

RealMoney.com Contributor

4/28/2009 8:12 AM EDT

Fasten your seat belts. It's going to be a bumpy night.

-- Bette Davis as "Margo" in All About Eve

News this morning that Bank of America (BAC) and Citigroup (C) may need to raise capital in order to avoid undue "stress" is helping to give us a weak open. We also have news of further swine flu breakouts, some downgrades of banks and weak action overseas.

With major earnings reports winding down, the primary government stimulus and bailouts plans already announced and a big jump in hope that the economy is turning, we have plenty of obstacles to further upside. The market has been chugging along quite nicely since the March lows and has given us some classic "climb the wall of worry" action as well as some performance anxiety. It has been awfully difficult for many investors who were burned badly over the past 18 months to set aside their worries and concerns and jump back in.

What has been most interesting about the rally off the March low is how widely it has been embraced as not just a bear-market move but as the end of the bear market. Like many, I've maintained a high level of skepticism and have not been very aggressive on the long side. Even among the bulls, this rally has required some blind faith, as much of the gains have come on surprise news from the government rather than on economic or earnings news. We've seen some very good earnings reports as expectations have been quite low, but forward guidance still indicates a rocky road.

The market, specifically the S&P 500, has been in a trading range for two and half weeks after gapping up on the Thursday before the Easter holiday when Wells Fargo (WFC) announced it would beat earnings expectations. Since then we have seen very aggressive trading in some of the more speculative small-caps and have been helped out by good reports from the likes of Apple (AAPL) , Amazon (AMZN) and Microsoft (MSFT) , but we are seeing some signs of weakening action.

Yesterday the outbreak of swine flu dominated the news and was used as an excuse for some selling. Overall, that selling was pretty mild given how far the market has come, but we lost some momentum and the dip-buyers were not as energetic as they have been. Overseas markets were shaky overnight, and news that banks need more capital is putting pressure on things. This will be a good test to see if the dip-buyers retain their desire to jump in quickly on each pullback. They have done that steadily for a while now and have helped hold this market up for longer than many have expected.

We can pull back quite a bit at this point without completely killing the move off the March low. We can go to 825 on the S&P 500 and 1600 on the Nasdaq and still be within the recent trading range. The good thing about a correction and/or consolidation is that it will help separate the good stocks from the bad and allow stock-picking to come to the forefront. Stock-picking hasn't mattered a whole lot until just recently, as the market was mostly moving as a single monolith. In the last few weeks we've seen many more pockets of speculative action, which signals that traders are working harder to find individual stocks rather than just reacting to macro market and economic news.

Don't be discouraged if we start seeing a pullback in the overall market. The good news is that the nature of trading has changed recently, and that is likely to continue and reward us with better opportunities. At the moment it looks like the pressure is on the banks, and that is going to cause some problems, but we need for some tests of the downside.

It looks like a bumpy ride today, so adjust your trading helmet before you strap yourself into the trading turret. Good luck and go get 'em.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: PRXL +21.5%, EFUT +19.2%, ODP +18.6%, AAN +7.0%, TLAB +5.2% (light volume), DIN +4.8%, UHS +4.2%, SUPG +3.9%, WRI +2.7%, AMED +2.1% (light volume), LOPE +2.0%, BIDU +1.9% (upgraded to Hold at Needham), BP +1.7%, EW +1.3% (light volume)... Select drug and infectious disease related names showing continued spread of swine flu epidemic: NVAX +18.4%, APT +12.8%, BCRX +10.8%, PURE +5.2%... Other news: CSIQ +4.3% (announces potential new credit facilities with three Chinese state banks), NAT +2.4% (Cramer makes positive comments on Mad Money), DNDN +1.7% (still checking), FRO +1.1% (Cramer makes positive comments on Mad Money)... Analyst comments: CVS +2.4% (added to Conviction Buy list at Goldman- Reuters).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: SSW -25.9%, ECOL -14.5%, SLG -8.4%, JEC -8.1%, RCII -7.6%, SMG -7.5%, X -7.5%, DB -5.3%, XL -5.2%, FMD -5.0% (light volume), HBI -4.7%, WMGI -3.9%... Select financial names showing weakness: BAC -13.6% and C -9.8% (Fed pushes Citi, BofA to increase capital - WSJ), NTRS -7.3% (confirms equity offering of $750 mln), ING -5.2%, WFC -4.9%, STD -4.3%, MS -3.3%, JPM -3.1%, HBC -2.9%, UBS -2.3%, LYG -1.9%... Select oil/gas related names trading lower: SLB -2.5%, CVX -1.2%, XOM -1.0%... Select metals/mining names showing weakness: RTP -6.8%, MT -5.8%, AAUK -4.9%, ABX -3.6%, BHP -2.7%, BBL -2.4%, RIO -2.0%, GLD -2.0%... Select travel related names showing continued weakness with spread of the swine flu epidemic: LCC -10.0%, JBLU -5.6%, DAL -4.4%, RCL -3.4%, CAL -1.6%... Other news: Other DFG -7.9% (announces public offering of 3,000,000 shares of common stock), Other DT -7.3% (trading ex dividend), Other SPWRA -6.2% (announces 9 mln share offering of common stock and $175 mln convertible debenture)... Analyst comments: EP -10.4% (downgraded to Neutral at Wachovia), HP -5.3% (downgraded to Underweight at JPMorgan), FIC -3.7% (downgraded to Sell from Hold at Argus), WY -3.6% (downgraded to Hold at Deutsche), STAR -3.3% (downgraded to Hold from Buy at Cantor Fitzgerald), GLW -2.5% (downgraded to Market Perform at Bernstein), PHM -2.3% (downgraded to Neutral from Buy at FTN Equity), NTAP -2.2% (downgraded to Neutral at BofA/Merrill), ISRG -2.0% (downgraded to Market Perform at JMP), WHR -1.7% (downgraded to Market Perform from Outperform at Raymond James). -

Päris üllatav:

April Consumer Confidence 39.2 vs 29.7 consensus, prior 26.0 -

Turud korralikult üles.

-

Tarbijausaldus on tänase päeva alguses turgudele väga kõva kindluse andnud, mingeid nõrkuse märke veel ei ilmutata.

-

Kas täna tuleb mingi rekordkäibega päev USA-s ?

-

Vabandust, paistab et finance.yahoo.org paneb jälle tänase käibe kohta segast.

-

Käivet võib olla aga liikumist vähe, igav!

-

http://finance.yahoo.com/ ikkagi.