Börsipäev 12. oktoober

Kommentaari jätmiseks loo konto või logi sisse

-

Antud nädalal on nüüd oodata päris mitme olulise tegija 3. kvartali tulemusi. Kui täna on enne turgu tulemused avaldamas üksnes Fastenal (FAST), siis teisipäeval näeme juba Johnson & Johnson (JNJ) ja Inteli (INTC), kolmapäeval JP Morgan Chase'i (JPM), neljapäeval Citigroupi (C), Goldman Sachsi (GS), Nokia (NOK), Google'i (GOOG) ja IBM (IBM) ning reedel Bank of America (BAC), General Electric (GE) ja Halliburton (HAL) tulemusi.

Olulisi majandusraporteid nädala alguses seekord ei tule.

USA eelturg on väikeses ca 0.1% kuni 0.2%lises plussis. -

Singapur raporteerib Aasias alati esimesena kvartaalsest SKP numbrist ja seekord tehti regioonile positiivne sissejuhatus. Singapuri SKP tõusis märtsis 0.8%YoY (annualized rate of 14.9% from the previous three months) vs konsensuse poolt oodatud 0.5% YoY. Valitsus tõstis 2009. a SKP prognoose & uue väljavaate järgi oodatakse languseks 2-2.5% YoY vs varasem languse prognoos 4-6% YoY. Kirjutasin siin, et valitsuse varasemad prognoosid on liiga konservatiivsed ja Singapuri majandus on Aasias lääneriikide suhtes suurima beetaga. HSBC kirjutas täna:

"We would be more optimistic than the government, and while GDP will obviously not retain its current momentum, the economy is likely to expand by a healthy 6.5% next year"

"It's not impossible that year-on-year growth could hit double digits in the first quarter of 2010." (pikemalt siin)

Tuletaks artiklist meelde DB arvamust septembri alguses:

Singapore is one of Asia’s cheaper markets, with PB of 1.5x well below this market’s long-run average of 1.8x. Our economists expect a strong V-shaped recovery during the rest of the year. Exports have already risen by 17% between January and May. That suggests that the consensus forecasts among analysts, who look for EPS to fall by 23% this year, are probably too pessimistic. In our view,Singapore offers an appealing combination of strong cyclical recovery, still reasonable valuations and the robustness that comes with being a developed market.

Singapuri on võimalik investeerida läbi börsil kaubeldava fondi iShares MSCI Singapore Index (EWS).

-

Euroopa turud on kauplemas oma uutel 52-nädala tippudel. Näiteks Saksamaa DAX indeks on päevaga tõusnud 1.4% ning kaupleb 5790 punkti peal kõrgeimail tasemel alates 2008. aasta septembrikuu lõpust. USA futuurid on eelturul koos ülespoole liikunud Euroopaga tõusnud ca 0.6% plusspoolele. Dow Jones tööstusindeksi jaoks tähendab see, et on jõutud 10 000 punkti piiri vahetusse lähedusse.

-

Nordealt päris omapärane vaatepunkt valitsevale sentimendile läbi otsiterminite. Ehk et Google Trendsist sõnade inflation, recession, economic recovery, deflation, stagflation otsisageduse graafikud. Paistab, et langusest ollakse üle saanud ning üha rohkem pälvib tähelepanu inflatsioon :)

Short URL: http://bit.ly/13ODLA -

... seik pärit siis Global Intermarket Perspectives analüüsist.

-

wise, pole küll ise kasutanud, kuid äkki huvitab see link - Predicting the Present with Google Trends

-

Seosed tekkimas Roche'i ja Dendreoni vahel?

Briefing: DNDN is trading up 2 pts (+7.3%) this morning, with strength attributed to the addition of two new board members, Ian Clark and Pedro Granadillo. Clark is the CEO of Roche's Genentech. -

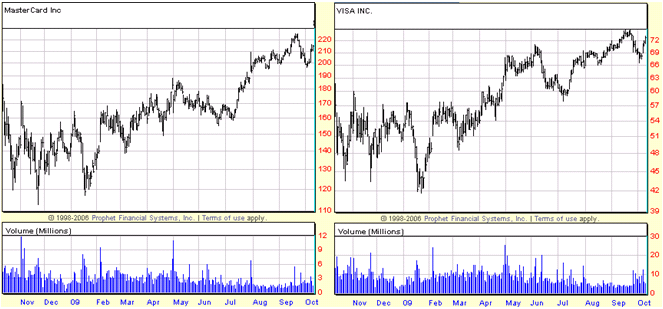

Credit Suisse tõstab täna Mastercardi (MA) ja Visa (V) soovituse neutraalse pealt 'outperform' peale ning ütleb, et aktsiad pakuvad pikaajaliselt atraktiivset sisenemiskohta. Mastercardi hinnasiht kergitatakse $210 pealt $255 peale ning Visal (V) $70 pealt $84 peale.

Lisaks alandab Deutsche Bank täna hommikul Baidu.com (BIDU) soovituse 'osta' pealt 'neutraalse' peale ning Thomas Weisel on kergitanud oma hinnasihti Google'il (GOOG) $530 pealt $620 peale ja Kaufman $520 pealt $600 peale.

-

Euroopa turud:

Saksamaa DAX +1.36%

Prantsusmaa CAC 40 +1.19%

Inglismaa FTSE 100 +0.98%

Hispaania IBEX 35 +0.86%

Rootsi OMX 30 +1.46%

Venemaa MICEX +2.58%

Poola WIG +0.70%Aasia turud:

Jaapani Nikkei 225 N/A (börs suletud)

Hong Kongi Hang Seng -0.93%

Hiina Shanghai A (kodumaine) -0.59%

Hiina Shanghai B (välismaine) -0.39%

Lõuna-Korea Kosdaq +0.77%

Tai Set 50 +0.51%

India Sensex 30 +2.31% -

The Bulls Are Still in Charge

By Rev Shark

RealMoney.com Contributor

10/12/2009 8:49 AM EDT

What happens is not as important as how you react to what happens.

-- Thaddeus Golas

Last week, for the fourth time since early July, the market pulled off a very impressive "V"-shaped recovery after flirting with a breakdown in the uptrend that has been in place since March. The ability of this market to not only recover when things are beginning to look a bit tired, but to do so completely and in such aggressive fashion, has been remarkable.

This impressively positive action has not only destroyed the bears, who keep talking about how the fundamentals can't possibly justify this action, it has also created a huge supply of buyers waiting to put money to work on pullbacks. These dip-buyers don't seem to believe the fundamentals are that fantastic either, but they are sick and tired of being left behind as the market just keeps on trending higher.

Last week's bounce brings us to a particularly interesting juncture, as the major earnings reports kick off this week. Last quarter, the market went straight up during earnings season after a strong start from Goldman Sachs (GS) and Intel (INTC) , both of which report again this week. Those two stocks triggered some huge momentum and we were parabolic for the following three weeks as one company after the next posted better-than-expected earnings.

So the big question we face now is whether earnings season is going to produce similar action once again. Obviously, prices are higher now than they were in July and expectations have come up quite a bit as the idea of an economic recovery no longer seems so far-fetched.

We have to watch for whether the market is psychologically inclined for a "sell-the-news" reaction to earnings reports. Are expectations so high that a good report will be unable to generate further buying interest?

It is quite easy to make an argument for why the market will be vulnerable during earnings season. We are technically extended and we have fairly high expectations. It doesn't take a lot of thinking to surmise how that could create a negative environment if reports aren't relentlessly upbeat.

But the problems for the bears are twofold. First, what has been driving this market above all else is a flood of liquidity. The economic stimulus and the various bailouts have created a lot of cash with no place to go. The stock market has been the main beneficiary, as interest rates are zero and real estate is still in flux. As long as there is that much cash out there supporting the market, it doesn't much matter what the negative fundamental arguments might be.

Liquidity goes to the heart of the second issue, which is also supporting the bulls, and that is the substantial momentum. The market continues to be mired in a huge uptrend. It will take some very substantial selling to change the course of this market.

Our primary job this week will be to watch and weigh how the psychology of the market develops as earnings roll out. Will buyers continue to flock to positive reports? Will we see "selling the news"? Will dip-buyers look to buy pullbacks on good reports?

This morning, we have an upbeat atmosphere once again. The first big report is INTC on Tuesday night, so until then, we are likely to drift around as market players debate to what degree they want to get in front of the news. Just keep in mind that the bulls are still solidly in control and showing few signs of relenting.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: PHG +6.5%, BDK +5.8% (light volume)... Select financial related names showing strength: AIB +2.7%, IRE +2.6%, AZ +2.0%, ING +1.8% (Two Singapore banks compete with big players for ING assets - WSJ), AIG +1.8%, CS +1.7%, WFC +1.5%, BAC +1.4%, MS +1.2%, C +1.1%, JPM +1.1%... Select metals/mining names trading higher with continued weakness in dollar: GSS +13.0%, NG +4.7%, HL +3.4%, MT +2.6%... Select European drug related names stocks showing strength: NVS +1.8%, SNY +1.5%... Select telecom related names ticking higher: ALU +4.9% (upgraded to Hold from Sell at Societe Generale), ERIC +2.6%, NOK +2.1%... Select oil/gas related names trading modestly higher: NOV +2.9%, WFT +2.5%, STO +2.2%, TOT +1.5%... Other news: RPTP +109.0% (trades under RPTPD; reports positive interim phase 2a clinical data in non-alcoholic steatohepatitis), MRNA +25.0% (reports UsiRNA reduces tumor growth in vivo), NCS +6.8% (continued momentum from Friday's 15% pop), DNDN +5.5% (strength attributed to the addition of two new board members, Ian Clark and Pedro Granadillo), WCRX +4.8% (Cramer makes positive comments on MadMoney), ONXX +4.1% (signed a definitive agreement to acquire Proteolix), NVLS +3.7% and EBS +3.2% (Cramer makes positive comments on MadMoney), OSK +2.7% (light volume; awarded additional 923 M-ATVs valued at $408.5 million), MHP +2.6% (mentioned positively in Barron's), UL +2.1% (still checking), SYMC +1.4% (informed Digital River that it will not extend E-commerce contract beyond June 30, 2010 expiration)... Analyst comments: PCL +3.3% (upgraded to Neutral at JPMorgan), AMD +2.9% (upgraded to Buy at UBS), ANF +2.1% (upgraded to Buy at Pali), V +1.5% (upgraded to Outperform at Credit Suisse), GOOG +0.9% (Thomas Weisel raises their tgt on Google to $620 from $530 - Reuters and tgt raised to $600 at Kaufman).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: FAST -2.3% (light volume)... Other news: DRIV -32.3% (informed by Symantec that it will not extend E-commerce contract beyond June 30, 2010 expiration; also downgraded to Hold at Lazard), DEPO -31.4% (announces ll four co-primary endpoints of the 1800mg dose at 4 weeks demonstrated significant reductions in frequency and severity in both clinical trials), KBH -5.2% (discloses in Form 10-Q that SEC is investigating the co), YONG -4.9% (to Adopt EITF 07-05 and 00-19; to restate its previously issue financial statements), LYG -2.3% (Lloyds TSB ready to raise 11 bln pounds - Times of London), TSN -2.0% (light volume; Japan blocks some Tyson beef imports after mix-up - Reuters.com), AOB -1.7% (files $150 mln mixed shelf offering), BCS -1.6% (to sell GBP 4 bln in assets - Financial Times)... Analyst comments: EL -2.2% (added to Conviction Sell list at Goldman- Reuters), DPS -2.0% (downgraded to Hold at Deutsche), SNDK -1.8% (downgraded to Sell at UBS), VE -1.5% (downgraded to Neutral at HSBC), NVDA -1.2% (downgraded to Underperform from Sector Perform at PacCrest), BIDU -1.1% (downgraded to Hold from Buy at Deutsche Bank). -

Siit on võimalik kuulata ca 3.5-minutilist intervjuud Steve Forbes'iga, kus lahatakse USA majanduse ja dollari väljavaadete üle. Peamine põhjus dollari nõrgenemise taga on ikkagi rekordilised defitsiidid ning tõik, et peale tugevast dollarist rääkimise ei ole USA teinud mitte midagi, et dollari tugevust hoida. Kiiresti nõrgenev dollar võib kokkuvõttes kaasa tuua inflatsiooni/stagflatsiooni ohu.

-

Fundtech (FNDT) on täna tegemas väga ilusat breakouti uutele 52-nädala tippudele. Aktsia on täna tõusnud ca 10%. Viimase 2 aasta graafik:

-

Turg tervikuna on suhteliselt haigelt käitumas... tugev pluss on käest antud ja liigutud juba miinuspoolele.

-

Käibed on tulemuste eel igaljuhul pea olematuks muutunud - õhuke kauplemispäev