Börsipäev 13. november

Kommentaari jätmiseks loo konto või logi sisse

-

Tegu siis selle aasta kolmanda ja viimase reede ning 13-ga.

Aasia turud on olnud suuremate liikumisteta ning enamus turge kaupleb möödunud päeva sulgemishindade juures. USA futuurid on tänu pisut nõrgenenud dollarile eelturul ca 0.2% plusspoolel.

Majandusuudiste poole pealt kuuleme tund aega enne USA turgude avanemist kell 15.30 USA septembrikuu kaubandusbilansi numbritest (ootus -$31.8 miljardit) ning kell 16.55 näeme novembrikuu Michigani sentimendi indeksit (ootus 71.0 punkti). -

Euro-zone gross domestic product expanded 0.4% in the third quarter, returning to growth after five consecutive quarters of shrinking output. Compared to the the third quarter of last year, GDP fell by 4.1%. Economists had forecast a 0.6% quarterly rise and a 3.9% year-on-year decline.

-

eur/usd võiks täna kusagile 1.4700 - 1.4720 vahemikku kukkuda hetke seisuga. Huvitav, kas viib SP500 ka kaasa?

-

J.C. Penney Co. JCP said Friday that its third-quarter profit tumbled 78% to $27 million, or 11 cents a share, from $124 million, or 56 cents, a year earlier. Sales declined 3.2% to $4.18 billion. Excluding pension expense, the company said it would have earned 30 cents a share. J.C. Penney also raised its full-year outlook to profit of 93 cents to $1.08 a share for the year from a previous projection of profit of as much as 90 cents a share. For the fourth quarter, it forecast profit of 70 cents to 85 cents a share. The department-store operator was expected to earn 12 cents a share in the third quarter, 82 cents in the fourth quarter and $1.05 for the year, according to FactSet.

Aktsia kauplemas eelturul 4.3% kõrgemal $30.65 tasemel. Viimased nädalad on olnud müügisurve all, mis viitasid ka madlamatele ootustele. -

October Import Prices M/M +0.7% vs +1.0% consensus; prior +0.2%; Y/Y -5.7% vs -5.5% consensus, prior -12.0%

September Trade Balance -$36.58 bln vs -$31.8 bln consensus, prior revised to -$30.8 bln from -$30.7 bln -

Üks intervjuu Doug Kassiga, kes on aktsiaturu tõusu suhtes skeptiline ning ütleb, et ostjad peavad täna arvestama üha nõrgema riski-tulu suhtega - link siin. Kui vaadata aga saatejuhtide nägusid, siis ei ütleks küll, et keegi südamest usuks, et see, mida Kass räägib, võiks ka tõeks saada.

-

Reeglina on B-aktsiad Hiinas oluliselt odavamad kui kodumaised A-aktsiad. Nüüd, kus regulatsioonid hakkavad võimaldama kergemini valuutavahetust, lendasid odavama hinnatasemega dollaris-noteeritud B-aktsiad ca 10% päevaga kõrgemale. Link B-aktsiate tõusule siin.

Euroopa turud:

Saksamaa DAX +0.09%

Prantsusmaa CAC 40 -0.35%

Inglismaa FTSE 100 +0.18%

Hispaania IBEX 35 -0.05%

Rootsi OMX 30 -0.33%

Venemaa MICEX -0.74%

Poola WIG -0.86%Aasia turud:

Jaapani Nikkei 225 -0.35%

Hong Kongi Hang Seng +0.70%

Hiina Shanghai A (kodumaine) +0.42%

Hiina Shanghai B (välismaine) +9.42%

Lõuna-Korea Kosdaq -0.63%

Tai Set 50 +0.23%

India Sensex 30 +0.92% -

Flight to Quality

By Rev Shark

RealMoney.com Contributor

11/13/2009 8:34 AM EST

The chief value of money lies in the fact that one lives in a world in which it is overestimated.

--H. L. Mencken

After a six-day run, the market finally took a rest on Thursday. Both the S&P500 and the Nasdaq were turned back right around the highs of the year that were hit in mid-October. The selling wasn't particularly aggressive and the only reason volume was higher on the Nasdaq was because of huge volume traded in 3Com (COMS) following news of its acquisition by Hewlett-Packard (HPQ) .

The primary catalyst, or excuse, for the selling was some strength in the dollar and some weakness in oil prices. The market is highly sensitized to any movement in the dollar lately, as this is the main driving force behind what is known as the 'carry trade'. The carry trade is where investors borrow low-yielding currencies like the dollar and use the funds to invest in other assets which they believe will yield higher returns in the short term. This produces a huge amount of liquidity and has been one of the primary driving forces behind the real appreciation of a whole host of assets, particularly oil and commodities.

The risk in the carry trade is that the dollar will rise and investors who used the funds to buy assets not dominated in dollars will have to pay back more expensive dollars. So, when the dollar rises, there is pressure to unwind the trade by selling assets like gold and oil and to repay the borrowed dollars before they rise further.

With interest rates so low and the dollar in a downward spiral, the carry trade has been a massive driving force for all sorts of assets and helps explain why the market seems to be so much more optimistic than most views of the economy. We have a lot of cheap cash out there looking for places to go. At some point, the forces that are driving the carry trade will reverse and that is what will give us some jitters -- like we saw yesterday -- but there seems to be little support for the dollar these days.

The dollar is going to continue to be a key to this market, but another thing we have to watch is how investors may be shifting from one asset to another. Over the past month or so, we have seen small-cap stocks falling out of favor and more funds moving into the bigger names, like Amazon (AMZN) , Google (GOOG) , Apple (AAPL) , Baidu (BIDU) BIDU, Netflix (NFLX) and so on. This is making the major indices a bit deceptive, because there has been much more damage to many individual stocks under the surface than either the DJ-30, S&P500 or Nasdaq would seem to indicate.

The market often goes through periods where it narrows as investors become less speculative and prefer 'higher quality' big-cap names. This is a theme that is likely to be very important going into the end of the year.

This morning, we are seeing a little bounce as the dollar weakens slightly once again. The technical action yesterday, while negative, was healthy in the longer run, as it helps to shake out weak holders and allows for some consolidation. I suspect the dip buyers are well prepared to do their thing and will continue to provide some strong underlying bids. The bears need a stronger dollar and something that will cause some worry among the bulls and they just don't have it right now.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: RINO +13.0%, TSTC +12.1%, SORL +7.2% (light volume), MDSO +6.8% (light volume), ANF +6.1%, A +4.3%, JCP +3.4%, YGE +2.4%, DIS +2.2%... Select metals/mining names showing strength: RTP +2.6%, BBL +2.3%, BHP +1.2% (BHP Billiton says it has considerable interest in Ravensthorpe sale - DJ)... Select oil/gas names seeing early strength: BP +1.9%, WFT +1.4%, SU +1.3% (upgraded to Buy from Underperform at BofA/Merrill), NXY +1.2% (upgraded to Buy from Underperform at BofA/Merrill), TOT +1.0%... Select large cap drug names trading higher: SHPGY +1.3%, GSK +1.2%, AZN +1.1%... Other news: LXRX +18.7% (announces 'positive' phase 2 results of LX1031 in non-constipating irritable bowel syndrome), PLA +10.1% (continued strength following yesterday's ICON comments that may be interested in buying company), PDLI +5.5% (announces special dividend payment), GMR +4.9% (declared cumulative quarterly and special dividends of $21.615 per share), BUD +4.6% (still checking), IOC +4.4% (successfully logged 1,224 feet of the reservoir in the Antelope Reef structure), ABC +2.2% (increases dividend 33% to $0.08 and authorizes a new $500 mln share repurchase program), NOK +1.8% (still checking for anything specific), CY +1.8% (Cramer makes positive comments on MadMoney)... Analyst comments: GT +5.5% (upgraded to Buy from Neutral at Goldman- Reuters), MSCC +2.8% (upgraded to Buy at Needham), HBC +2.6% (upgraded to Underperform at Calyon), WYNN +2.1% (initiated with Buy at Deutsche), JNPR +2.0% (upgraded to Outperform at Oppenheimer), LVS +1.7% (initiated with Buy at Deutsche), QCOM +1.1% (upgraded to Outperform at Wells Fargo), TLM +0.9% (upgraded to Buy from Neutral at BofA/Merrill).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: LIME -17.2%, ESE -16.2% (also downgraded to Hold at Brean Murray), BBI -14.5%, PUDA -12.1%, ZAGG -10.7%, LBTYA -9.1%, WPRT -5.9% (light volume), JWN -4.8%... Other news: SMED -11.4% (announced a 3.2 mln share common stock offering; 500K will be sold by the co and the remainder by selling shareholders), CADX -6.5% (announces FDA extends New Drug Application review for intravenous acetaminophen by three months), DCTH -6.4% (priced its public offering of 8.5 million shares of its common stock at $3.60 per share), LKFN -5.4% (announces it has priced a public offering of 3.5 mln shares of common stock at $17.00 per share for total gross proceeds of $59.5 mln), TCLP -4.5% (announces offering of 5 mln common units), CML -2.8% (announces 3.0 mln share common stock offering), RHB -2.5% (announces pricing of its public offering of common stock at $24/share)... Analyst comments: DCP -4.4% (cut to Sell from Neutral at Goldman- Reuters), SUN -2.3% (added to Conviction Sell list at Goldman- Reuters), NBL -1.3% (downgraded to Sell from Neutral at Goldman), PWRD -1.1% (downgraded to Neutral at Pali Research based on valuation). -

Oodatust oluliselt nõrgem:

November University of Michigan-prelim 66.0 vs 71.0 consensus, October 70.6 -

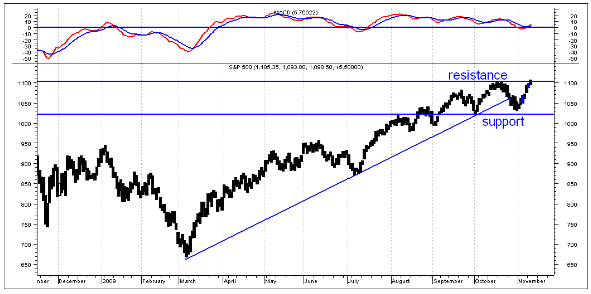

Dick Arms on RealMoney all SP500 graafikule paar joont peale tõmmanud. 1100 punkti on ilmne vastupanutase ja toetus 1025 punkti juures.

-

eur/usd muster täiesti segamini.