Börsipäev 23. november

Kommentaari jätmiseks loo konto või logi sisse

-

Antud nädal on paljudele ameeriklastele hingelähedane. Neljapäeval, 26. novembril on USAs Tänupühad ning aktsiaturud on suletud. Sellele järgneval reedel ehk 27. novembril on USA aktsiaturud küll avatud, kuid seda lühendatult. Tänupühajärgset reedet kutsutakse Mustaks Reedeks, mil enamus USA suurimaid poode teevad oma uksed lahti enne päikesetõusu ning on avatud kas terve öö läbi või vähemasti varaste hommikutundideni välja. Musta Reedet peetakse jõulu sisseostude hooaja alguseks, mil poed üritavad suurte allahindlustega inimesi poodidesse meelitada ning loota, et tugevalt allahinnatud kauba kõrval ostetakse ka tavahinnaga kaupu. Must Reede on läbimüügi poolest olnud suurim jõulumüügi päev aastail 2003 ja 2005, suuruselt teine päev aastail 2002 ja 2004 ning ülejäänud aastail jäänud vähemalt esikümne sisse.

Ööga on euro dollari vastu taaskord tugevnenud, sedapuhku ca 0.7%, ning kauplemas euro vastu tasemel €1=$1.496. USA aktsiaturu futuurid on nõrk dollar üles kruttinud ning S&P500 indeksi futuur on reedega võrreldes tõusnud 0.4%. Nafta on +1.2% @ $78.4.

Täna kell 17.00 teatatakse oktoobrikuu olemasolevate majade müüginumbrid. Septembri näit oli 5.57 miljonit, oktoobrilt oodatakse paranemist 5.7 miljoni peale.

-

Euroopas avaldatakse täna ridamisi novembrikuu esialgseid PMI indekseid (Prantsusmaa kl 10.00, Saksamaa 10.30 ja eurotsoon kl 11.00), mis konsensuste arvates peaksid ületama oktoobri numbreid ning peegeldama eurotsooni ärikeskkonna paranemise jätkumist ka neljandas kvartalis.

-

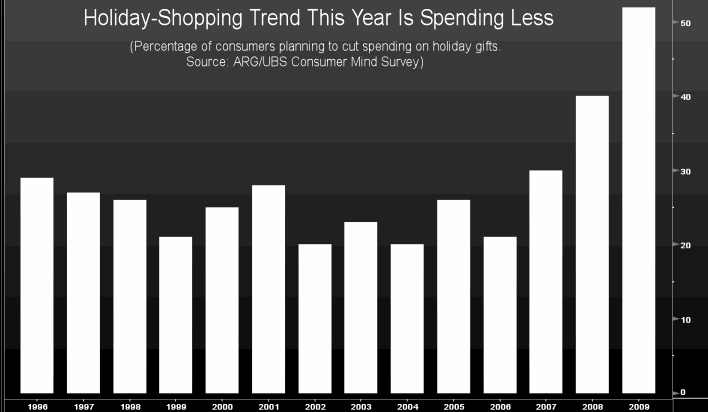

Joeli kommentaarile täienduseks on American Research Group ja UBS viinud novembri keskel läbi küsitluse 1000 ameeriklase seas, kellest 52% vastas, et kavatsevad tänavu kinkidele vähem raha kulutada. Allolevalt graafikult on näha, et kokkuhoidlikuse trend on alates 2007. aastast drastiliselt kasvama hakanud, jõudes sel aastal esmakordselt üle 50%. Eelmisel kuul esimest korda alates 1983. aastast 10% taseme ületanud töötusemäär (vaata animatsiooni) sunnib tarbijaid lugema igat senti, mistõttu võidakse otsida ainult kõige atraktiivsemaid pakkumisi ning pöörata vähem tähelepanu tavahindadega esemetele.

-

USA valitsus müüb järgneva kolme oksjoniga rekordilise 118 miljardi dollari eest valitsuse võlakirju. Täna müüakse 44 miljardi eest kaheaastaseid võlakirju, homme 42 miljardi eest viieaastaseid võlakirju ja ülehomme 32 miljardi eest seitsmeaastaseid võlakirju. Tasub jälgida, milliseks kujuneb nõudlus.

-

EUR/USD on tegemas taaskord väga suuri ühepäevaseid liikumisi, mis maailma suurimatele valuutadele küll kohased ei ole. Aga EUR/USD täna +0.9% nüüd tasemel €1=$1.499 ning kahenädalane euro nõrgenemise trend tundub sellega murtud olevat...

-

Euro-zone Nov. composite PMI 53.7 vs. 53.0 in Oct.

-

Kes soovib, siis eelmisel nädalal palju diskussiooni tekitanud SocGeni halvima stsenaariumi analüüsi on võimalik täies hiilguses lugeda siit

-

Kui eur/usd nädalaküünlaid vaadata, siis avanesime joone all ja püsime esialgu allpool.

Nädala R1 on 1.4984

Esialgu pakuks, et on võimalus allapoole tulla. -

Joel, kas sellest Mustast Reedest tehakse operatiivselt kokkuvõtteid ka? Kui ta juba nii märgilise tähtsusega on.

-

Schlagbaumm, kokkuvõtteid tehakse jah loomulikult. Ja seda nii enne (erinevad küsitlused) kui pärast reaalset ostlemist. Siin Erko poolt äratoodud UBSi küsitluse graafiku ja palju muude küsimuste tulemuste kohta saab õige varsti meie portaalis lugeda ka ühte artiklit.

-

23. november 2009. a. 6:23:32

(EU) EU: No assessment on Estonia Euro entry until May of 2010 -

Euroopa turud:

Saksamaa DAX +2.00%

Prantsusmaa CAC 40 +2.03%

Inglismaa FTSE 100 +1.78%

Hispaania IBEX 35 +1.72%

Rootsi OMX 30 +2.33%

Venemaa MICEX +1.86%

Poola WIG +1.48%Aasia turud:

Jaapani Nikkei 225 N/A (börs suletud)

Hong Kongi Hang Seng +1.41%

Hiina Shanghai A (kodumaine) +0.92%

Hiina Shanghai B (välismaine) -0.61%

Lõuna-Korea Kosdaq +0.08%

Tai Set 50 -0.78%

India Sensex 30 +0.93% -

Koosoleku tõttu väikese viivitusega ka Sharki kommentaar:

Weak Dollar Provides a Lively Open

By Rev Shark

RealMoney.com Contributor

11/23/2009 8:19 AM EST

"Acceptance is not submission; it is acknowledgement of the facts of a situation. Then deciding what you're going to do about it."

-- Kathleen Casey Theisen

We are kicking off Thanksgiving week with a lively Monday morning open. Once again, it is weakness in the dollar that is the primary driving force. Precious metals and oil are the first thing investors look to buy when the dollar is down, and that is what they are doing this morning. Gold is trading up around $19 to another new high.

The market's very strong inverse correlation to the dollar pretty much undermines any other issue out there. As long as the dollar is weak, the economy and everything else is a secondary consideration.

Recently, the biggest obstacle for the bulls was that we were a bit technically overextended, but after four days of fairly flat action last week, we have alleviated that to some extent, which makes it easier for the buyers to find some entry points. The technical condition of the indices looks pretty good, and buyers are wasting no time taking advantage this morning.

Trading during Thanksgiving week is often upbeat as market players are in a happy holiday mood as they look forward to some time off and the positive seasonality we generally see at the end of the year. I'll be watching very carefully to see what strong trading themes emerge. Traders often flock to pockets of momentum in the lighter trading around holidays. As I mentioned last week, I think small-cap China names will be active and, obviously, metals and commodities are already quite hot on the weak dollar.

The most notable characteristic of this market continues to be the great amount of skepticism out there. Market players just can't seem to accept the fact that this market continues to run straight up with nary a pause. Many folks just can't allow themselves to embrace the positive price action. Their view of the economy is at odds with a market that is acting like the economy is not only in fine shape but is booming.

We have been almost giddy with excitement for months now, and the investors who keep waiting for "reality" to set in just become more frustrated as their pessimism is completely ignored. Some of these folks on the sidelines throw in the towel and start inching in just because they are so frustrated, and that helps drive us up even more and causes more frustration and disbelief.

The best thing to do is not focus too much on the negative fundamental arguments and just accept the fact that the market is being driven up by the weak dollar and excessive liquidity. We all know what the bearish arguments are, but until the market shows some inclination to actually care about them, they don't matter. Right now, this market is all about the dollar, liquidity and underinvested longs who keep trying to find some long exposure.

We'll see how things look an hour or so after another euphoric Monday morning open. The bears are being run over, and they may just get out of the way and stay there. The pattern has been that, once we start off strong, we tend to keep going, especially on Mondays.

----------------------------

Ülespoole avanesid:

In reaction to strong earnings/guidance: CHINA +17.8%, LDK +13.8%, JOBS +6.8%, TECD +5.1%, CPB +3.1%... M&A news: FIF +38.0% and PBCT +3.3% (People's United Financial to acquire Financial Federal Corporation), CBY +2.5% (Kraft weighs higher Cadbury bid as rivals circle, source says - Reuters.com)... Select financial names trading higher: ING +4.5%, CS +3.7%, RBS +3.4% (Rockspring buys distressed RBS assets - FT), STD +3.2%, HBC +2.3%, LYG +1.7% (Lloyds TSB raises GBP8.5 billion in bond exchange - DJ), BAC +1.1%, AIG +1.0% (American Intl Trustee sought exit, but agreed to remain - WSJ)... Select metals/mining names showing strength: HL +3.8% (target raised to $8 at Rodman & Renshaw), EGO +3.3%, GOLD +3.3%, NEM +2.6%, ABX +2.5%, GG +2.3%, RTP +2.5%, BBL +2.0%, GLD +1.2%... Select oil/gas related names trading higher: PBR +2.9%, TOT +2.2%, COP +1.5%, RDS.A +1.4%, E +1.3%... Select drug names showing strength: NVS +2.7%, SNY +2.3%, AZN +1.3%... Other news: IBAS +32.7% (KPN and iBasis reach agreement on tender offer), ABIO +13.8% (ARCA biopharma receives FDA Fast Track Designation for Gencaro development in genotype-defined heart failure population), SEED +12.9% (received the Bio-safety Certificate from the Ministry of Agriculture as a final approval for commercial approval of the world's first genetically modified phytase corn), SPPI +9.1% (Spectrum Pharma and Handok Pharmaceuticals announce collaboration agreement for Apaziquone in South Korea; total deal value could exceed $19 mln), FSLR +2.0% (First Solar sells California solar power project to NRG; no terms disclosed), DISCA +1.4% (mentioned positively in Barron's), ... Analyst comments: ANN +4.3% (upgraded to Overweight from Market Weight at Thomas Weisel), SLW +3.9% (upgraded to Outperform at RBC), DE +3.3% (upgraded to Overweight at Morgan Stanley), WATG +3.1% (initiated with a Buy at Jefferies), WLP +3.1% (upgraded to Overweight from Neutral at JP Morgan), SLB +3.0% (upgraded to Outperform at Credit Suisse), RIGL +2.8% (upgraded to Outperform at RBC), ZION +2.4% (upgraded to Buy at Soleil), SBUX +2.3% (upgraded to Buy at Jefferies), AXP +2.1% (initiated with Overweight at MorganStanley), Q +1.6% (upgraded to Neutral from Underweight at Piper Jaffray),

Allapoole avanesid:

In reaction to disappointing earnings/guidance: TSN -1.4% (light volume)... Other news: NYNY -17.9% (still checking), CEPH -9.2% (Cephalon and Ception Therapeutics provide initial results of a Phase IIb/III study of CINQUIL in pediatric eosinophilic esophagitis; analysis shows significant reduction in esophageal eosinophil levels vs. placebo), VRX -7.1% (light volume; announced that it has now launched chlordiazepoxide hydrochloride and clidinium bromide), CIEN -6.6% (buys Nortel operations for $769 mln: Sources - Reuters; also downgraded to Mkt Perform at Morgan Keegan), TRA -1.9% ( CF Industries Holdings commented on statements made by Terra Industries; stated that Terra's board of directors would determine a process to get to the best ultimate value for stockholders)... Analyst comments: JEF -1.4% (downgraded to Sell from Neutral at Goldman - DJ). -

October Existing Home Sales 6.1 mln vs. 5.7 mln consensus; M/M change +10.1%.

-

kas see valitsuse poolne majade ostusoodustus on endiselt jõus?

-

Tegu on programmiga, mis pidi algselt novembriga ära lõppema, kuid paar nädalat tagasi teatati selle pikendamisest - üks link ka siin.

-

Fitch downgrades Mexico's Foreign Currency Rating to 'BBB'; Outlook Stable

-

Täna üle pika aja päev, kus peale esimest 45 minutit ostusurvet tiksutakse ilma käibeta allapoole. Tavapäraselt suund ikka teisele poole. Üsna pea võlakirjaoksjoni tulemused samuti väljas, kas sealt ka suund?

-

Auction Out -04/32 3.380%

The market bumped a little bit better in the wake of an aution that was not quite up to snuff. The at-record $44B 2-yrs draw 0.802%, a 3.16 bid-to-cover with an indirect bidder take of 44.5%. Only a so-so showing and not very reflective of the anticipated demand for the shorter maturities. The solid bid-to-cover and indirect rate were there, but players were not as aggressive as they could have been, with the yield decidedly higher than expected, but as noted (12:02 comment), with rates at historic lows there was demand for a little more "pay back." The fact that the shortened week is stuffed with offerings with the record $42B 5-yrs hitting tomorrow and the $32B 7-yrs on the Wednesday.

Turg hetkel erilist tähelepanu pole tulemustele pööranud. -

USGS reports magnitude 5.7 quake near Santa Cruz Islands

-

White House says evaluating "sensible and reasonable" measures to spur US growth - Reuters

-

Dip-buyerid hetkel jälle tavapärasel moel ostmas, kuid ei usu, et siit veel tippudele võiks minna. Nagu eelpool mainitud ei ole ikka väga pikka aega olnud sellist päeva, kus turg tiksub väikese käibega allapoole. Seega oleks küllaltki ettevaatlik ostma tormamisega:)

-

Kes on dip-byerid?

-

Hewlett-Packard reaffirms 1Q10 EPS of $1.03-1.05 vs the $1.04 consensus; revs of $29.6-29.9 bln vs the $29.70 bln consensus

Hewlett-Packard reports Q4 EPS of $1.14 vs the $1.14 preannouncement on Nov. 11 and the $1.13 consensus

Hewlett-Packard reaffirms recently raised FY10 guidance; sees non-GAAP EPS of $4.25-4.35 vs the $4.31 consnesus; revs of $118-119 bln vs the $119.06 bln consensus

Aktsia järelturul esimese hooga üle $51 taseme. -

To:valev

Tänan, kirjaviga korrigeeritud. -

Minu arust on huvitav see, et päeva võimsalt plussis alustanud nafta lõpetas õhtuks nullis või isegi punases... ja seda vaatamata dollari olulisele nõrgenemisele euro vastu.