Börsipäev 2. märts

Kommentaari jätmiseks loo konto või logi sisse

-

USAst täna olulisi makrosündmusi tulemas ei ole. Eesti aja järgi üksnes kell 21 avaldatakse veebruarikuu sõiduauto ja veoauto müüginumbrid. Eelturg on USAs rahulik - indeksite futuurid eilsete sulgumistasemete juures.

-

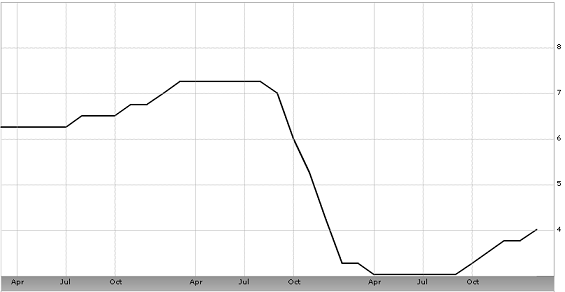

Austraalia keskpank usub jätkuvalt majanduskasvu taastumist ja tõstis täna neljandat korda viimase viie kohtumise jooksul intressimäära 0.25% võrra kõrgemale:

-

New car registrations in Germany totaled around 195,000 in February, down 30% from the same month last year, the German Association of International Motor Vehicle Manufacturers, or VDIK, said Tuesday, according to Dow Jones Newswires. For the first two months of the year, registrations are off 20%, to 376,000 units, compared to the same period in 2009, the report said. The decline is attributed to the expiration of Germany's car-scrapping incentive program in the fall.

-

Toon siia välja mõned lõigud JPM Jamie Dimoni pühapäevasest sõnavõtust:

"Greece itself would not be an issue for this company, nor would any other country," said Dimon. "We don't really foresee the European Union coming apart." Dimon did not explain how he expects the PIIGS to be bailed out. His focus is clearly not on the PIIGS. He said that JP Morgan Chase and other US rivals are largely immune from the European debt crisis, as the risks have largely been hedged.The California budget deficit will likely come in at between $20 billion and $3o billion. Where's California going to raise that kind of money? Dimon is correct to be nervous. Will he get Obama to put the squeeze on Bernanke to bail out Cali?

By the end of March, California's cash will be down to roughly a billion dollars, after that it goes negative.

California probleemid on Kreeka taustal jäänud avalikuse ees tagaplaanile (kõik teavad, kuid keegi ei räägi), kas sealt varsti uus paanika?

Üks väga hea lugu siia juurde - link.

-

täienduseks Alari postitusele...

Mitmed Euroopa riigid jätkavad käesoleval aastal autoturu subsideerimist, tänu millele kasvas regioonis uute neljarattaliste registreerimine jaanuaris eelmise aastaga võrreldes 12.9%. Üks suuremaid erandeid on aga Saksamaa, kus raha-romu-eest programmi lõpetamine on kahjustanud nõudlust täpselt samamoodi nagu USA-s eelmise aasta sügisel. Veebruaris vähenes uute autode registreerimine Saksamaal 30%. Tänaseks on USA autoturg septembri kukkumisest tasahilju paranemas ning mitmed Euroopa autotootjad jäävad seetõttu Ühendriikide (ja ka Hiina) edasiste väljavaadete osas märksa positiivsemale arvamusele kui oma koduturu suhtes.

Samadel põhjustel langetas Cantor Fitzgerald eile Daimleri, Volkswageni, BMW ja Fiati soovituse „müü“ peale. Viimasel kolmel oli eelnevalt olnud „osta“ reiting.

„This industry has too many players making too much product for an audience that only buys when offered an incredible deal.“

-

sealt tuleb kindlasti uus paanika, eeldusel, et lükatakse euro odavamaks ja dollar kallimaks vs. euro. siis nad avastavad, et usd põhine eksport saab haiget, makro numbrid sellel baasil nõrgenevad ja ongi võimalik põhjus paanikaks. Euroopa eksport peaks saam hoogu sisse kuid aasia suunaline võib väheneda, seoses Hiina sooviga majandusel tuure vähemaks kruttida. USA keskpangal vist väga palju hoobasid alles ka ei ole jäänud selles hetkes oluliselt majandust stimuleerida.

-

Meedia vahendusel võib hommikust õhtuni ennast harida teemadel, kus eurotsoon kukub kohe-kohe kokku ja ainuke õige koht kuhu investeerida on USA. Iseenesest seda massipsüholoogiat ei tasu alahinnata.

-

Goldman Sachsi traderid teenisid eelmisel aastal 131. päeval rohkem kui $100m dollarit:

Goldman Sachs made at least $100m in net trading revenues on 131 days last year – equivalent to once every other trading day, according to a filing with the Securities and Exchange Commission on Monday.

Goldman managed the result even as it took greater trading risks in 2009 than in the previous year. Its daily “value at risk” (VAR) – the most that the bank estimates that its traders could lose on a given day – was $218m in 2009, up from $180m during the previous fiscal year, which closed in November 2008. (FT link siin)

-

Alari poolt pandud link sellele, kus JP Morgani juht on turge hoiatamas Kalifornia rahahädade ees, väärib kindlasti lugemist. Kalifornia rahaprobleemidest kirjutasin meie portaalis 2009. aasta 29. detsembril siin. Sellest, kuidas meedia on minu arvates Kreeka probleemide taustal USA ja Kalifornia ära unustanud, kirjutasin 2010. aasta 16. veebruaril e24's siin.

Kreeka moodustab eurotsooni agregeeritud SKPst ca 4%, Kalifornia USA omast aga 13%.

-

Videointervjuu IMAXi CEO Rich Gelfondiga, kes räägib lähemalt firma sisenemisest Hollywoodi, Avatari meeletust edust ja ettevõtte tulevikust. IMAX kuulub LHV Pro investeerimisideede hulka

-

USA alustab tänast kauplemispäeva korraliku plussiga. S&P500 indeksi ning Nasdaq100 indeksi futuurid on hetkel ca +0.5% ning nafta on +0.9% ja kauplemas $79.4 peal.

Euroopa turud:

Saksamaa DAX +0.92%

Prantsusmaa CAC 40 +0.82%

Inglismaa FTSE 100 +0.87%

Hispaania IBEX 35 +0.73%

Rootsi OMX 30 +0.53%

Venemaa MICEX +0.66%

Poola WIG +1.49%Aasia turud:

Jaapani Nikkei 225 +0.49%

Hongkongi Hang Seng -0.72%

Hiina Shanghai A (kodumaine) -0.47%

Hiina Shanghai B (välismaine) -1.11%

Lõuna-Korea Kosdaq +0.18%

Tai Set 50 +1.86%

India Sensex 30 +2.09% -

Forget 'Normal'

By Rev Shark

RealMoney.com Contributor

3/2/2010 8:38 AM EST

The only normal people are the ones you don't know very well.

-- Alfred Adler

One question I've heard a number of traders ask recently is, "When is this market going to act normal again?" The question is the result of being caught by surprise way too often by action like we saw yesterday.

Market players who haven't just bought and hold have been scrambling to keep up with this market since the bottom last March. They are consistently out of position for this persistent strength, and they want to blame the market for being illogical rather than focus on their inability to understand it.

The problem is that the market just isn't a logical beast and there never is anything "normal" when it comes to its behavior. Sometimes we just happen to be more in tune with what is happening. I'm sure there are plenty of traders who don't see anything peculiar or unusual about the way this market is acting.

The main reason traders are questioning the normality of this market is that they are still struggling to reconcile their macroeconomic concerns with a market that seems not to have any worries. The market acts like we have quickly and easily shrugged off the worst economic crisis since the 1920s, and many traders find that difficult to embrace.

In addition to this disconnect between Main Street and Wall Street there has been a flood of liquidity created by bailouts and stimulus plans. This cash has had few places to go except for the stock market, and that is one of the main reasons the market has been so persistently positive for so long.

My point this morning is that if we wait for the market to act "normally," we are going to be waiting for a very long time. We will never completely understand or fully appreciate the driving forces at work. We just have to keep adapting the best we can and stay in tune with what is going on.

The biggest struggle I've had with this market is how it has consistently rallied on declining volume and cut through overhead resistance without much hesitation. I think the reason for that is the high level of liquidity, and at some point that is going to come to an end. I thought we were already seeing signs of that after the breakdown in mid-January, but the action yesterday was very much like the "normal" action we saw in 2009.

Just keep in mind that what is "normal" for the market will change constantly. Our job isn't to complain about it but to try to adapt to it. Sometimes we simply aren't going to understand why the market is doing what it is doing. Rather than argue with it, we should just admit that we don't understand the forces at work and try to find ways to benefit from it. It can be very difficult to embrace a market that you think is nuts, but we will have to do that quite often if we want to be active and make money.

The technical action of this market hasn't felt very "normal" to me for a while, but I have no choice but to appreciate it and try to embrace it as best I can.

We are set to gap up again this morning. The dollar is weak again, which is helping, but mostly it looks like it is just some momentum after positive action yesterday.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: FDP +12.3% (light volume), QCOR +8.6%, BPI +8.1%, CSR +7.6%, LIWA +6.9%, DPZ +6.0%, AIB +5.9%, CKEC +5.3%, CVI +5.0%, TTM +4.8%, MBI +4.2%, MWE +3.1% (light volume), DBRN +1.0%... M&A news: TRA +12.4% (CF Industries confirms offer of $47.40/share for Terra Industries)... Select metals/mining stocks showing strength: HMY +1.8%, EGO +1.8%, MT +1.7%, AUY +1.5%, AU +1.4%, SLV +1.4%, GG +1.3%, ABX +1.2%, GLD +0.6%... Select financial related names trading higher: RBS +4.2%, IRE +4.2% (up in sympathy with AIB), UBS +2.0%, BBVA +1.6%, BCS +1.6%, HBC +1.6%, LYG +1.3%, CS +1.2%... Other news: CRXX +44.1% (FDA Approves Exalgo Extended-Release Tablets), PSTI +25.0% (Receives DSMB Approval to Advance to Final Dose Level With PLX-PAD), AIS +11.1% (announces completion of patient enrollment in Phase 3 Pivotal Trial of Anturol for the treatment of overactive bladder), CGEN +7.2% (appoints Anat Cohen-Dayag as President and CEO Martin Gerstel to reassume Chairman post), SNTA +7.0% (announces Elesclomol clinical development to resume), CGV +5.2% (still checking), CRZO +4.0% (Cramer makes positive comments on MadMoney), QCOM +3.1% (increases quarterly dividend by 12% and announces new $3.0 billion stock repurchase program), YGE +1.5% (to Supply More Than 10 MW of PV Modules to SunDurance Energy), FMS +1.3% (still checking), BMY +1.2% (FDA Advisory Committee recommends approval of belatacept, an investigational agent for prophylaxis of acute rejection in de novo kidney transplant patients), FCX +0.5% (Announces Redemption of its $1 bln Senior Floating Rate Notes due 2015)... Analyst comments: MXB +2.7% (upgraded to Buy from Neutral at UBS), MRVL +2.5% (Lazard Capital upgrades to Buy from Hold and sets a $26 tgt), AEG +2.4% (upgraded to Buy at UBS), DELL +2.0% (upgraded to Buy at UBS), WLT +1.3% (initiated with an Outperform at Macquarie), SU +0.9% (upgraded to Hold from Sell at Deutsche Bank),

Allapoole avanevad:

In reaction to disappointing earnings/guidance: NTRI -13.8%, SYKE -8.8%, SPLS -6.1%, MDR -3.1%, IOC -2.7%, AMSF -2.5%... M&A news: CF -7.9% (CF Industries confirms offer of $47.40/share for Terra Industries; filed for a mixed shelf offering for an indeterminate amount)... Other news: NUHC -18.2% (announces termination of distribution agreement with Xilinx; Thomas Weisel downgrades Nu Horizons (NUHC 4.40) to Market Weight from Overweight), DNDN -12.2% (early weakness is being attributed to a boutique research report out suggesting that the co's Provenge drug may be brought in front of an FDA advisory panel), PUK -8.6% (S&P puts Prudential and subs ratings on watch negative), LTXC -7.5% (announces proposed public offering of common stock), PNNT -4.6% (announces a 5 mln share common stock offering), TRW -4.0% (announces commencement of secondary common stock offering of 11 mln shares), LUX -3.8% (still checking)... Analyst comments: KMB -2.1% (downgraded to Sell from Neutral at Goldman), MU -1.2% (downgraded to Neutral from Buy at UBS), RVBD -1.2% (downgraded to Neutral at BofA/Merrill), SUG -1.0% (downgraded to Hold from Buy at Stifel Nicolaus), DT -0.9% (downgraded to Equal Weight from Overweight at Barclays). -

Sequenom (SQNM): Hearing upgraded to Buy from Hold at Cantor Fitzgerald- tgt raised to $16 from $4

-

Kuidas LHV SQNM-i suhtub tänaselt hinnatasemelt?

-

Henri XI, tegu puhtalt uudise edastusega. LHV Pank SQNM aktsiat ei kata.

-

Selge, tänud.

-

Henri loe siit:

Hitihoiatus kõrge riskitaluvusega investoritele

http://www.lhv.ee/news/index.cfm?id=1164224

(see on küll aasta vanune lugu)

Ise ole long ja juhiks tähele panu, et viimase 2 nädalaga on aktsia tõusnud üle 100% (seega siit siseneda üsna riskantne).

Kuigi minuarust on tegemis DNDN nr 2 :) -

Fed's Hoenig, on CNBC, says he dissented because they shouldn't be guaranteeing the markets a zero rate for an extended period

Fed's Hoenig, on CNBC, says zero rates are not sustainable; says guaranteed zero rates invite future excesses -

Vaatan, et USA-s näitab viimase tehingu hinda 0,0001$ täpsusega. Kuidas see võimalik on?

-

GM says will offer zero-percent financing for 72 months on remaining 2009 model year inventory in March - Reuters

-

Ford Motor reports February monthly sales of +43.1% vs. +33% Street consensus

-

Obama proposes $3,000 rebates for homeowners for retrofitting homes for energy efficiency - Reuters

-

Trükib neile 3k sulli juurde:D peo peale kohe

-

German Finance Minister Schaueble says Greece has not asked for aid, so question of aid not on agenda, paper says - Reuters

-

U.S. Seantor Graham says economy-wide cap and trade climate plan 'I think is dead' - Reuters