Börsipäev 31. märts

Log in or create an account to leave a comment

-

Makroandmete poole pealt ootame täna kell 15.15 märtsikuu ADP hinnangut tööjõu hõivatuse muutusele, kust oodatakse +40 000. Kui number tuleb oodatust suurem, tähendaks see paremaid väljavaateid reedel avaldatavale ametlikule märtsikuu tööjõuraportile ning oodatust nõrgem number omaks vastupidist mõju. Kell 17.00 tuleb ka oluline veebruarikuu tehaste tellimuste muutus, kust oodatakse +0.5%list kasvu. Mida suurem see kasv on, seda jõudsamini edeneb majanduskasv.

Varane eelturg on 2010. aasta 1. kvartali viimase börsipäeva eel suurte muutusteta. Hetkel S&P500 ja Nasdaq100 indeksi futuurid ca -0.25%.

Kõigile LHV foorumikülastajatele siinkohal aga palve minu poolt. Oma magistritöö raames palun abi ca 10 minutilise aktsiaturgude teemalise küsitluse täitmisel. Tõsi, tavaliselt pooldame selliste küsitluste panemist 'vaba teema' alla, kuid kuna töö teema on seotud otseselt investeerimise ja aktsiaturgudega, kasutan moderaatori õigusi ning levitan oma küsitlust kuni märtsikuu lõpuni ka siinses börsipäeva foorumis - seega palun kõigi abi küsitlusele vastamisel veel viimast päeva. Link küsitlusele on siin. Palun kõigil, kel vähegi võimalik, selle täitmiseks 10 minutit eraldada. Suured tänud kõigile vastajatele!

-

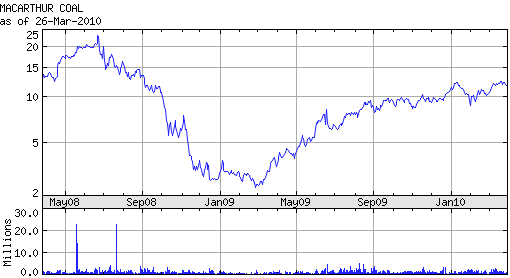

Eile hilisõhtul teatas Peabody Energy (BTU), et on valmis $3 miljardilise sularaha pakkumisega ära ostma Austraalia kivisöe ettevõtte Macarthur Coal'i (MCC.AX) ning pakkus A$13 aktsia eest. Enne pakkumist olid Macarthuri aktsiad sulgenud $12.09 peal, kuid kuna juhtkonna arvates ei ole pakkumine piisavalt hea, hüppasid börsipäeva alguses Macarthuri aktsiad $14.50ni ning kauplevad hetkel $14.0 peal. Seega oodatakse, et Peabody tõstaks oma pakkumist. Energiasektor konsolideerumises - oleme viimasel ajal näinud omajagu ülevõtte nii maagaasi kui kivisöesektoris.

-

ADP alla ootuste ja turg selle peale miinusesse vajumas.

Briefing: March ADP Employment Change -23K vs 40K consensus -

USA indeksite futuurid ca -0.4%, kuid nafta on rallimas ja +1.4%ga tõusnud tasemele $83.55.

Euroopa turud:

Saksamaa DAX -0.46%

Prantsusmaa CAC 40 -0.74%

Inglismaa FTSE 100 -0.34%

Hispaania IBEX 35 -1.46%

Rootsi OMX 30 -0.37%

Venemaa MICEX +0.56%

Poola WIG -0.28%Aasia turud:

Jaapani Nikkei 225 -0.06%

Hong Kongi Hang Seng -0.63%

Hiina Shanghai A (kodumaine) -0.62%

Hiina Shanghai B (välismaine) +0.26%

Lõuna-Korea Kosdaq -0.45%

Tai Set 50 -0.01%

India Sensex 30 -0.35% -

The New Normal

By Rev Shark

RealMoney.com Contributor

3/31/2010 9:01 AM EDT

An ounce of performance is worth pounds of promises.

-- Mae West

We wrap up the first quarter of 2010 today, and it is another good one for the bulls. It looks much like the last three quarters of 2009 and there doesn't seem to be any worry or concern that it won't continue. The market remains surprisingly buoyant and refuses to make it easy for those who keep looking to buy on pullbacks. I won't even mention how miserable it has been for the bears who have been fighting this action for so long.

The current run since early February is a good example of how lopsided the action has been. We have had only three days where the market has pulled back more than 0.5%, and in each case we reversed back up almost immediately. Volume has been mediocre almost the whole time and we've seen few pockets of wild momentum. We have become more and more extended and it's becoming increasingly difficult to find entry points, yet the market refuses to rest.

Although we have had numerous straight-up moves in this market over the past year, individual investors seem to have missed out on much of it. They actually have been withdrawing money the whole time and have never really come to embrace the market like they have during rallies in years past.

There are two primary reasons for this. First many market players never were able to shake their pessimism about the overall economy and have been unable to embrace this optimistic action in the stock market. There has been a huge disconnect between the fast and easy recovery the stock market is enjoying and the struggling economy on Main Street, where the real estate and jobs markets are still trying to stabilize.

The market has been driven not by individual investors, but by a flood of cheap cash created by the stimulus and bailout programs and by more and more computerized trading that attempt to put that cash to work.

These factors have made for a market that has traded in ways that are quite different from what we have seen in the past. I've never heard from so many experienced and successful traders who are struggling to deal with this market. While they may be enjoying some profits, they have felt out of tune and have struggled to find trading methodologies that work well.

Back in January when we pulled back rather sharply, I thought we were finally undergoing a change in market character. That proved to be dead wrong as we went straight back up in "V"-shaped fashion like we did so often last year.

The old adage "The trend is your friend" has proved to be the best strategy by far. Unfortunately, many individual investors have had trust issues with this market and have never really embraced it. It is the toughest bull market I've ever seen, and it is going to continue to present some major challenges as we start the next quarter.

Overseas markets were slightly positive but the euro is stronger and the dollar is weaker and that is helping to boast oil and commodities this morning. It is likely to be another slow day, but there will likely be some end-of-the-quarter position to provide a little volatility.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: LIWA +13.0%, IRE +12.0% (Bank of Ireland to raise capital; reports earnings - WSJ), FSII +5.1%, FUL +4.2%, IMMR +2.4% (CAE Healthcare acquires Immersion medical simulation product lines and licenses TouchSense technology), HON +2.3%, CELM +1.9%... Select metals/mining stocks trading higher: GG +1.8%, GOLD +1.5% (reports increase in reserves and resources in FY09 annual report), SLV +1.5%, NGG +1.3%, SLW +1.2%... Other news: ARQL +40.0% (announces results of Ph. 2 trial with ARQ 197 in NSCLC), IRE +11.4% (still checking), ATSG +9.1% (announces new long-term aircraft and operating agreements with DHL), ISIS +6.8% (ISIS Pharm and GSK collaborate on RNA Therapeutics for rare and infectious diseases), AIB +5.2% (up in sympathy with IRE), ORCT +3.4% (still checking), CLNE +2.5% (signs agreement with AT&T to provide CNG fueling stations to support AT&T's deployment of 8,000 CNG fleet vehicles), AIXG +2.0% (still checking), SYT +1.9% (Syngenta launches isopyrazam with first registration in the UK)... Analyst comments: OXGN +23.0% (initiated with a Buy at Roth), WNR +2.9% (initiated with an Outperform at Macquarie), UL +1.9% (upgraded to Buy from Neutral at BofA/Merrill), RIMM +0.3% (initiated with an Outperform at Exane BNP Paribas).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: ZOOM -11.8%, HEAT -10.1%, RAD -8.3%, APWR -6.5%, SAI -5.7%, LNDC -5.5%, ZZ -3.8%, CAGC -3.1%... Select financial related names showing weakness: DB -2.9%, MBI -1.7%, STD -1.7%, RF -1.2%, NBG -1.2% (Moody's downgrades National Bank of Greece to A2 from A1)... Select casino related stocks trading lower: MPEL -1.8%, LVS -1.7%, MGM -1.5%, WYNN -1.2%... Other news: ONP -10.9% (announces it has priced its public offering of 3 mln shares of common stock at $8.25/share), HHGP -8.5% (filed for and priced a 4.2 mln share common stock offering at $4.35/share), ENCO -7.3% (pulling back from this week's 100%+ surge higher), CTIC -6.7% ( to sell $20 mln of shares of Series 4 Preferred Stock and warrants to purchase common stock to three institutional investors), LINC -3.6% (announces public equity offering of 3.0 mln shares by a selling stockholder), MWE -3.5% (announces public offering of 4 mln common units), LTD -3.4% (trading ex dividend), CATM -2.1% (prices 7.0 mln common shares at $12.00/share), IOC -1.7% (mentioned negatively again by Fraud Discovery; highlights "court documents that reveal conflicting statements"), BA -1.4% (expects to recognize an income tax charge of ~$0.20 per share as a result of the recently enacted Patient Protection and Affordable Care Act ), VVUS -1.1% (announces termination of agreement for the development of Testosterone MDTS)... Analyst comments: PSYS -1.5% (downgraded to Underweight from Neutral at Piper Jaffray), MS -1.1% (ests cut at Keefe Bruyette). -

Briefing: March Chicago PMI 58.8 vs 61.0 consensus, February 62.6

-

Pimco haldab üle triljoni dollari varasid ja on maailma suurim investor võlakirjadesse. Siin kirjeldab nende CEO ja co-CIO Mohamed El-Erian oma nägemust võlakirjadest ja majandusest.

"Remember, it’s not a question of whether countries will adjust their ballooning balance sheets. They will. It’s a question of when and how. And when they do, their actions will impact every other sector in the economy. They can tax and cut spending. And, if things get really bad, they can try to inflate themselves out of the problem or, at the extreme, default."

-

Tehaste tellimused tõusid oodatust natuke rohkem:

February Factory Orders +0.6% vs +0.5% consensus, prior revised to +2.5% from +1.7%

-

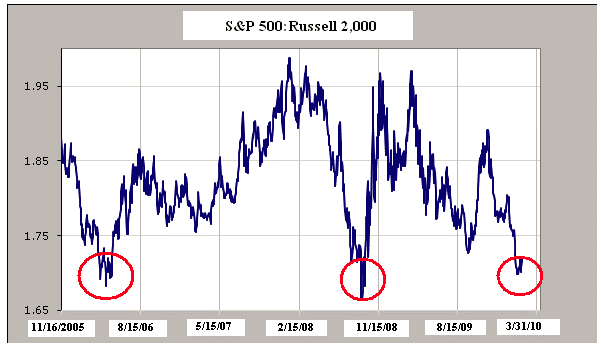

Veebruari põhjadest on Russell 2000 indeks (kajastab väikeettevõtete käekäiku) teinud võimsa tõusu. Siin üks hea graafik, mis näitab, et huvi väikeettevõtete aktsiate vastu on olnud väga suur (eelnevatel kordadel 2006 ja 2008 on Russelli sellisele suhtelisele tugevusele järgnenud >10% korrektsioon):

-

Moody's cuts 24 structured finance transactions backed by Greek Asset Pools - DJ

-

Börsihai 2009 mängus leidis huvi selline aktsia nagu TONE (TierOne Corp). Ettevõte maadleb rahahädas ja täna teatati, et OTS annab neile armuaega kuni 31.mai 2010. Selleks kuupäevaks peab olema ettevõte leidnud uued rahastajad. Hetkel kauplemas $0.30 ehk siis suure tõenäosusega olemasolevatele aktsionäridele jäävad tühjad pihud. Juhul kui leitakse keegi, kes tahab neid kas ära osta või nendega liituda tuleb esitada dokumendid OTS-ile 30. aprilliks. Vastasel juhul müüakse kõik olemasolevad varad ja ettevõte likvideeritakse.

-

White House says that regardless of outcome of March payrolls report, the US has a lot more work to do for jobs market - Reuters

Väga huvitav väljaütlemine enne reedest tööjõuraporti avaldamist. -

Fed's Lockhart says effect on housing sector of end of Fed's MBS purchases "should not be adverse" - Reuters

-

Fed's Lockhart says concerned about U.S. fiscal pressures, would think long and hard about second stimulus - Reuters

Hetkel küll ei paista kuskilt otsast, et keegi võiks uute stiimulite vastuvõtmisel ka tagajärgi kaaluda. -

Fed's Lockhart says "neutral" on whether discount rate must go back to traditional 100 bps spread over fed funds - Reuters

-

Fed's Duke says hit 'rocky bottom' on commercial real-estate loans - DJ

-

Vägisi tundub, et turg moodustamas tippu ja lähiajal peaks kerget langust nägema. Samas on see S&P 500 1200 punkti nii ahvatlevalt ligidal. Viimasel ajal turg ikka hämmastavalt tugev olnud (bid kogu aeg all) -> kas see tuleneb müüjate puudumisest või meeletust rahatulvast (turul käive väike), ei teagi. Tundub, et päris mitmed ettevõtted on hetkeseisuga üle ostetud ja tulemustesadu ukse ees, seega tulemused tõotavad anda huvitavaid kauplemisideid mõlemas suunas.

-

Üle hulga aja kipub tulema straddle enne tulemusi kvartal. Volatiilsus madal, mis võib kerida enne tulemusi tublisti kõrgemale. Saab näha, õnged välja!

-

LHV Traderi vahendusel on võimalus ka päris mitmeid muid optsioonistrateegiaid rakendada, mis võiksid üsna edukaks osutuda. Hetkel üsna paljudel kaubeldav volatiilsus suht madal, mis võib ka volatiilsusele panustamise atraktiivsemaks muuta.

-

Täna siis RIMM ja MOS

RIMM hea liikuja. Ootused EPS 1.28 (+42.2% yoy ) ja rev. 4.312B (+24.5 yoy )

AAPL varjus võiks siit isegi langust oodata. Oodatakse 11M telef. müüki, ise nad on adnud 10.6-11.2 vahele.

Reuters ootab gross m. 43.3% ( Q3 oli 42.7 )

Eelmine kord Q3 oli EPS 0.06 parem oodatust, siis aktsia tõusis. 63 juurest 71. Tulud oli 3,92B v 3.78B

Q2 oli EPS 0.03 parem oodatust ja rev. 3.53 v 3.63, siis kukkus 83 juurest 70.

Trade: kui EPS in line või natuke parem ja tulud alla ootuste, siis kukkumine -

Micron (MU) prelim $0.39 vs $0.24 Thomson Reuters consensus; revs $1.96 bln vs $1.82 bln Thomson Reuters consensus

-

Pakun kaks straddle ideed, Aaple(AAPL) ja Alliance Data Systems Corporation (ADS). Esimesel tulemused 20.aprillil ja teisel 19.aprillil. Volatiilsuse kasvu võib sealt oodata 10-20%.