Börsipäev 22. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

Eileõhtused suuremad kvartalitulemuste pettumused tulid eBay'lt (EBAY) ja Qualcommilt (QCOM), kes vajusid järelturul mõlemad üle 8% miinusesse ning vedasid ka börsipäeva sulgemise eel juba korralikult kosunud indeksite futuurid mitu punkti taas madalamale. Tulemuste teatajaid on ka täna väga palju, kuid kindlasti ootame suure põnevusega täna lõuna ajal oma numbrid raporteeriva Nokia (NOK) näite.

Eesti aja järgi kell 15.30 teatatakse USA esmaste töötu abiraha taotlejate arv (ootus 450 000), kestvate töötu abiraha taotlejate arv (ootus 4.6 miljonit), märtsikuu tootjahinnaindeksi muutus (ootus +0.5%) ning kell 17.00 tuleb märtsikuu olemasolevate eluasemete müüginumber (ootus 5.28 miljonit).

Eelturul on S&P500 indeksi futuurid hetkel -0.2% ja Nasdaq100 futuurid -0.15%. -

Tulemuste tabel nüüd eileõhtuste numbritega uuendatud - link tabelile.

-

Euroopa on teinud järsu tagasipöörde ja samamoodi USA futuurid (S&P500 10 minutiga 1203 pealt 1194 peale) pärast seda, kui Eurostat revideeris Kreeka mullust eelarvepuudujääki varasemalt 12.7%lt 13.6%le. Teatud tuletisinstrumentide tõttu võib see number kujuneda isegi 0.3-0.5 protsendipunkti kõrgemaks.

-

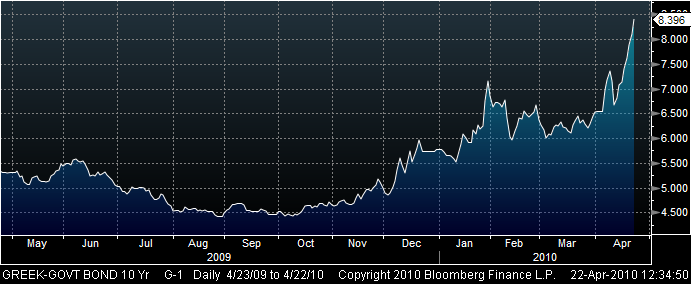

Selle peale purustab Kreeka 10a võlakirja tulusus uusi rekorded ja üha tõenäolisemaks muutub asjaolu, et EU ja IMF abipakett aktiveeritakse, sest selliste intresside juures muutub laenude teenindamise võime juba väga küsitavaks.

-

Nokia jäi esmapilgul nii käibe kui ka kasumi osas ootustele alla

-

Aktsia hetkel -10%

-

Üks intervjuu Bloombergis, kus tänase Kreeka oodatust suurema eelarvedefitsiidi valguses käiakse välja mõte, et euro langustsükkel teiste maailma valuutade vastu võib kesta kogunisti 7 aastat. Link intervjuule siin.

-

Esmaste ja kestvate töötu abiraha taotluste arv vähenes USAs eelmisel nädalal võrreldes varasemaga, mis tööturu jaoks positiivne märk:

Initial Claims 456k vs 450k consensus; prior revised to 480k from 484k

Continuing Claims falls to 4.646 mln from 4.686 mln

-

Tootjahinnaindeks tegi märtsis oodatust natuke suurema tõusu, kuid ilma toiduainete ja energiata on surve hindadele jätkuvalt madal:

March PPI m/m +0.7% vs. +0.5% consensus; prior -0.6%

March Core PPI m/m +0.1% vs +0.1% consensus

-

USA futuurid eelturul korralikult miinuses. Hetkel S&P500 indeks -0.55%, Nasdaq100 indeks -0.65% ja nafta -1.40%.

Euroopa turud:

Saksamaa DAX -0.87%

Prantsusmaa CAC 40 -0.97%

Inglismaa FTSE 100 -0.76%

Hispaania IBEX 35 -1.96%

Rootsi OMX 30 -0.94%

Venemaa MICEX -0.68%

Poola WIG -1.31%Aasia turud:

Jaapani Nikkei 225 -1.27%

Hong Kongi Hang Seng -0.26%

Hiina Shanghai A (kodumaine) -1.12%

Hiina Shanghai B (välismaine) -0.14%

Lõuna-Korea Kosdaq +0.09%

Tai Set 50 +0.29%

India Sensex 30 +0.58% -

Protect Your Gains

By Rev Shark

RealMoney.com Contributor

4/22/2010 8:28 AM EDT

To be prepared for war is one of the most effectual means of preserving peace.

-- George Washington

Earnings reports issued since the market close are receiving a mediocre response from the market this morning. Chipotle (CMG) , Netflix (NFLX) and Starbucks (SBUX) are seeing some positive action, but technology stocks such as Nokia (NOK) , Qualcomm (QCOM) , Intersil (ISIL) , F5 (FFIV) and Lam Research (LRCX) are all trading in the red. Overseas markets were mostly down as Asia fell on a stronger yen and Europe continues to grapple with Greece and now Portugal.

To add to the pressure, President Obama is scheduled to give a speech criticizing Wall Street and the financial industry as he pushes for a reform bill. Even the mayor of New York has declared that "the bashing of Wall Street is something that should worry everybody."

This market just hasn't cared about the negatives that the bears kept hoping and praying would finally start to matter. There have been plenty of logical and insightful arguments from the pessimistically inclined, but the unrelenting positive momentum of this market has crushed those who have harbored doubts.

It sounds a bit trite and simplistic, but in the market, negatives don't matter until they do. Many market traders work very hard at trying to catch a market turn, but there just isn't any easy way to know when market sentiment will shift. It always is a bit surprising how suddenly the mood can shift. One day there isn't a care in the world and the next day there seems to be a long list of things to worry about.

I don't want to sound overly bearish at this point, but we definitely are seeing a "sell the news" response to earnings this morning. The market fought back nicely in the final hour yesterday and Apple's (AAPL) strong response to its earnings report masked quite a bit of poor action, but the momentum driving this market has definitely cooled ever since the Goldman Sachs (GS) fraud charges hit. We aren't suddenly falling apart, but we are slowing down and there is a greater inclination to lock in some gains.

We had an almost ideal setup for a "sell the news" reaction to earnings this quarter. We were very technically extended and expectations were quite high. Intel (INTL) and AAPL surprised the bears but overall the reaction to earnings has been quite mixed. We really haven't seen any major pullbacks yet, but there are definite signs that the bulls are losing steam. We certainly can't underestimate the power of the dip-buyers who did another fine job late yesterday, but increased defensiveness is prudent at this point.

The key to producing market-beating performance is to hold on to gains once you earn them. If you keep your portfolio fairly close to highs at all times, you will outperform. To do that means you have to be very aggressive about selling when the market is starting to show signs of weakness. In this environment, such a strategy has often proved frustrating because we have so often bounced so hard. Nonetheless, over time, the disciplined trader who is fast to protect profits will produce the best returns.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: CYBE +20.5% (light volume), MKSI +9.3%, ACUR +5.9% (light volume), , TER +5.9%, SNDK +5.7%, CMG +5.5% (also upgraded to Buy at Jesup & Lamont; upgraded to Buy from Underperform at Jefferies; upgraded to Perform from Underperform at Oppenheimer), PNC +4.1%, HBI +3.9%, LEG +3.7%, GRNB +3.3% (light volume), SCSS +3.0%, HSY +2.4%, NFLX +2.2%, ESV +1.5% (light volume), BANR +1.4%, SLM +1.4%, SBUX +1.3% (also upgraded to Buy at Jesup & Lamont), MAR +1.0%, NE +0.9% .

M&A news: Q +10.1% (Qwest and CenturyLink agree to merge, Qwest shareholders to receive equivalent to $6.02 of CenturyLink stock).

Other news: DCTH +31.2% (announces Phase III Trial results exceed primary endpoint expectations; initiated with a Buy at Roth), DGLY +9.9% (Digital Ally receives international contracts from South America and Middle East), VICL +8.5% (Presents encouraging preliminary data from final 12-month follow-up in TransVax CMV vaccine Phase 2 transplant recipient trial), NBS +7.2% (Neostem and ImmuneRegen BioSciences announce a collaborative agreement to advance stem cell technology), NVAX +6.4% (notified by Department of Health and Human Services that its proposal for a contract award is in the competitive range for the advanced development of its recombinant influenza vaccine), VRNM +6.3% (Awarded U.S. Department of Energy Funding for Demonstration-Scale Facility), CEGN +5.9% (announced the development of its Protein-Protein Interaction Blockers Discovery Platform), STR +4.7% (considering spin-off of exploration & production business), S +3.7% (Cramer makes positive comments on MadMoney), GGP +3.1% (Simon Property Group announces $1.1 bln in new capital commitments for General Growth recapitalization), CAKE +1.6% (ticking higher in sympathy with CMG).

Analyst comments: RRGB +3.6% (upgraded to Buy from Hold at KeyBanc), HBAN +1.7% (upgraded to Market Perform from Underperform at Keefe Bruyette), ADBE +1.4% (added to Conviction Buy List at Goldman), MTG +1.3% (upgraded to Outperform from Market Perform at Keefe, Bruyette).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: NOK -13.0%, BAX -9.8%, EBAY -8.1% (also downgraded to Sell at MKM Partners), QCOM -8.0%, DO -5.9% (also declares special cash dividend of $1.375 per share), CCMP -5.6% (light volume), ISIL -5.1%, TEX -3.9%, URI -3.7% (also filed for a $1 bln mixed shelf offering), TSCO -3.2%, FFIV -3.2%, PM -2.9%, PLCM -2.7%, CTXS -2.6%, LRCX -2.5%, PTV -2.0%, MEE -1.7%, CSGP -1.6% (light volume), BTU -1.3%, AMGN -1.2%, UHT -1.2%, FITB -1.0%.

M&A news: CTL -1.7% (Qwest and CenturyLink agree to merge, Qwest shareholders to receive equivalent to $6.02 of CenturyLink stock; downgraded to Market Perform from Outperform at Raymond James).

Select financial related names showing weakness: CS -5.9%, NBG -4.2%, AIB -3.6%, BBVA -3.5%, STD -3.3%, DB -2.8%, ING -2.6%, IRE -1.9%, HBC -1.4%, MS -1.3%, LYG -1.2%, BAC -0.9% (AXA Private Equity acquires $1.9 bln portfolio of private equity funds from Bank of America ).

Select metals/mining stocks trading lower: RTP -2.7%, MT -2.1%, GOLD -1.9%, BHP -1.9%, BBL -1.8%, GDX -1.4%, AU -1.1%, ABX -1.1%, GLD -0.6%, .

Select oil/gas related names showing weakness: TOT -1.9%, E -1.8%, BP 1.7%, RDS.A -1.7%, RIG -1.2%.

Select telecom/cmcn names ticking lower in early trade: PT -3.5%, FTE -1.9%, TEF -1.4%, DT -1.2%...

Other news: NLTX -11.6% (announces pricing of 6.5 mln shares of common stock at $0.70), VALU -11.2% (trading ex dividend), ABB -7.5% (still checking), MOT -4.6% (trading lower in sympathy with NOK), SYT -4.5% (trading ex dividend), GU -1.8% (has and will temporarily suspend operations at its Shanghai plant from April 15, 2010 to October 31, 2010), DRYS -1.8% (priced of its previously announced public offering of convertible sr notes).

Analyst comments: ARRY -4.6% (downgraded to Neutral from Buy at UBS), BZH -2.5% (downgraded to Hold from Buy at Citigroup), VISN -2.1% (initiated with a Sell at Auriga), ELN -1.7% (downgraded to Sell from Neutral at UBS), EMC -1.3% (removed from Conviction Buy list at Goldman), DNDN -1.1% (downgraded to Hold from Buy at Lazard). -

EUR/USD on põhju ründamas (põhjus hommikul mainitud Kreeka võlakoormuses, mis on Eurostati hinnangul suurem, kui kreeklased ütlevad. Fundamentaalselt on Kreeka pilt nii või naa kehv...):

-

USA tarbijad on varsti lõppevat maksusoodustust ära kasutamas ja märtsis tegi olemasolevate eluasemete müük korraliku tõusu (huvitav on näha, mis saab siis, kui maksusoodustus ära kaob):

March Existing Home Sales 5.35 mln vs 5.29 mln; M/M +6.8%

-

Maagaasivarud enam-vähem vastavalt ootustele, kasvades konsensusega võrreldes pisut vähem.

Natural gas inventory showed a build of 73 bcf, analysts were expecting a build of 78 bcf, with ests ranging from a build of 64 bcf to a build of 80 bcf. -

Kreeka riigireiting saab Moody'selt reitingulangetuse:

Briefing: Moody's downgrades Greece's sovereign ratings to A3; on review for further possible downgrade -

Eesti aja järgi kell 18.55 peaks USA president Barack Obama pidama kõne finantsreformide ja finantsregulatsioonide teemal. Kui Obama poolt väljakäidav sõnastus on väga karm, siis võib see turgude tänast müügilainet võimendada. Kui sõnastus on leebe, võib kaasa tuua kergenduse ja väikese ostusurve. Igaljuhul paarikümne minuti pärast siis kõne algus.

-

Ilmselt obamal oleks hea insider tehinguid teha :) ostab karja pute- sõimab pankuritel näo täis, müüb maha, ostab karja calle ja lubab bailouti :)

-

CNBC reports that Redwood Property Trust has filed a prospectus for $230 mln in bonds backed by jumbo mortgages; will be offered next week

Esimene RMBS aastast 2007, ilma riikliku toeta. -

Amazon.com prelim $0.66 vs $0.61 Thomson Reuters consensus; revs $7.13 bln vs $6.87 bln Thomson Reuters consensus.

Amazon.com sees Q2 operating income of $220-320 mln vs $327.78 mln street consensus.

Amazon.com sees Q2 revs $6.1-6.7 bln vs $6.43 bln Thomson Reuters consensus. -

Amazon.com (AMZN) on mitte-kõige-suurejoonelisemate numbrite peale järelturul igaljuhul tagasi andmas. Kui enne tulemusi kaubeldi $150 peal, siis hetkel on hinnaks $142.

-

Micorsofti numbrid 'ainult veidikene' üle ametlike ootuste.

Microsoft prelim $0.45 vs $0.42 Thomson Reuters consensus; revs $14.5 bln vs $14.39 bln Thomson Reuters consensus