Börsipäev 21. juuni

Kommentaari jätmiseks loo konto või logi sisse

-

Kuigi Eestis on sellel nädalal pühade tõttu tegu lühendatud kauplemisnädalaga, siis USAs kestab kauplemine iga päev. USAst täna majandusuudiseid tulemas ei ole, kuid põnevust on tekitanud liikumised Hiina jüaanis, kus Hiina keskpank on pisut lõdvendanud kahe aasta pikkust fikseeritud vahetuskurssi. Hiina jüaan on kerkinud 0,36% tasemele $1=6,8 jüaani. See võiks viidata ka sellele, et paljude poolt kardetud Hiina majanduse seis võiks olla parem, kui seni arvatud. Üks link ka Bloombergi loole.

Välismaistel ettevõtetel läheb elu sellega lihtsamaks ning USA aktsiaturgudel on indeksite futuurid hetkel ca 1,5% plussis. Nafta on kerkinud üle 2% ja jõudnud tasemele $78,9 ning maagaas samuti üle 2% ja kaupleb hetkel $5,1 peal. Maagaasihinda aitab ülespoole liigutada veel Venemaa ja Valgevene vaheline gaasitüli, kus Venemaa on ähvardanud tarned Valgevenesse peatada.

-

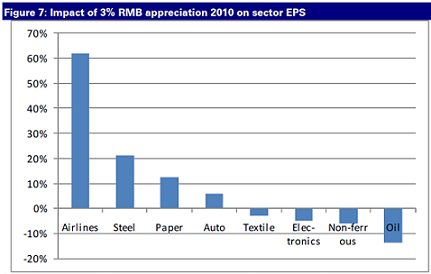

Üks viis jüaani kallinemisele panustada on läbi Hiina lennufirmade, mis kauplevad ka USA börsil sümbolite all ZNH (China Southern Airlines) ja CEA (China Eastern Airlines). China Southern Airlinesi aktsat oleme pikemalt tutvustanud ka LHV Maailma Pro all siin. Deutsche Banki hinnangul suureneks Hiina lennufirmade EPS ca 60%, kui jüaan kallineks kõigest 3%.

-

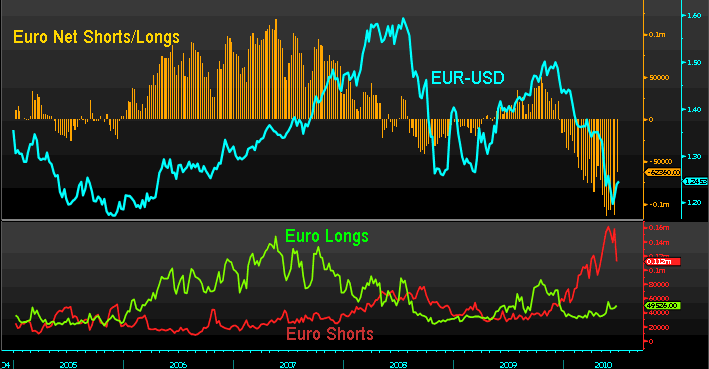

Lühikeseks müüjad on üks seltskond, kes on positsioonide katmisega euro viimase kahe nädala rallile kaasa aidanud. Allolevalt Nomura graafikult on näha, et neto lühikeste positsioonide omanike arv vähenes eelmisel nädalal rekordilise 49 585 lepingu võrra, toetades euro 2,3%list kallinemist dollari suhtes, mis osutus kiireimaks tõusuks alates 2009.a maist. Analüüsimaja sõnul on Euroopa võlaprobleemid muutnud valuuta haavatavaks spekulantide sentimenti kiire muutumise suhtes, kuid riskiisu näib nende meelest olevat siiski tagasi tulnud ja see võib eurot kanda järgnevate nädalate jooksul 1,27 dollarini.

-

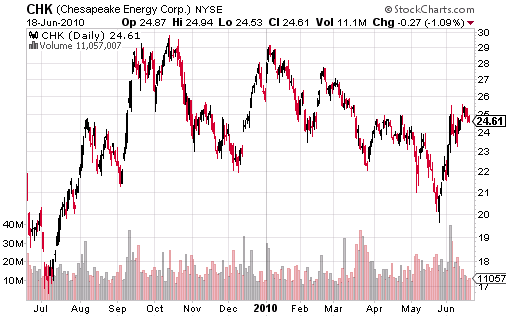

Venemaa-Valgevene vahel (taas)puhkenud gaasitüli valguses võiks vaadata USA maagaasipuurija Chesapeake Energy (CHK) poole. Täna tuli ka teade, et Korea Investment Corp, China Investment Corp ja Singapuri riiklik investor Temasek Holding on investeerimas sadu miljoneid dollareid Chesapeake Energy eelisaktsiatesse. Korea Investment Corp põhjendab tehtud investeeringut sellega, et usub maagaasihindade pikaajalisse tõusu seoses globaalse majanduskasvuga ning BP poolt tekitatud naftareostuse järgse inimkonna sooviga tarbida puhtamaid energiaallikaid ning piirata süvavee puurimist.

-

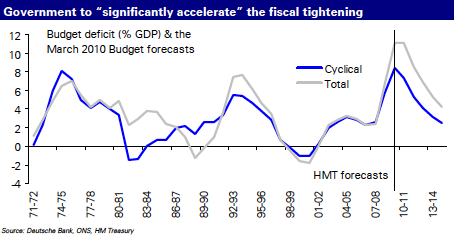

Homme on Suurbritannias ütlemata tähtis päev ning uudiste mõju saab tunda kindlasti ka aktsiaturgudel – uus rahandusminister George Osborne avaldab parlamendis plaani saareriigi eelarvedefitsiidi vähendamiseks. Majandusteadlaste sõnul võetakse vastu uus maksupoliitika, mis täiendaks riigi rahakotti ca $40 miljardi võrra. Kärbete suuruseks prognoositakse ca 2 – 3% SKTst. Suurimaks muutuseks oodatakse VAT ehk käibemaksu tõusu 17.5% pealt 20%le, mis tähendaks lisa £11 miljardit.

Tänase päeva seisuga on Suurbritannia valitsus teatanud £6 miljardi suurusest eelarvekärpest (0.4% SKTst), kuid homne avaldus toob arvatavasti kaasa lisakärpeid. Peaminister on samuti lubanud avaldada plaani, kuidas eelarvet hakatakse tasakaalustama järgneva viie aasta jooksul. DB on prognoosinud, et praegune 8.5%line eelarvedefitsiit SKTst suudetakse tasakaalustada aastateks 2014 – 2015.

Allikas: Deutsche Bank

-

Poisid, poisid - millal Osborne'ist peaminister sai UKs?

-

Karum6mm, väga õige märkus. Tegemist on siiski rahandusministriga ning homme avaldatakse plaan koos peaministriga =) Nüüd on siis tekst ka ülalpool ära parandatud.

-

Ärge ehmatage mind nii :-D

-

Ameerika Ühendriikides ning ka mujal maailmas on jätkuvalt nii-öelda “kuumaks” teemaks BP, mis kaupleb eelturul ca 4.50% reedesest sulgemishinnast madalamal (NYSE). Nimelt langetas Oppenheimer analüüsimaja hommikul BP aktsiahinna sihi $55 pealt $45 peale. Põhjus seisneb selles, et Anadarko Petroleum keeldus maksmast 25% BP naftalekkega seonduvatest kulutustest. BP teatas täna, et kulutusi on tehtud $2 miljardi väärtuses.

Anadarko on kommenteerinud probleemi järgnevalt:“Under the terms of the JOA all partners are joint and severally liable for the costs to clean up and associated damages – except where the operator is found to have acted with Gross Negligence or Willful Misconduct. APC has not explicitly stated its intentions as it relates to paying any share of the spill; but with a formal dispute now evident, arbitration is the likely next step – however we would also expect that any out of pocket costs ultimately payable will also be deferred.”

-

Meredith Whitney on CNBC says she is still as bearish as she's ever been; says stocks aren't baking in a double-dip in housing

Whitney on jätkuvalt väga karune finantsturgude osas. -

Esimese nädalalõpu tulemus IMAXi (IMAX) kinodes:

Avatar: USAs $9.5 mln + $4.1 mln rahvusvaheliselt = $13.6 mln

Alice Imedemaal: USAs $12.1 mln + $3.1 mln rahvusvaheliselt = $15.2 mln

Monsters vs Aliens: USAs $5.1 mln

Shrek Forever After: USAs $4.8 mln + $0.75 mln rahvusvaheliselt = $5.55 mln

Toy Story 3: USAs $8.4 mln + $1.2 mln rahvusvaheliselt = $9.6 mln

Tubli tulemus Toy Story 3'lt.

-

USA indeksite futuurid hoiavad jätkuvalt ca 1,3% kuni 1,5%list tõusu. Maagaas on tõusnud 3,1% ning nafta 2,0%.

Euroopa turud:

Saksamaa DAX +1,10%

Pantsusmaa CAC 40 +1,33%

Suurbritannia FTSE100 +0,91%

Hispaania IBEX 35 +1,66%

Rootsi OMX 30 +0,84%

Venemaa MICEX +2,28%

Poola WIG +0,97%Aasia turud:

Jaapani Nikkei 225 +2,43%

Hong Kongi Hang Seng +3,08%

Hiina Shanghai A (kodumaine) +2,90%

Hiina Shanghai B (välismaine) +3,74%

Lõuna-Korea Kosdaq +0,63%

Tai Set 50 +2,05%

India Sensex 30 +1,74% -

Bulls Charge Ahead on Yuan News

By Rev Shark

RealMoney.com Contributor

6/21/2010 8:42 AM EDT

China trade deals are basically like the Bobby Knight of trade deals. You know, you abuse, you abuse, you abuse, and then they say, "Well, OK, we'll let you try one more time."

-- David Bonior

Once again we have the traditional Monday-morning gap taking place. Since the low in March 2009, a very large percentage of the gains in this market have occurred between the close on Friday and the open on Monday. If you missed the Monday strength, you have pretty much missed the uptrend.

The gain this morning is being produced due to China dropping its peg of its currency, the yuan, with the dollar. China has been criticized for quite some time for artificially keeping the yuan low, a position that helps its export market. A stronger yuan allows China to buy more commodities and it also helps to cool off exports and helps to keep inflation in check.

Plenty of market players are skeptical of China's true intentions and question whether the country will really allow the yuan to rise much, but it is already at its highest point since being revalued in July 2005. There are many complexities to the yuan impact, but the bottom line is that the market likes it and indices are up sharply worldwide.

As I discussed after the close on Friday, three days of relative flat action have created a good foundation for further upside. We not only held the very important breakout over the 200-day simple moving average of the S&P 500 at 1108, we then consolidated the gains to a good degree with the subsequent flat action.

Overall we look like we are in good shape to run further at this point. We have the end of the quarter coming up and the rebalancing of the Russell indices, both of which should have a positive influence. In addition, we don't hit the next area of major resistance for the market until the 50-day simple moving average at SPX 1139. There is some minor resistance around 1125, but we will take that out with the open.

Not only do we tend to have gaps on Monday morning, we also tend to hold the gains for the rest of the day. I don't think we have had any major market reversals on a Monday since the bottom in March 2009.

Furthermore, we can't forget this market's propensity for low-volume "V"-shaped rallies. There has been a consistent pattern of going straight up once a low-volume bounce begins. So far, the action of the past couple weeks looks very similar to the bounce that began in February. I doubt we'll have a low-volume rally as extreme as we had in March, but I'm sure that the bears and underinvested bulls are very aware of this pattern of action.

One thing I'm looking forward to this week is playing the Russell rebalancing. Berkshire Hathaway B Shares (BRK.B) is the biggest addition to the Russell 1000, and you can see how that has been acting. There are some good setups in the small-caps being added to the Russell 2000; I'll post some specific names that I'm trading later.

Buckle up -- it's going to be an interesting ride into the end of the quarter.

-----------------------------------

Briefing.com vahendusel:

Ülespoole avanevad:

M&A news: EFJI 41.7% (announces amended merger agreement with Francisco Partners, increases takeover price to $1.50/share ), AIPC +26.1% (Ralcorp Holdings to acquire Amer Italian Pasta for $53.00 per share).

Select metals/mining names related names showing strength: FRG +8.4% (reports drilling hits 2.35 ounces/ton Gold and 33.18 ounces/ton silver over 9.6 feet at Sandman, Nevada), FCX +6.2%, MT +5.7%, SCCO +5.5%, RTP +5.1%, MTL +4.8%, PAL +4.7%, BHP +4.7%, VALE +3.8%, GDX +3.0%, GOLD +2.4%, .

Select financial stocks trading higher: NBG +4.6%, STD +3.2%, BPOP +3.0%, FITB +2.6%, RDN +2.5%, CS +2.5%, PUK +2.5%, BCS +2.4%, HBC +2.0%, BAC +1.8%, C +1.5%, UBS +1.3%, .

Select steel related names seeing early strength: AKS +4.3%, X +3.0%, STLD +2.0%, NUE +1.7%.

Select oil/gas related names showing strength: ACGY +11.7%, CEO +4.2%, WLT +3.3%, RIG +2.9%, REP +2.6%, HAL +2.3%, RDS.A +1.7%, TOT +1.6%, APC +0.8%, .

Other news: PTN +16.0% (announces positive preclinical data with PL-3994 for asthma indications), CRUS +3.8% (continued momentum), MWE +2.7% (Cramer made positive comments on MadMoney), DRI +0.8% (Cramer made positive comments on MadMoney).

Analyst comments: TC +4.3% (upgraded to Buy from Neutral at UBS), GXDX +3.5% (upgraded to Hold at Auriga), MPW +1.6% (upgraded to Market Perform from Underperform at Wells Fargo).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: CPKI -5.7% (light volume).

Other news: AFFY -63.3% (Affymax and Takeda Hematide trial data; safety data from a subgroup showed a greater occurrence of CSE events; also downgraded to Neutral from Outperform at Cowen), BPAX -10.0% (Says FDA Advisory Committee Recommendation Against Flibanserin has No Impact on LibiGel), PSEC -6.6% (made senior secured investment of $6 mln in private-equity-owned provider of services to the steel products industry), BP -4.2% (provided an update on developments in the response to the MC252 oil well incident in the Gulf of Mexico). -

House Dems want to add student lender to watchdog purview; want to strike Senate proposal relating to CMBS risk retention, according to CNBC

-

MA ja V on saanud tuule tiibadesse peale House paneli poolt Volckner rule muudatusi, eelkõige tasude sõnastuse muutmisest. Mõlemad aktsiad jõudsid üle 7% tõusu, nüüdseks on kergelt madalamale tuldud.

-

Amazon.com: CNBC reporting AMZN cutting its prices on Kindle to $189 from ~$259