Börsipäev 9. september

Log in or create an account to leave a comment

-

Vaatamate sellele, et eile õhtul avaldatud FED-i beeži raamatu järgi on märgid majanduskasvu aeglustumisest USA-s muutumas laildasemaks, ei andnud turud sellele erilist uudisväärtust ning S&P 500 lõpetas päeva 0,6% kõrgemal. Aasias kaubeldakse kerges plussis, üheks erandiks on aga Hiina, kus uuesti kerkima hakanud kinnisvarahinnad süvendasid hirmu, et riigi valitsus kavatseb sektori jahutamiseks võtta appi täiendavaid meetmeid. Nikkei +0,82%, Hang Seng +0,55%, CSI 300 -1,4%. USA futuurid liiguvad hetkel -0,1% punases.

Tänase päeva põhitähelepanu koondub esmakordsetele töötuabiraha taotlejate arvule USA-s (kl 15.30), mis on viimaste nädalate jooksul pisut allapoole tulnud, kuid nagu graafikult näha, liigutakse jätkuvalt väga kõrgel tasemel piiratud vahemikus juba viimased aasta aega. Konsensus ootab möödunud nädalal taotluste arvuks 470 000, märkides sellisel juhul vähenemist 2000 võrra. Kestvate töötuabiraha taotluste arvuks prognoositakse 4,445 mln vs 4,456 eelneval nädalal. Ühtlasi avaldatakse kell 15.30 USA juulikuu ekspordi-impordi statistikat ning Labour Day tõttu hilinemisega ka toornafta varude raport (kl 18.00).

-

Wadhwani Asset Managementi tegevjuht ja endine Inglise keskpanga rahakomitee liige Sushil Wadhwan räägib eilses FT artiklis topeltpõhja võimalikkusest, tõdedes et üldjuhul on need suhteliselt haruldased (kõigest kolmel korral USA 32-st majanduslikust taatumisest alates aastast 1854), kuid sel korral võib turgudel valitseval hirmul alust olla. Esiteks ähvardab tagasilöögi anda Euroopa võlakriis, teiseks valitsuste liialt varajased kulukärped ja kolmandaks teadmine, et isegi kui uut majanduslangust suudetakse vältida, siis võlakorrmuse vähendamine ja konservatiivsem fiskaalpoliitika toovad arenenenud riikides suure tõenäosusega kaasa aeglase majanduskasvu. Kokkuvõttes jõuab ta aga järeldusele, et keskpangad peaksid olema proakviised ning alustama QE2-ga, mitte ootama majandusnäitajate halvenemist, mis võib Jaapani näitel osutuda väga kulukaks. Link artiklile

-

UK BOE Asset Purchase Target stays at 200B. UK BOE Rates stays at 0.50%.

-

Makro oodatust parem ning USA futuurid spike'sid +0,7% juurde

Weekly Initial Claims 451K vs. 470K Briefing.com consensus; prior revised to 478K from 472K

Continuing Claims falls to 4.478 mln vs. 4.445 mln Briefing.com consensus; prior revised to 4.480 mln from 4.456 mln

July Trade Balance -$42.8 bln vs -$47.3 bln Briefing.com consensus; prior revised to -$49.8 bln from -$49.9 bln

-

Taaskord üks ülevõtmine 3M (MMM) poolt. Ettevõte ostab $810 miljoni eest Arizanti, kes pakub patsientide soojas hoidmise lahendusi operatsioonide ajal, vältimaks alajahtumist.

3M Company to acquire Arizant for $810 in cash. Arizant is a manufacturer of patient warming solutions designed to prevent hypothermia in surgical settings.

-

USA turud alustamas korralikus plussis: ES +0,98%, YN +0,76%, NQ +0,92%. Nafta kaupleb +1,45% @ 75 USD ja ja kuld -0,14% @1253,9 USD.

Euroopa turud:

Saksamaa DAX +0,78%

Pantsusmaa CAC 40 +1,09%

Suurbritannia FTSE100 +1,18%

Hispaania IBEX 35 +1,12%

Rootsi OMX 30 +0,75%

Venemaa MICEX +1,58%

Poola WIG +0,08%Aasia turud:

Jaapani Nikkei 225 +0,82%

Hong Kongi Hang Seng +0,37%

Hiina Shanghai A (kodumaine) -1,45%

Hiina Shanghai B (välismaine) -1,29%

Lõuna-Korea Kosdaq +0.68%

Tai Set 50 -0.39%

India Sensex 30 +0,71% -

Gapping down

In reaction to disappointing earnings/guidance: SEH -10.0% (light volume; also downgraded to Hold at KeyBanc Capital Mkts), AVAV -3.2% (light volume), MCD -2.3%.M&A news: EMMS -7.3% (JS Acquisition terminates offer to purchase all of co's outstanding shares of Class A Common Stock for $2.40; co terminates issue of 12% PIK Senior Subordinated Notes due 2017).

Other news: FUQI -22.8% (discloses it was notified recently by the SEC of a formal investigation), QCOR -5.6% (FDA will require additional time to complete its review of H.P. Acthar Gel ), NI -1.2% (prices offering of 21.1 mln shares of its common stock ).

Analyst comments: BZ -2.0% (downgraded to Neutral from Buy at Goldman), SUN -0.4% (downgraded to Sell from Hold at Argus).

Gapping up

In reaction to strong earnings/guidance: MW +2.4%.Select financial related names showing strength: BCS +3.0%, RBS +2.8%, UBS +2.0%, BBVA +1.7%, FITB +1.4%, RF +1.2%, CS +1.0%, .

Select metals/mining stocks trading higher: RTP +2.4%, BHP +2.2%, GOLD +1.8%, MT +1.8%.

Other news: SNTS +14.9% (licenses novel type 2 Diabetes drug CYCLOSET), GERN +5.7% (Sierra Sciences co-authors paper announcing successful lengthening of telomeres to extend human lifespan), ARMH +5.0% (introduced the Cortex-A15 MPCore processor ), NRGY +1.3% and NUE +0.8% (Cramer makes positive comments on MadMoney), .

Analyst comments: MVIS +7.3% (light volume; initiated with a Buy at Stifel Nicolaus), HMY +1.5% (upgraded to Overweight from Neutral at JP Morgan), TEVA +1.1% (upgraded to Outperform at Oppenheimer).

-

Rev Shark: Individual Stocks Matter Again -- For Now

09/09/2010 7:26 AMI long to accomplish a great and noble task, but it is my chief duty to accomplish small tasks as if they were great and noble.

-- Helen KellerOne of the most challenging aspects of this market for well over a year has been the highly correlated nature of most stocks. It has been all about the big picture and making the big call rather than picking a good stock or two. Individual stock-picking hasn't mattered much as stocks as a group go up or down together.

With the increasing influence of ETFs and computerized trading, this development isn't too surprising. The vast majority of the volume in the market is from the trading of big baskets of stocks without much regard as to what individual stocks happen to be in those baskets.

I've discussed this in the past, but I bring up it again because the picking of individual stocks has been working much better in recent days. This is mainly a function of aggressive speculative money moving quickly to try to catch some momentum and to produce some relative outperformance. The big-basket transactions are still taking place, but the hot money is having more of an impact at the margins, and that is making for some interesting pockets of trading.

This shift may be occurring because there is very little news flow right now. Earnings season doesn't start for a while and the economic calendar is very sparse. President Obama's speech yesterday generated some partisan reactions, but the market did nothing on the news. We are likely to move big on macroeconomic concerns again quite soon, but for the moment we are adrift and focusing more just on some individual stocks.

I've often found that some of the best trading takes place when the market is in a muddle. In such a situation, traders tend to gravitate toward a smaller group of stocks and it become easier to identify what has the best momentum. That seems to be the case in the last few days as a relative small group of stocks are seeing aggressive action while many others are just drifting around aimlessly.

Technically the major indices are sitting in a trading range, waiting to see which side is going to seize control. The S&P 500 is sitting smack in the middle of its 50-day and 200-day simple moving averages. There is obvious overhead resistance and equally obvious underlying support, but we aren't testing either at the moment. We are slightly overbought and there is some resistance at 1100 of the S&P 500, so the bears have a very slight edge, but it isn't enough to undermine the action in some of the better-acting individual stock.

So overall, I'm happy to report that it really is a stock-picker's market at the moment. Unfortunately, I think we'll see the high correlation between stocks resume as we dance around to macroeconomic concerns, but for now we might as well enjoy the trading while we can.

Overseas markets were mostly green and we have a slightly positive open on the way. Weekly unemployment claims are hitting, and that is going to set the early tone.

-

Futuurid on küll oodatust paremate töötu abiraha numbrite peale üle 1% plussis... Aga (!) - Labor Day püha tõttu on seekord nende numbritega mängitud isegi rohkem kui tavaliselt ning see võib tähendada järgmisel nädalal korralikku numbrite ümbervaatamist. California ja Virginia ei ole üldse väikesed osariigid.

"For the latest reporting week, nine states didn't file claims data to the Labor Department in Washington because of the Labor Day holiday earlier this week, a department official told reporters. California and Virginia estimated their figures and the U.S. government estimated the other seven." -

$13 bln 30-year Bond Auction Results: Yield 3.820% (3.806% expected); Bid/Cover 2.73x (Prior 2.77x, 12-auction avg 2.65x); Indirect Bidders 36.1% (Prior 46.0%, 12-auction avg 35.4%)

-

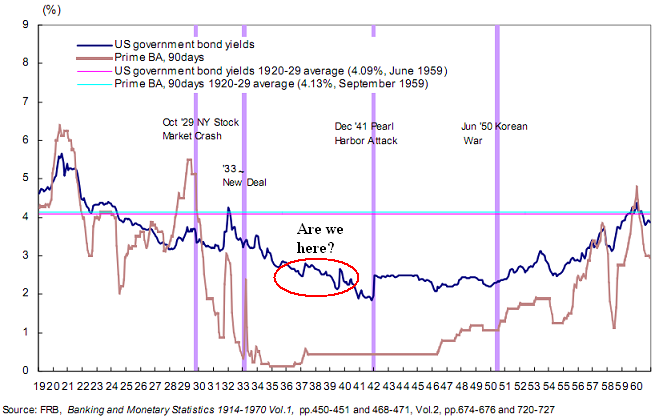

Oodatust paremate esmakordselt töötuabiraha taotluste ja kestvate töötuabiraha taotluste numbrite peale on täna hinnas riskantsemad varaklassid. All on USA 10-aastase võlakirja tulususe määra viimase 5 päeva graafik.

Paar päeva tagasi ilmus Pragmatic Capitalist’is lugu, kus räägiti võlakirjade nii-öelda mullist. Sisuliselt üritati leida tänase makrokeskkonnaga sarnast perioodi ning välja pakkuti 1930ndate aastate lõpp, kui mureks oli deflatsioon, madalad tulususe määrad, nõrk makrokeskkond, kõrge töötusmäär ning erasektori suur võlakoorem. Tulemuseks saadi allolev graafik.

-

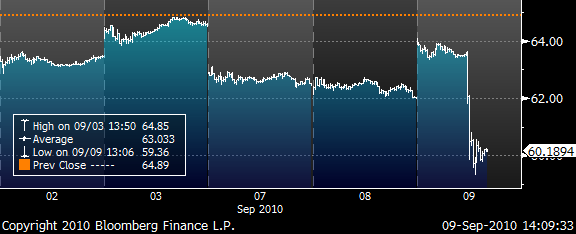

Turgudel ringlevad uudised, et Deutche Bank on pidamas kapitali tõstmise osas läbirääkimisi investeerimispankadega. Väidetavalt plaanib DB tõsta kapitali ca €9 miljardi väärtuses. Juunis peetud investorite koosolekul teatas DB, et ettevõte võib suurendada oma 30%list osalust Postbank’is ning tehingu finantseerimiseks toodi välja kapitali tõstmine. All on Deutche Banka viimase 5 kauplemispäeva graafik (NYSE: DB).