Börsipäev 11. oktoober

Kommentaari jätmiseks loo konto või logi sisse

-

Valuutade nõrgestamine oli nädalavahetusel toimunud IMF-i iga-aastase miitingu peamiseks teemaks, kui rahandusministrid pöördusid Valuutafondi poole hoidmaks ära riikidevahelisi suuremaid vastuseise. Kokkuvõttes lubati vaid omavahelist koostööd parandada, ent kindlate meetmete ja eesmärkideni ei jõutud. Täna hommikul on dollar jätkanud langust olulisemate valuutade vastu, kui USD/JPY jõudis momendiks käia tasemel 81,39 ning EUR/USD kaupleb hetkel 1,397 tasemel.

Makro osas kujuneb täna päev vaikseks, piirdudes vaid Euroopaga, kus Prantsusmaa ja Itaalia avaldavad oma tööstustoodangu numbrid. USA-s võib aga kauplemine täna õhemaks jääda, kuna Kolumbuse päeva tõttu on võlakirjaturud ja finantsasutused suletud. Kanadas on tänupühade tõttu kõik turud suletud.

-

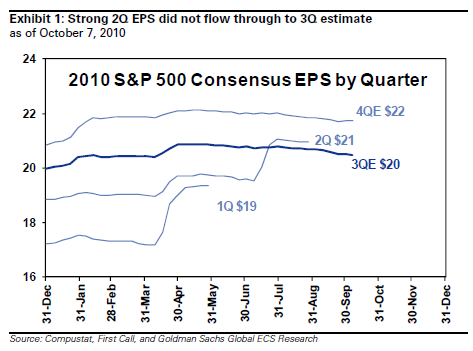

Käesolevast nädalast võtab tulemustehooaeg vaikselt tuure üles, kui S&P 500 liikmetest avalikustavad oma Q3 näitajad 17 ettevõtet (7% turukapitalisatsioonist), nendest kõige olulisemad on Intel (teisipäeval peale turgu), JPMorgan (kolmapäeval enne turgu), AMD ja Google (neljapäeval peale turgu), GE (reedel enne turgu). Allolevalt Goldman Sachsi graafikult on näha, et S&P 500 aktsiakasumi ootus on mõnevõrra allapoole tulnud, kuid seda suhteliselt marginaalset. Eriti tugevalt on kärbitud prognoose just finantside osas.

-

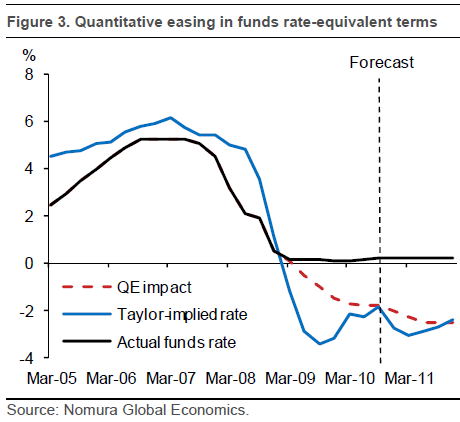

Kui turud on QE2 sisuliselt juba ajaloo raamatutesse kirjutanud siis jätkuvalt käib vaidlus selle üle kui suur peaks olema rahatrüki maht. Üldiselt kiputakse summaks pakkuma 500-1000 miljardit dollarit, ent eelmisel nädalal jäi CNBC-st kõrvu, et suuremat laadi mõju avaldamine eeldaks rahapakkumise suurendamist koguni 6-7 triljoni dollari võrra. Nomura on oma arvutustes piirdunud konservatiivsema prognoosiga, kuid jätab ukse võimalikele üllatustele avatuks.

In the peak months of QE1 (April through June 2009), the Fed purchased about $100bn of securities per month. We think this is probably a good indication of the maximum pace of purchases it is comfortable with. Putting it all together, our expectation is that the Fed will announce $200bn in purchases at the November, January and April meetings (the equivalent of three 25bp funds rate cuts), for a cumulative increase in its securities holdings of $600bn. This would close the “Taylor rule gap” and, hopefully, provide a meaningful stimulus to growth.

We would emphasize that there is a great deal of uncertainty around these estimates and, if anything, the risks are skewed towards more forceful action. Particularly at the November meeting, we think the Fed will have a strong desire to deliver a favorable surprise to markets. This could take the form of strong language around the potential for much greater purchases, a larger initial purchase amount, and/or complementary measures like an inflation target (see “An inflation target for the Fed” in this issue).

-

Gapping down

In reaction to disappointing earnings/guidance: CKSW -6.2% (anticipates revenues for Q3 ended September 30, 2010 to be ~$17.3 mln vs consensus of $18.4 mln).

Select gold related names seeing modest weakness: GG -2.3%, HMY -0.8%, GDXJ -0.8%, HMY -0.8%, AU -0.7%, GFI -0.6%, KGC -0.5%, EGO -0.5%, GDX -0.4%.

Select livestock related names seeing conintued weakness: SFD -1.5% (dropped 7% on Friday), TSN -1.1% (down 8% on Friday).

Other news: JAZZ -7.5% (receives FDA complete response letter regarding JZP-6 for treatment of fibromyalgia), ACGY -4.3% (still checking), ARMH -1.1% (still checking for anything specific).

Analyst comments: CX -3.9% (downgraded to Hold from Buy at Deutsche Bank), PUK -2.1% (light volume; downgraded to Underweight from Neutral at JP Morgan), BT -2.0% (downgraded to Underperform from Market Perform at Bernstein), MTW -1.8% (downgraded to Hold from Buy at Deutsche Bank), BP -1.4% (downgraded to Hold from Buy at RBS), COST -0.8% (downgraded to Underperform from Market Perform at BMO Capital).

Gapping up

In reaction to strong earnings/guidance: IMGN +8.5% (updated guidance, entered into a collaboration agreement with Novartis and announced presentation of encouraging clinical data for Lorvotuzumab Mertansine at ESMO Annual Meeting), LDK +8.2%, FTK +7.8%.

M&A news: HRBN +21.7% (Harbin Electric announces receipt of 'going private' proposal at $24.00 per share).

Select casino related names showing strength: MGM +2.2%, WYNN +1.6%, LVS +1.1%.

Select potash/agriculutre related stocks showing continued strength: SYT +2.7% (traded higher overseas),MOS +2.6%, AGU +1.5%, CF +1.5%, DE +1.1%, POT +1.0%.

Other news: ASTI +14.7% (has become the first manufacturer of thin-film flexible monolithically integrated CIGS modules to receive full IEC 61646 certification upon completion of environmental testing), EXEL +13.5% (licenses programs to Bristol-Myers Squibb), RVSN +11.1% (announces a new strategic relationship with Microsoft to deliver advanced integration to Microsoft's unified communication solutions), ALTH +9.4% (announces Presentation of Favorable Survival Data from Randomized Phase 2b Study of FOLOTYN in Patients with Advanced Non-Small Cell Lung Cancer), LPH +8.1% (still checking), POZN +7.7% (still checking), SOLF +4.6% (subsidiary Jiangsu Linyang Solar Power Electronic Engineering has entered into an engineering, procurement and construction contract with Guangdong Guohua New Energy Investment), SGEN +4.4% (Seattle Genetics Genetics and Millennium announce positive top-line Brentuximab Vedotin data from phase II trial; co reports encouraging phase I data for SGN-75), MITI +3.2% (ticking higher; announces FDA acceptance of investigational NDA for BiTE Antibody MT111/MEDI-565), ATPG +3.2% (Commences Production From Second Well at Telemark Hub), CHK +3.0% (Chesapeake Energy and CNOOC announce Eagle Ford Shale Project cooperation agreement), NOK +1.6% (still checking), FTR +1.3% and NTGR +1.0% (Cramer makes positive comments on MadMoney), JCP +1.0% (VNO announced it has acquired beneficial ownership of ~9.9% of the common stock of JCP).

-

S&P 500 futuur hetkel kauplemas +0,15% kõrgemal, nafta -0,36% (83,05 USd) ja kuld -0,07% (1344.4 USD).

Euroopa turud:

Saksamaa DAX +0,22%

Prantsusmaa CAC 40 +0,17%

Suurbritannia FTSE100 +0,32%

Hispaania IBEX 35 -0,32%

Rootsi OMX 30 +0,71%

Venemaa MICEX +0,98%

Poola WIG +0,31%Aasia turud:

Jaapani Nikkei 225 suletud

Hong Kongi Hang Seng +1,15%

Hiina Shanghai A (kodumaine) +2,5%

Hiina Shanghai B (välismaine) +1,99%

Lõuna-Korea Kosdaq -0,06%

Austraalia S&P/ASX 200 +0,34%

Tai Set 50 +1,71%

India Sensex 30 +0,44% -

Rev Shark: It's Not the Economy, Stupid

10/11/2010 7:58 AM"Nowhere am I so desperately needed as among a shipload of illogical humans."

-- Mr. Spock of Star Trek

For quite some time, the biggest challenge of this market has been maintaining a bullish bias while ignoring much of the negative economic data. It just doesn't seem very logical, but that has been the way to make money. On Friday, we had another classic example where, despite a loss of nearly 100,000 jobs, the market moved up nicely and hit its highest point in nearly five months.

On the surface, it is very hard to understand, but the disconnect between Wall Street and Main Street has been going on since the lows of March 2009. If you simply look at the stock market since then, there is no clue at all that we are wallowing in one of most stubborn and protracted recessions since the 1930s.

There are a number of explanations for this, most of which are just a variation of there being a lot of cheap money out there with no other place to go. QE 2, which has been in the forefront lately, is simply the injection of more cash into the economy through the purchase of bonds. That money has to go someplace, and market players expect that stocks will be major recipients.

In addition to liquidity, computerized trading, particularly high-frequency, algorithmic trading now makes up nearly 70% of total volume. This trading has nothing to do with fundamentals and can often serve to reinforce prevailing trends and take the market to extreme overbought and oversold levels.

Another factor that may be influencing the market is the hope of a Republican victory in November and gridlock. In the past, the market has excelled when different parties controlled the Presidency and Congress. Odds are high that we are heading that way again, and the market is probably pricing it in.

The only way for individual investors to deal with some of this illogic is to simply understand that our negative views of the economy just don't apply. The horrible jobs situation and real estate market just aren't meaningful to the market right now. At some point, those things and all the government reaction to them will matter, but today is not the day.

Right now, we have a clear uptrend in the major indices, and there isn't any reason to be overly bearish. We are a bit extended, but the S&P 500 cut through that 1,150 resistance level and is holding up well. It was troublesome that we had such intense selling in some of the leading high-beta, big-cap names on Thursday. They recovered some on Friday, but we'll have to watch them carefully now. Another reversal to the downside could be a major problem.

We have some standard Monday morning strength once again, but it is a little quieter than usual with the bond market closed for Columbus Day.

As long as the S&P 500 stays above 1,150, we are technically healthy, and there is little reason to be overly defensive. We have some earnings reports this week, but most of the major reports are still a week or so away. It is the bulls' game to lose at this point, and they have a pretty big lead right now.

-

Broadcom (BRCM) added to Conviction Buy List Goldman

-

YUM! Brands (YUM) removed from US Key Calls List at UBS

-

Gymboree (GYMB) to Be Acquired By Bain Capital for $65.40 in Cash Per Share (halted)

Children's Place (PLCE) popping on GYMB news -

Chesapeake Energy (CHK) aktsia on nädalavahetusel avaldatud uudise peale (et China National Offshore Oil Corporation ehk CNOOC ostab 33% Chesapeake’i Lõuna-Texase maardlast $1.1 miljardi eest ning maksab veel kuni $1.1 miljardit nende maardlate väljaarendamise eest, kusjuures Chesapeake’i poolt arendamise eest makstavatest kuludest katab kuni selle summa täitumiseni 75% CNOOC... ehk teiste sõnadega CHK saab endale bilanssi $1.1 miljardit cashi ja jõuka partneri maardlate arendamiseks ning ei pea maardla arendamise eest ise peaaegu midagi välja käima) täna eelturul üle 5% plussis. Põhjuseks siis diil jõuka Hiina partneri CNOOCiga. Link ühele selleteemalisele loole ka.

See diil CNOOCiga ei pruugi iseenesest jääda viimaseks ning näitab kui osavalt ettevõte jätkuvalt oma bilansis võimendust vähendab. CNOOCiga tehtud diil aitab Chesapeake’i nüüd oluliselt lähemale, et täita oma eesmärk investment grade credit rating saada.

-

Täna tõotab vist tulla see päev, mil Apple'i aktsia käib $300 peal ära...

-

BCSI tegi korraliku käibega spike. Viimasel ajal tema kohta palju ülevõtukuulujutte olnud, kuid hetkel ei ole konkreetset uudist/kuulujuttu kusagil veel näha.

-

Täna turg eriti õhuke ja EUR/USD samuti turust veidi lahti sidunud. Turg hakkab muutuma?

-

http://en.wikipedia.org/wiki/Columbus_Day

-

Fed's Yellen makes no comment on outlook for monetary policy, according to CNBC

Says monetary policy cannot be a primary instrument for systemic risk mgmt.

Hetkel paistab, et siiski on:) -

NKE juba 2 päeva spurtinud pealepoole $82 taset ja sealt täpselt $82 peale tagasi müüdud. Nüüd lihtsalt seisab $82 tasemel. Kas hakkab väsima?

-

miks turg pööras?

-

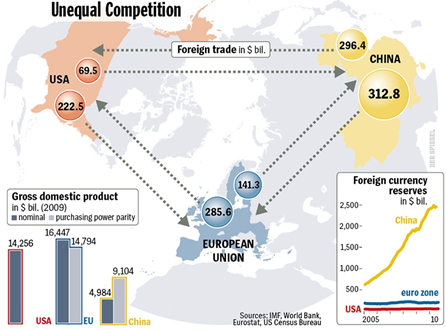

Der Spiegel toob välja ilusa kaardi, mis näitab kui ebavõrdsed on Euroopa Liit ja USA ekspordi ja impordi võrdluses Hiinaga. Jooniselt on näha, et Hiina eksport on nii USA kui ka EL puhul suurem kui import ning seega suureneb välisvaluuta reservide maht. Kaubavahetuse defitsiidi tõttu avaldavad EL ja USA Hiinale survet, et viimane oma valuutat revalveeriks, kuid Hiina ei nõustu seda tegema, öeldes, et USA ja väiksemal määral ka EL devalveerivad oma valuutasid läbi kvantitatiivse lõdvendamise.

-

Karda Hiinlast! Minu moto kogu ülejäänud elu. Kui Eestis lubasid inimesed eesmärgi nimel kasvõi kartulikoori süüa ja vähem kui dekaadi jooksul oli asi unustatud, siis Hiinas võivad miljonid ja miljonid inimesed süüa kartulikoori ja ka väikest kõrvalekallet plaanist ei toimuks. Viimasel ajal on hakanud välja ujuma arvamused ja kirjutised, et Hiina kas juba praegu, või siis lähitulevikus tänu oma massiivsetele välisvaluutareservidele on võimeline kogu maailma FX turgu kontrollima. Suhtkoht häiriv kui nii peaks minema.

-

NKE järelturul ostetud $84.50 tasemele, põhjuseks:

http://www.cnbc.com/id/39621145?__source=yahoo%7Cheadline%7Cquote%7Ctext%7C&par=yahoo