Börsipäev 2. november

Kommentaari jätmiseks loo konto või logi sisse

-

Eilset sessiooni ligi protsendise tõusuga alustanud USA indeksitel kadus teises päevas jõud murda läbi viie kuu tippudest, kui tugevnenud dollar ning teadmatus keskpanga kvantitatiivse lõdvendamise programmi osas sundis investoreid ettevaatlikkusele. Hetkeks jõuti käia koguni miinuspoolel, kuid ostjad aitasid viimasel tunnil indeksitel sisuliselt nullis lõpetada. Hetkel kauplevad futuurid 0,1%kuni 0,2% plusspoolel.

Aasias on turud liikumas valdavalt rohelises, olles teinud kiire taastumise pärast Austraalia keskpanga üllatuslikku intressimäära tõstmist 0,25 protsendipunkti võrra 4,75% peale. RBA sõnul eksisteerib keskpikas perspektiivis inflatsiooni kiirenemise risk, mis võiks viidata intressimäära edasisele tõstmisele. Austraalia dollar tugevnes pärast keskpanga otsust 1,3%, jõudes dollari suhtes enam kui 20 aasta kõrgeimale tasemele. Intressimäära kergitas täna ka India keskpak, tõstes viimase 0,25 protsendipunkti võrra 5,25% peale, mis vastas konsensuse ootustele.

AUD/USD

Olulisi makrouudiseid täna oodata ei ole. Euroopas avalikustatakse kell 11.00 eurotsooni oktoobrikuu töötleva tööstuse lõplik PMI, kuid seal ei oodata suuremat muutust võrreldes esialgse numbriga. USA-s koondub tähelepanu Kongressi vahevalimistele.

-

Vahevalimiste võimalikust mõjust börsidele kirjutasime pikemalt siin.

-

Saksamaa oktoobri lõplik PMI tööstusindeks 56,6 vs oodatud 56,1 punkti. Eurotsooni PMI tööstusindeks tuli 54,6 vs oodatud 54,1. EURUSD +0,57% 1,3971 tasemel.

-

Suurbritannia ehitussektori PMI 51,6 vs oodatud 53,0. Naelsterling müügisurve all: GBPUSD kukkus ~50 punkti ja asub hetkel 1,6026 tasemel.

-

Ülikoolide professorid on Iiri valitsuse võlakirjaturul investoritel hirmu naha vahele ajanud, tõdedes et 7. detsembrile planeeritud eelarve avalikustamine ei pruugi anda piisavat kindlustunnet järgnevate aastate fiskaalpoliitika osas ning õhus ripub oht, et riigil tuleb sarnaselt Kreekale välist abi paluda.

Väike lõik Bloombergist: The premium on Irish bonds has doubled since August and is now wider than the spread on Greek debt four days before it sought a European Union-led bailout in April.

Iiri valitsuse 10.a võlakirja yield

-

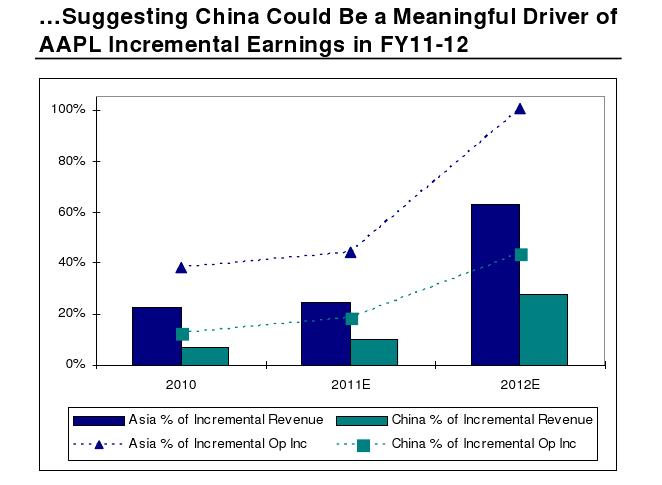

Morgan Stanley analüütikud on täna taas Apple (AAPL) -it ülistamas, öeldes, et ettevõte võib lähiaastatel Hiinas oma müügikäivet koguni kolmekordistada.

Apple may triple revenue from China over two years as the maker of the iPhone expands its sales network in the country and Chinese consumers become increasingly affluent, Morgan Stanley said.

-

Mitte IPhonide müük vaid kogu müük 3x kui ingl.k. teksti lugeda.

-

to Opex: Jah, nii oleks täpsem tõesti. Teen vajalikud parandused.

-

Täna on Citi analüütikud ostusoovitusega väljas MEMC Electronic Materials (WFR) –i aktsia kohta. Analüütikud on lisanud WFR-i ka oma TPL ( Top Picks Live) nimekirja ning tõstavad aktsia hinnasihi $15 pealt $18 peale.

Eile teatas ettevõte oma kolmanda kvartali tulemustest ning need ei olnud turuosalistele just meeltmööda.

MEMC Elec prelim $0.10, ex items, may not compare to $0.13 Thomson Reuters consensus; revs $503.1 mln vs $531.27 mln Thomson Reuters konsensus.Aktsia müüdi eelturul ligi 5% miinusesse. Lisaks sellele teatas ettevõtte juhtkond ka, et Rovigo müügi ja SunEdison`i ülevõtust tingitud mõju ei oska nad veel oma tulemustele hinnata.

"Given our financial performance year to date and the complexity and uncertainty surrounding the timing of GAAP profit recognition related to the Rovigo sale and other SunEdison direct sale project transactions, the company is suspending its 2010 EPS guidance.

WFR on ettevõte, mis disainib, toodab ja müüb räniplaate pooljuhtide valmistajatele kogu maailmas. Firma tooteid kasutatakse erinevates pooljuhtide seadmetes ja ühtlasi ka alternatiivenergia patareides.

Kuid nüüd tagasi Citi analüütikute soovituse juurde.

Upgrading Hold (2S) to Buy (1S), tgt to $18 on ~10x new est of 2011/2012 EPS power. Add WFR to Citi’s Top Picks Live (TPL). While WFR suspended CQ4 guide, revs/EPS delta w/Street are due to acct’g timing in SunEd project biz w/core biz ahead of CQ3 expectations for the first time in a long while. Near term, even assuming flat operating profit in core wafer biz, EPS on a non- GAAP (apples-to-apples) basis looks at least in-line w/Street $0.30 and the value of the SunEd pipeline is crystallizing. Also, WFR finally controls its own destiny on costs & measured poly capacity expansion should add another lever to the model in 2011/2012. Into 2011/2012, using even a conservative set of assumptions and no growth in the SunEd pipeline, we estimate EPS power of at least $1.75. On SunEd, our checks and work now suggest this could actually be a >$2B revs business by 2012 w/EBITDA of >$500MM. While valuation is complex, this argues the segment is worth a lot more than the $2-3/share purchase price the Street seems to currently contemplate. Increasing CQ4:10 EPS (non-GAAP) from $0.28 to $0.41 with F2011 EPS increased from $0.81 to $1.59 (PF EPS $1.70) primarily due to firmer conviction on SunEd and could see biz worth >$10/share.

Lühidalt kokku võttes usuvad analüütikud, et isegi siis, kui SunEd ei lisa olulist väärtust, prognoosivad nad EPS-i vähemalt $1,75. Samas võib nende arvates SunEd olla 2012. aastaks vähemalt $2 miljardi suurune äri ehk $10 aktsia kohta.

Coming into this Q, we have been positioning WFR favorably longer term, but have been still looking for more clarity on both its costs and the SunEd pipeline. While cost reductions are still necessary in 2011 to hit margin targets, we think this Q will represent an inflection point in this story and we are finally upgrading Hold (2s) to Buy (1S) and adding to Citi’s Top Picks Live (TPL) list of top ideas. We think there is increasing evidence that this business model can drive at least $1.75 in EPS power within 2yrs if not much earlier. Additionally, costs appear to have turned a corner as internal wafering operations get up and running in 1H:11 and WFR starts to finally expand its polysilicon capacity more aggressively in 2011. This should add another degree of freedom on the upside to revs while the internal cost control on the solar wafer side should mitigate any unexpected negative margin surprises as has been the case the last few Qs.

Positives — 1) Another operationally clean quarter; 2) poly capacity expansion

appears well though-out and more measured than peers.Negatives — 1) SunEd accounting complexity scares investors away/results in

lower multiple; 2) semi/solar wafer margin targets still challenging in 2011.Analüütikud toovad välja ka peamised positiivsed ja negatiivsed aspektid ja negatiivsete osas juhiks tähelepanu peamisele investorite hirmule, mis aktsiat kammitseb - ebaselgus SunEd mõju hindamisel, mis võib osutuda ka negatiivseks.

Citi analüüsimaja on täna siiani ainuke, kes on aktsia suhtes positiivne ja teised on oma hinnangutes pigem konservatiivsed ning eelistavad äraootavale seisukohale jääda.

Kauplemise seisukohast tasub aktsiat jälgida, kui võimalikku põrkemängu peale avanemist. Järelturul kauples aktsia $11-$12 vahemikus, aga eelturul on käinud mõned tehingud isegi pealpool $13 taset. Hetkel kaupleb WFR $12,30 kandis.

-

Hetkel valitseva konsensuse kohaselt teatab Föderaalreserv homme (meie aja järgi kell 20.15) uueks likviidsusprogrammiks $500 miljardit, mis suunatakse valitsuse pikaajalistesse võlakirjadesse. Bloombergis avaldati täna ka vastavasisuline artikkel.

-

Pakun, et tehakse natukene rohkem, et "sell on fact" efekti ei tekiks ;)

-

Kuidas BP sohust välja tuleb?

-

WFR osas olid augustis insider buying igatahes.

-

Gapping down

In reaction to disappointing earnings/guidance: CCUR -30.4% BIOS -16.5%, ESLR -9.4%, MSPD -7.3% (also downgraded to Hold from Buy at Needham), ROG -6.5%, ENR -5.9% (light volume), , ADM -5.0%, HK -4.5%, VMC -4.1%, SANM -3.7% (also downgraded to Hold at Collins Stewart), THC -3.5%, CLX -3.3%, LYG -2.1%, EMR -2.1%, K -1.5%, APC -1.2%, BEXP -1.1%.Other news: SWI -5.3% (still checking), OFC -4.5% (announces offering of 6,500,000 common shares), TRS -4.2% (announces sale of 3,000,000 shares of common stock by stockholder), LAZ -3.8% (announces certain shareholders have agreed to sell 3 mln of their shares of Lazard Ltd Class A common stock in an underwritten public offering), BBVA -1.6% (GE Capital sells Garanti stake to BBVA), NUVA -0.6% (weakness attributed to tier 1 firm downgrade).

Analyst comments: MVIS -15.0% (downgraded to Hold from Buy at Stifel Nicolaus), PTEN -1.9% (downgraded to Sell from Neutral at Goldman).

Gapping up

In reaction to strong earnings/guidance: BPI +14.8%, RDN +13.4%, NAVR +10.0%, SKH +9.4% (ticking higher; also upgraded to Buy from Hold at Citigroup), MPEL +7.5% (light volume), SHOO +7.5%, CGNX +6.8%, NTRI +6.8%, NVMI +6.1%, IVAC +5.3%, DEPO +4.9%, LF +4.5%, IOSP +3.6% (light volume), MA +3.3%, PRGO +3.0%, BP +1.5%, TEVA +1.5%.M&A news: TEAM +16.1% (light volume; TechTeam to merge with Stefanini IT Solutions affiliate for $8.35 per share).

Select financial related names showing strength: NBG +2.9%, UBS +2.8%, ING +2.6%, CS +2.1%, CS +2.0%, DB +1.8%, HBC +1.2%, STD +1.1%.

Select mortgage insurer names ticking higher following RDN results: MTG +5.9%, PMI +4.4%, MBI +0.8%.

Select metals/mining stocks trading higher: MT +2.1%, BHP +1.9%, BBL +1.7%, SLW +1.7%, RIO +1.5%, VALE +1.4%, NEM +1.2%, FCX +1.2%, AUY +1.1%, ABX +1.0%.

Select oil/gas related names showing strength: TOT +2.6%, STO +2.3%, E +2.1%, RIG +1.3%, RDS.A +1.1%.

Select European drug names trading higher: SNY +1.6%, NVS +1.2%, AZN +1.0%.

Other news: IRWD +12.6% and FRX +3.7% (Forest Labs and Ironwood announce positive Linaclotide results from Second Phase 3 trial in patients with Irritable Bowel Syndrome with Constipation), RGN +8.4% (ticking higher, Reports Positive Results of Preclinical Dry Eye Study), HNSN +13.2% (Hansen Medical announces that it has received unconditional Investigational Device Exemption approval from the FDA), LGND +8.1% (receives approval for Revolade in Japan ), VTRO +3.9% (continued strength), RFMD +1.7% and AGN +1.1% (Cramer makes positive comments on MadMoney), NXG +1.4% (discovers high grade mineralization in a previously untested area at its Stawell Gold Mine), RRD +1.3% (Awarded Multi-Year Catalog Production Agreement by Swanson Health Products).

Analyst comments: ENDP +1.4% (upgraded to Strong Buy from Buy at Duncan Williams), MRVL +1.3% (upgraded to Positive from Neutral at Susquehanna).

-

USA indeksite futuurid indikeerimas avanemist ca 0,5% kõrgemal. Nafta barrel +0,8% @ 83,6USD, kuld +0,3% @ 1354 USD. EUR/USD +0,9% @ 1,4020

Euroopa turud:

Saksamaa DAX +0,68%

Prantsusmaa CAC 40 +0,69%

Suurbritannia FTSE100 +1,12%

Hispaania IBEX 35 +0,28%

Rootsi OMX 30 +0,30%

Venemaa MICEX +0,32%

Poola WIG +0,84%%Aasia turud:

Jaapani Nikkei 225 +0,06%

Hong Kongi Hang Seng +0,08%

Hiina Shanghai A (kodumaine) -0,28%

Hiina Shanghai B (välismaine) -0,44%

Lõuna-Korea Kosdaq -0,77%

Austraalia S&P/ASX 200 +0,06%

Tai Set 50 +0,14%

India Sensex 30 -0,05% -

Fossil (FOSL) initiated with a Buy at BB&T - tgt $68

-

Rev Shark: Navigating the Crosscurrents

11/02/2010 7:46 AMAs your governor, you're going to be seeing a lot of me on the front page, saying, "Governor LePage tells Obama to go to hell."

-- Paul LePage, Maine Republican gubernatorial candidate who is leading in the polls.The market has been positively anticipating Election Day for a while now in hopes that gridlock will ensue. The polls show that there is a very high likelihood that the Republicans will take control of the House, but the primary issue now is just how far the backlash against the incumbents will go. Does it matter to the market how lopsided the Republican victory might be? Or is it enough that we have a split in the government?

Wall Street has received much of the blame for the economic chaos of the last few years, but even if it is well deserved, the market is anxious for a more market-friendly Washington. That means a continuation of the Bush tax cuts, less focus on new regulatory schemes and some efforts to keep the debt down so that inflation will not eventually raise its ugly head. It is widely believed that a strong Republican showing today will help to ensure those things will occur.

In the short term, the market will probably be disappointed if the Republicans don't have a very strong showing, but as long as the end result is gridlock, conditions for the market will be more favorable for the long term. It is already well anticipated, so the election results may not give us much more upside in the near term.

It is going to be very interesting to see how the election shakes out today, but it isn't going to make for very easy trading. As we saw yesterday there is already plenty of nervousness about a "sell the news" reaction, but we are upbeat again this morning and are overlooking yesterday's action, so it is obvious that emotions are running very high.

What really complicates things is that after we have all the election results tomorrow morning, we have the Fed interest rate decision in the afternoon. It is widely expected that a quantitative easing program will be announced, but there is great uncertainty about its size. This has probably been a much more potent driving force than the election recently and it also has been well anticipated.

Although many pundits think "QE 2" will have little impact and may actually be harmful, the market view it as a major positive. Market players refuse to fight the Fed and almost every new mention of "QE 2" triggers more buying. When we have the actual decision tomorrow, we are very likely to see a high level of volatility.

I'd really like to tell you with a high level of confidence what this market is going to do as the news hits tomorrow. It is very easy to make a bearish "sell the news" argument, but the flat action over the last few weeks has bullish characteristics. I believe that the most likely outcome tomorrow will be some swings up and down. It is likely to take a few days before things settle down and a clearer trend emerges.

Position here is extremely tricky. There will likely be some very good ultra-short-term action but building and holding longer-term positions is very risky. The risk of a major change in trend is high, and while the market is likely to keep things difficult for the bears the upside is likely to be a bumpy ride as well.

We have a weaker dollar this morning and oil is pushing higher, which is giving as a positive open, but most market players are in wait-and-see mode in front of tomorrow's big news events.

-

Kust oleks võimalik leida täna infot, milliste ettevõtete tulemused homme välja tulevad?

-

http://biz.yahoo.com/research/earncal/today.html

-

WFR-s oodatud põrget täna ei tulnud. Ilmselgelt kaalus ebaselgus tuleviku suhtes Citi analüütikute argumendid seekord üles. Tänase äärmiselt tugeva turu taustal oleks ikkagi eeldanud,et vähemalt korra suudetakse aktsia rohelisse osta.

AAPL-i puhul igal juhul läksid täna Morgan Stanely positiivsed kommentaarid asja ette ja aktsia kaupleb hetkel juba $309 lähedal. Eelturul pakuti aktsiat $305 juures. -

Wynn Resorts prelim $0.39 vs $0.39 Thomson Reuters consensus; revs $1 bln vs $990.83 mln Thomson Reuters consensus

Wynn Resorts Declares $8 Cash Dividend -

Biodel Awarded $1.2 Million in Therapeutic Discovery Research Grants From IRS

-

Nanometrics (NANO) reports EPS in-line, revs in-line

Reports Q3 (Sep) earnings of $0.53 per share, in-line with the Thomson Reuters consensus of $0.53; revenues rose 6.1% year -

STEC Inc prelim $0.31 vs $0.20 Thomson Reuters consensus; revs $86.1 mln vs $79.41 mln Thomson Reuters consensus

STEC Inc sees Q4 $0.31-0.33 vs $0.25 Thomson Reuters consensus; sees revs $88-90 mln vs $88.48 mln Thomson Reuters consensus -

Kas hingedeööl juhtus midagi imelikku ...

USA börsil kukkus TGB (kullakaevanduse) aktsia -26% praegu, õhtune sulgemishind oli 6,31 ja praeguseks on kukkunud tasemele 4,75.

Kel vaba raha, siis oleks vist hea ostukoht? Kui just tuumasõda pole alanud, siis peaks siit +10% vähemalt üles põrkama?

Kas keegi oskab arvata midagi? Mis toimub? -

STEC võiks homme kauplemise mõttes osta .Aga ilmselt mitte kohe turu avanemise järel.

Kui turg toetab siis tõuseb mitu päeva arvan:))

Nali:)) -

Uudised on TGB kohta mitmesuguseid: http://www.tasekomines.com/tko/Home.asp

Siin üks hea uudis: http://www.bclocalnews.com/business/106284613.html?c=y&curSection=/tri_city_maple_ridge/tricitynews&curTitle=BC+Business&bc09=true

Veel üks uudis: http://messages.finance.yahoo.com/Stocks_%28A_to_Z%29/Stocks_T/threadview?m=tm&bn=23617&tid=89946&mid=89946&tof=2&frt=2

Mõni analüütik hirmutab, et turg tervikuna hakkab kukkuma: http://www.stealthstocksonline.com/index.aspx?page=ECapture4new&r=Bing

Yahoo Finance, TGB message board: "Flash crash?!" Aga mõni arvab, et: "Starting to think there was no flash crash, someone wanted out"; aga mõni ütleb: " buying with both hands ... " Homne päev näitab, mis saab ... -

Only amateurs sell into AH panics 2-Nov-10 05:58 pm Just so you know. Is commodities and copper all of a sudden NOT the hottest things going?? I am calling at least a 5.50 close tomorrow. Mark my post if you wish.

Praegu 4,65 -

Canada blocks development of Taseko mining project

viide

http://www.reuters.com/article/idAFN0215397320101102?rpc=44 -

TGB. Buy now when others panic out.

Just like last time when the environment assessment out, everybody hurry out, the share went down sharply, if you bought on that time, you have doubled your money. the stock will be oversold tomorrow,after bad news, good news will come, the stock price will up quickly. -

Kes USA valimisi ei jälgi, siis neile teadmiseks, et vabariiklased said täna peetud valimistel enamuse esindajatekojas. Tuletan siinkohal aga meelde, et enne valimisi küsitluste põhjal tehtud prognoosid täide ei läinud, kuna vabariiklaste võitu oodati hoopis senatis. Paraku on USA valitsussüsteem võrdlemisi keeruline ehk seaduste kinnitamiseks on vaja heakskiitu nii senatilt, esindajatekojalt ning ka presidendilt. Teisisõnu muutub igasugune majanduse “stimuleerimine” ning finantslehtede esikaasi hakkavad vallutma uudised seoses Bushi maksulangetuste aegumisega 31. detsembril.

-

NYTimes.com andmetele tuginedes on esindajatekojas koha saanud 203 vabariiklast, 142 demokraati ning veel 90 koha kohta informatsiooni hetkel veel ei ole. Enne valimisi oli demokraatidel esindajatekojas 255 poliitikut. Sisuliselt on vabariiklastel veel võimalik võtta võit ka senatis, kuna hetkel on demokraatide arv 49, vabariiklaste arv 44 ning veel 7 saadiku kohta informatsioon puudub. Enamuse tagamiseks peaksid vabariiklased senatisse saama veel 6 saadikut.

-

Senatis jäi enamus demokraatidele