Börsipäev 20. detsember

Kommentaari jätmiseks loo konto või logi sisse

-

Geopoliitilised pinged Aasias on avanud jõulunädala aktsiaturgudel punastes toonides, kui Lõuna-Korea teatas, et alustas naaberriigi piiri läheda suurtükiväe õppustega. Lõuna-Korea valuuta ning aktsiad taastusid päeva põhjadest pärast teadet, et Põhja-Korea on nõustunud laskma ÜRO ametnikke tagasi riiki, mis suurendas lootust, et võimalikku pingete eskaleerumist suudetakse ära hoida.

Käesolev nädal saab pühade tõttu olema makromajanduslike uudiste osas suhteliselt kesine ning tõenäoliselt on paljud turuosalised juba töökohustustega selleks aastaks lõpparve teinud, mistõttu on oodata ka tagasihoidlikumaid käibeid. Makrokalender ei paku täna ühtegi olulist uudist. Enne USA turgude avanemist avaldab oma majandustulemused Jefferies, pärast sulgumist aga Adobe Systems ja Jabil Circuit.

USA indeksite futuurid on hetkel kauplemas 0,1% miinuspoolel.

-

Bangladeshis puhkesid eile rahutused, kui investorid hakkasid pärast kohaliku börsi 7-protsendist langust - suurim ühepäevane langus börsi ajaloos - märatsema.

Around 500 investors marched on the Dhaka Stock Exchange in Motijheel and the Securities and Exchange Commission (SEC) offices clasing with security and police who were called to the scene.

"They chanted slogans against the government and the regulators, and marched through the busy roads in the Motijheel Commercial area, halting traffic. They also staged a sit-in at the SEC building," Dhaka police chief Tofazzal Hossain told the AFP news agency.

The government began intervening in markets earlier this month saying stocks were getting overvalued. Restrictions have been imposed on lending for stock purchases, while Sunday's fall co-incided with an official interest rate increase implmeneted by the Bangladesh Central Bank.

The moves have unnerved institutions which are the biggest investors in Bangladesh. The government is now reviewing, and intends relaxing the measures in order to stabilise the market, which has drawn in hundreds of thousands of Bangladeshis.

-

Tänased upgrade/downgrade-d

Upgrades:

CME Group (CME) - BofA/Merrill

Huntington Bancshares (HBAN) - BofA/Merrill

Post Properties (PPS) - Barclays

Patriot Coal (PCX) - FBR Capital

CONSOL Energy (CNX) - FBR Capital

NetApp (NTAP) - Stifel Nicolaus

Downgrades:

MannKind (MNKD) - BofA/Merrill

BMO Financial (BMO) - Barclays

Fiserv (FISV) - RW Baird

Sunstone Hotel (SHO) - RW Baird

American Express (AXP) - Stifel Nicolaus

Iridium Communications (IRDM) - Stifel Nicolaus

-

Euro on täna tugeva surve all: EURUSD -0,37% (1,3140); EURAUD -0,88% (1,3223) - kõikide aegade põhi; EURCHF -0,7% (1,2686) - samuti kõikide aegade põhi; EURJPY -0,67% (110,02); EURGBP -0,37% (0,8460).

-

Gapping up

M&A news: APSG +8.1% (Applied Signal to be acquired by Raytheon for $38/share on cash),.

Select metals/mining stocks trading higher: PZG +6.5%, SA +3.9%, AAU +3.0%, NGD +2.7%, SLW +2.5%, HL +2.4%, HMY +1.6%, AU +1.5%, FCX +1.3%, ABX +1.2%, AEM +1.0%.

Select oil/gas related names showing strength: CHK +2.6% (Carl Icahn discloses 5.8% stake in 13D), SDRL +2.3%, RIG +1.3%, WFT +1.1%, BP +0.8%, E +0.6%, TOT +0.5%.

Other news: CHTP +9.0% (completed a pre-NDA assessment with FDA and intends to accelerate its new drug application for NORTHERA ), IDCC +4.9% (Cramer makes positive comments on MadMoney), VVUS +4.3% (files European Marketing Authorization application for QNEXA in the treatment of obesity), LVS +2.5% (received a letter from the Macau Land, Public Works and Transport Bureau; should clear the way to start preparing for the sale of shares for Four Seasons-branded apartment at the Cotai Strip in Macau), SI +1.8% (still checking), UL +1.1% and UN +1.0% (Alberto Culver stockholders approve merger), AMZN +0.9% (hearing strength attributed to tgt raise at tier 1 firm).

Analyst comments: SNSS +10.7% (upgraded to Outperform from Sector Perform at RBC; tgt $1), ITMN +3.8% (upgraded to Outperform from Neutral at Robert W. Baird), AGNC +2.3% (initiated with Outperform at Credit Suisse), CCL + 2.0% (initiated with Overweight at HSBC), CLD +1.8% (upgraded to Outperform at FBR Capital), RCL + 1.2% (initiated with Neutral at HSBC).

-

VECO võib täna samuti kerge upside saada, kuna reedel jäi UBS peale reaktsioon suht kesiseks. Täna on Kaufman Bros väljas BUY ja target $55, kuid tuleb arvestada, et tegemist reitingu kinnitusega, mitte tõstmisega.

-

Chicago Fed aktiivsusindeks (nov) -0,46 vs oodatud 0,00. Eelmise kuu näit korrigeeriti -0,28 pealt -0,25 peale.

-

Gapping down

M&A news: SLE -2.8% (pulling back from Friday's surge higher in late trade on takeover talks; Reuters.com reported over weekend that the co has been in talks to sell itself to JBS).

Select China airlines ticking lower in early trade: CEA -5.5%, ZNH -2.4%.

Other news: MNKD -2.1% (Hearing weakness attributed to tier 1 firm downgrade).

Analyst comments: SWN -1.0% (downgraded to Neutral from Accumulate at Global Hunter; tgt $33), AXP -0.7% (downgraded to Hold at Stifel Nicolaus on Durbin; more exposed post-Fed draft), FISV -0.4% (downgraded to Neutral from Outperform at Robert W. Baird).

-

USA indeksite futuurid indikeerimas avanemist 0,3-0,4% kõrgemal võrreldes reedes sulgumisega. EUR/USD -0,26% @ 1,3150, kuld +0,5% @ 1385 USD, nafta +0,26% @ 88,2 USD.

Euroopa turud:

Saksamaa DAX +1,02%

Prantsusmaa CAC 40 +1,01%

Suurbritannia FTSE100 +0,56%

Hispaania IBEX 35 +1,36%

Rootsi OMX 30 +0,33%

Venemaa MICEX +0,09%

Poola WIG -0,64%Aasia turud:

Jaapani Nikkei 225 -0,85%

Hong Kongi Hang Seng -0,33%

Hiina Shanghai A (kodumaine) -1,41%

Hiina Shanghai B (välismaine) -0,69%

Lõuna-Korea Kosdaq -2,50%

Austraalia S&P/ASX 200 -0,56%

Tai Set 50 -1,70%

India Sensex 30 +0,12% -

Rev Shark: Stick With the Trend

12/20/2010 9:06 AMIf I had my life to live over, I would perhaps have more actual troubles but I'd have fewer imaginary ones.

-- Don HeroldWe will see the standard Monday morning gap up greeting us as we count down to the end of the year. There are only nine more trading days left in 2010. Don't forget that the market is not closed this year at all for New Year's Day. We only have one official holiday this season: Dec. 24. Nonetheless, volume will slow dramatically later this week and be extremely light next week.

The good news is that there tends to be positive seasonality through the end of the year. Market players are in a good mood and many will put off taking gains until the new year begins. However, we usually see some selling squalls as some folks will want to recognize losses this year and make portfolio moves. It is quite easy to be caught in some quick dips as the year winds down, but they usually don't last long.

The market has been tremendously frustrating for the bears lately as it continues to drift up slowly -- but with some bothersome underlying action. Breadth has been quite mediocre lately and there have been some breakdowns in key stocks. The bears keep pointing out the many negatives out there, but this market just isn't paying much attention at all. There doesn't seem to be much worry, which may be a contrary indicator to the bears but so far it hasn't mattered at all.

Last week, it really looked like we were ready for some consolidation as key leadership stocks struggled quite a bit. The indices never quite succumbed but market players started to lean a bit more bearish on Wednesday and then were squeezed on Thursday and Friday. A lot of folks were trying to call a top, and that is probably one of the main reasons the market is holding up so well.

My approach this market is to not be sucked into the top-calling game. I want to stick with the long side until there is some price action that is clearly negative. It just hasn't paid to keep anticipating a market top. It isn't difficult to understand why the bears keep thinking the market is going to roll over. There are plenty of good and logical pessimistic arguments, but it just isn't happening and it may not happen in the near term.

When I reflect back on the action since the low in March 2009, the single most costly action for most market players, including me, has been an inclination to not believe that an uptrend could last. After all, how could this market go practically straight up for so long when the economic situation is so challenging? Unemployment is high, real estate stinks and there is hardly any growth, but many companies have had great earnings and the stock market acts like we are in a booming economy.

It is nearly impossible to reconcile the differences between Main Street and Wall Street. The best approach is to not even try, but to simply stick with the trend as long as you can. When stocks start acting poorly, then we need to act quickly. But anticipation of future problems is not a strategy that has worked for a very long time.

The market has a good gap up open to the start the day. As I mentioned on Friday, I was looking at the gold sector a bounce and that group is looking OK. We'll see how well the bulls can hold up this market after the open, but at the moment, it looks like there is little fear or worry.

None

-

Euroopa keskpank annab teada, et nad ostsid eelmisel nädalal €603 miljoni eest riikide võlakirjasid.

-

Eurotsooni tarbijausalduse indeks kukkus novembrikuu -9,4 pealt -11,0 punktini vs oodatud -9,4. EURUSD -0,32% ja kaupleb 1,3145 juures.

-

Euro käis ka allpool $1,3100 piiri. Hetkel kaupleb 0,7% madalamal $1,3098 juures.

-

The Fed purchased $7.79 bln of 2018-2020 maturities through Permanent Open Market Operations as dealers looked to put back $17.22 bln

-

Moody's placed 30 Spanish banks on review for possible downgrade, subsequent to Kingdom of Spain's Aa1 bond rating review

-

InterMune (ITMN): Hearing Wedbush out suggesting GILD could be interested in ITMN

Räägivad, et Gilead Sciences Inc. on InterMune-st huvitatud. Tegemist üsna huvitava ettevõttega ja ka ravimipagas korralik. Kunagi sai juhitud tähelepanu, et Pirfenidone on Jaapanis apteegiravim, kuid USA ja EU ei ole ravimit müügile lubanud. -

The Fed purchased $6.78 bln of 2014-2016 maturities through Permanent Open Market Operations as dealers looked to put back $16.36 bln

-

ECB's Stark: Reiterates that the global financial crisis is not over yet - interview

-

Wells Fargo (WFC): Brown Reaches Settlement With Wells Fargo Worth More Than $2 Billion to Californians With Risky Adjustable-Rate Mortgages

-

CHK täna tegija

-

Chesapeake Energy (CHK): Carl Icahn discloses 5.8% stake in 13D

-

Dell Inc (DELL) Discloses that Michael Dell bought 7.4M shares at $13.57 on 12/17 - filing

- Adds to the 260M shares already held by Dell and his family. -

Wall Street Journal kirjutab, et DirectTV Group (DTV) plaanib järgmise aasta augustis või septembris välja lasta uue teenuse, mille abil näidatakse majapidamistele nende eelistustele vastavat reklaami. Ehk et koeraomanikud näevad koeratoidu reklaami mitte kassiliiva reklaami jne. Selleks kasutab DirectTV kolmanda osapoole kogutuid andmeid ja salvestab need iga majapidamise digiboksi. Reklaami näitamise ajal valib digiboks andmebaasides olevatest reklaamidest iga majapidamise jaoks sobivaimad.

DirectTV on antud teenust arendanud kolm aastat. Kindlale auditooriumile suunatud reklaamituru suuruseks hindab Bank of America Merrill Lynch 2015. aastaks $11.5 miljardit. Praegu on DirectTV sõlminud koostöölepingu Starcom MediaVestiga, kes ostab reklaamiaega sellistele suurtele ettevõtetele nagu Procter & Gamble ja Coca-Cola.

-

Adobe Systems (ADBE) prelim $0.56 vs $0.52 Thomson Reuters consensus; revs $1.01 bln vs $988.07 mln Thomson Reuters consensus

-

CNBC kirjutab, et New York Fed plaanib lähiajal tõsta SOMA limiidi veel 35% pealt 70%le. Sisuliselt tähendab uudis seda, et Fedil on õigus omada peaaegu piiramatus koguses selliseid võlakirju nagu nad parasjagu soovivad.

-

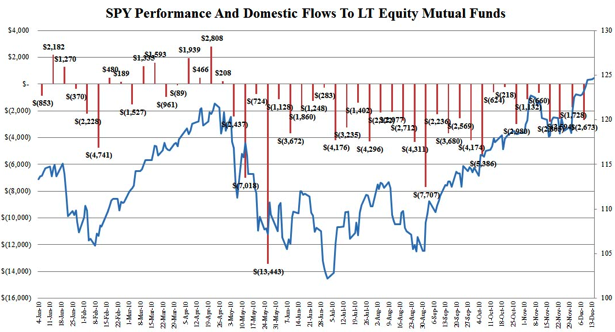

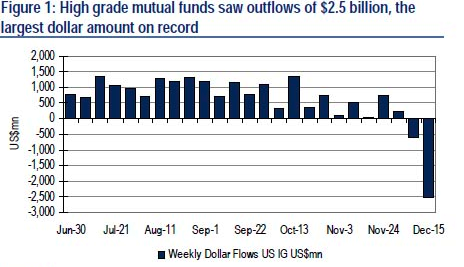

15. detsembril teatas ICI, et USA aktsiafondidest on “välja voolanud” nüüdseks 32 nädalat järjest ning viimati müüdi osakuid $2.7 miljardi väärtuses enam kui osteti. Täna avaldas analüüsi omakorda Bank of America, milles kirjutatakse, et kõrgete krediidireitingutega investeerimisfondidest voolas 15. detsembriga lõppenud nädalal välja $2.5 miljardit, mis on ajalooliseks tipuks. Kõrget tootlust pakkuvatesse investeerimsfondidesse paigutati aga vaid $222 miljonit. Ehk kui ülalpool öeldut kokku võtta, siis on jaeinvestorid aktsiaturult kiiresti kadumas. QE3?

-

Allolev graafik pärineb zerohedge’ist ning näitab eelpool öeldu tähtsust turgudele (S&P 500 indeksi ETF).