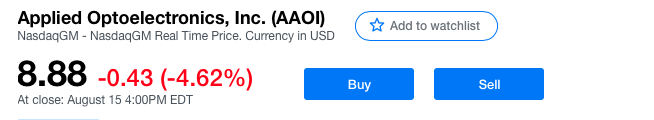

Applied Optoelectronics, Inc. (NASDAQ: AAOI)

Kommentaari jätmiseks loo konto või logi sisse

-

Teeme siis siia uue teema.

Minu arvates on positiivne see, et firma teab, kus see hetke langus pärit on.

Failures could result from faulty components or design, problems in manufacturing or other unforeseen reasons. Any such failures could delay product shipments to our customers or result in a loss of customers. For example, shipments of certain of our 100 Gbps transceiver products to one of our customers decreased during the three months ended September 30, 2018 due to customer concerns about failures of similar products shipped

previously. As a result, we could incur significant costs to repair or replace defective products under warranty, particularly when such failures occur in installed systems. Our products are typically embedded in, or deployed in conjunction with, our customers’ products, which incorporate a variety of components, modules and subsystems and may be expected to interoperate with modules produced by third parties. As a result, not all defects are immediately detectable and when problems occur, it may be difficult to identify the source of the problem. We face this risk because our products are widely deployed in many demanding environments and applications worldwide. In addition, we may in certain circumstances honor warranty claims after the warranty has expired or for problems not covered by warranty to maintain customer relationships.

Fundamentaalselt on odav, kui ei eelda pankrotti. omanike vara pole nii drastiliselt langenud, kui aktsia hind.

Ehitatakse ka uut tehast, mis saab 2020 valmis.

China factory construction

On February 8, 2018, we entered into a construction contract with Zhejiang Xinyu Construction Group Co., Ltd. for

the construction of a new factory and other facilities at our Ningbo, China location. Construction costs for these facilities under this contract are estimated to total approximately $27.5 million. As of March 31, 2019, approximately $12.0 million of this total cost has been incurred, with the remaining portion due as the construction progress. Construction under this contract is expected to be completed in early 2020

Ei ole puhtalt Hiina mäng

Additionally, a substantial portion of our property, plant and equipment, 36.8%, 29.9% and 23.0% as of December 31, 2018, 2017 and 2016, was located in China

Eelmine kvartal oli 6 uut "disaini" võitu, millest 3 on ära tuntavat nime, iga leping väärt miljoneid.

there was 6 new wins in Q1 and three of them was new clients. 3 was regonice names.

Prior to the sale of new products, our customers typically require us to “qualify” our products for use in their

applications. At the successful completion of this qualification process, we refer to the resulting sales opportunity as a“design win.”

Uued seadmed müüki tulemas, suht hiljuti teatud

http://ao-inc.com/news-events/applied-optoelectronics-announces-400g-short-reach-transceiver

http://ao-inc.com/news-events/applied-optoelectronics-announces-100gbps-pin-photodiode-chips

Tegemist ei ole ostu soovitusega, hind liigub väga järsult, aga kuna ise olen ca aasta lihtsalt kõrvalt jälginud seda langust 100$ juurest siia 10$ juurde, siis ruumi vähemalt põrkeks siin on või päevakauplemiseks. -

Pakun, et kuni järgmiste tulemusteni, siit mingit suurt liikumist ei tule. "Suur" on muidugi suhteline, sest vabalt võib liikuda 10-20% siia sinna, aga ma mõtlen trendimuutvat.

Kui järgmise kvartali prognoos on sama masendav või hullem, siis krt seda teab kui alla võib veel minna.

Samas panustaksin siis juba ikkagi ülevõtmispakkumisele. Või mis arvate? -

Siin paadis istub hästi palju lühikesi 43%, siit võib väga kergelt tuule alla võtta 20-30% ralli juba enne jaanipäeva, fundamentaalselt võib jah trend murduda aasta teises pooles.

https://finviz.com/quote.ashx?t=aaoi&ty=c&ta=1&p=d -

Täna kaks uudist peale turgu mailis

http://investors.ao-inc.com/news-releases/news-release-details/applied-optoelectronics-participate-upcoming-investor-15

http://investors.ao-inc.com/news-releases/news-release-details/applied-optoelectronics-inc-and-innovium-announce

Meenub SolarEdge kellel pidevalt tuli peale uut tehnoloogiat, sai koos päikesega tapi, tiksus seal 13$ peal, vaatasin ka, et uskumatu lugu, nüüd hakkab siin sama deja vu tunne tekkima. (sedasi kolki saanud).

Kas mõni targem teemat ka täpsemalt jagab, täna oli uudis, et Google rajab Soome data centery keskuse mingi 600M eest, et kelle seadmed sinna lähevad?

Long keskmisega 9.03$ -

Põhimõtteliselt eesmärk on saada vägev sõit shortide kulul (on tees ja fundamentaal pole nii hull kui hind väidab)

Komistasin hea lause otsa:

Sometimes the worst, most fundamentally flawed company can become the best performing stock if there are too many shorts. (AAOI -is istub 43%, äkki 11 juuni kõlab midagi kenasti) -

Eile A.H ka uudis http://investors.ao-inc.com/static-files/cb7be4cf-a831-41c6-b2d3-88fe05d8e0ed

Suuremad eelmine kvartal lisanud.

Uudised aitavad ka momentumit ülesse ehitada, MACD vaikselt kergib, 9,12$ võiks akumuleermise faasi lõpetada.

Tegemist ei ole ostu soovitusega (virtuaalne päevik) - -

Ahah, conflicyt minerals disclosure annab momentumit juurde uudisele, kus firma annab teada, et osaleb üritusel, kus osalevad veel tuhanded.

-

ymeramees

Ahah, conflicyt minerals disclosure annab momentumit juurde uudisele, kus firma annab teada, et osaleb üritusel, kus osalevad veel tuhanded.

Vahet pole mis uudis, aga aitab pildil püsida. +3,5% up (päeva kõrgem 9,30) -

Läheb shortide kõrvetamiseks, upgrade ja Pre +17%

Hea omada CALL -e aasta alguseks :) -

Rosenblatt upgrades Applied Optoelectronics (NASDAQ:AAOI) from Sell to Neutral with a $10 price target.

The firm says AAOI could benefit from the proposed $300B tariff because it has a factory in Taiwan, unlike many major Chinese competitors.

Rosenblatt thinks Amazon will increase its 40G optical module orders in Q2 and Q3, which would stablize AAOI's margins. Next year, Facebook's demand for100G CWDM4 modules could "at least double."

AAOI shares are up 14.7% pre-market to $10.88. -

Ja mida see siis tähendab ka?

-

Visahing

Värske

http://investors.ao-inc.com/node/11151/html

Vahel ostavad sellised ärid aksiaid põhjusel, et on suur nõudlus lühikeseksmüügi vastu ehk soovitakse aktsiaid laenata. -

Aga kui see nii tõenäoliselt ei ole?

-

Lühikeseks müügil vast pole eriti pointi, kui peaaegu 50% ootab juba ukse taga, et välja saada, trend is you frend, until end. https://finviz.com/quote.ashx?t=aaoi&ty=c&ta=1&p=d

Nagu eelnevalt juttu, siis tegelikult on palju uut nodi nendel turule tulemas, kunagi kui üks oli päikeses üleni negatiivne ja SEDG 15$ oli, siis reaalselt oli parim aeg ostmiseks. Kõik see uus nodi nendel tõi väga head pappi ja ei läinud kaua, kui aktsia oli 45$.

AAOi omad öelnud, et teine poolaasta tuleb parem, 80% võiks anda täenäosuseks, et see aktsia on aasta lõpus vähemalt 2x.

Meenutuseks -

Milleks sellised eeposed?

Mida see niiöelda värske filing tähendas? -

ymeramees

Milleks sellised eeposed?

Mida see niiöelda värske filing tähendas?

Unustasin ära, et sa muidu aru ei saa, kui puust ja punaseks ei tee.

Jah Velvo, oled õigesti ka aru saanud, tuumik ostab neid shortidele laenamiseks (iroonia) -

Mida see tähendas siis, järsku ikka aitad?

-

ymeramees

Mida see tähendas siis, järsku ikka aitad?

Kui paned õhtul võrgud merre ja kõik hiir vaikne ning hommikul merele minnes kuuled kodus kohinat, võid kindel olla, et merele jõudes, on meri juba valge. -

Njah. Linke ja linkidest kopeerides võiks ikka asjatundmatuid valgustada, millega tegu.

Muidu on kõik hiir vaikselt, aga midagi ei juhtugi, seega keegi ei saanudki aru, oli tegu positiivse, negatiivse või hoopistükkis who the fuck cares tüüpi uudisega. -

CSCO buying ACIA- Cisco acquire Acacia for $70.00 per share in cash.

Eks need optikad koos AAOI nüüd tõusus. -

Lippab päris hästi osa kasumist lukku ära lööma hullud päevad ei pruugi kesta

-

Esimese suurema jõnksatuse peale jäid shordid väga enesekindlaks. Eks mõned ostsid tagasi, aga samapalju siis müüsid. Eks näis, et mis järgmised numbrid näitavad ja kas ollakse sama kindlad edasi.

-

velvo

Esimese suurema jõnksatuse peale jäid shordid väga enesekindlaks. Eks mõned ostsid tagasi, aga samapalju siis müüsid. Eks näis, et mis järgmised numbrid näitavad ja kas ollakse sama kindlad edasi.

Maitseasi, aga see leht väge parem jälgimiseks https://shortvolume.com/ -

Applied Optoelectronics reports Q2 EPS (26c), consensus (37c) Reports Q2 revenue $43.4M, consensus $42.49M. We are pleased with our execution in the quarter as we delivered revenue within our guidance range and achieved better than expected bottom-line results," said Dr. Thompson Lin, Applied Optoelectronics Inc. founder and CEO. "The datacenter demand environment remained consistent with our expectations and we secured five new datacenter design wins. We continue to have good technical engagement with both existing and new customers and are encouraged by the positive response to our innovations."

Applied Optoelectronics sees Q3 EPS (21c)-(28c), consensus (26c) Sees Q3 revenue of $46M-$49M, consensus $49.57M.

Read more at:

https://thefly.com/landingPageNews.php?id=2947559 -

Datacenterite product mix - 100G 23%, 40G 72% tekitas ühe Q:

if I look at the broader landscape going forward, what - why should investors believe that you would meaningfully have any success in 100 gig and 40 gig rolls off when you have had little to no meaningful success of late and so quality issue with your leaders in 100 gig, what would you - what would you tell investors. Do you have hope in your story? Apologies for the broad ended question, but I am just struggling to see how – if you are not succeeding in 100 gig, how will you succeed in 400 gig? -

ymeramees, kodutöö kontroll, kas läheksid täna pikaks või lühikeseks?

Siis tean, kas mõtet konfi lugeda :) -

Ikka tuli ise lugeda ja väike kokkuvõte- pakun beat põrge üles ja alla müük-spekulatsioon

Positiivne natuke positiivne, kuna firma ennemgi sousti ajanud

The datacenter market dynamics played out in Q2 as expected. We are starting to see early signs of recovery among two of our hyperscale datacenter customers, while one customer continues to purchase product from us, but with reduced demand.

As datacenter operators continue to demand greater bandwidth, the migration from 100G to 400G will be the next major step in datacenter architecture. As datacenter customers add 400G connectivity to their 100G infrastructure, they are looking for validated and interoperable solutions to gain confidence and reduce deployment timelines. We are very pleased to have a solution with the demonstrated interoperability that our customers demand.

Remote PHY product is a key enabling technologies for these new distributed access networks and we are excited about the customer interest in Remote PHY. We expect to receive our first significant orders for our Remote PHY product soon.

50% shorte sees.

Kasvav kaotus, vahet pole, et nende ootusi ületas

Operating loss in Q2 was $7.7 million, compared with an operating loss of $6.8 million in Q1. Non-GAAAP net loss after tax for the second quarter was $5.2 million or a loss of $0.26 per basic share, which was better than our guidance. This compares to net income of $12.9 million or $0.64 per diluted share in Q2 of 2018.

Ootus-loss

Moving now to our Q3 outlook. We expect Q3 revenue to be between $46 million and $49 million and non-GAAP gross margin to be in the range of 27% to 29%. Non-GAAP net loss is expected to be in the range of $4.2 million to $5.7 million and non-GAAP loss per share between $0.21 per share and $0.28 per share using a weighted average basic share count of approximately 20 million shares.

Turg

cable TV business- vaata sümbol FTR, surnud asi usas.

Kui Leopold küsib, seda on päris pull kuulata kõnes ja kuidas kokutades vastatakse - eelmine ER oli nii, korralik puude alla panemine.

so-so

Thompson Lin

But maybe I add further two points. One, for EAML, what does EAML, there are very surprise, okay, compared to 25G EAML So I'll make EAML in-house. Of course, it’s very be, much, much bigger than 25G EAML or 100G transceiver, number one.

Number two, yes, we had quality issues, we have managed it, we solved the problem and in the past few quarters we have many design wins of 100G transceiver with many new customer, okay, not only in U.S., including Asia, including many big equipment OEM company and many hyperscale operator, okay, worldwide.

The slowdown related to this specific customer is not the quality issues, is that demand really slow down, okay. And we are confident and we believe when that demand come back, we’ll be one of the major suppliers, okay, in the future, it could be sometime next year. All right. -

Ja nii ka läks, avanedes hüpe, nõrgema närviga lühikeste katmine, vaatasid beat. Kuna õun seest mäda, läks müügiks.

-

Visahing

Ja nii ka läks, avanedes hüpe, nõrgema närviga lühikeste katmine, vaatasid beat. Kuna õun seest mäda, läks müügiks.

-

paistab, et seltsimehed teevad callide 11 peale panuseid või turvavad lühikesed peput, silma torkav volume selle aktsia kohta.

Kuhu jäi aus pakkumine Ymera? Ega tasugi vast ühtki teesi järeldust oodata, alati loobid siin foorumis ainult s ventikatesse, nii et inimesed pipid. -

Ma püüan teinekord vohavale pehmusele tähelepanu juhtida, see on kõik.

Viimasel ajal on mingil imelikul põhjusel postitaja kohta mõte tulnud, et huvitav, kes teda riidesse aitab panna või talle piima valab.

AAOI kohta vaid niipalju, et 40G peal pikalt ei suusata. Ja kuna ta on põhiliselt datacenter stock ning seal omakorda paari-kolme kliendiga kaldu, siis on väikestviisi võimalik, et ei uju välja. Kliendi kaotamine, põhjendatud kahtlused.

Design win ei ole ilmtingimata tuleviku revenue, vaid optsioon kliendile.

Teisest küljest ei olnud kvartalis ka midagi šokeerivat, seega no edge. Alguses üles ja siis alla. Loto või lollus. -

Ei üles alla tähendab- need kes pealkirju loevad, need totmavad ostma, teised kes sisuga kursis, tulevad peale liikumist müüma. Mingit lotod, psühholoogia ja algod, mis teevad liikumisi. Iga lühike teab, et 50% on selline kogus, et uks on väga väike. Teen ise ka optsioonidega enne tulemusi kaitseid.

-

Eilsest võib oletada, et nii mõnigi lühike läks katma. Arvestades asjaolu, et aktsia hind sulgus kolme kuu kõrgemail tasemel, siis nii mõnigi lühike võiks muret tunda.

Õhtul avaldatakse ka shortide osakaal juuli lõpu seisuga ja kui selgub, et see pole palju muutunud, siis võib siin mõneks ajaks kitsaks minna. -

Nii mõnigi lühike haigutakse selle jutu peale. Mis on see katalüst?

Nagu näha, +2% tõusvad kuubikud tulemustepäeval seda ei olnud.

Seda, et asjal on põhjusega kõrge SI, teavad kõik ja nende vanaemad juba päris pikka aega. -

velvo

Eilsest võib oletada, et nii mõnigi lühike läks katma. Arvestades asjaolu, et aktsia hind sulgus kolme kuu kõrgemail tasemel, siis nii mõnigi lühike võiks muret tunda.

Õhtul avaldatakse ka shortide osakaal juuli lõpu seisuga ja kui selgub, et see pole palju muutunud, siis võib siin mõneks ajaks kitsaks minna.

ma lihtsalt jätan selle siia:

Kõrge SI võib teha lühiajalisi squeeze, aga lõpuks leiavad aktsiad enda suuna ikka uuesti üles. Vaata ka OSTK (tulemused mõni päev tagasi), DDS (tulemused aftekal). -

ostjate muutus, kahjuks osad näitajad Fintel tasuliseks teinud.

Müüsin tulemuste ralli aegu aktsiad, oman näpuotsaga call optsioone. -

Tegelikult tehniliselt on aktsia huvitavas kohas, ajalooliselt tugev tugi, kas põrkab toelt üles (tehnilised ostjad lähevad põhja õngitsema lähedal stopiga) siht seal range 11 ülemine joon.

-

Jälle vana head kvaliteethuumorit, kuidas aktsia peale kukkumist ikka juba varem müüdi, seal kõrgemal. Jah, me siin olemegi kõik koos keskmisest naiivsemad..... not.

-

ymeramees

Jälle vana head kvaliteethuumorit, kuidas aktsia peale kukkumist ikka juba varem müüdi, seal kõrgemal. Jah, me siin olemegi kõik koos keskmisest naiivsemad..... not.

Sa rohkem ilma vaatleja, pole kunagi kuulnud, et ka miskit ostad,müüd, ainult jahu ajad huumorivend.

Ütlesin peale tulemusi, et beat , hind tõuseb, sisu mäda õun ja hiljem kukub. Müümis vihje oli olemas, ise oled tainas, kui aru ei saa, kas osta või müüa. -

ymeramees

velvo

Eilsest võib oletada, et nii mõnigi lühike läks katma. Arvestades asjaolu, et aktsia hind sulgus kolme kuu kõrgemail tasemel, siis nii mõnigi lühike võiks muret tunda.

Õhtul avaldatakse ka shortide osakaal juuli lõpu seisuga ja kui selgub, et see pole palju muutunud, siis võib siin mõneks ajaks kitsaks minna.

ma lihtsalt jätan selle siia:

Kõrge SI võib teha lühiajalisi squeeze, aga lõpuks leiavad aktsiad enda suuna ikka uuesti üles. Vaata ka OSTK (tulemused mõni päev tagasi), DDS (tulemused aftekal).

Jätaks ka siis midagi siia. Minupoolne täielik fopaa, sest ei saanud aru, et tegemist on ostusoovitusega, Ei suutnud oma esialgset plaani pidada ja müüsin suht alt, selle asemel, et osta. Õnneks müüsin siiski väiksema osa.

Loodame siis arvamusele, et siit tullakse kindlasti alla.

Ahjaa, hind praegu 11.30. -

Sulle lihtsalt infoks, et mida kärnasem aktsia, seda kõrgemalt see viimastel päevadel lendab. AAOI põrge on suhteliselt väike, ju siis ei ole veel kõike suurem saast.

-

Jah, nagu retailis PIR kaks päeva, kuuga hind 3x.

-

GLW

Optical Communications Segment Update

Within Corning's Optical Communications segment, several major carriers are further reducing capital spending on cable deployments and fiber-to-the-home projects. In addition, some enterprise customers have reduced their spending below anticipated levels. Consequently, Corning now expects third-quarter Optical Communications sales to decline year-over-year by a low-teen percentage, versus a prior expectation of a low-single digit percentage decline.

For the full-year 2019, Corning now forecasts Optical Communications sales will decline by 3% to 5%, versus its prior expectation of a low-to-mid-single digit percentage increase. Corning expects both carrier and enterprise network sales to decline year-over-year in the second half of 2019. -

Visahing

Tegelikult tehniliselt on aktsia huvitavas kohas, ajalooliselt tugev tugi, kas põrkab toelt üles (tehnilised ostjad lähevad põhja õngitsema lähedal stopiga) siht seal range 11 ülemine joon.

Ja 1 kuu hiljem(parem klikk ja ava uues aknas, siis ka pilt suur)

-

Mida tehniline analüüs tänaseks AAOI liikumiseks ennustab?

-

On täenäoline, läheb üles10,05 ni.

-

Homme, 6. nov, saame Q3 tulemused teada. Praegu rallib päris kõvasti. Eile 10,6 peale ja täna eelturul juba 11,6

-

Upgrade 13$ täna rallib edasi.

-

Kuidas siis tulemused olid ka?