Börsipäev 23. september

Kommentaari jätmiseks loo konto või logi sisse

-

Sure Bet teisel pool lauda on juba ka oma USA turu avanemise eelset ülevaadet lõpetamas, aga enne veel uudiseid koduvabariigist, :)

Täna avaldatud Eesti Panga andmete kohaselt on Eesti kommertspankade laenuportfell jooksva aasta 8 kuuga 19,4% suurenenud, sh. eraisikutele väljastatud laenude summa kasvanud 28,7%.

Võtab mõtlema ..., :) -

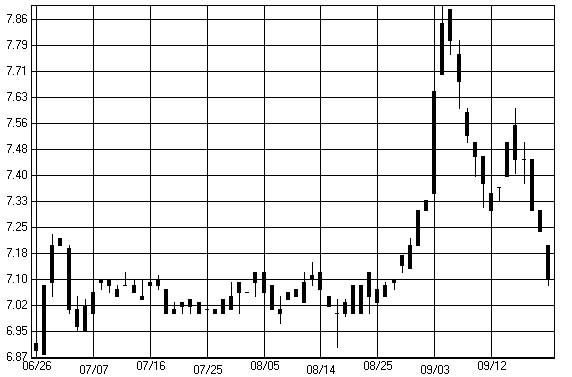

Ja 1 ilus graafik Eesti aktsiaturult ...

Eesti Telekom

-

Noore pensionäri reklaam paremal üleval ei lase seda ilu täiel rinnal nautida.

-

Mõned teemad tänaseks päevaks:

- Lehman Brothers tõstab täna hommikul kogu wireline telekomiseadmete sektori reitingut Neutraalse pealt Positiivse juurde. Nende arvates kulutavad operaatorid sellel aastal $41.5 mld seadmete ostmiseks. Seda on oluliselt rohkem kui 2002. aasta $17.5 mld number.

Reitingu tõstmisega seoses tõstetakse ka Norteli (NT) reiting Equal Weight peale varasema Underweight pealt. Põhimõtteliselt soovitatakse nüüd Norteli aktsiaid hoida portfellis samas osakaalus ülejäänud sektori aktsiatega.

Lisaks sellele tõstetakse hinnasihte järgmistel aktsiatel: Lucent (alust. $2.50), Tekelec (TKLC) $18.50 peale varasema $15 pealt, Somera Comm (SMRA) $2.50 varasema $2 pealt.

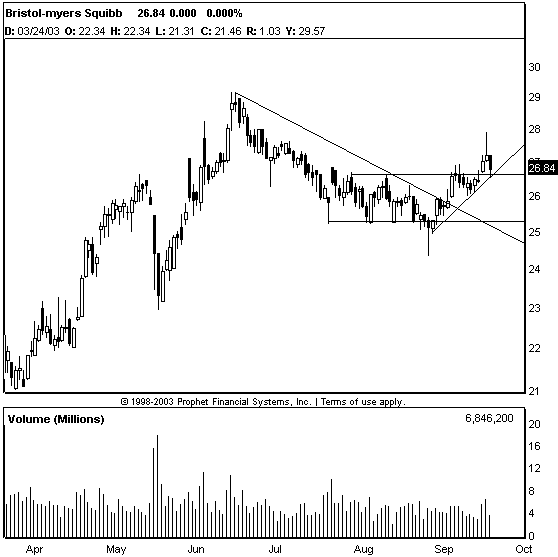

- Immucor (BLUD) müüs eile päeva alguses pool pt alla, kuid siis jätkas rallitamist.- Bristol-Myers (BMY) kukkus eile koos ülejäänud turuga, kuid jäi toetusel pidama. Täna võib sektori kohta üldiselt veidi neg. alatooniga uudiseid tulla seoses juurdlustega Medicaidi pettuste suhtes. Need ei tohiks investoreid liiga palju ehmatada.

- CF First Boston tõstab GlaxoSmithKline (GSK) reitingu Outperform peale varasema Neutraalse pealt. Mõnede analüütikute arvates on just GSK üks odavamaid suuri farmaatsiaettevõtteid.

- Smith Barney alandab täna hommikul kaheksa katsetööstuse aktsia reitinguid. LMT, LLL, NOC, RTN, EDO, ja ATK kukuvad Hoia peale varasema Osta pealt. GD, ESLT kukuvad Müü peale varasema Hoia pealt. Ameeriklaste toetus oma riigi järjest suureneva kaitseeelarve väheneb. Kui 2001. aastal olid suurenenud kulutustega nõus 80% küsitletutest, siis 2002. oli number 50% ning nüüdseks on see kukkunud 31% peale.

- Vastukaaluks Lehmani uuenenud pos. reitingule telekomiseadmetele, teatas Ameerika suurim operaator Verizon (VZ), et vähendab oma 2003. aasta kasumiprognoosi. VZ on eelturul vaid 3-4% miinuses, mis räägib siiski sellest, et turul oskasid uudist oodata.

- Pisike George Sorose poolt finantseeritav jaemüüja Bluefly (BFLY) teatas täna, et on palganud endise Spiegel Catalo'i CEO Melissa Payner-Gregor'i oma operatsioone juhtima.

- Täna avaldasid oma tulemused ka suured maaklerid Lehman (LEH), Morgan Stanley (MWD) ning Goldman Sachs (GS). Nagu viimasel ajal kombeks, ületati prognoose suure varuga.

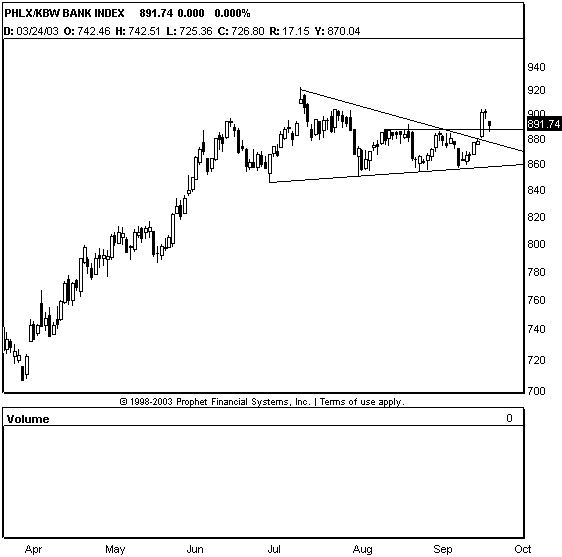

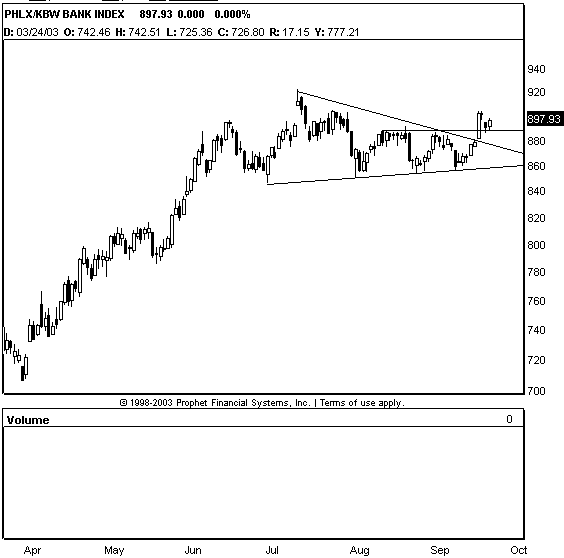

- Oluline finantssektori liikumist kirjeldav indeks $BKX tõmbus eile tagasi, jõudes sellega toetuse juurde. Tehnilise analüüsi fännid vaataksid seda kui ostumomenti (kogu turu jaoks)

- Gary B. Smith, Ameerikas populaarne tehnilise analüüsi kommentaator hindab Nasdaqi liikumist:

- RevShark arvab:Concerns about exchange rates provided a convenient excuse for a bout of profit-taking yesterday. Given the strength in this market over the past six months or so the lighter-volume pullback was barely a blip on the screen. However, the bears still hope that this is just the beginning of the inevitable market failure.

The currency action yesterday was widely cited as the reason for the market skittishness even though many market observers seemed rather confused about how a weaker dollar will ultimately affect the market. The simple fact is that the market was due for some profit-taking and consolidation. The currency issues provided a good excuse for some selling. If that issue had not arose the likelihood is that the market may have found some other reason for a pullback and/or basing action.

No matter how you look at it, the pullback yesterday was mild and does not rise to the level of a market failure. Breadth was poor but the light volume made up for it. The market needs some follow-through to the downside before we can justify any real concern about its health. A one-day pullback on lighter volume simply isn't bad enough to undermine the huge momentum we've had in this market for months now. It is going to take much more than brief bouts of profit-taking to kill off the bulls.

The bears have two things going for them at this juncture. First is that earnings preannouncement season is beginning. For example, I see Verizon (VZ:NYSE) has lowered its guidance this morning. There is likely to be other such news in the weeks ahead.

The second thing the bears have going for them is related, and that is seasonality. The bears have been talking about this for some time now but August was a great month and so far September is holding up very well. They are still hoping that seasonality will kick in at some point in the next few weeks and gain a bit of momentum.

The bottom line is that even after the weak action yesterday the market is still in very good shape. The bulls have had so much success for so long that they will not go away easily. The bears will have to beat on them for awhile before they become discouraged and prone to sell. The bears' arguments about valuation and a tepid economic recovery are being shrugged off as inconsequential. They aren't going to be given any respect until we actually see some sustained weakness.

In the early going the markets are attempting to bounce. The dollar remains under mild pressure. European markets are slightly negative to flat. Tokyo is closed for a holiday. We don't have any significant economic news on the wires. There are some earnings reports due from the big brokers this morning and they're expected to be solid and will likely influence the market tone.

For months now the pullbacks in this market have been very limited affairs. Will it be different this time or will the bears finally see a little relief?

Futuurid: Naz 0.35% Sp 0.15%

sB -

Huvitav, mille järgi analüütikud ja investeerimispangad annavad hinnasihte sellisele aktsiale nagu AMZN, ... Kahju nendest investoritest, kes ostavad mulli

-

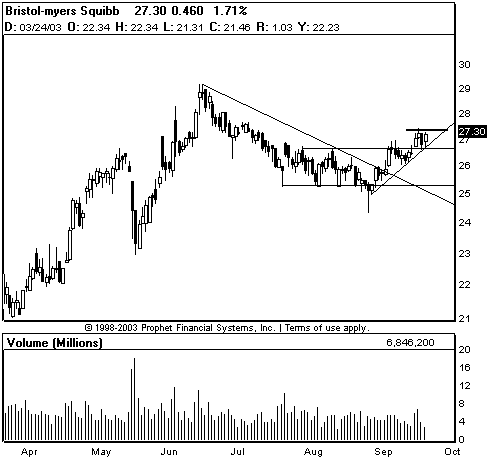

Bristol-Myers (BMY) - järgmine loogiline ostukoht 27.30-27.35 taseme murdmine:

Rick12,Mul on kahju nendest ka, kes AMZN-i viimase aasta jooksul on lyhikeseks pyydnud myya (k.a yours truly)

sB

-

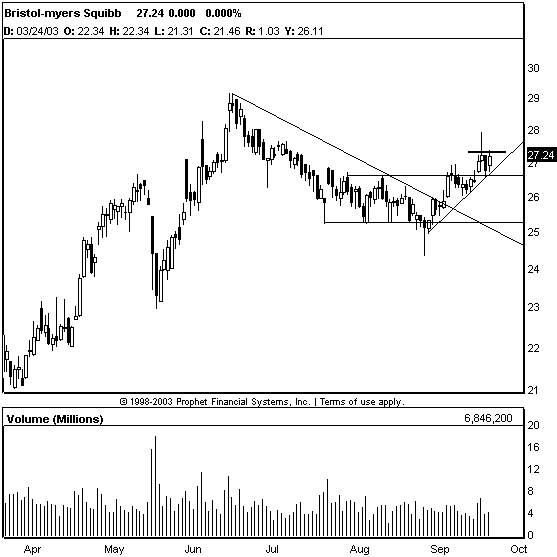

Nii näeb BMY graafikut vist paremini.

-

Mul ka :), aga kuidas loogiliselt põhjendada sellise mulli tekkimist nt. AMZN puhul. Ise arvasin, et kui aktsia tõusis 30 $ kanti, siis potsatab varsti 10 $ peale, aga täna juba üle 50 $.

Nt. P/E on 130 :) -

Mina ei julgeks küll nii väikese turuväärtusega ettevõtteid (nagu Amazon) USA turul lühikeseks müüa. Põhiaktsionär või -kreeditorid võivad sellise ettevõtte puhul just lühikeseksmüüjaid lollitada.

-

Muuseas, sügishooajaga anname kick-stardi ka chatile -

Homme (kolmapäeval) kell 15.00 valige kõik ülevalt Foorumi rippmenüüst Chat ja tulge vestlema.

Anname Oliveriga kommentaare turgude kohta juba enne avanemist. -

Mõned teemad tänaseks päevaks:

- Täna chat alates 15.00

- Sonus Networks (SONS)-i emissioon 17 mln aktsiale toimub @ $7.75. Eile sulgusid aktsiad $8.96 peale. Eelturul on aktsiad pool dollarit miinuses.

- ESS Tech (ESST) teatas, et kahjum tuleb selles kvartalis oodatust väiksem. Lisaks sellele on ka käive 20% oodatust suurem. See uudis võib veidi elu sisse ajada ka konkurent Zoranile (ZRAN), mis mõnede turuosaliste arvates on käitunud viimastel päevade nagu hakkaks andma kasumihoiatust. DVD seadmete tootjatega tegemist.

- Lehman alandab Genentechi (DNA) reitingut Equal Weight peale varasema Overweight pealt. Põhjuseks kõrge valuatsioon. DNA kaupleb 100% preemiaga P/E järgi vs. ülejäänud biotehnoloogia (mis on isegi kallis sektor).

- Eile õhtul teatas Cisco Systems (CSCO), et ostab tagasi $7 mld eest oma enda firma aktsiaid.

- Powerwave (PWAV), mis tegeleb võrgusektori jaoks võimendite toomisega, sai Piper Jaffray käest Underperform reitingu varasema Market Perform asemel. Analüütikud usuvad, et PWAV läheb siit korrektsiooni.

- FuelCell Energy (FCEL) on eelturul 15% plussis, kuna firma teatas, et on koos Catepillariga (CAT) suutnud California osariigile müüa esimese mobiilse fuel cellidel põhineva elektrijaamakese.

Lisaks sellele teatas OPEC, et vähendab väljalaset 900,000 barreli võrra. Tavaliselt selliste uudiste peale fuelcellid hakkavad tõusma. CPST, BLDP, MCEL, PRTN on eelturul plussis.

- Nasdaq 100 (QQQ), mis oli suutnud terve hommiku plussis veeta, kukkus pool tundi enne turu avanemist korraks miinuspoolele.

- Bristol-Myers (BMY) näitas ennast koos ülejäänud turuga tugevastu küljest. Graafik näeb väga positiivne välja, toetades madalat valuatsiooni. LHV Pro all vastasin ühe kliendi küsimustele BMY teemal.

- $BKX-i käitumise kohta ütleksid tehnilise analüüsi fännid vaid head:

- RevShark arvab:The most impressive thing about the market since it started rallying way back in March is its consistency. There have been 10 or so pullbacks during the course of this seven-month-long rally. Almost all of them came on a decrease in volume and they lasted no more than a few days. None of the pullbacks have built any substantial downside momentum. There are only a couple instances where we had two fairly large negative days in a row.

It is instructive to look at a Japanese candlestick chart of the Nasdaq. The number of black candlesticks, which indicate that the index closed lower than it opened, is quite small compared to the number of white candlesticks, which indicate that the index gained strength throughout the day. Buyers have consistently taken advantage of any weakness during the day and closed the market strongly.

The move since March is a textbook uptrend. The market has done all of the things you want to see to support a continuation of the move: Volume has tended to increase on up days and decreased on down days, there have been consistently strong closes and any breaches of the uptrend line have been quickly repaired, usually on good volume.

The one slight negative is that there has not been much consolidation, with market not taking much time to digest gains. However, that may be one of the things that has kept this market going, because the skeptics simply have not been given any great opportunities to buy. If you have wanted to be in this market you have had to chase it higher. Anxiety about being left on the sidelines has probably helped fuel the steady and consistent rise.

Yesterday we saw the market once again shrug off a quick dip. The indices, especially the Nasdaq, roared back on increased volume and lots of speculative action. The worries about currency risks on Monday were completely forgotten and now the focus is new highs.

Most of us probably have a natural tendency to look for flaws in a market this strong. We are all familiar with the positive aspects of this market, especially steadily increasing prices, so we focus on trying to find warning signs that the end is near. We look at things like VIX, valuation measures or put/call ratios and lose sight of the big technical picture, which is extremely positive. Being a nitpicker has been very costly when it comes to considering this market.

The markets are set to follow through on yesterday's positive finish. Overseas markets are generally positive. There is no economic news until tomorrow and analysts continue to be generally positive. Aggressive traders have been doing well and I don't see anything at the moment that is going to slow them down.

Futuurid: Naz 0.14% SP 0.13%