Börsipäev 15. - 16. oktoober

Kommentaari jätmiseks loo konto või logi sisse

-

Mõned teemad tänaseks päevaks:

- Inteli tulemused tulid oodatust paremad ning aktsiad ronisid järelturul $31 sulgemishinnast $32 alla (eelturul $33 all). Põhimõtteliselt oli tegemist parima kolmanda kvartali tulemusega viimse 25 aasta jooksul. Analüütikud aplodeerivad ning täna hommikul teatas Merrill Lynch, et tõstab firma hinnasihi $32 pealt $40 peale. Inteli arvates saab hinna 2010. aastaks suuremaks personaalarvutite tarbijaks kui seda on USA. Hiina muutus suuruselt teiseks turuks INTC jaoks eelmise aastal. Sellel aastal müüakse Hiinas ca 13 mln PC-d, ületades napilt Jaapani 12.7 mln nõudlust. USA-s müüakse sellel aastal ca 51 mln PC-d.

Kokku moodustas Aasia (va. Jaapan) 42% Inteli selle kvartali käibest. Koos Jaapaniga oli see number 51%.- Deutsche Bank teatas, et alustas SCO Groupi (SCOX) katmist OSTA reitinguga ning tervelt $45 hinnasihiga. Praegu kauplevad aktsiad $15-16 juures. Mäletatavasti kaebas SCOX kohtusse IBM (IBM)-i süüdistades viimast piraatluses seoses UNIX-i lähtekoodiga. Kui IBM (jt.) peaks hakkama SCOX-le UNIX-i eest maksma, võivad tulud ulatuda sadadesse miljonitesse dollaritesse. Põhimõtteliselt on SCOX kui call-optsioon. Võidu korral on SCOX-i aktsiad väärt $50+ ning kaotuse korral praktiliselt 0.

- Flash mälul põhinevate tech-vidinate tootja SanDisk (SNDK) tuli välja kvartalitulemustega, mis ületasid ootusi märkimisväärselt. EPS tuli $0.60 vs $0.45 konsensust ning aastaks prognoositakse üle $1 mld suurust käivet. SNDK head tulemused/prognoosid mõjutavad ilmselt kogu sektorit: LEXR, FLSH, STTI.

- Palusin Kristjanil avaldada arvamust ka E-Loani (EELN) tehnilise pildi suhtes. Konkurendid LEND ning CFC, millest ralli üldse alguse sai jätkasid tõusu ka eile. Eelturul kaupleb EELN $4.40-4.50 vahel.

- Keegi märkas, et Intel (INTC) ei muutnud oma capexi prognoose? Samas Novellus (NVLS) tuli välja "heade" tulemustega, mis on üles ajanud ka teised sektori tegijad (AMAT, LRCX, KLAC jne).

- Karud? Kus on karud?

- Gary B. Smith

- RevShark

Intel (INTC:Nasdaq) delivered exactly what the bulls wanted. Revenues, earnings, margins and forward guidance were all solid. Analyst are raising targets to the 40 level and the stock is trading up over a dollar and a half. It's tough to find flaws in that report but that has not stopped the bears, who are hoping that the "valuation" argument will finally kick in one of these days.

As this market continues to move higher the bears have been carefully considering all of the reasons why this strength is unjustified. While they wait for their theories and arguments to bear fruit the merry bulls have continued to wallow in their ignorance and rack up big gains. Careful consideration of what can go wrong leads to poor results when those around you are frolicking with abandon.

Once again we are faced with the same question that has plagued this market since March: Can good news keep driving this market higher or is it finally completely priced in this time? There is no question that the Intel report is very solid but the market is up nine of the 10 trading days so far in October. Doesn't the action over the prior two weeks indicate that investors saw this good news coming and have priced it in? We'll find out as the day progresses but at the moment there are plenty of folks prepared to buy this open as they fear being left behind yet again as we climb still higher.

Even if you are leery about how extended this market is, it is difficult to be overtly bearish given the number of folks who are battling major underperformance. The underinvested, underperforming bulls keep hoping and praying for some sort of pullback that will allow them to do some buying. They are so frustrated that they take advantage of the most minor of pullbacks.

So the stage is set: It's all good news, and we are going to gap up at the open and the chips are going to lead the way. What we have to watch for is whether a sell-the-good-news reaction kicks in. After solid reports yesterday morning it looked like we were going to sell off but the market strengthened as the day wore on and we closed solidly.

We obviously will have to keep a close watch on Intel and the chips. Can they hold the opening gains and build on them? If we pull back from a strong open, how long will the dip buyers contain themselves before throwing money at the market?

It's going to be a particularly interesting day. As things progress the focus will shift to a long list of earnings reports due after the close tonight, and important economic data in the morning.

Put on your lucky trading hat and get ready to rumble.

Futuurid: Naz +1.23%, SP 0.60% -

S&P avaneb üle olulise 1050 punkti taseme, seni kuni indeks ka sellest kõrgemal püsib, on kõik hästi.

Jälgige seda taset. -

Valus, valus on vaadata Inteli tulemusi. Passisin omal ajal tehnoloogiasektori põhinimesid - INTC (14-15 USD, IBM 55, CSCO 9, YHOO 8-10), aga kui need väikese tõusu tegid, siis ootasin uut langust. Nüüd vaatan, et isegi 30 USD Inteli eest on mõistlik hind.

-

scox rallib uhkelt

-

Hoolimata ettevõtete kohati väga headest tulemustest kipuvad aktsiaturud tõusust "väsima" ...

-

Praegu paistab pilt turust päris vilets, kui kella 18.00ks ka kosuda ei suudeta, siis võib olukord ka päris koledaks minna.

Intel siiski veel 3% plussis. -

10:42 ET Hearing that a tier-1 broker is a size buyer of QQQ Dec puts this morning

sB -

Miks just 18.00, miks mitte 19.00 :) ?

-

Reeglina on esimene tund ja ehk ka esimsed poolteist tundi olulised suuna indikaatorid.

-

Kristjan on ebausklik :P

tõsisemalt: 19:00 on USAs 12:00, inimesed lähevad ära sööma, börsi käive kuivab kokku. -

Rene

nagu Sa tead tellivad tõsisemad kauplejad endale pizza või wrapi arvuti taha, :) -

Täna olen mitmest kohast kuulnud, et just puttide ostmise tõttu on turg miinuses. Sageli otsitakse iga languse taga uudist, küll süüdi languses vigane order futuurides või muud sellist.

Tegelikult on sageli põhjus lihtsalt selles, et inimesed võtavad kasumit - iga languse ega tõus taga ei pea olema uudis. -

Henno, kas sellise pizza, mida saab osta stockmannist ja mida mikros soojendada ei saa :P

-

Üks täheleapanek veel kellaaegade kohta - päeva viimasel tunnil toimub harva pööranguid - indeksid liiguvad päeva viimasel tunnil reeglina samas suunas kuhu nad terve päeva on liikunud.

Täna on suund olnud alla ja seega ma ei usu, et S&P 500 üle 1045 punkti suudab sulguda. -

E*TRADE beats by $0.01, narrows EPS guidance (11.19 +0.01)

Reports Q3 (Sep) earnings of $0.17 per share, ex items, $0.01 better than the Reuters Research consensus of $0.16; revenues rose 20.7% year/year to $397.7 mln vs the $389.7 mln consensus. Company narrows Y03 EPS guidance to $0.56-0.58 from its previous expectation of $0.52 to $0.57 per share . -

IBMi (IBM) tulemused tunduvad esmapilgul üsna kesised - kasum vastas täpselt ootustele, käive alla ootuste.

16:10 ET IBM reports Q3 in line, misses on revs (IBM) 93.01 +0.29: -- Update -- Reports Q3 (Sep) earnings of $1.02 per share, in line with the Reuters Research consensus of $1.02; revenues rose 8.6% year/year to $21.52 bln vs the $21.85 bln consensus. -

E*trade seevastu oli väga tugev, Rene tõi numbrid ülalpool.

-

IBMiga järelturul veel ei kaubelda, kuid noteeringud on langenud juba alla 90 USD ehk ligemale 4%. Sellise suure aktsia kohta päris korralik liikumine.

-

Mõned teemad tänaseks päevaks:

- IBM (IBM) tuli küll mõnevõrra allpool ootusi, kuid täna hommikul on analüütikud suhteliselt leebed. Toonid on pigem positiivsed, räägitakse turuosa võitmisest ning sellest, kuidas järgmised kvartalid tulevad juba märksa paremad. Raske usukuda, et IBM $88-$90 kandist allapoole võiks liikuda.

- Apple Computer (AAPL) kukus eile $23.6 tasemele vs $24.8 sulgumistasemega. Põhjuseks tulemused/prognoosid, mis ei olnud turu ootustega päris vastavad. Smith Barney kinnitab oma Müü reitingut ning alandab hinnasihti $22 peale $20 juurde. Ülejäänud analüütikud nii negatiivsed siiski pole.

- Pisikese protsessoritootja Trasmeta (TMTA) aktsionärid on täna hommikul ilmselt päris tusased. Aktsiad kukkusid järelturul 25-30%, kuna firma ei suutnud analüütikute prognoose täita. Käive kukkus ligemale 60% vs. eelmise aasta sama kvartal. Eriti roosilised ei olnud ka firma prognoosid tulevaks kvartaliks. Aktsiaid katvad analüütikud aga kinnitasid oma Tugev Osta soovitusi täna hommikul. Nemad nimelt usuvad, et firma uued Efficeon protsessorid suudavad haarata kuni 5% turuosa 50 mln+ tk. turust.

- Office Depot (ODP) tuli välja oma Q3 tulemustega, mis ületasid ootusi. Siiski võivad järgmise kvartali tulemused jääda veidi allapoole ootustest tänu mitmesugustele mahakandmistele seoses Euroopa operatsioonidega. Turuosalised võtavad vähemalt eelturul uudiseid päris leigelt. Muutusi hinnas ei ole toimunud.

- Nextel (NXTL), USA üks suuremaid ja edukamaid mobiilsideoperaatoreid tuli välja oma tulemustega, mis ületasid ootusi. Lisaks sellele tõstis firma ka oma kasumiprognoose 2003. aastaks. Mobiilisektori suhtes teeb veidi ettevaatlikuks USA-s jõustunud seadus, mille kohaselt on klientidel võimalik ühe operaatori juurest teise juurde minna numbrit vahetamata. See teeb konkurentsi märgatavalt kõvemaks ning alandab hindu. Hea tarbijatele kuid mitte nii hea operaatoritele. Siiski on Nextelist (NXTL) räägitud kui aasta pärast $25-30 aktsiast.

- Nokia (NOK) kaupleb 3-4% allpool eilset sulgemishinda. Prognoosid ning ASP jäid ootustega võrreldes veidi nõrgaks. RFMD tõenäoliselt jälle lühikeseks müügi kandidaat.

- Futuurid on suure osa hommikust plusspoolel veetnud. Seda hoolimata IBM-st.

- Gary B. Smith

- RevShark:There are market observers who contend that there is a single human emotion that ultimately determines the course of the market. That emotion is fear. We either fear that we will lose money or we fear that we will not make enough. Some folks consider greed to be a fundamental emotion that also drives the market. Greed is really just another form of fear. It is the fear, rightfully or wrongfully, of not having enough.

Throughout the three-year bear market, fear of losing money was the predominant emotion. Rallies were sold quickly because investors feared they wouldn't last. After a huge six-month rally investors' predominate fear has shifted to the fear of not making enough money. Many were cautious for far too long, and now that their friends and neighbors are starting to talk about making money in the market again, their fears of being left behind are driving them.

The fear of being left out manifests itself by driving investors to chase momentum and/or buy minor pullbacks. It is the reason that the market continues to look extended and has had only minor corrections. Investors are clamoring to buy stocks to ease their concerns about not participating -- the fear of losing money is a minor concern.

Even when the market was slightly negative like yesterday, we continue to have a huge number of new highs, especially in the smaller-cap stocks. This is because of the large contingent of folks who fear that they have squandered their chances of making money and are now anxious to make up for it.

Don't underestimate the fear of not making enough money. It manifests itself differently than the fear of losing money, but it's a very potent force that does not evaporate quickly. It is the key driving force now, and it's the reason you can't feel confident that the market will suddenly go straight down. There is a big pool of investors who are kicking themselves for underperforming and will jump on opportunities to buy.

Yesterday we had a taste of the old-fashioned fear of losing money -- or perhaps it should be characterized as prudent profit-taking. Despite good news and solid earnings reports, we sold off on an increase in volume. The most troublesome thing about the action was that breadth was poor. The pullback was fairly minor, but the failure of good news to rally the market should keep us on guard for further excuses to take profits in an extended market.

IBM (IBM:NYSE) reported a generally good quarter, but it traded down sharply on the news. There was nothing glaringly bad about the report, but investors are in a sell-the-news mindset after the weakness yesterday. There are a number of other solid reports out there such as Nextel (NXTL:Nasdaq) this morning, but futures are indicating a slightly negative open to start the day.

So we have a bit of the sell-the-news psychology to contend with because the market has been so strong in recent weeks and folks are inclined to protect profits. However, the fear of being left behind is a more basic force at work and will likely serve to keep the sell-the-news pullback from going too far.

Once again I'm looking for some good trading action in the smaller-cap stocks. There is a lot of "hot money" sloshing around out there looking for something to trade. That drive for speculative action should produce some interesting trading opportunities.

Futuurid: Naz -0.11% Sp 0.02% -

Legendaarne tehnilise analüüsi spets Dick Arms avaldab arvamust:

I last looked at Eastman Kodak (EK) as a short at the end of last year. Now it's starting to look as though the worst is behind it, and that it's going higher. After the huge down volume a month ago it found a support level, as evidenced by the square entries. In the last few days it has moved higher, and even gapped to the upside on good volume. I think this stock could be bought here.

Lisainfoks: Tunnen hedge fundi, mis ostis EK aktsiaid kohe peale dividendikärbet (viimane suur kukkumine). Nende arvates on EK jaoks kukkumine läbi. Aktsiad on viimase 15 aasta põhjade juures.

sB -

Täna hommikul tulid üsna halvad tulemused ka Caterpillarilt (CAT), aktsia on -5.5%.

Seega IBM on Dow Jones indeksis suuruselt teise osakaaluga ja CAT suuruselt kolmas, mõni ime et Dow praeguseks 64 punkti miinuses on.

Kui nende kesiste uudiste peale suudab turg kosuda, on see tugev märk. -

Miks hüpoteeklaenudega tegelevad firmad ja E-Loan (EELN) täna miinusest alustasid?

Greenpoint Fincl misses by $0.16 (GPT) 30.71: Reports Q3 (Sep) earnings of $0.85 per share, $0.16 worse than the Reuters Research consensus of $1.01; revenues fell 15.6% year/year to $277.8 mln vs the $313.7 mln consensus. Co says the sudden increase in interest rates had an immediate, negative impact on mortgage banking, making Q3 a difficult one.

Veel sektori nimesid: CFC, NCC, WM, WFC, GDW, LEND

My take?

Non-event. GPT ei ole nii suur tegija, et turgu nii mõjutada.

sB -

see numbri vahetamiseta operaatori vahetus vist usas ei kehti veel?

või kehtib juba? -

Lahti läheb al. 24. Nov.

sB -

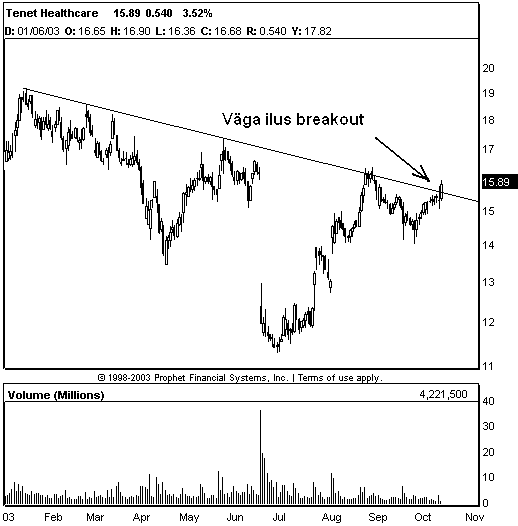

Keegi Tenet Healthcare (THC) liikumisi on viimasel ajal jälginud? Väga ilus breakout! Tundub, et aktsia on liikumas kõrgemale.

-

sB

-

San Francisco Fed'i president - Parry avaldas väga positiivseid kommentaare tööjõturu kohta ja praegu tundub just see olevat põhjuseks miks turg järsult plussi on hüpanud.