Börsipäev 17. oktoober - AMD päev

Kommentaari jätmiseks loo konto või logi sisse

-

Mõned teemad tänaseks päevaks:

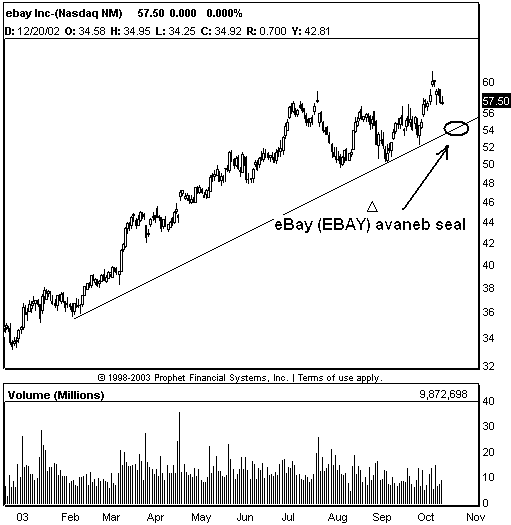

- eBay (EBAY) kukkus järelturul 6-7%. Miks? Kuna tulemused tulid enam-vähem kooskõlas analüütikute ootustega. Kasumit 18 senti aktsia kohta (konsensus 18) ning käive kasvas aastaga 84% 530 mln dollari peale. Ka 2004. aasta prognoosid vastasid enam-vähem ootustele. Käive peaks tulema $2.9 mld (konsensus $2.89) ning kasum aktsia kohta kuni 98 senti. Siiski ootasid üli-optimistlikud analüütikud juba ühe dollari suurust kasumit.

eBay (EBAY) kukkus $53-54 kanti, mis päevasel graafikul on ka toetustasemeks. Täna hommikul ei ole ma kuulnud ühegi analüütiku reitinguid langetavat. Ainukeseks langetajaks oli juba nädala alguses Smith Barney, kes tõi oma reitingu Hoia pealt Müü peale. Lisaks sellele on meil hulganisti lühikeseks müüjaid, kes kasutavad ilmselt iga võimalust rongi pealt maha astuda. Ma ei usu, et eBay-l praegu eriti palju kukkuda on.

- Advanced Micro Devices (AMD) tuli välja päris huvitavate tulemustega, mis lõid ka kõige optimistlikumate turuosaliste ootusi. Oodatust kõrgemad käive, marginaalid ning oodatust madalam kulubaas olid põhjused selle taga. Käive kasvas 48% võrreldes eelmise kvartaliga ning EPS tuli -$0.09 vs ca -$0.36 konsensust. Firma peaks kasumisse jõudma aasta varem kui seda olid prognoosinud analüütikud. Reaktsiooniks oli ligemale 10% hüpe ülespoole järelturul.

Täna hommikul on mitmed analüütikud muutmas oma Müü soovitusi Hoia soovituteks. Ainukeseks vastukaaluks on SoundView, mis alandas oma reitingu Neutraalse peale varasema Outperform pealt. Blow-off top, anyone? Kas positiivsus ei hakka veidi liiale minema? Üheks AMD reitingut tõstnud pangaks on Deutsche, kelle hinnasihiks on $15. Täna hommikul aktsiad seal kauplevadki.

Ainukeseks suuremaks upside riskiks on pidevalt turul liikuv kuulujutt selle kohta, et IBM (IBM) võiks firma ära osta.

- Black and Decker (BDK), mis on ka LHV Pro üks valikuid, teatas, et tõstab oma kvartaalset dividendi 75% võrra. Alates 1996. aastast makstud 12 sendi asemel makstakse nüüd 21 senti. Praegusel tasemel võrdub see igati respekteeritava 2% div. tootlusega. Hea firma suhteliselt odavalt. Rahulik investeering.

- Lexar Media (LEXR), mis figureerib tihedalt ka LHV enimkaubeldud aktsiate nimekirjas, sai SG Coweni käest kõrgema reitingu. Strong Buy ehk Tugev Osta varasema Market Perform asemel.

- Palusin Kristjanil avaldada arvamust E-Loani (EELN) tehnilise pildi teemal:

- Housing starts rise 3.4% to 1.888 vs consensus of 1.827 mln; Building Permits 1.860 mln vs consensus of 1.835 mln- Office Depot (OPD) reitingut alandati täna hommikul Goldman Sachsi poolt. In−Line peale varasema Outperform pealt. Analüütikud näevad aktsiaid kukkumas $12 juurde. Ma ei julge uskuda, et need sinna võiksid siiski kukkuda.

- BusinessWeeki tänase hommiku aktsiavalikud on: IMAX, PDQ ning TJX. Kaks esimest eriti huvitavad pisikesed firmad. Lähemalt juba esmaspäeval.

- Gary B. Smith:

- RevShark:

Although the market has been struggling with some intermittent bouts of sell-the-news as earnings reports roll in, the bold bulls continue to find good opportunities on the long side. Given the quick and steady pace of the market's rise, it is very tempting to look for reasons why you should be increasingly conservative and start anticipating market weakness. Despite some poor earnings from the likes of General Electric (GE:NYSE), IBM (IBM:NYSE) and Caterpillar (CAT:NYSE), the indices have held steady.

With the new annual high list producing a steady stream of 500 or more stocks each day, there clearly is some momentum out there, even though the pace of the overall indices has waned a bit recently. Bold trading of secondary stocks has been very productive lately. It won't last forever, but the phenomena is occurring, and if you look under the surface you can see it.

This morning eBay (EBAY:Nasdaq) is helping to produce a shaky start to the day. The Internet giant tempered guidance and raised concerns about the rate of growth. The stock is trading down close to $4 in early trading. Obviously we will have to watch for fallout in the Internet group. Amazon (AMZN:Nasdaq) is trading down about $1 in sympathy.

Chip stocks, though, posted some fairly good reports. Advanced Micro Devices (AMD:NYSE) is trading up about 70 cents on a much narrower loss than expected, but it has a downgrade from SoundView on valuation.

On the other hand, Broadcom (BRCM:Nasdaq) is trading down on its report. Overall the chip sector has had very good earnings reports, but will be very important to watch for signs of sell-the-news action.

We have a shaky start, but the market has done a fairly good job dealing with early weakness lately. Over the last five trading days, the only day we didn't finish higher than we opened was when we gapped up big on Intel's (INTC:Nasdaq) earnings. Strong finishes are typically a bullish sign and often become self-fulfilling as traders anticipate them reoccurring.

Technically the markets are still clearly in an uptrend, but they are somewhat extended and don't have much of a base. Consolidation and/or some profit-taking would help produce a better technical picture. Even though the indices are a bit overbought, there is nothing to indicate that we need to be overtly bearish.

I'm expecting to see a continuation of yesterday's drifty action, but there should be some pockets of strength to trade. The hot money traders have been doing well lately, and they will be stalking the small-caps for opportunities.

Good luck and go get 'em.

Futuurid: Naz -0.18%, SP -0.10%sB

-

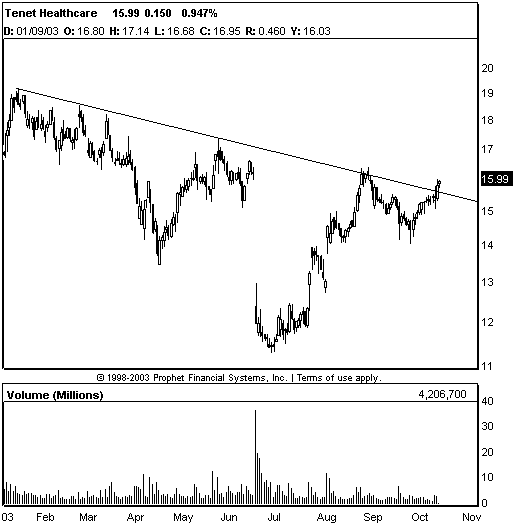

Tenet Healthcare (THC) liikumas ülespoole. Täna hommikul tuli uudis:

08:31 ET THC Tenet Healthcare receives additional DOJ subpoena (15.84)

Co announces that it has received an additional subpoena from the U.S. Attorney's Office in Los Angeles that it understands is related to the previously disclosed investigation of Medicare outlier payments to hospitals owned by certain of the company's subsidiaries. The subpoena seeks medical and billing records from 1998 to the present for certain identified patients who were treated at two Los Angeles-area facilities owned by Tenet subsidiaries -- Tarzana Regional Medical Center and USC University Hospital. Additionally, the subpoena seeks personnel information concerning certain managers at those facilities during that period, as well as information about the two hospitals' gross charges for the same time period.

Investorid vaatavad nendest süüdistustest juba kaugemale!

sB

-

Avalöögis olen mitu korda maininud 1040 punkti taseme olulisust - vaatame kas see tänase müügisurve ka vastu peab.

-

Läbivajumine oli järsk, igatahes.

-

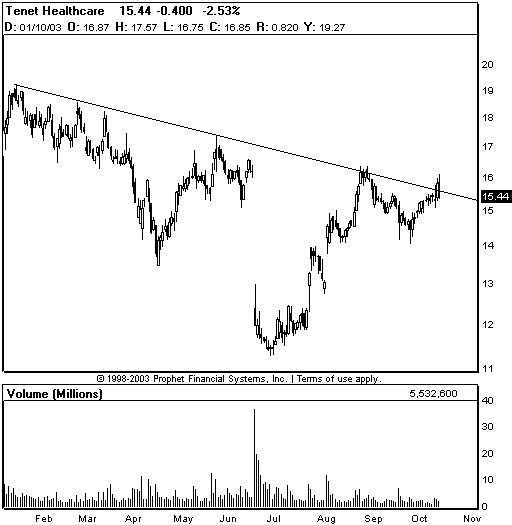

Tenet Healthcare (THC) tegi kannapöörde koos ylejäänud turuga. Eilse päeva low murdmine suurendaks edasise kukkumise t6enäosust:

sB

-

l6petage see graafikute panemine, see on tagantj2rele tarkus!

-

ja eksitab!