Börsipäev 3 - 4. november

Kommentaari jätmiseks loo konto või logi sisse

-

Tele2 kavatseb rootsis kasutusele võtta CDMA tehnoloogial põhineva 3G võrgu ehk CDMA 2000, GSMil põhineva 3G asemel (UMTS). Nokia-Ericssonile hoop allapoole vööd.

Väidetavalt on CDMA2000 odavam, kui UMTS. -

Millel see väide põhineb? Kas oskad ehk ka allikale viidata? Isiklikult ei usu sellesse teatesse mitte 1 põrm!

-

Wall Street Journal

-

Kuigi esialgu võib Tele2 plaanide vastu olla telefonide puudumine. Vaja oleks telefoni, kus üheaegselt oleks sees CDMA ja GSM...

-

ReneI,

äkki paned lingi või teed copy-paste (kuigi Velikij'le see ei meeldi :)))

You may enlight us!!! -

kahjuks ei ole mul juurdepääsu WSJile, kuid:

Ruotsalaisoperaattori Tele2 suunnittelee amerikkalaislähtöisen cdma-teknologian käyttämistä omassa verkossaan, kertoo Wall Street Journal. Tämä olisi poikkeuksellinen teko, sillä tätä teknologiaa ei ole Euroopassa käytössä, vaan täällä on tukeuduttu Nokian (NOK1V) ja Ericssonin kehittämään ja ajamaan gsm-teknologiaan.

Cdma on gsm:n kanssa kilpaileva matkapuhelinteknologia, jonka kolmannen sukupolven johdannainen on niin sanottu cdma 2000. Suuren osan tämän Yhdysvalloissa suositun teknologian patenteista omistaa jenkkiyhtiö Qualcomm.

Tele2 tutkii nimenomaan cdma 2000 –vaihtoehtoa 3G-verkkoonsa. WSJ:n mukaan myös Hutchison Whampoan ja Investorin omistama Ruotsissa toimiva Hi3G Access tutkii tätä vaihtoehtoa. Joidenkin mukaan cdma 2000 voi tulla halvemmaksi kuin gsm:stä kehitetty kolmannen sukupolven verkko, jossa elävä kuva liikkuu vikkelästi.

Comviq-nimellä toimiva Tele2 on Ruotsissa TeliaSoneran (TLS1V) paha kilpailija. Tällä selkeästi voitollisella mobiili- ja kiinteän verkon palveluja tarjoavalla yhtiöllä on Euroopassa kaikkiaan 20,4 miljoonaa asiakasta ja se kehuu kasvavansa Euroopan nopeinta tahtia. -

(This story was originally published Friday)

By Robb M. Stewart

Of DOW JONES NEWSWIRES

STOCKHOLM (Dow Jones)--Europe's mobile phone technologies may be about to

face competition from the U.S. standard on their home ground for the first

time.

A number of operators are considering the possibility of using a version of

the U.S.-favored CDMA technology in some areas of Sweden, a person familiar

with the situation said.

The move would give a boost to the CDMA standard promoted by Qualcomm Inc.

(QCOM) in its global battle with the European standard, which is associated

with players such as Nokia Corp. (NOK) and Sweden's Telefon AB LM Ericsson

(ERICY).

Joe Nordgaard, managing director of wireless consultancy Spectral Advantage

LLC, said a move to operate the U.S.-devised technology in Sweden would be

"a bit of an earthquake."

But he said Europe had now adopted the idea that licenses shouldn't be based

around specific mobile technologies, so "hopefully the political issues

won't be as pronounced in the past."

Sweden's telecommunications regulator, PTS, has received 13 letters of

interest in response to its proposal to set aside some or all of the

spectrum around the 450 MHz bandwidth for digital mobile phone services,

people familiar with the situation said.

Tele2 AB (TLTOB), a Swedish telecoms company, was one of the companies to

respond. Spokesman Jan Cjernell told Dow Jones Newswires the company is

examining whether it could use a variant of CDMA, known as CDMA2000, in that

spectrum space.

A person familiar with the situation said other operators are also studying

this possibility, among them Hi3G Access AB, a joint venture between

Hutchison Whampoa Ltd. (0013.HK) and Investor AB (INVE-B.SK).

Hi3G spokesman Niclas Lilja said his company has submitted a letter of

interest in potentially using the 450 MHz bandwidth in remote areas of

Sweden, but declined to say which technology standard it might use.

A spokesman for Vodafone Group PLC (VOD) confirmed the company had expressed

an interest, but stressed "it's early days yet." Even if an auction is

called for the available spectrum, Vodafone hasn't made a decision on

participating, he said.

Sweden has three network operators using the Global System For Mobile

Communication, or GSM, system that was developed in Europe and helped

establish Europe's strong position in mobile technology. In December 2000,

four operators were granted licenses for third-generation networks, also

using European technology, but only Hi3G has launched a service.

CDMA - which stands for Code Division Multiple Access - is technology

promoted by Qualcomm, which holds patents on key aspects of it, as a more

efficient system than GSM. The two systems are fighting for the favors of

operators worldwide.

Tele2 is looking specifically at the CDMA2000 variant, which supporters say

offers many of the benefits of Europe's 3G technology at lower overall cost.

Tele2 spokesman Cjernell said the spectrum bandwidth that may be available

has the potential to sit alongside higher-bandwidth 3G transmissions outside

populated areas.

Spectral Advantage's Nordgaard said the choice of CDMA in that slot would be

logical. The amount of spectrum on offer was small, so it made sense for

operators to use CDMA instead of a variant of GSM because it could squeeze

many more users into the same spectrum space.

In addition, Nordgaard said the 450 MHz spectrum band is cost-effective for

covering large areas. That would allow advanced digital communications to be

available to far-flung users such as those working in Sweden's forestry

industry or the sparsely populated northern border with Norway.

The Swedish telecoms regulator said in a statement on its Web site it will

review the 450 MHz submissions, which had to be in by Oct. 15, and decide

whether to call an auction of the available spectrum.

-By Robb M. Stewart, Dow Jones Newswires; +46 8 545 130 94;

robb.stewart@dowjones.com

(Gren Manuel in London contributed to this article.)

(END) Dow Jones Newswires -

Mõned teemad tänaseks päevaks:

- Semiconductor Industry Association (SIA) teatas nädalavahetusel, et globaalne pooljuhtide müük kasvas septembris 17% (y/y). See on kõige järsem ühe kuu tõus alates 1990. aastast. Tõenäoliselt püüavad tech-pullid selle infokillukese peal täna veidi liugu lasta. Euroopa pooljuhtide toomisega seotud firmad näitavad suht tugevat plussi. Kokku müüdi kolmandas kvartalis 43.3 miljardi dollari eest pooljuhte. Kui keegi veel mäletab, siis Intel (INTC) teatas 14. oktoobril kasuminumbrid, mis näitasid enam kui 2x tõusu vs eelmise aasta sama periood.

- Ameritrade (AMTD) suuremad aktsionärid müüvad turule 44.1 mln aktsiat. Firm teatas, et soovib nendest 7.5 mln ise tagasi osta. Usun, et internetimaaklerid on praegustel tasemetel õiglaselt hinnatud. Tundub, et suured aktsionärid arvavad sama.

- Barrons kirjutab positiivse loo Pier 1 Imports (PIR) nimelisest jaemüüjast. Intervjueeritav fondijuht peab aktsiaid, mis kauplevad tasemel 16x selle aasta ning 14x järgmise aasta kasumit aktsia kohta, odavateks. Fondijuhi sõnul on see odav hind maksta kasvuaktsia eest. Firmal võlg puudub ning kassavoog on piisavalt suur, et tagada kiireks arenguks vajalikud investeeringud ning pakkuda head dividendi ka aktsionäridele.

- ThinkEquity teatas, et tõstis Siebel Systemsi (SEBL) reitingu Strong Buy peale varasema Overweight juurest. Nende arvates jätkub nõudluse kasv firma CRM toodete järele ka tulevikus. Mäletan ühte ca aasta tagasi tehtud küsitlust, millest tuli välja, et võimaluse korral panustavad firmade CIO (chief information officers)-d esimesena just CRM-i peale. Tundub, et nii ka on läinud.

- Üks USA suuremaid elektroonika ning eriti PC/konsoolimängude jaemüüjaid Electronics Boutique (ELBO) andis kasumihoiatuse täna hommikul. Seda nii Q3 kui ka kogu 2003 aasta jaoks. Põhjendus? "Unfortunately, software sales for this quarter were weak, and a number of releases we expected during the third quarter have been delayed until the fourth quarter or later. In addition, key hardware platforms -- existing and new -- fell short of our projections." Konkurendid? GME. Lisaks sellele ma usun, et mängutootjate aktsiad saavad oma osa langusest.

- Rääkides mängutootjatest, siis ATVI, mis on täna hommikul 4% ELBO prognooside peale kukkunud, sai reede hommikul Banc of America analüütikutelt upgreidi. Varasema Neutraalse asemel Osta peale. Võimalik short squeeze tulemas ennast täna hommikul lühikeseks müünud turuosaliste kulul.

- Ivanhoe Energy (IVAN), mis figureerib täna eelturu tõusjate nimekirja tipus. Aktsiate 10% tõusu põhjust pole ma suutnud tuvastada. Siiski on aktsia viimasel ajal figureerinud ka LHV enimkaubeldute nimekirjas.

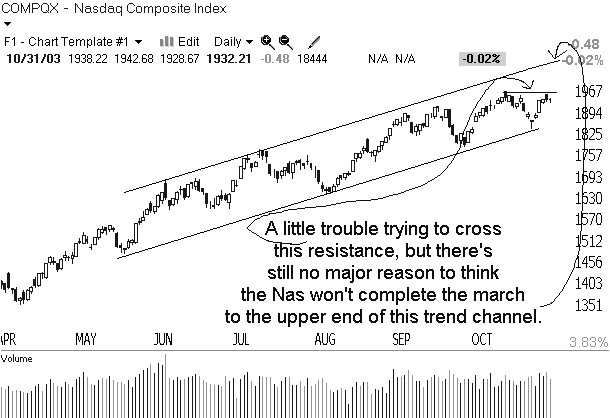

- Gary B. Smith

- ReVshark:

Good morning. As we enter the final two months of the year, the question we must contemplate is whether the bulls can persevere. We have been rallying steadily since March 12 and the major indices are all within a stone's throw of new highs. Is another breakout on the horizon?

The seasonal weakness that many expected to see at some point in August, September or October never occurred. The pullbacks were shallow and short-lived. We now enter the traditionally strongest time of the year and the bears are hoping that seasonal patterns continue to be ignored. More than one bear has been heard saying hopefully, "Since we didn't see weakness in fall we shouldn't expect strength in the winter."

One of the more interesting consequences of the persistent rally is that the folks who were looking to buy in order to position themselves for the end of the year never really had a chance. The ideal setup for an end-of-the-year rally would have been a rise in fear and a sharp pullback in September or October. Does the fact that we didn't really pull back a lot lessen the chances of a strong November and December as the bears hope?

The answer depends to a great extent on the degree that bulls remain underinvested. I contend that the high level of bullishness has not been an effective contrary indicator for a long time because so many of the bulls continue to have untapped buying power. After suffering through the ugliest bear market of their lifetime it hasn't been easy for even the most optimistic bull to stay fully invested. Taking profits was the smart thing to do for a very long time and the pressure still remains if you suffered through the popping bubble.

One of the consequences of a large supply of underinvested bulls is the prevalence of dip buying. As the market continues to work steadily higher the bulls who have cash available tell themselves, "The next time there is a dip I'm throwing money at it." The dips never really develop into anything major and the bulls who waited too long to put more money to work are once again left hoping for "buying opportunities."

As we start the week the technical picture looks fairly good. We bounced straight back up from the mid-October pullback but have been working off the overbought condition for the past three days by churning and gaining little ground. Given that the beginning of November is usually a strong period, we are set up for a run at news highs.

In the early going we have a positive start shaping up. European stocks are broadly highly. Semiconductors are leading the move to the upside based on a 6.5% increase in industry sales, the biggest jump since 1990. Obviously we're going to have to watch this sector today.

We continue to have a fair amount of earnings reports rolling in but most are from smaller and secondary companies. On the economic calendar we have vehicle sales, construction spending and the ISM number. The ISM number, which is a survey of the intentions of purchasing managers, is due at 10 a.m. EST and it has the potential to produce a blip or two.

Futuurid: Naz 0.60% SP 0.30%

sB

-

Kas keegi metallidega ka positsioone võtab? Vaadates just nikli ja vase meeletut rallit, tekib küll lühikese positsiooni isu varsti. Indoneesia vasekaevandus on turu küll täiesti segamini löönud, kuid teiste kaevadnuste toodangu suurenemine peaks hakkama hindu allapressima. Samuti plaanivad tootjad toodangu vähendamist.

-

PIR puhul jääb mulle segaseks väljend "head dividendid", äkki selgitad Bettie

-

1.5% div. tootlust

sB -

tänud Fit.

-

1.5 % vähevõitu kuidagi

-

CNXT + GSPN.Conexant on langenud 5,30 peale.Kas ja millal võiks osta ?

-

Analüütikud arvavad nii: Needham comments on CNXT/GSPN merger

Needham believes that this morning's Conexant (CNXT 5.26 -0.58)/GlobeSpan (GSPN 6.15 unch) merger is very logical, as CNXT was facing a heavy investment program to catch up with GSPN, TXI, BRCM, Atheros and others in 802.11, and was narrowly focused on ADSL for CPE only. Firm also believes the impact on CTLM is positive, since it calls attention to the co's low valuation as well as deal activity in DSL in particular; although it is unclear who the most likely suitor for CTLM would be, firm says BRCM and TXN are possibilities if either or both decide they do not have enough scale in ADSL; however, firm thinks that CTLM's very low equity valuation suggests that it would have difficulty buying an attractive 802.11 chip co such as privately-held Atheros.

sB -

Mõned teemad tänaseks päevaks:

- Storage area networks (SAN)-de alal tegutsev McData (MCDT) andis täna hommikul käibehoiatuse. Selles kvartalis peaks käive tulema $93-95 mln vs $107-$112 mln analüütikute konsensust. Põhjendus? "Unfortunately, the company was not able to reach agreement with its largest OEM, EMC, in October on a variety of terms in a time frame that would allow all orders to be fulfilled and recognized for McDATA's third quarter. However, we continue to work closely with EMC and value our strong, ongoing relationship." Sektori suurim tegija EMC (EMC) omab 80% osalust MCDT-s.

- Legendaarne investor Carl Icahn võib olla ostmas suurt osalust probleemide käes vaevlevas Eastman Kodakis (EK). Väidetavalt on miljardär saanud valitsuselt loa vähemalt $50 mln suuruse investeeringu tegemiseks. Eastman kaupleb viimase 15 aasta madalamate tasemete juures, kuna firma fototooted hakkavad digitaalsele revolutsioonile jalgu jääma. Tuttav riskifond alustas aktsiate ostmist juba $20 pealt (hektel $24) ning täna hommikuse jutuajamise juures mainisid nad oma lühiajaliseks hinnasihiks $26.

- JP Morgani analüütikud tõstavad täna hommikul Hewlett-Packardi (HPQ) reitingu Overweight peale varasema Neutraalse juurest. Kuigi konkurents IBM (IBM)-i ning Dell (DELL)-i suunall on lakkamatu, peaksid tulemused paranema hakkama.

- AG Edwards teatas, et alandab Qualcommi (QCOM) reitingu Osta peale Hoia peale. Põhjuseks loomulikult valuatsioon. Esimest korda märkan analüütikute analüüsis märget ka võimalikust konkurentsist Nokia (NOK) poolt. Teatas ju Nokia koos partnerite STMicro (STM) ning Texas Instrumentsi (TXN)-ga, et hakkavad CDMA turul kanda kinnitama (asi, millele Rene Ilves juhtis tähelepanu juba mõne kuu eest). Hinnasihiks $48.

- Wall Street Journal kirjutab huvitava loo pisikesest Matritech (NMPS)-st. Firma on tegev eesnäärmevähi tuvatamisel (siiani väga halvasti tuvastatav vähk) kasutatavate testide arendamise juures. Tegemist on väga suure turuvõimalusega ning konkurente on ka WSJ andmetel vaid üks. Tegemist on $2 aktsiaga, mis tõenäoliselt hüppab artikli mõjul kiiresti üles.

- Novell Inc (NOVL) teatas, et ostab 210 mln dollari eest Suse Linuxi. Lisaks sellele teatas firma, et IBM (IBM) investeerib firmasse läbi vahetusvõlakirjade $50 mln. NOVL on eelturul 20% üleval. Kui ma õigesti mäletan, siis Novell oli kunagi üks juhtivaid IT-firmasid.

- Keegi VeriSign (VRSN)-i graafikut on vaadanud?

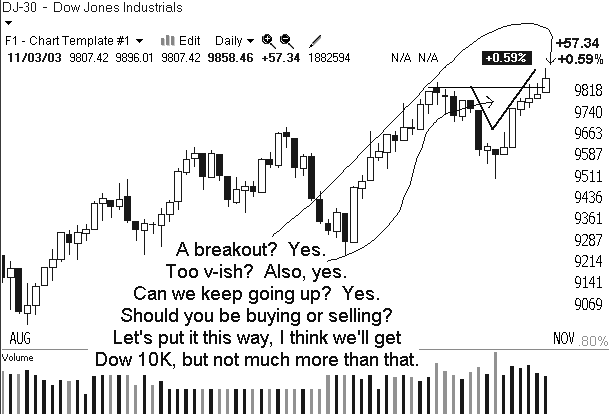

- Gary. B. Smith

- ReVshark

For seven months now we have been hearing reasons from the bears for why this market shouldn't be rallying. Many of the arguments are logical and sound and will ultimately prove to be correct. Unfortunately, for the pessimists the market isn't paying any attention to the negative scenarios. If you are making good money in this market you are making it on the long side.

The key to generating market beating returns is to press an advantage when you have one. Even if the market seems to be irrational and illogical, the folks who keep pushing when they have an edge are the ones who will prosper. Theoretical arguments about why the market should move one way or the other can seldom compete with the profits generated by catching a strong surge of momentum.

For many cautious investors, far more money is lost by overanticipation of events than is actually lost in the event. The different between pressing when things are going your way vs. selling and/or buying prematurely can make or break your performance.

When your luck is running and the opportunities are popping up at a quick pace, don't be afraid to take advantage. The money you can make when it feels like you are too late to the party can dwarf the losses you incur even if the market turns on you.

The folks who made the big money back in the bubble days were those who dared to walk the high wire as we flew higher and higher. They don't overanticipate a turn. They reacted once there were clear signs of trouble. Ultimately they benefited to a far greater degree than the skeptics who had turned bearish far too early.

Even in this somewhat extended market there continue to be many good opportunities on the long side. Don't allow yourself to become paralyzed by arguments that doomsday is on the horizon. Press your luck when it is running strong but be prepared to act quickly when the action indicates trouble is at hand.

Yesterday we saw clear breakouts to new highs in most of the key indices. Volume was lacking in some cases but breadth was solid and the bulls clearly have some momentum. The big question now is whether we can build on the breakout. Unfortunately, the move to a new high comes without much technical support. We are mildly overbought. We have had little basing action or consolidation and that makes it tougher for us to continue to move straight up.

However, don't be too quick to assume that a somewhat extended market means that we have major downside potential right now. One of the most dominate themes of this market has been the persistence of the dip-buyers. Over and over the pullbacks have been aggressively bought, producing V-shaped reversals.

There are simply too many folks looking for entries at better prices. They are the bids under this market and they will prevent a major meltdown, especially in this seasonally positive time of the year.

We have slightly negative action in the early going. European markets are flat and Asia was strong after a holiday in Japan. Gold is up and oil down. We still have earnings reports rolling in but nothing too major until Cisco (CSCO:Nasdaq) tomorrow evening.

It should continue to be a good trading market for adept stock pickers. There are pockets of strength and a lot of money looking to catch the hot stocks of the day. Be ready to roll. It's going to be another interesting day.

Futuurid: Naz -0.24% SP 0.03%

-

Hiljutine ProPick FBC tegi muide eile korraliku ~10% tõusu ning on tänagi pisut lisanud, liikudes 25USD kandis. Need, kes 22. okt. ei sulgenud, on tänaseks kenasti kasumisse jõudnud:)

-

Kiire mõte - AJG on praegu kukkunud üsna suppordi juurde (turuhind $29.04) ja stop on väga lähedal ($28.75), seega oleks praegu hea ostukoht, aktsia võib kiiresti $30 juurde minna.

-

Muuseas, kauaoodatud uudis kauplejatele/investoritele - alates 1. detsembrist hakkab kauplema indeksaktsia, mis peegeldab kulla liikumist.

-

Ma vaatan, et LHV kliendid on aktiivselt Yukost (YUKOY) kaubelnud (ostnud?), kust võiks saada selle ADRi kohta rohkem infot. Raskusi on nimelt reaalaja hindade kättesaamisel ja ega fundamentaalnäitajad ka paha ei teeks. Mis arvate üldse firma edasisest käekäigust?

-

kas teil valuutakursse kuskil lehel pole ?

-

Yanek, avalehel, üleval paremas nurgas.