Börsipäev 20 -21. november

Kommentaari jätmiseks loo konto või logi sisse

-

Euroopa turud tegid kell 11.10 kiire languse 2% - põhjuseks pommiplahvatused Istanbulis ja jätkuvad teated uutest plahvatustest ja hukkunutest.

Siiamaani on toimunud 4 plahvatust, muuhulgas 1 Briti Saatkonna ja 1 HSBC panga sealse peakorteri juures, teateid on vähemalt 6 hukkunust ja vigastatute arv üle 100.

Turud on siiski taastumas, põhjadest on suudetud uuesti ca 1% ülespoole liikuda.

-

Mõned teemad tänaseks päevaks:

- Istanbulis toimusid täna hommikul vähemalt 5 suurt plahvatust, milles esimeste andmete järgi sai surma 15-25 inimest. Üks plahvatustest toimus ka Briti saatkonna juures ning teine globaalse finantshiiglase HSBC kohaliku kontori ees. vastutuse on osaliselt enda peale võtnud al-Qaida. Euroopa turud reageerisid uudisele esimese hooga paariprotsendise kukkumisega, kuid siis tulid ostjad tagasi ning praeguseks on suuremad kaotused juba tasa tehtud. Kui me vaatame ajalugu, siis on praktiliselt alati tasunud osta terroriaktide poolt tekitatud langusi. Vähemalt lühiajaliselt. USA futuurid on vähem kui pool protsenti miinuses.

- Eile õhtul avaldatud Semi book-to-bill tuli oodatust veidi parem. 1.00 vs 0.96 analüütikute konsensust.

- Varian Semiconductor (VSEA) on täna hommikul 6-7% eelturul miinuses, kuna Banc of America langetas oma reitingu Neutraalse pealt Müü peale. Nende arvates on sobivaks hinnasihiks $29, aktsiate hetkel kaubeldes $43-45 kandis. Kommentaariks öeldi, et tegemist on "väikese kultusaktsiaga", kuna firma suutis eelmise tsükli tipus näidata väga tugevaid kasumeid, mis nüüd ei pruugi enam korduda. Konkurents on kasvanud.

- JP Morgan lisab Hewlett-Packardi (HPQ) oma Fookusnimekirja, pooleaastase $28 hinnasihiga.

- Barrons kirjutab, et turgusid võib ees oodata veel paar nädalat kukkumist. Tehniline muster nimega kiil (wedge) on allapoole murdunud ning see räägib enda eest. Lisaks sellele võivad langusele kaasa aitada sellised katalüsaatorid nagu terrorism ning hirm kaotada viimase 9 kuu jooksul võidetud raha.

- Reuters raporteerib, et Intel (INTC) on esimest korda ajaloos kukkunud flash mälude tootjate nimekirja tipust allapoole. Hetkel ollakse mahu poolest 4. kohal. Kaks esimest on nüüd Samsung ning Toshiba. Kolmandaks tõusis FASL LLC (AMD + Fujitsu). Kolmanda kvartali flash mälude turu maht oli $3.1 mld, mis on 27% enam kui teises kvartalis.

- Initial Claims 355K vs 365K consensus

- Dick Arms

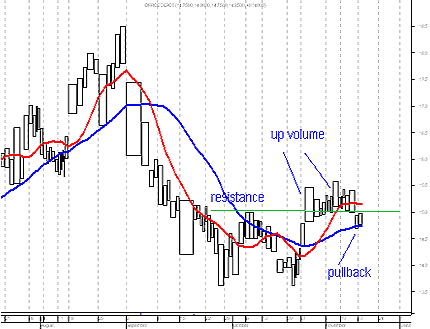

Office Depot (ODP) has been seeing good upside volume during the last month of trading. It broke up through an important resistance level, and has now pulled back on lighter trading. It looks as though it could be bought around current levels, looking for a return to the highs of late August.

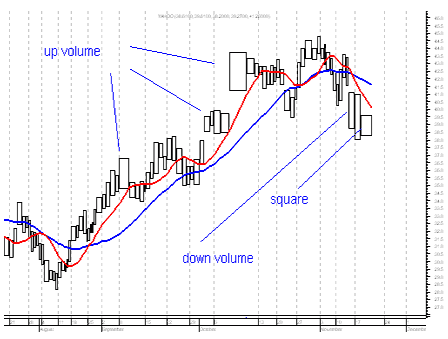

Yahoo! (YHOO) is another stock that appears to be heading lower, and could be sold short. Notice the way in which volume emphasis has changed recently. Prior to this week, each time it went higher volume tended to increase. But now we have seen downside volume coming in. Yesterday's very square Equivolume entry indicates some support at the lows for the day. Consequently, I would look for a rally over the next few days, but would treat such a rally as an opportunity to short the stock at a better level.

- RevShark:Multiple explosions in Turkey that killed at least 15 people have stirred up dormant fears of terrorism this morning. European markets quickly reversed after Al Qaeda claimed responsibility for the blasts. Asian markets closed before the news and were up nicely. Spot gold has had a muted reaction to the news and is only up about $1, to $396.

Will renewed terrorism fears be too much to bear for a market that is already struggling? In a more positive atmosphere, it would be easier for the markets to shrug off this attack. But this is not a particularly healthy market at the moment. The bounce yesterday was rather tepid, and the fragile momentum can easily be undermined if terrorism fears begin to blossom.

We probably would have had a positive open this morning if it weren't for this terrorist attack. Hewlett-Packard (HPQ:NYSE) posted a solid quarter. That and a decent semiconductor book-to-bill were sources of some reassurance for technology investors.

The bulls are still hopeful that yesterday's bounce will continue to build like so many of the other reversals have during this rally. I keep talking about the prevalence of V-shaped bounces during this rally, because I think it is the key to understanding the psychology that has been driving us since March.

The technical analysis textbooks will tell you that the odds of a V-shaped bounce are fairly low. It is more far more likely that there will be at least a couple tests of the lows before a chart turns back up and makes new highs. Investors usually need some time to shrug off their fears before a reversal is completed. They generally make several false starts and shake out the weak holders before gaining the strength to resume a rally.

That has not been the case during our long rally. The reversals have come quickly, and the moves back up have been without pause. Why is it that we have been defying the TA playbook?

I believe there are two reasons. Foremost, there has been a huge supply of underinvested bulls waiting to put their cash to work. They have been skeptical about this rally and have held back their cash, waiting for entry points. They have been given few chances to put money to work, so they have tended to pounce on the dips aggressively when they have occurred. The bulls who were still hesitating would then panic and help move us straight up.

The second reason for these quick recoveries is the presence of the serial shorters. The hardcore bears who have been convinced that this rally is doomed have tried to press each time we have dipped. When we start to bounce, they have helped fuel the move as they are squeezed out of their positions.

Are those dynamics still at work? Probably, but we have to wonder if the underinvested bulls are finally sated to some extent after all those months. Certainly there are many who have still failed to fully embrace this rally, but we have been running so strongly for so long now that the likelihood is that even the conservative bulls have put some cash to work and have less buying power available.

We have some interesting crosscurrents to deal with today. We'll see how the market deals with the terrorism concerns. There are positives such as HPQ and the semiconductor book-to-bill. We have the weekly unemployment report at 8:30 a.m. EST and leading indicators and the Philly Fed later in the day.

If we shake off these terrorism concerns this morning, that will be bode well for the bulls.

Futuurid: Naz0.47% SP0.42%

sB

-

MSNBC reports that White House is being evacuated after plane enters no-fly zone

-

MSNBC reports that situation resolved; plane escorted out of zone

-

Türklased on shokis eilsest jalgpallitulemusest. Nende asemel paugutaks ise kaa. :-)

-

LHV Pro all üks uus ning huvitav firma väga atraktiivsetel hinnatasemetel.

sB -

Päris kole pööre allapoole. Kuuldavasti uurimise all olevad fondid müüvad, et saada vahendeid investoritele maksmiseks, kes soovivad oma raha fondidest välja võtta. Sunnitud müük.

sB -

huvitav,

et kohe kui suurbritanniasse bush läheb,

hakatakse suurbritannia vastu terroit tegema..

ma vist olen paranoiline? -

Mõned teemad tänaseks päevaks:

- Euroopa turud tunduvad USA eilse kannapöörde päris ilusti üle elavat. Enamuse Euroopa börse on pisikeses plussis. Nagu juba eile õhtul mainisin, oli eilse suure kukkumise põhjuseks fondiskandaalid. Investorid soovivad fondidest lahkuda ning fondid peavad raha turult välja võtma. Põhimõtteliselt tekitab selline sunnitud müük mingil ajal ostuvõimaluse. (NB: täna on ka optsioonireede)

- Merck (MRK), üks Ameerika ning maailma suurimaid ravimitootjaid teatas eile õhtul, et kakestab MK-767 (diabeediravim) kolmanda faasi katsed, kuna ravimikandidaat ei ole päris nii ohutu kui varem arvati. Ravim oleks pidanud turule jõudma 2006. aastal ning omas üle 1 miljardi dollari suurust müügipotentsiaali.

Eilne uudis tuli vaid 10 päeva peale seda kui MRK oli teatanud MK-0869 (depressiooniravim) katsete katkestamisest.

Merck (MRK)-i puhul on probleemiks see, et ravimikandidaatide "pipeline" on üpriski kokku kuivanud. Ainukeseks tõeliselt suureks asjaks ongi jäänud Zetia/Zocori kombinatsioon, mis peaks turule jõudma 2004. aasta lõpus. Seda arendati teatavasti koos Schering-Plough (SGP)-ga.

Selles tulenevalt usun, et järjest tõenäolisemaks saab see, et MRK ostab mingil hetkel SGP ära. Sellega saadakse endale kogu Zetia/Zocori kasum, mida muidu peaks SGP-ga jagama.

Turuväärtused? MRK $100.5 mld, SGP $22.45 mld.

Täna hommikul Morgan Stanley alandab MRK-i reitingu Overweight peale Equal-Weight peale. Hinnasihiks $51.

- Disney (DIS) tulemused tulid eile õhtul analüütikute ootustest paremad. Puhaskasum aktsia kohta kahekordistus võrreldes eelmise aastaga. See peaks teatud kujul positiivselt mõjuma ka Six Flags (PKS)-i ümbritsevale sentimentile.

- Pisike Immtech (IMM) avaldas täna hommikul pressiteate, kus süüdistab lühikeseks müüjaid oma aktsiate eilses 33% suuruses kukkumises. Reeglina need firmad, mis hakkavad aktiivselt lühikeseks müüjatega meedia vahendusel vaidlema, kukuvad kindlamini kui need, kes ei hakka.

- Barrons kirjutab, et tervishoiusektoris tegutsev Baxter International (BAX) võib olla tulevikus väga heaks investeeringuks. Firma aktsiad on 2002. aasta algusest 54% kukkunud ning seda nõrgale nõudlusele firma toodete järele ja sellest tingitud kolmele kasumihoiatusele. Siiski mõned investorid usuvad, et nüüd suudab firma oma Q4 prognoosidega toime tulla. Hetkel kauplevad aktsiad 12.5x P/E juures, mis on märgatavalt allpool firma ajaloolist keskmist (22x). Lisaks sellele kauplevad aktsiad ka 60% allapool konkurentide valuatsioone.

- RevShark:The bulls were faced with some trials, temptations and disappointments yesterday. They started off nicely by overcoming the trial presented by the news of the terrorist attack in Turkey. The gap-down open quickly reversed, and that tempted the buyers, who took us into the green. The economic news was good, and we traded back above the important 50-day moving averages that everyone has been focused on. Things looked solid, but the afternoon turned into disappointment for the bulls as we fell fast and hard to conclude the day.

The popular media blamed the poor day on worries about terrorist action. It certainly was the most convenient explanation for the weakness, but if you were following the action, it doesn't ring true. The market had already shrugged off the terrorism worries by midmorning. It is illogical to attribute the afternoon reversal to renewed concerns about the events in Turkey.

So what did cause the reversal? Jim Cramer thinks it may have been options-related, in anticipation of expiry today. That may well be the case. We really don't have any way of knowing for sure, but the action had the feel of program trading.

This simply is a nervous market right now. We are down five of the last six days and eight of the last 10. We are cracking support levels, and the bears are beating the drums and shouting the refrain that the rally is over and that everyone is going to take their profits and go home for the rest of the year.

There is no question that the charts have weakened considerably. The Nasdaq has just barely broken the trendline that has been in place since March, and the S&P 500 has broken its 50-day moving average. We have had similar breaches during the course of this rally and have been able to overcome them, but that doesn't mean we will do so again. We need to be increasingly cautious.

The bullish scenario for this market is that this correction goes long enough and deep enough to raise the level of worry and concern and produce a deep oversold condition. Once weak holders are scared out and the level of concern grows, we will climb the wall of worry, enjoy a Santa Claus rally and hit new highs by the end of the year.The bears' response to this is to shake their heads and say "Everyone thinks that is how its going to play out, so it's certain not to happen." Are they right? Is it too widely believed to happen? One flaw with that thinking is that it assumes that the folks who believe in this scenario have already expended their buying power and won't have the funds to make it self-fulfilling.

That contrarian thinking has been wrong for many months now. Throughout this rally we have seen a very high level of bullishness, but we have continued to move higher despite what the contrarians have been arguing. I believe it's because the bulls have remained underinvested and cautious after being burned by the bear market. They have had untapped buying power and have only inched back in, even though they are feeling much more positive. Whether we rally into the end of the year or not will depend on this phenomenon continuing. The recent weak action actually undermines the bears' contention that contrarian clues point to a weak finish to the year.

In the early going, the tone is positive. The ugly conclusion to the day yesterday has been forgotten for the moment, and there is a little more confidence so far. Overseas markets are slightly positive. Intel (INTC:NYSE) has an estimate increase at Morgan Stanley, which has also raised its target price to $40. Gold is trading up to the $397 level again as traders position in anticipation of another assault on the $400 level.

It's option expiry day, which will create some random action. Be careful out there, and don't forget that we are technically very vulnerable right now. Keep those stops tight.

Futuurid: Naz0.40% SP0.26%

sB

-

So far so good,

Indeksid on rohelises aga kauaks? Tõenäoliselt Semid (SMH) annavad vastuse. Eilne kukkumine sai alguse Intelist (INTC)...

sB -

LEXR: Market chatter that Intel will make a bid for Lexar