Börsipäev 28. november - kauplemine kuni 20.00

Kommentaari jätmiseks loo konto või logi sisse

-

Mõned teemad tänaseks hommikuks:

- Kristjan kirjutab AValöögi all päris huvitavatest ajaloolistest turu liikumistest. Tänane päev on viimase 50 aasta jooksul 79% kordadest positiivselt lõppenud (SP500 jaoks). Vähemalt hetkel on futuurid päris tublis miinuses. Põhjuseks ilmselt dollari kukkumisega seotud negatiivsus.

- Sibneft teatas, et katkestab liitumistehingu Yukosega (YUKOY). Viimase aktsiad on selle uudise peale 7-8% miinuses.

- Lõbustus-ja teemaparkide operaatori Six Flagsi (PKS) COO (chief operating officer) lahkub tööpostilt tervislikel põhjustel. Kui aktsiad peaksid selle uudise peale kukkuma üle 5% on see lühiajaline kauplemisvõimalus. PKS on LHV Pro valik ka veidi pikemas perspektiivis.

- Business Weeki valikud on täna hommkul Biolase Tech (BLTI), MedAmicus (MEDM) ning Mattel (MAT). BLTI on eriti huvitav mäng, kuna 39% firma aktsiatest on lühikeseks müüdud. Siiski firma tulemused on pärast mitmeaastast madalseisu paranemas ning tänane BW artikkel võib tekitada lausa hiiglasliku short-squeezi. BLTI tegeleb uut laadi hambapuuride arendamise ja müügiga. BW hinnasihiks $20.

- Pooljuhtide müük oktoobris kasvas 23.3% võrreldes eelmise aastaga (kasv 6.8% võrreldes eelmise kuuga). Käibeks $15.4 milajrdit.

- Wall Street Journal kirjutab täna Merckist (MRK) loo, kus mainitakse, et firma 11 ravimikandidaadist on viimase aja jooksul 4 tükki ebaõnnestunud. See jätab firma päris kitsikusse ning üheks võimalikuks väljapääsuks on Zetia/Zocori partneri Schering-Plough (SGP) ostmine. Lisaks sellele teatas täna SGP juht, et on ostnud ligemale $5 mln eest firma aktsiaid. SGP on selle uudise peale eelturul tõusnud $15.70 peale.

- Dick Arms:

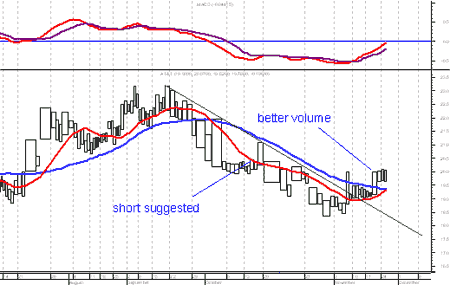

Oct. 16, AT&T (T) was suggested as a short. Now, after a substantial decline, it appears to have started to turn higher, and might be considered for a buy. The descending trend line has been penetrated and volume has improved as it has moved higher. The two moving average lines appear on the verge of crossing to the plus side. The MACD has already gone positive

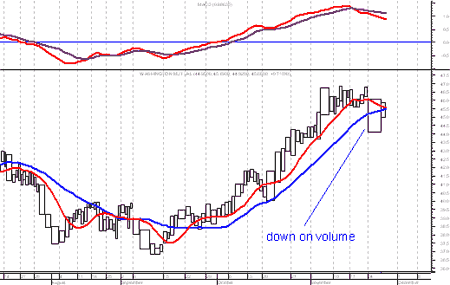

Washington Mutual (WM) has had a substantial advance over the last three months, but now appears to have turned lower. Two days ago, based on news, it took a big hit, and did so with much heavier volume. That produced a down box that implied it would go lower. MACD and moving averages are turning to the downside. It rallied yesterday, but on lighter trading. It looks like a short at current levels.RevShark:

hope everyone had a happy Thanksgiving. We have a short day today. The market closes at 1 p.m. EST, which should make it a little easier to deal with the holiday torpor. The other nice thing about the day after Thanksgiving, at least for the bulls, is that it is frequently a positive day for the indices. The buyers are in a shopping mood as the holiday season kicks in, and the sellers tend to take a break.

The key thing to remember about today is that the action is artificial since it is so thin. Don't try to read anything significant into what may happen today. Next week we'll have to deal with reality again. Today is simply the market equivalent of a slot machine with better odds.

The primary news so far this morning is the strength of the euro vs. the dollar. For the first time the euro has broken the $1.20 level. There are a variety of repercussions from the weak dollar, but probably the easiest to see is an increase in the price of gold. Spot gold is hitting 398.4 x 398.9 this morning. It has made several runs at the 400 level recently but has been unable to hold it so far. Although spot gold has yet to cleanly break out, the Philadelphia Gold and Silver Index (XAU) broke to a new high on Tuesday. It is now trading at its highest level since 1987.

Can the market rally with a weak dollar and strong gold? Don't those two things indicate that equities are in for some challenges? Perhaps, but historically there isn't a particularly strong correlation. We have periods when gold and equities move together and periods when they move counter to each other.

The weak dollar is more problematic. It can cut both ways. Some companies will enjoy competitive price advantages when selling overseas, while others will suffer higher costs if they use a lot of foreign suppliers. A weak dollar can be a good thing for a variety of stocks, while pressuring others.

Early indications are that the market is feeling like many of its participants: sluggish. We have a slightly negative open setting up at the moment. Overseas markets did fairly well yesterday while we were enjoying our turkey dinners, but are stumbling a bit today with mixed action in Asia and weakness in Europe.

It is fairly quiet on the news front today. Analysts are taking a break and there is no economic news to deal with.

It is going to be a thin day out there today and it will be quite easy to be caught by surprise if you aren't careful. However, there is likely to be some interesting trading action if you are quick and figure out where the hot money is flowing.

Futuurid: Naz-0.53% SP-0.38%

sB -

Selline uudis, SGP selle peale 3% plussis:

Fred Hassan filed a Form 4 this morning, which said he bought 303,500 shares of Schering-Plough on Wednesday. The $4.7 million purchase is more than a vote of confidence from the new SGP CEO... as a whole, corporate insiders have been cashing out in droves lately.

According to last week's issue of Barron's there had only been $52 million of insider buys this October, compared with $3.2 Billion of insider sales. -

Ma usun, et tänast nõrkust tuleks veidi osta, kuna tõenäoliselt suuremad turuosalised tulevad turule alles esmaspäeval. SP on tippudest kukesammu kaugusel ning kui täna õhukesel turul tegutsevad (lühikeseks)müüjad agressiivsemaks lähevad, saavad nad esmasp. hommikul karmi üllatuse osaliseks.

fwiw,

sB, long this and that.