Börsipäev 11.detsember

Kommentaari jätmiseks loo konto või logi sisse

-

Eile peale turu sulgemist tõstis oma Q4 prognoose TriQuint (TQNT), EPS ennustus tõsteti 0,03-0,04$ vs 0,02-0,04$ ja käibeprogoosi tõsteti $85-87M vs $80-83M. Aktsia tõusis uudise peale järelturul 5%, mind paneb imestama, kas tõesti on kellegi jaoks veel uudis, et mobiiltelefonide müük läheb hästi?

Warnaco (WRNC) teatas eile restruktureerimisprogrammist, ettevõte sulgeb 44 Speedo toodete poodi ja edaspidi müüakse tooteid WalMart poodides. Samuti outsourcetakse Põhja Ameerika pesutootmine ja ratsionaliseeritakse Warner brandi organisatsiooni Euroopas. 44 poe sulgemine ja müügi üleandmine WMTle on kahtlemata hea uudis WRNCle.

JP Morgan upgrades ERTSi, mis viimasel ajal on suure müügisurve osaliseks saanud. Overweight vs Neutral, põhjuseks oodatav hea jaemüük ja mure jaemüügi languse pärast on liialdatud. Aktsia võib tõusta täna, kaasa liiguvad TTWO, ATVI.

Wall Street Journal kirjutab täna AT&Tst (T) ja VoIPist. Nimelt hakkab AT&T varsti VoIP teenust pakkuma ja lisaks telefonide tarkvara ärilahendusteks. Teenus peaks suuremates metropolides firmadele ja tarbijale kättesaadavaks muutuma 1Q 2004.a. WSJ artikli peale liiguvad EGHT, NTOP, DDC, VOCL, VTEK ja ZTEL.

Barron's kirjutab täna Citigroupist (C) positiivse artikli, aktsia tundub odavana võrreldes ajaloolise valuatsiooni ja kasvuvõimaluste taustal. Kuigi aktsia on 52 nädala tipu lähedal on see siiski 13% madalamal kõigi aegade tipust:

Merrill Lynch tõstis BRCD investeerimissoovituse "Neutral" tasemele, varasemalt "Müü" tasemelt. Põhjuseks valuatsioon, võimalik marginaalide kasv järgmisel aastal ja CSCO oodatust väiksem konkurents.

DCGN teatas, et on avastanud kaks uut geeni, mis põhjustavad inimeste rasvumist. Koostööd tehakse Merckiga (MRK) ja püütakse arendada ravim rasvumise vastu. Kui ravimist asja hakkab saama, siis ilmselt ostab Merck DCGNi ära.

IDC tõstis 2003 ja 2004 aastate PC müügiennustusi. Nõudlus on tugeb tarbijasegmendis ja nõudlusele aitab kaasa ka agressiivne hinnapoliitika. Aastane PCde müük peaks y/y tõusma 11,4% (varasem ennustus 8,4%).

Ivanhoe Energy (IVAN) lisatakse S&P Toronto Stock Exchange indeksisse, alates 19.dets.

Initial Claims 378k vs 359k consensus

Retail Sales 0.9% vs 0.7% consensus; ex-auto 0.4% vs 0.3% consensus

Kuigi tehniliselt võiks turud teha põrke on märgata mõnda suurt müüjat.

-

RevSharki kommentaar:

The strict truth about yesterday's market action was that it didn't look bad at all. The major indices were down just a few points and actually managed a decent rally to conclude the day. The S&P 500 formed a hammer on the candlestick charts and closed above the November support levels. The Nasdaq 100 actually finished up 5 points, which must indicate that everything is just fine in the technology sector.

Why the yelps of pain and howls of anguish from so many active traders yesterday? The hot-money momentum boys were moaning and groaning about the action on their screens yesterday. It sounded like they were looking at a completely different market than what is laid out above.

The real truth of the market yesterday is that many recent winners were trashed, smashed, defiled and besmirched. The small-caps have been the leader of this market for some time, but yesterday the small-cap indices were the laggard with declines of greater than 1%. Still, that isn't all that terrible but if you look a bit deeper Nasdaq breadth was almost 2 to 1 negative, which means weakness was pervasive.

However, the best indicator of what happened to many momentum stocks can be seen by looking at the IBD top 100 stocks. This is a list of highflyers that meet the CANSLIM criteria popularized by William J. O'Neil, the publisher of Investors Business Daily. The IBD 100 was down a whopping 4.2% yesterday, which is equivalent to a drop in the DJIA of 416 points. If you heard some howls of pain form the hot-money momentum boys, that would probably explain it.

The question for us to contemplate this morning is what the pain and suffering in the momentum stocks and small-caps mean for the broader market. Is this simply a rotation out of stocks that investors have big gains in, into less-extended names, many of which are big-caps like General Electric (GE:NYSE) and General Motors (GM:NYSE)? Or is this a symptom of a more fundamental disease that is likely to spread and infect the whole market? After all, the major indices are still up a tremendous amount and if investors are taking profits in the small guys aren't they also likely to take profits in the big boys?

One of the problems for the market is that the big-cap stocks that are leading right now are not the types of stocks that tend to lead sustained rallies. The market generally needs leadership from groups such as the financials, technology, biotechnology, retailers and semiconductors in order to support a sustained rally. We don't have that right now, which means we are lacking the juice that will boost the market. That juice is momentum and there isn't much to be found.

Without better breadth and momentum, traders will have to stay very cautious. We may see some bounces and there may be some big-caps and cyclical stocks of interest but for now momentum is floundering.

I strongly suspect we will see another big burst of momentum around the end of the year but we have to be very careful about overanticipating such an event. Wait for evidence of better health before you remount your small-cap and momentum favorites.

In the early going we have a slightly positive open shaping up. John Chambers CEO of Cisco (CSCO:Nasdaq) offered some cautiously optimistic comments overnight about IT spending. The dollar is finding some support and spot gold is trading back down to the $403 level.

Semiconductors are indicating a follow-through to yesterday's bounce. This is going to be a particularly interesting group to watch. The chart is badly broken and the bears have to be watching for opportunities to short into strength. They have been burned many times in the past six months trying to short bounces after weak technical action, but perhaps they have more resolve this time.

-

mis raffas arvab, kas peaks täna õhtul pikad positsioonid kinni panema?

-

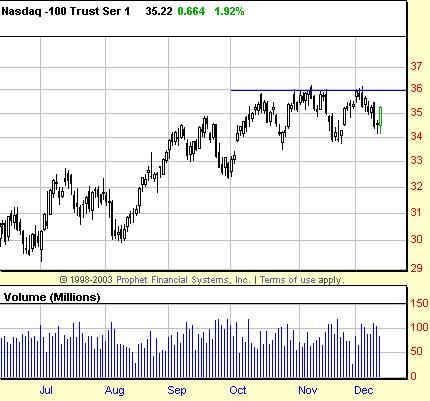

Andy, loomulikult oleneb ka, mis aktsiad sul on, kuid hetkel tundub, et QQQ läheb natuke veel üles, võibolla homme õhtul kinni panna (juhul, kui on tehnoloogiaaktsiad/turuga kaasas käivad aktisad):

-

Dow taas 10 000 punkti ja paistab, et sulgeme sellest tasemest kõrgemal.