Börsipäev 17. dets - põrkame veel?

Kommentaari jätmiseks loo konto või logi sisse

-

Mõned teemad tänaseks päevaks:

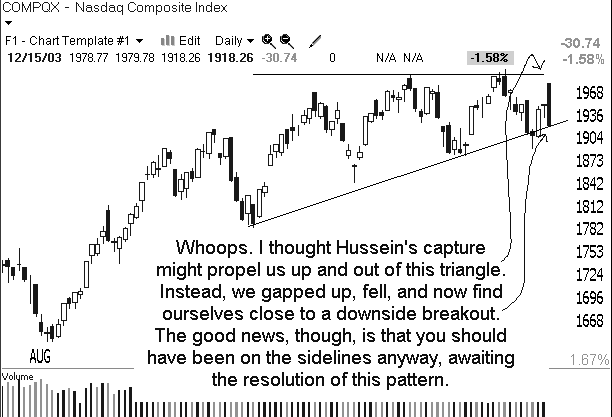

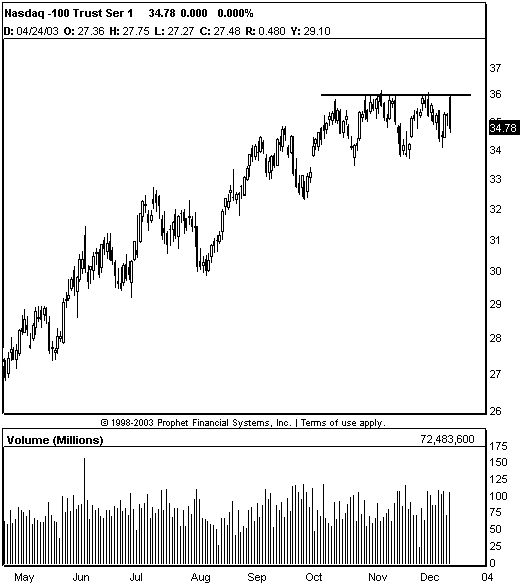

- Turg ei tahtnud eile isegi mitte põrgata. Suhteliselt halb märk oli ka see, et suured indeksid ning eriti Nasdaq 100 (QQQ) ei suutnud jälle murda viimasel ajal tehtud tippusid, vaid tulid sealt kohe alla. Ma ei hakka siinkohal kindlasti mitte tehnoloogia tippe väljakuulutama aga järjest negatiivsemana see liikumine näeb välja küll.

- Extreme Networks (EXTR) andis üllatuslikult kasumi-ja käibehoiatuse jooksvaks kvartaliks. Varasema 2-sendise EPS-i asemel loodetakse 2-6 senti kahjumit. Käibeks prognoosib firma jooksvas kvartalis $80-84 mln vs $92 konsensust. EXTR kaupleb 80x selle aast ning 40x järgmise aasta kasumit aktsia kohta. Lähimaks konkurendiks Foundry (FDRY) ning mõningal määral ka 3Com (COMS).

- Cap Gemini Ernst & Young, Euroopa suurim IT-teenuste firma andis oma kolmanda kasumihoiatuse sellel aastal. Räägib vist nii mõndagi Euroopa IT-nõudluse kohta?

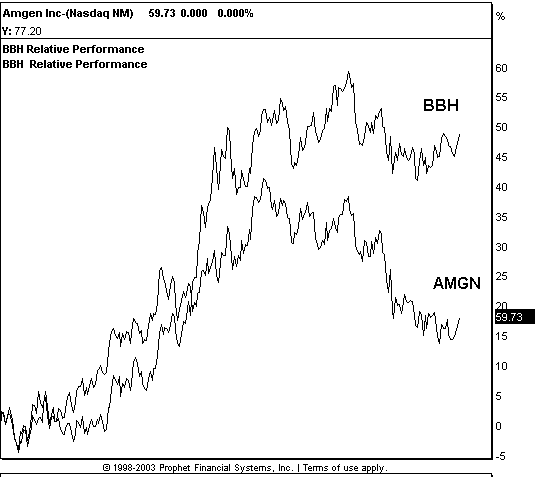

- Amgen (AMGN) teatas eile õhtul oma 2004. aasta prognoosid, mis jäid natuke alla analüütikute konsensusootustele. Aktsiad kukkusid järelturul paar protsenti. Siiski tasub mainida, et maailma suurima biotehniloogiafirma aktsiad on oma liikumisega sellel aastal märkimisväärselt alla jäänud sektorile. Näiteks on Biotech HOLDRs aasta algusest ligemale 50% plussis, kuid Amgen (AMGN) vaid ligemale 20%. Amgeni aktsiad kauplevad 24-25x järgmise aasta kasumit aktsia kohta, mis on vist kõige madalam number kõigi kasumlike biotechide seas. Üks sektori kommentaator tõi võrdluseks Eli Lilly (LLY), mille aktsiad kauplevad ka 24-25x järgmise aasta kasumit aktsia kohta. LLY on suur farmaatsiafirma.

- Current accounts -$135 bln vs -$136 bln consensus

- Housing starts 2.07 mln vs 1.914 mln consensus

- CPI -0.2% vs 0.1% consensus; core CPI -0.1% vs 0.1% consensus

Turu reaktsioon positiivne, dollar liikus euro vastu roheliseks.

- Kas täna võib tulla põrkepäev? Väga tõenäoline.

- Gray B. Smith:

- RevShark:The economic reports this morning are a bit surprising. CPI came in lower than expected, which indicates that inflation is not an issue that we need to worry about. Bonds are up sharply on the report.

Housing starts jumped sharply. Apparently consumers are buying homes rather than shopping at Target (TGT:NYSE) and Wal-Mart (WMT:NYSE) these days. The shorts have recently had a little success with their homebuilding positions, but it has not been an easy ride.

The economic data produced a slight uptick in our early indications but it certainly isn't looking very enthusiastic out there. We'll have to be very selective with our stock picking, keep stops tight and shorten time frames if we want to stay busy. If you have a longer-term time frame it's probably a good time to go finish up your holiday shopping.

There is no other way to spin it or characterize it: yesterday's market action was a disappointment for the bulls. Their hopes and expectations for a powerful rally were quickly dashed as we sold off steadily with increased vigor and volume as the day progressed. Breadth was poor and there was some very weak action in big blue-chips like Wal-Mart (WMT:NYSE) as well as recent momentum favorites like the Chinese industrial stocks.

Why did the day play out this way? After all, we have had generally good economic news recently in addition to the capture of Saddam. The simplest explanation is that after rallying for nine months investors have some hefty profits to protect. The big gap open on the Saddam news was tantamount to a flashing neon sign that said, "Lock in Profits!" Once the profit-taking kicked in it fed on itself as more market participants worried as they watched unbooked profits erode.

At this juncture folks are simply more worried about protecting existing gains than they are about trying to rack up some additional gains. They are thinking defensively and not offensively. Many of them feel they have already won the game this year so all they have to do now is stay conservative and run out the clock. This isn't the time to be aggressive and risk a turnover.

Will the inclination to protect this year's substantial gains pressure the market for the two weeks remaining in 2003? I'm looking for more pressure the rest of this week but I expect stabilization, especially around Christmas, as market participants start thinking about and positioning for the new year.

I do believe it is possible that we have seen the highs of the year. The year-end bounce that I'm anticipating may come from low enough levels and late enough in the year to be incapable of building new momentum. In that case I'm looking for an assault on the highs to come in early January. The bull isn't dead but he needs a rest.

For now we have to slog through a tough-looking environment. We have some very disappointing action in the retail sector as well as technology stocks. Amgen (AMGN:Nasdaq) isn't doing much for the biotechnology sector with its lackluster guidance. There are very few pockets of strength at the moment.

Overseas markets are reacting negatively to the weak action in the U.S. yesterday, with weakness across the board. The dollar continues to struggle, spot gold is up slightly and oil is down.

After the selloff yesterday the market is going to have some real difficulty regaining speculative momentum. As I mentioned yesterday morning, we have had quite a few black candlesticks lately, which indicate market failure after a decent open. Until the market starts seeing better buying interest at the close we can't be confident that upside momentum will return. Morning gaps that fail quickly undermine investor confidence.

For now, stay defensive, hedge yourself if that's your style and don't rush into buying new positions. Track your favorites but keep your powder dry and wait for the profit-taking to run its course. The market needs some time to stabilize and develop some support.

Futuurid: Naz-0.25% SPunch -

Üks huvitav graafik lisaks. Aktsia on murdnud vastupanutaseme ja tõenäoliselt jätkab tõusu. Stop 16,75$.

-

.

-

eeee . . . Time Warner sümbol?

-

TWX

-

ajab vihale... no ajab vihale lihtsalt noh

mis ma siin kauplen ja uurin ja puurin kui dollari langus kõik võidud ära sööb lihtsalt. eks varsti hakkab ka Bushil päriselt jalgealune kuumaks minema kui nii edasi läheb :)

siis ongi nii, et kui alustas sõda, et kaitsta dollarit, sest naftaäri kippus eurode peale minema, siis nüüd on sama tulemus käes ja hunnik inimesi on tapetud ja elu täitsa sassis ja kampaania rahastajad jäävad ikka kogu aeg vaesemaks ja vaesemaks.

mis võiks üldse olla dollari tõusu ajaperspektiiv ja key event?

Terv Tiit -

tiitp, osta ETL-i. Kui aktsia hind muidu ei tõuse, siis koos dollariga on ikka hinnatõus garanteeritud.

-

tiitp.

Keskendu hetkel dollarite arvu suurendamisele oma portfellis.

Lootus USD kursilangusest tekkinud vahe täitmiseks (näiteks

2 aastases perspektiivis) on piisavalt tõenäoline.

Dollareid lähitulevikus EEK baasil kasutades tuleb paratamatult

aluseks võtta usd hetkekurssi. -

isegi siis kui 13.1 pealt usdi ostma hakkasid, on valus.

samas kui hansapanga usdi ostu-myygi spread väljendab ilmekalt usdi volatiilsust.. -

Ostke Gillette pikaks! Teised on miski "mehele parim" sarja uue asja valmis saanud: http://no.spam.ee/~tonu/mach3.jpg.

take it seriously ;) -

Mõned teemad tänaseks päevaks:

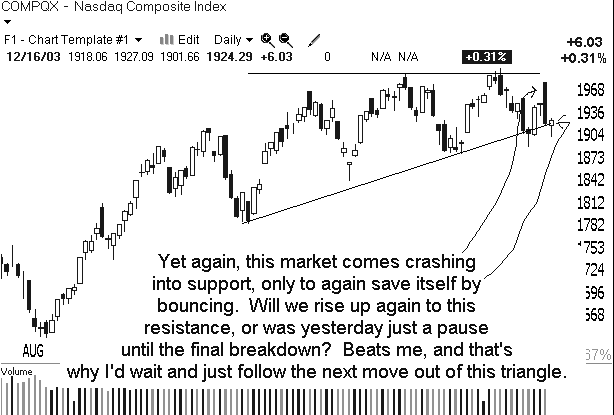

- Turg põrkas eile veidi ning mitmed turuosalised usuvad, et kuni reedese optsioonide lõppemiseni peaks tuul puhuma just pullidele soodsast suunast. Seda loomulikult eelmisel nädalal kõvasti put-optsioone ostnud turuosaliste tõttu.

Asja võib mõningal määral ära rikkuda SARS-i teemaline uudis Taiwanist, kus teatati, et ühel sõjaväelise uurimislabori töötajal tuvastati nakkus. SARS-i uurivad teadlased on pikalt hoiatanud viiruse tagasitulemise eest ning uudis selle kohta lööks kõige raskemalt ilmselt USA tehnoloogiasektorit.

- JP Morgan tõstab täna hommikul Inteli (INTC) 2004. aastal tootmisvahenditesse investeeritava kapitali prognoosi. Varasema 3% languse asemel ootavad analüütikud 10% suurust kasvu. See on positiivne just eelkõige Inteli jaoks masinaid tootvate firmade nagu AMAT, NVLS, LRCX jt. jaoks. Moodustab ju Intel umbes 20% kogu globaalsest capexist.

- E*trade (ET) tõstab täna hommikul oma 2004. aasta kasumiprognoose. EPS peaks tulema $0.70-0.85 versus 0.69 analüütikute konsensust. Samal ajal prognoosib firma 2003. aasta EPS-ks $0.50-0.54 versus $0.58 analüütikute konsensust.

- Wachovia analüütikud tõstavad täna hommikul Extreme Networksi (EXTR) reitingu Market Perform peale varasema Underperform pealt. Firma andis eile päris koleda kasumi-ja käibehoiatuse jooksvaks kvartaliks, mis langetas aktsiate hinda ligemale neljandiku võrra. Wachovia toob reitingu tõstmise peamiseks põhjuseks, et EXTR on allahinnatud võrreldes sektori teiste aktsiatega. Lähim konkurendi Foundry (FDRY) kaupleb 45x selle aasta kasumit aktsia kohta. Ütleb nii mõndagi.

- Suured elektroonika jaemüüjad avaldasid täna hommikul tulemusi:

Best Buy (BBY) tuli selles kvartalis OK, kuid langetas Q4 ja 2004. aasta kasumiprognoose. Aktsiad eelturul 2% miinuses.

Circuit City (CC) tulemused tulid jällegi allpool analüütikute konsensust. Firma aktsiad pole eelturul kaubelnud, kuid avanevad 5-10% allpool.

- Gary B. Smith:

- ReVshark:

A cursory glance at the indices would give the impression that yesterday was a pretty solid day for the markets. The DJIA and S&P 500 made new closing highs and the Nasdaq and Russell 2000 battled back from weak action to close in positive territory. That certainly looks pretty good.

However, when you dig a bit deeper the picture is not nearly as clear. Despite the strength in the indices a number of growth stocks, momentum favorites and small-caps were quite weak. The IBD 100, which is composed of growth stocks with exceptional relative strength, was down nearly half a percent yesterday.

What is going on here? Is this healthy for the overall market? It looks like investors are taking profits on some of the biggest winners to move into industrial and cyclical stocks that have not appreciated as much. After all, there are some huge gains in the sorts of stocks that make up the IBD 100 and it makes sense to not let those gains slip away, especially when the market had such a tepid response to the capture of Saddam. This is the first year in three when there were big gains to take and many folks will be happy to finally use the benefits of their capital-loss carryforwards.

But why the action in the stodgy industrials and cyclicals? Momentum money is just looking for some place to park until the growth favorites are sold out and ready to rally again. After all, the DJIA and S&P500 are at closing highs so there must be something that the hot money can chase. The momentum boys are only loyal to whatever is moving at the moment. At the moment it is industrial stocks.

Will this rotation into non-traditional momentum stocks last? Probably not. The core holders in these stocks tend to be conservative value-orientated funds that are going to be happy to sell to the hot-money boys if they run things up sharply. Supply will tend to overwhelm demand much quicker in cyclicals and industrials than in growth stocks.

I've mentioned several times lately that my working thesis is that we will have some aggressive profit-taking until around Christmas and then a sharp rally into the end of the year and first half of January. Despite what the indices are showing we are seeing the sort of profit-taking in the momentum favorites that are likely to lead a year-end bounce. Some of the pullbacks have been very sharp, especially in small-caps. Once these stocks stabilize and base a bit they will be set up for a decent rally.

In view of that thesis I'm staying very conservative with my buying. I am preparing lists of buy candidates and looking toward next week to become more aggressive in the accumulation of my favorites. If this selling continues it is not going to be hard at all to find stocks that have given back 50% or more of this years gains.

Over on Street Insight Doug Kass has been saying for some time that this market has no memory from day to day. That looks like the case this morning. Despite a solid finish yesterday we have a weak open shaping up. Overseas markets were not motivated by the strong action in the DJIA and are in the red. A case of SARS in Taiwan seemed to be the main culprit for the weakness. The dollar's continued struggles also is keeping the pressure on firms that export to the U.S.

We have nothing on the economic calendar today but a couple of big IPOs including Orbitz (ORBZ:Nasdaq), and earnings from some big brokers will provide some news.

Be careful out there. There are some major pockets of weakness and it is quite easy to be caught in an air pocket if you are in the wrong stocks.

Futuurid: Naz0.11% SP-0.07%sB

-

Tänane Avalöök jäi kiirete aegade tõttu vahele, kuid LHV Pro all on üks uus kauplemisidee.

-

Tänane suur IPO - China Life (LFC) on ka LHV-s koheselt kaubeldav.

-

Tonuonu, right back at ya!

http://www.megaphonic.co.uk/image001.jpg

sB -

Ega ometi SARS turge maha suru....?

-

Küsimus teadjatele, kas keegi oskab täpsemalt öelda mis toimub Harken Enrergy (HEC) aktsiatega. Kolmandat päeva toimuv tõus a' 15% päevas päris suurte käivetega ???

-

15. dets teatas HEC mittestrateegilisest Panhandle'i varade müügist 7 mln $ eest ja kõigi pangavõlade tasumisest (4 mln $). Eks see ole üks tõusu tekitaja.

-

thnx :)

-

Uurisin veidi veel Harken Energy (HRC) kohta. Oluline põhjus tõusuks oli ka 15. dets Marketwatch'i kolumnisti Thomas Calandra artikkel, kus ta käsitleb HRC-d ja kus ta ütleb, et HRC-l on potentsiaali tõusta järgmiseks Ivanhoe Energy tüüpi aktsiaks. HRC otsib samuti võimalusi välisriikides nafta- ja gaasitootmisega alustamiseks ning veel detsembri lõpus peaks Costa Ricast tulema oluline otsus, mille kohaselt HRC peaks jõudma sealse valitsusega kokkuleppele keskkonnaalaste piirangute osas. St, et HRC peaks seal saama tootmist varsti alustada. Samuti peaks HRC varsti saama nafta- ja gaasikaevandamisloa Nicaraguas. Calandra aktsiat otseselt osta ei soovita, kuna risk on liiga suur, kuid siiski ütleb ta, et lähiajal võib näha HRC puhul samasugust tõusu nagu oli seda IVAN-il. Kusjuures Calandra andis IVAN-ile ametliku ostusoovituse kui aktsia maksis $0,95.

-

sry, Harekn Energy sümbol ikka HEC

-

HECi suhtes on huvitav, et Calandra pickis ta juba 14. dets. õhtul. Kuni tänaseni ta väga ei tõusnud ja kõlkus niisama 75 sendi kandis. Aga eileöise taasmainimise peale rallib täna ropult. Ilmselt osad tyybid loevadki ainult igateisipäevast "ametlikku" ülevaadet. Weird. Oleks võind osta eile õhtul 75 sendi pealt. Oleks schmoleks...