Börsipäev, 9.veebruar.

Kommentaari jätmiseks loo konto või logi sisse

-

Tenet Will Not Likely Survive in its Present Form

According to Shareholder Committee Report

MIAMI, Fla., Feb. 9 /PRNewswire/ -- The Tenet Shareholder Committee today

issued a report, "Tenet's Death Rattle," predicting that Tenet Healthcare

Corp. will not likely survive in its present form.

"With Tenet's rapidly deteriorating cash position and potential multi

billion liabilities, we do not see how Tenet can survive as it is currently

structured," said M. Lee Pearce, M.D., chairman of the committee. "It seems

to us that the more likely outcome is a reorganization of Tenet into several

separate regional companies, perhaps as many as four," Pearce added.

"Looking ahead, what good news is out there for Tenet over the next year

or two?" Pearce asked. "How will Tenet -- burdened with multiple

investigations and huge potential liabilities, multiple earnings

disappointments, many debt downgrades to real junk status and other problems

-- navigate in what is already a very difficult environment for the entire

hospital industry?" Pearce added.

"In our view, Tenet will not have sufficient liquidity to handle the

eventual costs resulting from multiple government investigations, malpractice

lawsuits at Redding and other hospitals, multiple shareholder lawsuits and

other liabilities," Pearce said. "Can Tenet's liability be any less than the

$1.7 billion paid by HCA for an investigation that did not involve patient

deaths, and was only financial fraud? We think the bill for Tenet's alleged

wrongdoing will be considerably higher," Pearce added.

"Despite mostly cosmetic changes, slowly and reluctantly adopted, Tenet

still lacks the proper corporate culture, corporate governance, and quality of

care necessary to survive," Pearce said.

Observations from the Tenet Shareholder Committee report include:

-- Operations at the 27 hospitals to be sold will likely deteriorate

rapidly, as is often the case in the hospital industry following

announcement of a pending sale. This will likely cause a further

drain on Tenet's cash flow. Since the scandals erupted in late

October 2002 and following this planned sale, Tenet will have sold or

closed nearly 40% of its hospitals.

-- The committee believes Tenet's total liabilities arising from federal

and state investigations of outlier overpayments, Medicare upcoding,

past corporate integrity agreement violations, physician relocation

practices, many poor quality of care issues, as well as medical

malpractice lawsuits and shareholder lawsuits to be at least $3

billion.

-- Particularly in a national election year, the committee believes it is

highly unlikely that the government will enter into a favorable global

settlement with Tenet, a company with a felonious past and alleged

recidivist behavior. Opinion polls taken during the recent primaries

show that healthcare is a top issue in the 2004 election.

-- Even with the planned sale of the 27 hospitals, the committee believes

substantial asset sales will be required to support the company's

existing $4 billion in debt and the huge payments resulting from

government investigations, malpractice lawsuits, and other huge

liabilities associated with the $17 billion loss of shareholder value

over the last 15 months.

According to the committee's report, Tenet's existing assets could form

the basis for four separate companies. Tenet's assets in South Florida and

Texas could be the foundation of new companies. Assets in other southern

states could make a third new company spin off. Other assets might be

acquired by stronger not-for-profits. As explained in the report, "We believe

the assets in California, Philadelphia and St. Louis are the least marketable,

and these assets may become the residual Tenet, along with all the company's

massive liabilities, after the more viable assets are sold. Tenet could use

the sale proceeds from its stronger hospitals to fund its massive, but as yet

un-quantified liabilities."

Dr. Pearce concluded, "Starting almost four years ago, the Tenet

Shareholder Committee raised multiple red flags about Tenet's financial

performance, corporate governance, compliance procedures, excessive

compensation, management style, and lack of attention to quality care. We

warned against the practice of what we called 'Wall Street Medicine.' We

said, as forcefully as possible, that at Tenet, quality healthcare takes a

back seat to the almighty dollar. Unfortunately, senior management and the

Board either ignored us, or attacked us, or both. We believe the Board had a

narrow window of opportunity in which to save Tenet. We believe that window

has now closed."

A complete copy of the Tenet Shareholder Committee report, "Tenet's Death

Rattle," can be found on the committee's website:

www.tenetshareholdercommittee.org.

FROM: Myers, Myers & Adams Public Relations

938 Victoria Park Road, Fort Lauderdale, FL 33304 954-523-6262

CONTACT: Paul Brickman, paul@mmanda.com

FOR: Tenet Shareholder Committee, LLC

SOURCE Tenet Shareholder Committee

-0- 02/09/2004

/CONTACT: Paul Brickman of Myers, Myers & Adams Public Relations,

+1-954-523-6262, or paul@mmanda.com, for Tenet Shareholder Committee, LLC /

/Web site: http://www.tenetshareholdercommittee.org / -

Mõned teemad tänaseks päevaks:

- Vodafone (VOD) kavatseb liituda nende operaatorite nimekirjaga, kes teevad oma pakkumised AT&T Wirelessi (AWE) ostmiseks. Siini on teinud oma kindla pakkumise Cingular, mis kavatseb maksta AWE ühe aktsia eest $11. Ilmselt kujuneb lõplik hind kõrgemaks. Mõned analüütikud räägivad $13 hinnast kui õiglasest variandist.

- Linnugripp on jõudnud USA pinnale. Ühes Delaware farmis tapeti nädalavahetusel 12 000 lindu. Siinu on maailmas surnud linnugrippi 18 inimest (peamiselt Aasias). Uudis võib mõjutada toitlustusasutusi ning otseselt linnulihaga tegelevaid ettevõtteid.

Soovitan meelde tuletada turgude reaktsiooni hullu lehma tõvele.

- First Albany on täna hommikul väljas nupukesega, mille järgi peaksid Warnaco (WRNC) aktsiad lähinädalatel tõusma. Põhjuseks 23-26. veebruaril Las Vegases toimuv rõivamess, kus firma peaks esitlema uut toodangut. First Albany alustas WRNC aktsiate katmist mõne nädala eest Osta reitingu ning $22 hinnasihiga ja on marketeerimisel olnud päris agressiivne. Usun, et WRNC viimase aja tõusu taga ongi just FA kliendid. LHV Pro valik.

- Tenet Healthcare (THC) teatas täna uue CEO valimisest, mis on heaks uudiseks. Lisaks sellele tuli avaliku kirjaga välja THC aktsianäride esindus (vt. Fit'i postitus üleval). Kirja sisu on üpris negatiivne. Nimelt usuvad nad, et frma ei suuda jätkata endises olekus, vaid peab lahti lammutatama. Negatiivsed küljed, mida nad oma avalikus kirjas välja toovad ei ole kellelegi tegelikult uudiseks. Aktsia on eelturul 3-4% miinuses. LHV Pro valik.

- Juniper (JNPR) teatas, et ostab ära väiksema VPN konkurendi NetScreeni (NSCN). Jälgige NSCN-i konkurentide reaktsiooni: WGRD, SNWL, CHKP. Uurin alles aga usun, et turu avanedes on seal üht-teist karudele meelepärast.

- Jeff Cooper:

- RevShark:

A shaky jobs report leads to a bounce on very low volume. Although volume was light the bulls will tell you that the very strong breadth more than made up for the mediocre volume. Can we assume that the distinct lack of vigor will be offset by strength across the board? Can we count on this market to keep on going?

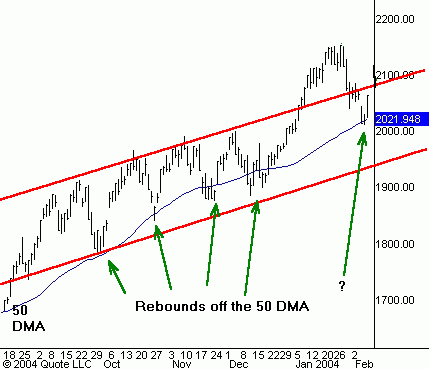

The TA textbook tells us to be skeptical. An oversold Nasdaq finds support exactly at the 50-day moving average bounces on low volume and fills a gap on the chart. The odds typically do not favor a strong follow-through. The light volume is a warning sign that the big institutional buyers were not active Friday. The greater likelihood is that a combination of short-covering and momentum traders with very short time frames produced the move. Those are not factors that can be trusted to last for long.

The bulls will argue that this rally has had a history of bounces exactly like this one. They start on light volume and confound many by continuing straight up to new highs. The low-volume "V" shaped bounce has produced big moves and burned the bears over and over. You can be a skeptic but it hasn't been a good idea for quite a while.

What caused the move on Friday? After all, the job report was not particularly impressive. Why did the market romp higher rather than sell off on that news? The answer is interest rates. The market was more worried that rates stay low than a stronger employment picture. The mediocre jobs number means that the FOMC is likely to wait longer before raising rates, than if employment were booming.

So do we have the juice to keep this market running higher? The biggest positive is that despite the jobs report the economic picture is bright -- not fantastic, but good enough to provide a foundation of support.

The biggest problem for the bulls right now is that there aren't many positive catalysts out there. Earnings season is just about over with Dell (DELL:Nasdaq) being the last big company left to report. Seasonal cash inflows are likely to slow. A new consideration is the solidification of John Kerry as the Democratic presidential candidate. President Bush is seen by many as a friend to the stock market and the threat of a viable opponent may weigh on the market.

There are reasons to worry and reasons to be optimistic. The single biggest reason to be skeptical of further upside is volume. We're going to have to watch that carefully. If it doesn't pick up we'll have to become increasingly cautious and skeptical about the ability to move higher.

Once again we have a little Monday morning optimism. The market has been pretty consistent with strength on Mondays, which some attribute to cash inflows into funds that are received over the weekend.

The G-7 meeting has failed to move the dollar much but the markets seem to be indifferent to that at the moment. Gold is trading up $3 to the $406 level.

It is shaping up to be a particularly tricky day. Watch for choppy action and some quick swings.

Futuurid; Naz0.64% SP0.20%sB

-

Ühe riskifondi analüütiku kiired mõtted:

This should ignite M&A going forward, already folks are saying ISSX and CHKP should lift off, ISSX being worth $25, if similar multiples applied ---"ISSX worth $25 on a look alike takeover @ roughly 40x paid by JNPR..on top of that u get $5 in cash. "

FWIW,

sB

Selliseid arvutusi tehakse alati kui sektoris on mõni suurem ülevõtmine. Siiski oleks rumal arvata, et konkurentide aktsiad kohe samasuguste valuatsioonide juures peaksid kauplema. -

USAs täna hinnainfoga probleeme, mitmete aktsiate puhul pole isegi praeguseks veel kauplemist alustatud.

-

EELN takeover speculation

-

Ja millise hinna üle spekuleeritakse (EELN)?