Börsipäev 6. mai - töötuid vähem

Kommentaari jätmiseks loo konto või logi sisse

-

-USA turud on avanemas miinuses, Nasdaqi futuurid on 8 punkti miinuses, S&P 500 5,5 punkti miinuses. Suuremat põhjust esmapilgul ei paista, futuurid järgisid Euroopa ja Aasia turgude suundumusi.

-Dollar nõrgenes Briti naela vastu, kuna Inglise Keskpank otsustas intressimäära tõsta 0,25 protsendi võrra 4,25 protsendile. Euroopa Keskpank jättis intressimäära muutmata.

-USA töötu abiraha taotluste arv kukkus 25 000 võrra 315 000 taotluse peale, mis ona madalaim näitaja alates 28. oktoobrist 2000.

-Wal Mart (WMT) teatas, et firma esimese kvartali müük kerkis 13% 66,1 miljardi dollarini, mis ületas analüütikute prognoose. Võrreldavate poodide müük kasvas esimese kvartalis 5,6%.

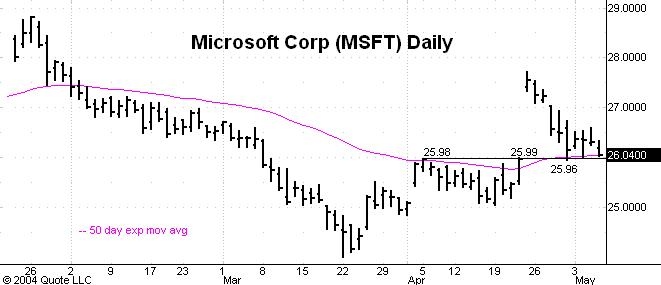

-UBS lisas Microsofti (MSFT) aktsia valitud 20 USA aktsia nimekirja, leides, et tarkvarafirma peaks kasu saama IT kulutuste kasvust ning suurenenud arvutite müügist.

Rev Shark:

The biggest problem for the market at the moment is that investors are not particularly interested in being involved. Interest rate concerns, rising oil prices, efforts to slow growth in China, terrorism and war have left many seeking the comfort of the sidelines. The lack of interest in buying was clearly reflected yesterday when Nasdaq volume fell to 1.59 billion and breadth was flat.

Sentiment has been shifting and the number of bears has been increasing recently, but it's the lack of intensity that is making this market unattractive. Until we see stronger emotions, one way or the other, it is going to be a very difficult environment for traders.

A lot of folks want to believe that the interest rate issue is going to be priced in and eventually forgotten, but as long as it is unclear when and to what degree rates will rise, that will continue to be a problem for the market. The jobs report tomorrow will be another piece in the interest rate puzzle and many folks are standing aside until that data is reported.

I've heard many folks opine that the report is a lose-lose situation for the market and will cause selling no matter what. I'm not so sure about that, but the technical picture is such that we should expect more downside action.

After a big drop last week, the Nasdaq has bounced mildly three straight days in a row on decreasing volume. This is a textbook dead-cat, oversold bounce. Make sure you take a close look at this pattern. We had a big, intense selloff with heavy volume last week. The 200-day simple moving average was cracked but the market had fallen so far and so fast that it attracted bargain hunters and traders looking for a snap back. The problem is that these buyers are not strong holders. It's the big-money institutional buyers -- who hold for the longer term -- who are the primary drivers of sustained trends; as volume indicated, they were not participating.

Volume for the last three days is the key thing to focus on. It dropped to 2.02 billion on the first day of the bounce and then to 1.87 billion and 1.59 billion on the next two consecutive days. That is a tip-off that the bounce is losing momentum and is likely to fail. As it fails, traders will be quick to exit and longer-term holders are likely to be discouraged, which will accelerate the downward pressure.

That is exactly what is happening this morning. We have a weak open, even though there is no particularly negative news on the wires. The Bank of England raised interest rates 25 basis points, which may be helping to fan fears of impending hikes in the U.S., but overseas markets were generally weak before that news.

We have productivity and weekly unemployment data this morning, which may cause a ripple or two if they vary much from consensus estimates, but the market will be looking forward to tomorrow morning's jobs report.

I remain very concerned about the ability of this market to regain an upward trend at this time. We have very few potential positive catalysts right now and this interest rate stuff is not going to go away quickly or easily.

The key thing to remember right now is that there is no big rush to anticipate a turn upward in the market. When it does occur, there will be plenty of time to board the train. Meaningful rallies last weeks or months, not just a day or two.

So stay cautious and don't be in a hurry to deploy your capital. When things start to act better, you'll be very pleased that you have the ability to jump into the best-acting stocks.

We have a dreary start to the day, with the futures indicated down rather sharply. I don't see any particular cause. It looks like the same general concerns we have been talking about for some time are weighing on the market. The chart pattern was the tip-off.

Gary B. Smith:

-

Tänane börsipäev algas üsna korralikus miinuses, oluline on kui kaugele tänane langus läheb, milliseks kujuneb päeva lõpp ja kuidas selle nädala põhjad lähipäevadel peavad.

-

QQQ selle nädala põhi oli esmaspäeval 34.89, prargu turg üsna selle taseme juures. Võib põrgata.

-

AAC on tuure ylesse v6tmas!!! :-)))

-

AAC on 3 senti üleval!!!!!!!!!!!!!!!!!!!!!!

Käive tõuseb!!!!!!!!!!!

Teadjad ostavad!!!!!!!!!!

Sky's the limit!!!!!!!!!!!!!!!!!!!!

JEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEE!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

AAC 10$ aktsia aastaks 2008!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Kuidas veel haipida võiks seda, anyone? -

no minu jaoks on see hea uudis, iga sent teenib 3500EEK.

Fit, see on ju pennystock. :-)) -

0.91 - 0.07 = $0.84

84c x 3500EEK = 294 000 EEK -

Kuigi turg on päris kole, näen siiski täna võimalust kosumiseks, homne makro on piisavalt oluline, et enne seda tervet päeva müüa ei juleta.

-

Kristjan, haibid Bluechipse vä?

:D -

Pisipehme ehk Microsoft (MSFT) asub mitmete oluliste toetuste peal:

-

Suffiks, näe - õnnestuski mul nii SPY kui ka QQQ LHV foorumi abil üles haipida!

-

Päris hästi jah. Homme, kui QQQ $8 ja SPY $20 peale kukub on palju õnnetuid kodusid...

Bagholders y'all!

:)