Börsipäev 21. mai-inflatsioon kontrolli all

Kommentaari jätmiseks loo konto või logi sisse

-

-USA futuurid on 0,5% plussis ning nädala viimane kauplemispäev tõotab tulla positiivne.

-Föderaalreserv rahustas turge, et inflatsioon jääb ka edaspidi stabiilseks. Pooljuhtide toodang kasvas aastaga 111% ning aprillis võrrelduna märtsiga 16%. Inteli (INTC) aktsia eelturul 0,8% plussis.

-Morgan Stanley alandas Nokia (NOK) aktsia hinnasihti "underweight" peale. Aktsia on testimas kolme aasta põhjasid ning Euroopas kaubeldakse alla olulise 11 euro taseme. Eeldades turu tänast tugevnemist võib loota ka Nokia hinna püsimajäämist ülevalpool olulisi tasemeid.

-Võlakirjaturg võttis Föderaalreservi kommentaare inflatsiooni osas positiivselt ning 10-aastase võlakirja intressimäär langes 4,7 protsendile.

Rev Shark:

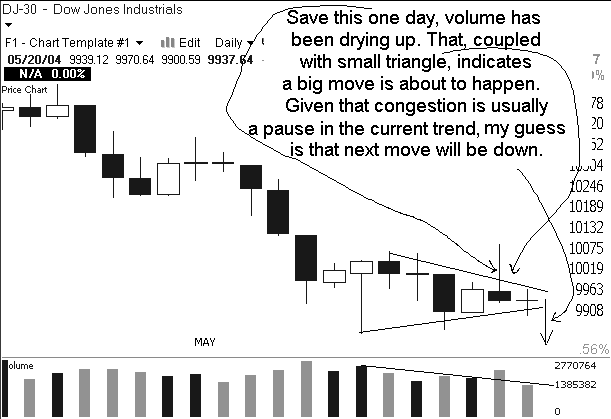

The market is often the most tiring and troubling when it does little. Market participants are constantly plotting their tactics and strategies, and they need the market to move in order to employ them. When the market is as dull as it was yesterday, we expend substantial energy looking for an edge or an advantage that simply doesn't exist.

However, dull days often set the stage for increased volatility. The bored traders sitting on the sidelines are anxious to jump in at the first signs of some sort of trend. They don't care if it's up or down; they simply want some action and will move quickly as soon as there is something to react to. But the spikes often reverse very quickly as the short-attention-span traders take profits and the contrarians fade the move.

We saw a very good illustration of this on Tuesday and Wednesday. Tuesday was the lightest-volume day of the year, and the trading range was very narrow. Traders, including this one, were bored and anxious for action. On Wednesday, the market open higher on good news and traders piled in. We spiked up big as volume swelled, but after a few hours, the contrarians and faders showed up and drove us straight back down again.

Yesterday, the traders retreated once again to the sidelines. Volume fell, and the range narrowed. This morning, we are seeing a positive tone and the traders are getting excited once again about the possibility of some meaningful movement. They are ready to jump in and, hopefully, find some action. But like on Wednesday, the chances of some quick profit-taking and selling into strength are highly probable.

Sooner or later, we will see a sustained move out and a different trading environment will develop, but for now the hungry traders on the sidelines looking for something to do are going to keep things difficult. This action is setting us up for a very strong move, but which direction it will take is not at all certain. Once we move out of the current range, things will run quickly and the hot-money traders will exacerbate the move.

For now, we stay vigilant, keep stops tight and avoid the temptation to make trades out of boredom. If you have raised a good cash stake, you are positioned to profit as a tradable trend emerges.

Overseas markets are trading higher on a good semiconductor book-to-bill report. We have very little news to drive this market right now, and that makes things particularly difficult. This is a moody, directionless market right now and it is extremely difficult to trade. Stay patient. The one great certainty in the market is that things will eventually change.

Gary B. Smith:

-

LHV Pro "Analüüsid ja Kolumnid" sektsiooni all uus analüüs pisikesest tehnoloogiafirmast, mis annab valuatsiooni järgi silmad ette nii mõnelegi väärtusaktsiale. Soovitan lugeda.

sB -

Raisio 7,84% plussis, mis põhjus võiks olla?

-

Raisio tõusu põhjust ei suutnud leida ei mina ega mõned Soome aktsia-analüütikud. Tugevalt ostmas on Mandatum ja Nordea. Põhjuseks ilmselt positsioneerimine enne 26.mai EU Komisjoni otsust, kas Raisio saab müüa kemikaaliüksuse (suur tõenäosus on tehingu õnnestumiseks).

-

panin just tähele, et sB ostis MICU aktsiaid, tema arvates on ainuüksi üks ettevõtte ravim samapalju väärt, kui aktsia praegu maksab.

sB vibutab siin näppu ja ütleb, et Don´t try this at home! :) -

Hee, kui tõsiselt anomaalset graafikut tahate näha, siis vaadake LXRS viimased pool aastat ;)

-

Raisio tõusu taga võib olla ka Soome maksusüsteemi parandusettepanek, mis päästaks Raisio kemikaaliüksuselt saadava raha pealt maksu maksmisest.

-

Samuti on täheldatud, et mitmed Soome fondid on Raisiot kokku ostmas. FIM, Kaupthing, Nordea, Mandatum....