Börsipäev 25. mai

Kommentaari jätmiseks loo konto või logi sisse

-

-USA futuurid on kerges miinuses ning USA aktsiaturud peaksid seetõttu avanema kerges miinuses. Kell 17.00 oodatakse mai tarbijausaldusindeksi ning majade müügi statistikat.

-Wal Mart (WMT) juht Lee Scott ütles Financial Times`le antud intervjuus, et firma kaalub suurt laienemist Euroopasse, teade kergitas Euroopa jaemüüjate aktsiaid.

-Deutsche Telekom (DT) teatas, et ostab Cingulari mobiiliüksused Nevadas ja Kalifornias 2,3 miljardi dollari eest.

-Smith Barney leiab, et tubakafirmade viimaste päevade hinnalangus on tekitanud antud sektoris hea ostuvõimaluse. Esile toodi kahte suurt firmat Altria (MO) ja RJR (RJR).

-Dollar langes euro vastu alla 1,21 eur/usd taset ning nafta hind on kerges languses, brent naftat maksab endiselt üle 41 dollari.

Rev Shark:

Doug Kass asks the rhetorical question on Street Insight: Who is more uncomfortable and nervous -- the bulls or the bears? He obviously feels the answer to that question is the bears. His logic is that given all the recent bad news, the increase in oil prices, problems in Iraq, etc., the market has been holding very well. If this negative news flow doesn't kill the market, then the bears must be worried.

To me the market seems confused rather than negative or positive. The problem with sentiment analysis is that it doesn't measure the degree of conviction of market participants. There are times when one group or the other feels quite confident in its view of the market. This isn't one of those times.

Traders are constantly trying to gauge overall market sentiment so they can use it as an aid to a contrarian trade. The problem right now is that many investors are dazed and confused rather than either bullish or bearish. We don't have a lot of bold bulls or brash bears right now. We have a lot of indecisive wimps who are waiting for something to happen so that they can react to it. That uncertainty is reflected in the very light volume we have had recently.

The contrarian trade works best when emotions are extreme. The present environment is mostly just muddled. The best evidence of this is the rush to fade just about every opening move lately. That inclination has left the indices in a very tight trading range over the past couple of weeks. A gap up is quickly sold and a gap down is bought and we go nowhere.

The most bullish thing about the market now is that it has stopped going down. We continue to hold above recent lows, and the action in small-caps has improved nicely. The most bearish thing about the market is that we can't seem to generate any decent upside movement and there still is plenty of overhead resistance to contend with. The net result isn't nervous bears or bulls, but uncertainty.

Sentiment isn't going to help us in this environment. What is going to happen is that we will eventually break out of the recent trading range and the hot money traders on the sideline will jump in and accelerate whatever move happens to emerge. The folks who are indecisive now will create momentum at some point when they rush to become involved as the market finally makes a strong move.

A lot of market participants are very flexible. They are not dedicated bulls or bears. They simply want to make money and will jump in, long or short, when they see an opportunity. Sentiment is an awfully murky guide to where things are headed when there is so little conviction.

We have a negative opening shaping up. Oil prices continue to be the major concern and have helped depress overseas markets. We have the consumer price index and new-home sales reports due out at 10 a.m. EDT, and they are likely to be market drivers.

For now the dominate emotion of this market isn't bullishness or bearishness but confusion. Maybe we need an animal metaphor for that condition. Perhaps a sloth, which sleeps 18 hours a day and is one of the slowest-moving mammals in existence.

Gary B. Smith:

-

LHV Pro all inglise keeles analüüs Nokia kohta. Hea ja ülevaatlik, loe siin.

-

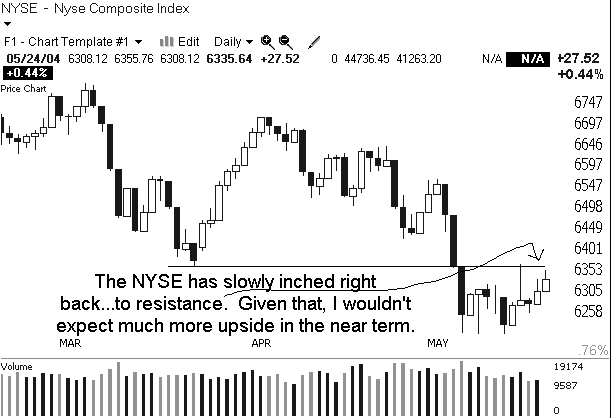

S&P 500 läbis kaks nädalat püsinud tipu (1105.93) ja Dow 200 päeva liikuva keskmise (10050), tundub et toimumas läbimure ülespoole.

-

Sulgemine eluliselt tähtis - viimasel ajal on just päeva lõpud olnud kesised ja see pole hea märk. Kui ka tänase ilusa päeva peale ei suudeta plussi hoida, on see märk nõrkusest.

Samas praeguse plussi hoidmine oleks hea märk edasiseks.