Börsipäev 26. mai- kindlustame tõusu?

Log in or create an account to leave a comment

-

-USA futuurid on peale eilset kiiret tõusu kerges miinuses. Nafta hind on endiselt üle 41 dollari ning seda peaks tugevalt mõjutama USA naftavarude statistika avaldamine.

-Kestvuskaupade tellimuste arv kukkus oodatust rohkem, aprillis langes vastav näitaja 2,9%, samas parandati märtsi 5% kasvunumber 5,7 protsendi peale.

-Lennkiehitaja Boeing (BA) aktsia võib sattuda löögi alla, Pentagon teatas täna et lükkab edasi 100 lennuki tellimuse, mille koguväärtuseks on 23,4 miljardit dollarit.

-Metsasektor on taastumas eilsest suuremast langusest, kui selgus, et EU, USA ja Kanada on võtnud ühiselt uurimise alla hinnafikseeringud. Soome UPM- Kymmene on saanud selles küsimuses immuunsuse, kuna andis jaanuaris regulaatoritele vastavasisulist infot.

Rev Shark:

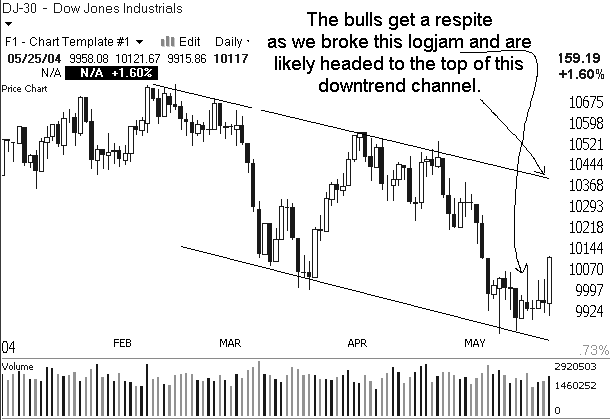

Yesterday the market took the first step in reversing its recent downtrend. After barely managing to hold key support levels and increasingly weak volume, the indices finally were able to gain some upside traction. As oil prices weakened breadth improved sharply and volume grew.

The bears, who have done particularly well lately fading even minor strength, suddenly found themselves leaning the wrong way and had to scramble to cover their short positions. That helped fuel a powerful finish and the best day in months.

One particular bright spot has been the better action in small-caps, momentum stocks, and stocks that posted strong earnings in the recent quarter. Many of these stocks have been pounded over the last couple of months but exhibited superior relative strength the last couple of days as the buyers searched for places to put their cash.

The next step for the market is going to be even tougher. All of the major indices are still under their 50-day simple moving averages (except for the Nasdaq 100 (QQQ)) and none of them have broken the downtrend line that connects the January and April highs. Those are the next big hurdles and will require some impressive work by the bulls if they are to fall.

Even if the market has turned and is ready to begin a new leg up, we will probably see some consolidation and profit-taking first. Quite often the best entry points come on the pullbacks after the initial surge. If you found yourself underinvested yesterday, don't despair. You haven't missed the boat. There will be entry points in good stocks if you stay vigilant and focused on finding the right technical setups.

Overseas markets were emboldened by the strength on Wall Street and are acting well overnight. Futures are indicating some slight profit-taking to begin the day but are overall holding up well. We have durable goods and new-home sales on the economic agenda but overall the news flow is slow.

Oil remains a key driver now and equity traders will be watching the price of crude as an indication of which way the market may be headed.

The move yesterday produced a sigh of relief among the bulls, but if they relent, the bears won't hesitate to press and stir up some fear. The bulls now have an advantage to work with and it's up to them to prove that it wasn't just a momentary fluke.

Gary B. Smith:

-

LHV Pro all ilmus ühe huvitava pisikese firma analüüs, mille aktsiate tõusupotentsiaaliks hindavad analüütikud 150%.

Analüüsi leiab siit

sB