Börsipäev 9-12. juuli - kas tuleb põrge?

Kommentaari jätmiseks loo konto või logi sisse

-

Tänane päev on algamas pisut rõõmsamate uudistega kui sel nädalal kombeks. Maailma ühe suurima kontserni General Electric (GE) tulemused ületasid ootusi nii käibe (37035M vs. ootus 35592M) kui kasumi (EPS 0.38 vs. ootus 0.37) osas - aktsia on eelturul 1,58% tõusnud ja suures osas tänu sellele leiame ka futuurid 0,2-0,6% plussis.

Tarkvarasektoris on rea kasumihoiatuste järel Computer Associates (CA) kinnitanud oma kvartali kasumiprognoose ehkki vähendanud käibeootusi, aktsia on eelturul +3,10% plussis, mis näitab kuidas viimastel päevadel paljukannatanud sektor januneb vähegi positiivse alatooniga uudiste järele. Sektor näitab ka kosumise tundemärke kui eile kasumihoiatuse andnud Siebel Systems (SEBL) on avanemas +2,88% kõrgemal eilsest jne.

Rev Shark:

"What is needed, rather than running away or controlling or suppressing or any other resistance, is understanding fear; that means, watch it, learn about it, come directly into contact with it. We are to learn about fear, not how to escape from it."

-- Jiddu Krishnamurti

Yesterday we experienced once of the most solidly negative market days we have seen all year. There was nothing particularly good about the action. The fundamental news was bad and the technical action poor. Buyers showed no inclination to hunt for bargains.

Days like that yesterday inevitably lead to contrarians searching for signs of a bottom. They stand back and attempt to objectively measure the degree of fear and pessimism in the market. When they feel that it is so great that everyone who is going to sell has already sold, they conclude that a market bottom is near.

What is interesting about this market-timing approach is that it requires that you be able to weigh market emotions in a very cold and logical fashion. That certainly is an ideal goal but an extremely difficult one for most market participants.

If you are active in the market, you very likely have a position long or short. If you find yourself long on a day like yesterday, it can be extremely hard to set aside your fear and carefully measure the prevailing mood of the market. The natural inclination is to hope that a bottom is near. When you evaluate things, it is extremely difficult to fully set aside your biases.

Our inherent biases lead to a tendency to underestimate how far the market can move once it starts to trend. We start to impose our beliefs as to what is "reasonable" in the market, but because we already are invested, our evaluation is colored by our subjective feelings of fear and greed.

My point is that we need to be very careful when trying to determine whether the market is at an emotional extreme and ready for a turn. It is tremendously easy to let our holdings influence our thinking. After all, we "know" that the stock we are holding is a great pick and it's only a matter of time before the rest of the market realizes what a great bargain it is at a lower price.

So has fear reached an extreme? I don't think so. There is still plenty of hope that earnings season will be strong enough to turn the tide back up. The specter of some solid reports is beckoning, and that is what is preventing a real washout from occurring.

The persistent flow of bad news has certainly taken a toll on investor sentiment in recent days, but earnings season still holds sufficient promise that the bulls have not given up. The bounce this morning on the traditional "one cent better than expectations" report from General Electric (GE:NYSE) has improved the mood tremendously after yesterday's gloom, but the bulls need more of the same from other bellwethers if they are going to shift the trend.

There is an old Wall Street saying, "The trend is your friend." Which is simply a way of saying that we shouldn't try to anticipate turning points. When a solid turn does come, there is always plenty of time to join the party. There is no need to take needless risk by being overly anticipatory.

We have a bright start to the day. Can the bulls run with it on a summer Friday in front of a flood of earnings reports next week? We will soon find out.

G.B. Smith:

-

Bin Laden kavatseb sel aastal USA-d rünnata..........mis edasi....!

Mida osta, mida müüa või hoopiski paigutada raha soola... -

....ehk lühidalt ...kuidas käituda terroristide totaalse rünnaku puhul USAs ja Euroopas!?

-

to: adz

Kui on järeltulijaid, siis võtta nad enda kõrvale ja näidata, et what goes around, comes around, ehk kuidas koer külale, nõnda küla koerale. See on ilus ja lihtne õppetund elust. Isegi kõige suurem jõud maailmas, kui teeb ülekohut, saab mingi hetk oma palga.

Ja kui järeltulijaid ei ole, siis lihtsalt mõtiskle olukorra üle. Et kus peituvad põhjused selleks tegevuseks. -

...tuleb kolida Aasiasse...

B -

Saksa DAX 30 joonıstas tana Indıa kaardı. Eı tea, kas see ka mıdagı tahendab?

-

....hea musulman on surnud musulman...

-

Üks ettevõtja teadis,et tavalise elektrikaabli hind turul on kõvasti tõusnud .

Põhjuseks suur nõudlus Hiina turul. -

...aga lhv chatis võiks ka pikaks minna.

-

Tänane + USA-s on pigem mitte midagi ütleva fooniga

-

Kaabli hind on seotud vase hinnaga ....

-

Gapping Up

CLTK +15% (sells defense assets to TDY), FWHT +7% (added to S&P 600 SmallCap), IPIX +6% (continuation of yesterday's rally realted to new alQaeda threats), LSCC +6% (Wells Fargo upgrade), LEXR +5% (started at CSFB with an Outperform, $10 tgt).

Gapping Down

QDEL -37% (guides lower), CTMI -23% (guides below consensus), COMS -7% (Piper downgrade), LGND -4% (FDA guidance to result in trial delay). -

Ja vase hind on seotud vasest valmistavate toodete nõudlusega(+vase ressursid).

M.O.T.T. -

Reede õhtuks üks kauplemisidee - shortisin 11.82 pealt EPIC'ut, 12 on tugev vastupanu, kui tõuseb päevasiseselt üle $12.25, siis lähevad stopid käiku. Seega väga kiire idee.

Pool positsiooni paneksin ilmselt $11.20 juures kinni, ülejäänuga võib isegi langust $10 juurde ootada. Hea riski/tulu suhe. -

Need kes EPIC-s lühikesed:

Viimase poole tunni jooksul on keegi ostmas ilmeselge katsega shorte veidi kiusata. Tõusu käive oli suht kesine. Rääkisin Kristjaniga tel teel ning ta ootab veel positsiooni sulgemisega.

sB -

" There's no reason to become alarmed, and we hope you'll enjoy the rest of your flight. By the way, is there anyone on board who knows how to fly a plane?"

- Elaine Dickinson, Airplane

sB :) -

Kristjangi on siiski koigest inimene: ei ole see kahjumi vastuvotmine nii kerge, ikka viivitad ja loodad paremat:)

Tore, et seekord onn Kristjani poolel oli, paris ausalt on hea meel.

Olen vist liiga kaua Eestist ara olnud, eestlaslikud iseloomujooned hakkavad kaduma:) Kas toesti see paljukirutud amerikaniseerumine?:)

Annaks jumal, et Mihkel Raual ei tuleks tahtmist piirivalvepaalikuks hakata, muidu ei lastagi Eestisse tagasi:) -

Spunk, ei tasu enne õhtut hõisata, positsioon veel sulgemata :)

Aga need emotsiooninärvid, mis kahjumieid ei lase võtta (stope käiku lasta) olen endal juba ammu ära kaotanud - antud juhul oli asi selles, et EPIC oli nii ebalikviidne, et automaatset stopi ei saanud kasutada, seega jälgisin liikumist ja nagu Oliver ütles, üritas keegi suvise reede õhtu õhukest turgu ära kasutada ja väikse käibega aktsiat üles pushida, seega ei käivitanud stopi. -

Ja minu meelest ei tasu üldse nii palju tähelepanu pöörata ühele konkreetsele tehingule, vaid ikka kogutulemusele. Spekuleerimise puhul on kaotused täiesti loomulikud ja neisse tuleb suhtuda pragmaatiliselt. Kõige olulisem on see, et sisenemise hetkel oli riski/tulu suhe hea.

-

Muide, nende närvide ära kaotamine on väääga raske protsess ja ma alles tegelen sellega;)

-

Novelluse (NVLS) tulemused ja prognoosid ei olnud piisavalt roosilised. Aktsia täna hommikul eelturul -4%. Siiski, peale viimaste nädalate kukkumist peaksid ootused olema päris madalad. Eks näeb, mis turg avanemisel teeb.

sB -

Täitsa korralikud tulemused ja prognoosid NVLS poolt, oleks pigem oodanud plussi. Kuid eks turg ole viimaste nädalatega tunduvalt närvilisemaks läinud.

Kuigi tehniline pilt on praegu turul kole, lõhnab veidi selle järgi, et majandustulemuste hooaja jätkudes (ehk järgmine nädal) hakatakse juba ka keskpäraste tulemuste peale ostma. -

Nad said patenditeemalise kaotuse kohtus, siit siis arvatavasti löök allapoole vööd.

-

Rev Shark:

Adept Trading Required for Success in This Market

7/12/04 8:42 AM ET"Sometimes I pause and sadly think of all the things that might have been. Of all the golden chances I let slip by, And which never returned again. It fills me with gloom when I ponder this, Till I look on the other side. How I might have been completely engulfed by misfortune's surging tide."

-- G. J. Russell

A rising tide of gloomy developments is keeping the pressure on the market as we enter earnings season. The primary bad news we have had so far is the very high level of negative earnings preannouncements compared to positive ones. According to Thomson First Call, which was quoted in Barron's this weekend, out of 220 preannouncements for the second quarter, 82 were negative and 97 were positive, which yields a ratio of 0.85. That's the lowest number that has been recorded since records have been kept, and is dramatically lower than the historic level of 2.2.

To add to that already gloomy picture, Merrill Lynch is kicking off the week with a dramatic downgrade of the semiconductor industry to underweight from overweight. That includes a downgrade of Intel (INTC:Nasdaq) to neutral from buy, even though they expect an in-line report on Tuesday. They have also downgraded a whole slew of other companies in the group.

The market has been plagued by a dearth of positive news in recent weeks. The lack of good news isn't always bad if -- and this is a big "if" -- it is fully priced in already. The impact of bad news is limited when it's expected and has already been priced in by the market. Unfortunately, that doesn't seem to be the case in the current market environment.

Recent investor sentiment polls have continued to show surprisingly high levels of bullishness, despite soft price action in the market. The bulls have not been shaken out so far, even though the market has been struggling, and that is a major negative.

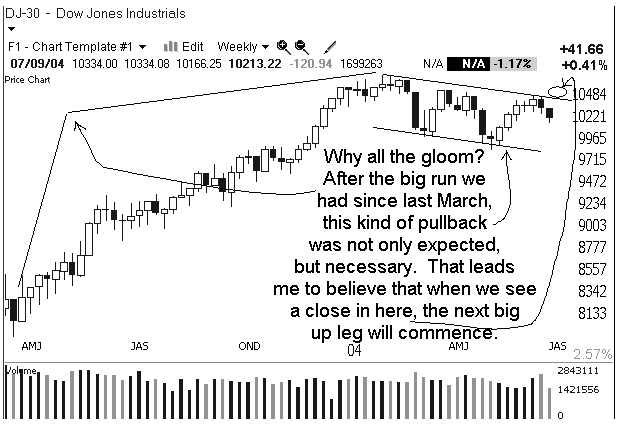

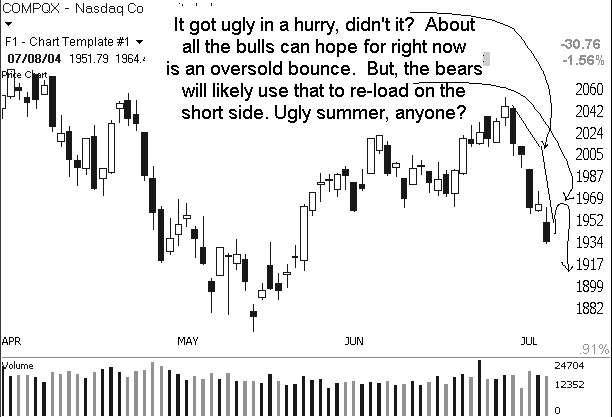

The technical picture of all the major indices remains quite troubling. They all took out important support levels last week and are struggling to hold on to the next important level. The Dow Jones Industrial Average, for example, is sitting right on its 200-day simple moving average of 10,182 and looks like it could easily test the 10,000 level once again should that fail.

The good news is that expectations going into earnings season are very low, and Merrill Lynch lowered some of them even further this morning. The semiconductor group has been under pressure since January, and this dramatic downgrade by Merrill is the sort of thing that often leads to bottoming action.

Despite the high level of earnings warnings we have seen so far, it is very likely that there are going to be some exceptional reports out there as well. Deft stock-picking and trading will be rewarded during earnings season, but it won't be an easy task. The nice thing about earnings season is that it helps produce a new crop of interesting trade candidates that have not been noticed previously.

We have two full days of trading before the first major earnings reports are issued on Tuesday night. The tone right now is very negative, and that is a good setup for a quick upside rally or two. The news flow has been so consistently bad that we are due for some sort of relief soon, but stay aware that the longer-term technical picture is looking very weak. In this market, it is going to take some adept trading in order to prosper.

We have a negative open shaping up, primarily due to the Merrill downgrade. Overseas markets were mixed with chip stocks supplying most of the downside pressure. Gold is trading up to the $408 level, the dollar is down and oil is close to flat.

-

Gapping Down

NVLS -4% (reports Q2), AMAT -2.5% (in sympathy with NVLS), CENT -15% (guides lower), ELAB -9% (ThinkEquity downgrade), EFII -5% (UBS downgrade), CTSH -4% (negative Barron's story).

Gapping Up

BNSO +19% (reports Q4), CALM +12% (reports MayQ), SCUR +11% (CGFW offers to buy co), CZN +8% (CEO to resign, co plans $2 special dividend, and $1 annual dividend), CTIC +7% (receives fast track designation for pixantrone), AIRT +6% (continues last week's momentum).... Under $3: WGAT +15% (receives $5 mln Motorola order), SQNM +13% (announces new technology for fetal genetic mutations), BIOM +10% (co and Phenomenome Discoveries sign collaboration agreement), TMWD +4%. -

EPICu shortijatele teadmiseks, $11.26 pealt panin nagu lubatud pool positsiooni kinni.

-

Turg on kiire ralli teinud

-

Ilmselt shortide katmine.

Ma usun, et see nädal tehakse veel korralikum ralliüritus, shortijad on kiiresti julgust kogunud ning seda julgust ilmselt kasutakse üheks "grande short squeeze'ks" ära.