Börsipäev 14-15. juuli - Nokia alla ootuste

Kommentaari jätmiseks loo konto või logi sisse

-

Eilse järelturu olulisemateks uudisteks olid 2 tehnoloogiasektori jaoks üliolulise ettevõtte tulemused ja prognooside muutmine.

Intel (INTC) suutis küll täita kasumiprognoosi, kuid jäi hätta ootustega käibe ja marginaalide osas, samuti kärpis ettevõte kahe järgneva kvartali marginaalide prognoose, aktsia täna eelturul -6,54%.

Juniper Networks (JNPR) kergistas oma kasumiületas ootusi nii kasumi (EPS 0.11 USD vs. konsensus 0.10 USD) kui käibe (366M-370M USD vs. konsensus 344M USD), aktsia eelturul +7,73%.

Suures osa Inteli tulemuste mõjul leiame täna tehnoloogiasektori avanemas üle 1% ja vana majanduse üle 0,5% eilsest allpool.

ASML (ASML) teatas täna hommikul nii kasumi- (EPS 0.16 USD vs 0.14 USD) kui käibeprognooside (762M USD vs 721M USD) ületamisest, kuid Inteli surve tõttu pooljuhtide sektorile on aktsia ikkagi langenud -2,32%.

Täna enne turu avanemist raporteerisid tuntumatest ettevõtetest veel Bank of America (BAC), aktsia inline tulemuste järel nullis. Harley-Davidson (HDI) aktsia on aga oodatust paremate tulemuste järel avanemas ca +3% üleval.

Rev Shark:

"We must accept finite disappointment, but never lose infinite hope."

-- Martin Luther King Jr.

Even though expectations for the Intel (INTC:Nasdaq) earnings report were fairly low the company still managed to disappoint. An increase in inventory combined with a forecasted decrease in margins has the stock gapping down this morning over $1 to below $25. Morgan Stanley and Prudential have downgraded the stock.

On Monday following a downgrade of Intel by Merrill Lynch many contrarian players were looking for a possible bottom in the semiconductor group. The sector has been underperforming for a while and the hope was that all of the bad news was already priced in. Obviously that wasn't the case but that same question is going to be asked again this morning on the poor report from Intel.

Be aware that the contrarians are eyeing the semiconductors and related technology stocks in hopes that they are close to washed-out. I don't know if that is the case nor is it my style of trading to try to catch a bottom but we need to keep in mind that the standard hedge fund playbook is to start looking for a bottom in the group.

Intel is a 800-pound gorilla of a stock and is going to have a large effect on the market today but the other major report last night from Juniper (JNPR:Nasdaq) did contain a few rays of hope. It raised revenue guidance for the second half of the year quite sharply and upped EPS estimates as well. That is having a positive effect on other networks such as Cisco (CSCO:Nasdaq), which is up fractionally despite the gloomy Intel forecast.

No matter how you slice, dice or chop it, Intel is a major disappointment for the market. Our job now is to try to determine to what extent the market has already priced in that disappointment. The stock has been the subject of numerous downgrades and cautionary comments in recent weeks so some of this news is already discounted. The stock will break technical support on the open today and will likely find some support around the 25 level where it based last summer -- with option expiration on Friday that's a likely spot for the stock to be pinned.

We'll have to watch to see if the stock can hold around that 25 level. It probably will to at least Friday as option games are played but if you are considering a bottom-fish play here I'd wait until next week to see if that 25 level really is solid support.

One positive is that it is earnings season and that means we have plenty of other reports to distract the market from the softness at Intel (INTC:Nasdaq). Tonight we have Apple (AAPL:Nasdaq), Advanced Micro (AMD:NYSE) and QLogic (QLGC:Nasdaq) among others, which should attract some attention. We have retail sales data out this morning, which market participants will be watching.

Overseas markets were lower on the Intel earnings report and we obviously have a weak open shaping up here.

I don't think chips are going to offer much in the way of trading opportunities at this juncture but the networking sector holds some promise.

This has been a tough market recently and it looks like it is going to stay that way for now. Don't let the market wear you down. If you are persistent and patient it will eventually pay off big.

G. B. Smith:

-

Cramer teravalt Inteli kohta:

The Real Reason Intel Seems So Bad

By James J. Cramer

RealMoney Columnist

7/14/2004 8:27 AM EDT

Click here for more stories by James J. Cramer

OK, I'll play the hedge fund game. If Intel (INTC:Nasdaq - commentary - research) is so bad, if it is so terrible, if it is such a disaster, then why isn't it at $19? Why isn't it at $21? Why isn't it appreciably lower?

The answer, of course, is that the reason Intel is "so bad" is that so many hedge funds are short it and so many are very good at getting the word out that people are freaking out left and right for nothing.

No, Intel is not a good stock to own today. Heck, it might not be a good stock to own for a couple of months. The next quarter could be down. Blah, blah, blah.

But let's look at it the way someone not in the hedge fund business should look at it, because, in the end, most of us aren't in that game. Nobody liked Intel in the teens a year ago, and then it put on a series of great numbers -- three different upside surprises -- that triggered a run to $36, whereupon everyone upgraded the stock and fell in love with the thing.

Intel believed the upside surprises itself and overbuilt capacity. That was a shame, a business judgment error, in retrospect. Lots of people would have made the same mistake, especially those who thought about the possibility of 5% gross domestic product growth, which had been in the cards for the second half until the recent slowdown.

In the interim, the stock, which is an amalgam of a lot of smart minds because it is as close to a perfectly priced instrument as I can recall, went from $37 to $26. During that period, lots of savvy analysts and some not-so-savvy analysts downgraded it, depending on the price at which it was downgraded.

Now it is at $25 and we are getting another three or four downgrades -- we already have two this morning.

Yawn.

By the end of the day we can safely start buying Intel if we are a multibillion-dollar mutual fund because nobody will be recommending it, so the downgrade factor won't count for much at all.

Let's say you run $10 billion. If you wanted to build an Intel position over time and you didn't own any, you could start with some at $24 and leg in and build at $23 and you would hope -- hope, mind you -- that you could put on your last bit at $22 going into the fall, when you would have what might end up being the last bad Intel number for a year in September. Maybe the stock doesn't bottom and the worst thing that happens is you have to buy a little more at $21-$22, which is a couple of points from here, but not more.

Then the upgrades begin again.

That's the darned cycle. That's how it works.

So forgive me if I yawn at the downgrades today and the panic and the shunning. Not because Intel isn't that bad. It is bad. It is disappointing. But what did you expect from a stock that just went from $37 to $25 -- an upside surprise?

Let the shorts press their bet. You have a six- to 12-month horizon, so you wait a few months and buy. But freak out about Intel? Wasn't the time to freak out about it at $37?

Personally, as someone who owns it for Action Alerts PLUS and can't trade around it because I talk about it all the time and am always frozen in it, I will wait for some five-day stretch in the next four months -- there should be one, maybe when I am on vacation again -- and I will buy a little at the prices I described above. And I will wait and play the cycle. I did it last time, kept some on -- a mistake, I guess -- but took some off for a huge profit in the $30s.

Because I don't run a hedge fund.

Frankly, I find the whole exercise in blasting Intel down here to be somewhat, well, comical. I laugh at the hedge funds telling me how "bad and terrible" Intel is, because I know they need it lower. That's their business.

But don't ask me to play the game any more than I just have.

'Cause it's a silly one.

Random musings: You can trade stocks like Intel and Sun Micro (SUNW:Nasdaq - commentary - research) and Cisco (CSCO:Nasdaq - commentary - research), or you can trade the stuff that really moves and makes some good percentage moves. This market is ideal for only one kind of trading, trading in small-dollar, undiscovered names like those in Stocks Under $10, which is why I keep emphasizing that product for the traders out there more than any other. -

JNPR +7% (reports, guides higher), HDI +2.8% (reports Q2), MCD +1.8% (guides higher), CZR +15% (Harrah's is near agreement to buy rival Caesars - WSJ), ZIXI +8% (awarded 3-year $500k contract), BNSO +5.5% (announces dividend), MOGN +4% (beats by $0.06), AGIL +4% (wins Philip Morris contract).... Under $3: EPMN +13% (receives notice from NIH to fund malaria vaccine project), VITX +11% (presents HIV clinical data), XNVA +7% (clinical data for anti-smoking trial).

Gapping Down

INTC -6.2% (reports Q2, concerns over margins, downgrades from Morgan Stanley, Prudential, Harris Nesbitt).... Down in sympathy: AMD -5.9%, KLAC -3%, AMAT -3%.... KOMG -8.4% (guides Q2 below consensus), OVTI -4% (Soundview downgrade), SMH -3.3% (this is the a semiconductor ETF), TASR -2.4%. -

Aktsiaturul ( nagu ka elus ) tehakse õigeid ja valesid otsuseid.Kolmas võimalus on mitte midagi

otsustada.Kui turg tõuseb ei ole see tragöödia.Samuti ei tähenda langus tegelikult tragöödiat.

Loomulikult on kõigil võimalus langus enda jaoks ise tragöödiaks muuta! -

Nii Dow kui Nasdaq plusspoolel.

-

Kommentaariks eilsetele USA tulemustele peale börsi:

Apple (AAPL) - taas väga tugevad tulemused, ületati prognoose ja veidi tõsteti edasisi, lisaks iPodide müük aastaga rohkem kui kahekordistunud. Aktsia +7.0%,

AMD (AMD) - täitis prognoosid väga täpselt ja esmase reaktsioonina kukkus -7%

QLogic (QLGC) - esimese reaktsioonina miinuses, kuid kogu teiste aktsiate tugevus lükkas ka QLGC 4% plusspoolele.

Sandisk (SNDK) - straddle kandidaat LHV Pro all, väga tugevad tulemused - tugevasti ületatud tulemused + kõrgemad prognoosid, aktsia järelturul +20%. -

Nokia oodetust kehvem ja esimese reaktsioonina -10%.

NOK Nokia reports Q3 of 0.08-0.10 euros vs guidance of 0.13-0.15; stock plunges 10% in European trading (14.24 ) -

Ja kõige selle (Nokia) möllu juures on QQQ 0.4% eelturul plussis.

sB -

ja Euroopa kosub

-

Ja Nokia allhankijad nagu näiteks RFMD, TXN on ka vastavalt 3% ja 0.6% miinuses. Olid märksa rohkem miinuses eelmine kord, kui maailma suurim moobillitootja investoreid prognoosidega hirmutas (6. apr, 2004).

sB -

Rev Shark:

"To fear the worst oft cures the worse."

-- William Shakespeare

For weeks now most of the economic and earnings news has been weak. The two major earnings reports so far this quarter, Yahoo! (YHOO:Nasdaq) and Intel (INTL:Nasdaq), were disappointments and prompted sharp negative reactions. Market action has been dreary and the mood increasingly negative.

There simply doesn't seem to be anything particularly positive at the moment, which brings us to the question of the day which is whether we have fully priced in the worst? Have fears and worries progressed to the point that they can't get any worse?

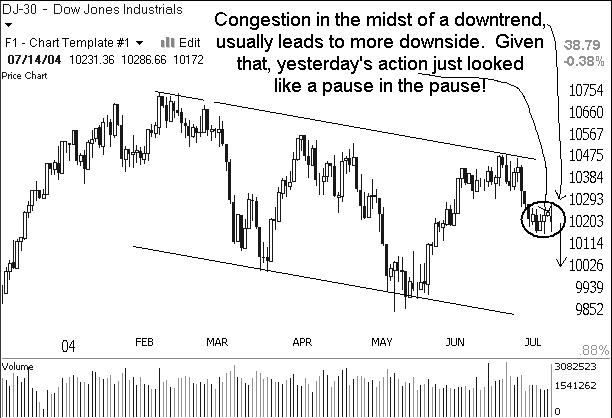

For a while yesterday that looked like that may have been the case. Despite the Intel earnings report, the major indices battled back from a sharp drop at the open and traded in positive territory for a while. It looked like market participants were ready to take advantage of the recent weakness and do some bottom fishing. However, as the day wore on, the buyers lost their nerve and the bounce fizzled fast. We ended up closing near the lows of the day.

The fact that the indices managed to bounce at all was an encouraging sign for the bulls. Obviously there are folks out there who are starting to think that the worst has been done to this market and that a bottom is near. Maybe so. My particular style is to not be overly anticipatory about such things but to wait for some clear signs that the selling is starting to abate. I prefer to err on the side of caution rather than to be the hero who nails the exact bottom.

There are some signs that we are close to a turn but there are still some troubling issues as well, such as the continued high degree of bullishness in the Investors Intelligence poll, the lack of any nearby technical support and the strength in defensive groups such as oils, HMOs and hospitals.

The market mode remains gloomy this morning but what we have to do is stay objective and watch for signs that selling on bad news has dried up. That will be the key to signal that a turning point is in the works. The market is becoming increasingly oversold and no one seems to be expecting a sudden burst of good news.

We have some important economic data on the agenda this morning, which could cause a reaction or two, and then IBM (IBM:NYSE) earnings are tonight, which is the next major earnings report. After that it is quiet until next Tuesday.

Overseas markets were generally weak as semiconductors continued their descent and Nokia shook up things in Europe. Oil and gold are trading down a tad.

Stay tough and don't let Mr. Market wear you down. Just when you are ready to give it up, the clouds will part and the sun will shine once again. Keep in mind the pseudo latin motto of World War II General Joseph (Vinegar Joe) Stillwell: "Illegitimis Non Carborundum."

G. B. Smith:

-

Gapping Up

SNDK +22% (solid Q2 results), up in sympathy: FLSH +11.5%, LEXR +10%.... AAPL +9.2% (reports JunQ; First Albany upgrade), ILMN +12.2% (reports Q2), PLNR +11% (reports JunQ; CIBC upgrade), NBIX +10% (to file Indiplon NDAs in Q4), CNVX +9% (US permits 3 cancer drugs from Cuba - NY Times), ORCT +9% (KDDI selects Corrigent's Packet ADM for nationwide deployment), CNJ +9% (LUX raises offer), NUI +8% (ATG to buy company), OVTI +6.4% (added to the JP Morgan Focus List), PPDI +6% (reports Q2; Baird and Raymond James upgrade), TASR +4.3% (announces orders), QLGC +4.1% (reports JunQ)... Vaccine stocks up on Project Bioshield bill passing: AVAN +10.6%, VXGNE +4.5%, SIGA +5%, HEPH +1.4%.... Under $3: DVID +10% (prelim Q2 results).

Gapping Down

NOK -16% (guides Q3 below consensus), down in sympathy: MOT -3.2%, ERICY -3.1%, RFMD -2.5%, SWKS -0.5%.... TRDO -16% (guides lower), DTAS -11% (reports Q2), SCLN -6.7% (CEO resigns), PLUG -4% (files $100 mln mixed shelf), LAB -3.4% (warns for Q2), HET -2.4% (CZR takeover).... Under $3: LQMTE -48% (to be dislisted from Nasdaq). -

Kommentaar turult:

Remember the scene in Braveheart when the Scots and Brits race across the open field and clash violently with one another? Swords, fists, kicks, arrows (no--arrows cost money!). That's what it feels like this morning as the information is coming out fast and furious. Lots to digest--please take the time to do it right.

Täna tõesti päris rohkelt actionit turul ja turuosalistel võtab selle seedimine veidi aega. Tulemus näha päeva lõpuks.

Näiteks Sandisk (SNDK) on juba kolmandiku tavalisest päevakäibest kaubelnud eelturul. -

Järgmine kommentaar turult:

The White House is on the tape saying that "the US recovery remains strong despite the economic data."

In an unrelated story, I remain thin despite what the scale says. -

--- Newswire service Reuters jumped the 16:00 embargo with a headline that the Philly Fed index has slipped to 23.8 in July from 28.9 in June. The gaffe caused initial market buying in Treasuries (dollar selling) that has since been reversed. ---

huvitav, palju koondamishüvitis vennal on? -

13:18 Floor Talk: Semiconductor Strength

The semiconductor strength intraday is being attributed to several datapoints. First, Cypress Semi's (CY +7%) call midday provided encouraging fodder for traders looking for encouraging signs of encouraging order growth in the semi space (see In Play updates 11:44, 11:59). Second, PMCS +10% reports after the close with institutional desks expecting more encouraging numbers coming out of the call in light of CY earnings announcement. In speaking with institutional desks, it appears smart money is also buying peripheral names in the group such as AMCC +2% and VTSS +4%. Finally, Merrill's cautious tone earlier on BRCM (+4%) is being dismissed by traders and was described as "stale" by one of our contacts. -

PMCS tängib effektselt. Sub $10, -$2.50 day hi'st

-

Hehee, ja nüüd juba $1.5 kosunud põhjast.

-

MO-le eile õhtul kaks positiivset uudist.

1) ringkonna appellatsioonikohtu otsus

2) senat kiitis heaks seaduse,mis annab tubakasaaduste kontrolli FDA pädevusse (MO väiksematel konkurentidel läheb elu raskemaks)