Börsipäev 5.-6. august

Kommentaari jätmiseks loo konto või logi sisse

-

Tänane hommik leiab turud avanemas plussis: Dow Jones ja S&P500 ca +0,15%, Nasdaq ca +0,44%. Eile üle 3% langenud nafta hind on 0,70% tõusnud ja taas ülespoole 43 USD piiri liikunud. Väga olulisi tulemusi täna enne turu avanemist ei ole laekunud, kuid enamus raporteerinud ettevõtteid on suutnud ootusi ületada või inline tulemusi näidata, mis loob positiivse fooni.

Eilselt järelturult:

Mõnda aega tagasi muutustest raamatupidamisarvestuses teatanud ja seetõttu järsu languse läbi teinud Red Hat (RHAT) avaldas oma uute arvestuspõhimõtete järgi korrigeeritud 2002-2004 aasta müügi- ja kasumiaruanded, kardetud suuri muutusi see kaasa ei ole toonud ja aktsia on eelturul +1,89% tõusnud.

United Online (UNTD) aktsia on eelturul koguni -21% languses hoolimata sellest et mais kasumihoiatuse andnud ettevõtte kasum tuli ikkagi üle ootuste (0.25 USD vs. 0.24 USD). Käive jäi siiski ootustele alla ja kärbiti ka järgmise kvartali käibeprognoosi rohkem kui 5% võrra.

Rev Shark asemel Cody Willard täna:

Bulls and bears, longs and shorts, daytraders and long-term investors -- you name the market participant -- are ready for this market to make a break in either direction.

Oil has undoubtedly been a major weight on this market. But to be clear, high oil prices didn't cause the nearly universal spending freeze on enterprise software last quarter. And high oil prices didn't cause the number of cable subscribers to decline last quarter. Today's retail sales numbers, which appear to be just OK, were perhaps muted because of consumers' pain at the pump.

Regardless of the near-term economic effects of skyrocketing oil prices, they've certainly been a big factor in the incredible shrinking P/E multiples in this market. Take a look at a chart of both the price of oil and the Nasdaq. The inverse movements of the two are striking. As oil has continued its ascent toward a 5-handle on crude barrels, market participants are rightly concerned about the sustainability of the economy's expansion over the intermediate term.

Somewhat surprisingly, given that oil prices have little or no direct effect on the fundamentals of the sector, the single biggest battlefield out there remains the semiconductor sector. The bears are certain that these companies have no chance of making the next few quarters' estimates, although they've thought that for the past two years when oil was lower. But participants who were bulls on these stocks have lost their faith in these companies' ability to earn what they say they will.

And plenty of would-be buyers continue to sit on their hands, worried about oil prices -- more so than rising interest rates, the threat of terrorism, the coming election or the blip that the economy might or might not have seen in June. I think those high oil prices are keeping a lid on this market and keeping investors from stepping up to the plate and awarding a more "reasonable" P/E, given the many strong numbers of last quarter and lots of strong guidance.

Will oil undermine this economic expansion? Have the chip companies already seen the their fundamentals top out? Will the continued pressure weighing down the stocks in the market bring on some sort of reflexivity-based recession? Good questions, and it'd be a lot easier to answer them with a "no" if oil would reverse. Oil in the $50s would have further ramifications on multiples, even if it doesn't immediately hurt the economic expansion.

I'm no oil expert, but as I've cited before, a market is usually much closer to a top than a bottom when capacity and supply constraints are all anybody can talk about and are spiking prices. Sure, it could be "different this time." Then again, I remember when the "New Economy" was supposed to make things "different" back in the late 1990s and 2000, too.

G. B. Smith:

-

Gapping Up

SYNX +58% (reports JunQ), AQNT +19% (beats by $0.05; Jefferies upgrade), HANS +16% (reports triple-digit increase in earnings), TWTC +11% (beats by $0.05), SCOX +10% (SCO has 'smoking gun' in IBM suit -- Forbes.com), KIND +10% (beats by $0.04; raises Y04 outlook), KOSP +9% (beats, guides higher), INCY +7% (UBS upgrade), UVN +5.2% (beats by $0.05; Merrill and Wachovia upgrades; short covering), XMSR +3% (beats, ups subscriber guidance for Y04; short covering), SIRI +2% (higher in sympathy with XMSR), BE +2% (beats by a penny).... Under $3: AKLM +31% (gets extension on credit agreement), SSPI +13.5% (DoD contract), XYBR +5.5% (reports results).

Gapping Down

UNTD -22% (beats, but guides lower; Piper and First Albany downgrades), WFII -21% (reports in line, guides below consensus; First Albany downgrade), LTON -15% (misses by a penny), MOSY -11.4% (misses by $0.04), ASYT -10.6% (beats, but guides lower), VISG -7.4% (prices 7.5 mln share offering at $5.50), CHINA -7.2% (disappointing qtr; CFO resigns), GPS -6.6% (July comps below consensus), ELNK -5.8% (in sympathy with UNTD), LAMR -4.9% (misses by $0.02), BOBJ -2.4% (momentum from 4.8% fall yesterday on Wells Notice), PNRA -1.8% (report in-line, guides a penny below). -

Russia says Yukos banned from using bank accounts -- Bloomberg

Watch for potential weakness in VIP and MBT and possible uptick in crude prices. -

Kui tõenäoline on, et FED tõstab intresse järgmisel teisipäeval 25 bp?

Vaadake siit - http://www.tradesports.com/jsp/intrade/contractSearch/searchPageBuilder.jsp?z=1091716412974&grpID=98#

Kõik olulisemad sündmused reaalse rahaga kaubeldavad - näiteks ka see, kus Google IPO avaneb ning kas esimesel päeval lõpetatakse plussis.

-

see on küll päris huvitav link, need andmed tõenäosuse kohta just. aga siin üks küsimus juures, kuivõrd adekvaatselt see kajastab antud valimi arvamusi, et keegi mõne "kaubaga" seal "turgu oma äranägemise järgi ei lükkaks."

-

Seal siiski päris suurte kogustega kaubeldakse, seega kui sa turgu üritad "ära osta", siis võid väga valusa miinusega lõpetada.

-

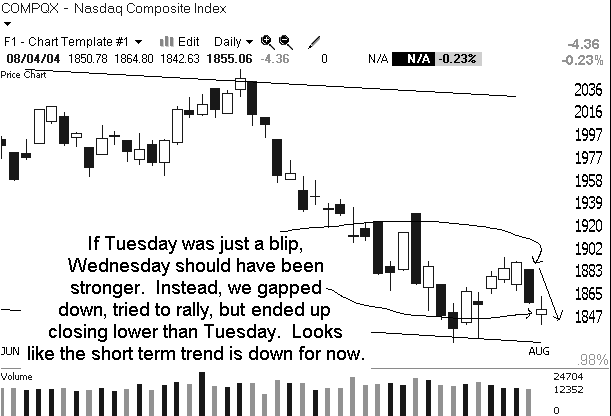

... ja testime siis 1830 juures vanu põhju

-

Jah, Nasdaq 1829 on tase mida jälgida. Ei uskunud, et nii ruttu nende tasemete juures tagasi oleme.

Päris kole seis, kuid tuleb arvestada, et homne tööjõutururaport ja teisipäevane FEDi sõnum võivad kõik pea peale pöörata. -

huvitav um see, et kauplejaid või treidimise huvilisi foorumites nagu oleks palju, aga lhv chatile ei saa vungi sisse. kel mahti, võiks chatti tulla.

-

Abesiki, inimesed arvutitest eemal - sügisest aitame ka chati käivitamisele kaasa.

-

Tough Trading as Oil Spikes

8/5/04 12:22 PM ET

Oil has spiked again on word that the EU is considering building a strategic petroleum reserve. Coinciding with that move in oil is (drum roll, please) a selloff in the stock market! The tensions around oil and the attention it's getting are spiking too -- high beta those tensions and attention are. Tough market to trade, so don't force it if you're looking for quick flips.

Cody Willard, RM -

Chat võib foorumitele negatiivselt mõjuda. Foorumite puhul ei jää headest mõttekildudest ilma. Chat on rohkem teismeliste lobisemise koht.

-

puhkuse loll jutt

-

puhkuse. really? 99% ajast seal võib olla bs, aga 1% kui tead miks oled või just for relax võib olla päris päris kasulik. 99% aja taustal leiad samuti ikkagi midagi - kas või opositsioonis. loomulikult kui sa oled permanentselt "tahan-nikku" jutukas, ei leia su vanaema ka sealt midagi mõistlikku. jutuka jaoks on oma aeg - fun feeling on kobe invseteering kui seda teed õigel ajal. jutukas on siis mõistlik, kui sa ei loba seal tervet päeva ja loodad, et mõni kobe aju suudab sulle midagi pakkuda ja sina temale. (ma ei viici pikemalt seletada).

-

16:20 NVDA prelim $0.03, vs $0.15 consensus; revs $456 mln, vs $502.8 mln consensus

Me thinks mu sept 12.5 - 17.5 strangle oli õige valik...

Kui nüüd CC-l Überguidance't ei anta, siis võib see ikka väga valus laks olla... -

2003 jaanuaris oli Nasdaq nt 1400 peal ja tegi eelmisel aastal 60% ralli.Öelge spetsialistid,miks ei võiks nt nasdaq tagasi vajuda jõuludeks 1400 peale?Ja mis tase on nn "odav" Kas nasdaq1000 jääb põhjaks ja kas nasdaq2000 omab juba minimaalse mulli mõõtmeid?

-

jah strangle kasum üle 100% ilmselt, sõltuvalt, mis hetk ostetud. Samas suhteliselt bold move, kui NVDA liikumine oleks kasvõi 10% piiresse jäänud siis erilist raha poleks tulnd.

Muide Kristjan miks sa NVDAt straddleks ei valind? -

Mis toimub, mingit pulbrit jagatakse kuskil tasuta voi? Voi ongi see juba Savisaare alkoholipoliitika tagajarg - Dow 3000, Nasd 1000...Katsuge ikka reaalsusesse tagasi tulla, sobrad.

-

Ostetud on $0.98-ga (incl. TT). Seepärast ma septembrisse võtsingi, et näost ära ei kukuks kohe, kui tulemused oleks minimaalselt liigutanud.

Ah, eks näis mis homme saab, ma arvan, et homme stabiliseerub $12 juures. Aga loodame halvemat :). -

// should of known better when that new nvdia chip required a seperate 6hp briggs and stratton engine to power it//

ma ei saa aru miks on vaja butterflayd, straddlet, stranglet või ükskõik mis vigurit panustamiseks. kas poleks mõtekam teha roppu moodi tööd ennem ja nii 70+ protsendise tõenäosusega täppi panna one-way ticketiga? -

abesiki, probla ongi selles, KES selle roppu moodi töö ära teeks? Mina olen Kristjanile igatahes tänulik...

-

NVDA lõpetas eile ca 11 ringis, Suffiksi strangle peaks selle taseme juures korraliku kasumi tooma.

Suffiks, tasuks veel mõelda eelturul kasumi aktsiatega lukku panemise peale, kui usud, et stabiliseerub 12 juures .. 1 puti kohta 100 aktsiat ostes saab seda üsna ilusti teha.

Ardo -

rick12, ei ole puhkuse jutt loll, paljud inimesed, kes käivad foorumis, ei pruugi chatti lihtsalt sisse saada, kuna kasutavad tööarvuteid ja nende firma IT-turvalisuse tase lihtsalt ei luba sellistele lehekülgedele siseneda. Seetõttu ma enam polegi pikka aega chatis käinud :-(((

-

öösel töötad vä, :))

-

Fit,

ega keegi NVDA poolt nii hullu laksu ka ei oodanud, muidu oleks putid enne sulgemist $4 ka maksnud. NVDA on lihtsalt liiga laialt jälgitav ja see teeb enne tulemusi volatiilsuse pealt teenimise väga raskeks. Seetõttu jäi ka välja.

Strangle vs. straddle - on suures osas maitseasi, strangle pakub suuremat potentsiaalset tootlust, aga samas on kaotusvõimalus oluliselt suurem. Mulle sobib straddle riski/tulu suhe paremini.

Muuseas, ma väga täpselt ei jõudnud veel arvutada, kuid ilmselt oleks augusti straddle toonud samasuguse protsentuaalse tootluse kui septembri strangle. -

rick12,

miljokas olen vä, et omale koju arvutit ja internetti osta jõuan???

ei ole :-((( -

Velikij,

Osta arvuti K-Arvutisalongist...:))) -

Chatis võiks jah rohkem rahvast olla,et ideid genereerida

-

Privador vaata kunagi on lhv pakkunud välja erinevaid ruume kui ma ei eksi

-

Töökohti lisandus oodatust siiski veel vähem - vaid 32 000 (oodati 240 000). Turu esimene reaktsioon allapoole (Nasdaqi futuurid kukkusid minutiga protsendi).

Ootused olid väga negatiivsed, seega ma ei imestaks kui siit kosuksime. -

dollar kukkus pea sekiga 150 pipsi:)

-

chf-ga sec ja eur-iga 15sec:)

-

James Altucher

Market reacting badly

8/6/04 8:40 AM ET

The market is reacting badly but that doesn't mean this isn't playable for a bounce. In every way the numbers look bad: 32K jobs added vs. 243K expected. Average workweek 33.7 vs 33.8 expected (this is particularly bad since the drop in June was mostly due to the Reagan funeral and economists had expected that to rebound this month. Hourly earnings ticked up and unemployment remained the same.

However, these are just one set of numbers, subject to the usual revisions and the market has largely been baking in these numbers during the slide of the past several weeks.

Sometimes it's best to test the waters right when people are in a panic. Right now we are opening 1.5 standard deviations below the 10-day moving average of the lows on QQQ. This has happened on 58 prior occasions. On 56 of those, QQQ moved up at least 0.8% from the open. On 38 of them, QQQ closed up higher than the open on the day. Overall, on all 58 prior occurrences, the average gain from open to close was 1.3%. Rather than buy the open, though, I'll probably wait for a further dip. Although such waiting has cost me in the past.

-

tuleb jälle must päev...Trader mul puha punane:(

-

Krt, mulle pole punane värv kunagi meeldinud. Nüüdseks on ikka kõva siiber sellest värvist.

-

Rev Shark:

"What greater reassurance can the weak have than that they are like anyone else?"

-- Eric Hoffer

My primary theme for quite some time now has been to avoid anticipating a turn in the market. In theory that is a very easy thing to do, but in practice it is much more difficult. The biggest problem is that traditional Wall Street constantly sends us the message that we have to stay heavily invested at all times and should be snapping up "bargains" as prices erode.

The Wall Street bias toward staying long even when the market is acting poorly is supported in a number of ways: the futility of "market timing," the "it's too late to sell" argument and "the market is stupid and will come to its senses soon" theory. There are a number of other variations of these arguments, but the one that is the most difficult for people to avoid is the attitude that "this is the way it's done."

We see fund managers on television and read their thoughts and opinions in influential financial publications. With the exception of a few perma-bears, none of them ever talk about being mostly in cash. A big cash position for most of these pros is 10% to 15%. If the folks who are managing billions of dollars approach the market in that way, shouldn't we be doing the same? After all, they are "professionals" and must know the best approach to the market.

Wrong! Big fund managers trying to beat benchmark indices know the best way to manage big funds, and that has very little to do with what is best for most individual investors. I don't think I've ever seen anyone in the general business media who has actually discussed the issue of whether individuals should manage their investments in the same way Fidelity manages theirs. It is simply assumed that we should.

The problem is that in market environments like we have now -- and like we had after the bubble burst -- that approach ensures that investors give back a huge proportion of their gains. Staying in the market is deemed to be far more important than protecting and maintaining your capital base.

I've started working on a book in which I will explore this topic in much greater depth. My working title is "Invest Like a Shark" because, like a shark, success in the market depends on staying in motion rather than wallowing like a whale when the market is difficult.

I'm sure I don't have to point out that the indices are acting very poorly. Oil prices are receiving most of the blame, but the likelihood is that the market would have found some other excuse to sell even if oil prices weren't running higher.

The technical picture is extremely poor going into the highly anticipated job's report that is due out at 8:30 a.m. EDT. There has been a lot of talk about how the number is not likely to meet the anticipated level of 250,000 new jobs. Some disappointment has already been baked into the market, but we really don't know to what degree a poor report will be tolerated.

The market mood does feel like it is finally becoming a bit too negative. It would have been more convincing if we had higher volume on the meltdown yesterday, but there is little question that last week's failed bounce has doled out some pain to the serial bottom callers.

I have no idea what is going to happen on the job's data this morning. We have priced in some disappointment, so it won't take much to produce a positive response. But the most important thing to keep in mind right now is that the trend is down and it is going to take more than a one-day bounce to turn this market.

Be prepared -- the one certainty is that we should see some decent movement when the report hits.

G. B. Smith:

-

Gapping Up

DOVP +28% (signs pact with Merck, to receive $35 mln upfront payment), MCIP +19% (beats handily, initiates large dividend, Lehman upgrade), NWRE +11% (beats, affirms guidance), SIPX +5.3% (reports Q2), OSUR +4.9% (receives $4 mln purchase order), SONSE +3.1% (Raymond James upgrade).

Gapping Down

NVDA -26% (misses qtr badly, Pac Growth downgrade), DTSI -27% (reports Q2, Piper lower tgt to $17), HLYW -26% (firm says financing condition to the consummation of the merger will not be satisfied), VSTA -26% (reports Q2, Wm Blair downgrade), BCSI -21% (warns for Q1), STCR -17% (reports JunQ), ESPD -12% (reports in line, but warns for Q3 and Y04), ZIXI -11% (reports Q2), CORV -7.1% (reports in-line), ATYT -6% (in sympathy with NVDA), RIMM -2.5%. -

NVDA strangle +130%

Septembri 17.5 callid jäid kätte, juhuks kui juhtub ime. -

Tugeva löögi turu langusest saavad eelkõige kunagised hype-aktsiad MAMA,MACE,NGEN,ASKJ

tubli 5-10% langust iga päev.Kes turu suuna ette näevad saaksid teenida kyll korralikult nende arvelt. -

Aitähh privador, aga 1 oleks piisand:))

-

Pardonks, väike arvutusviga, +180% siiski.

-

LHV Chat - kättesaadav LHV klientidele, juttu turust ja paljust muust ... astuge läbi!

-

krt, ma ikka ei saa sisse sinna.

-

11:36 Moscow court rules that govt's plan to seize main oil unit of Yukos is illegal - Bloomberg

-

Ühe turuosalise kommentaar tööturunäitajatele:

BuyHi: waiting for the bush spin on the jobs report..... "well this month we concentrated on creating jobs in india"

Bettie: lol

BuyHi: "I said I was creating jobs.... I just did not say what country"

BuyHi: "NaaaaaaaaaaaaaNAAAA NaNA"

BuyHi: (fingers in ears... waving hands around crazily)

sB :) -

yah. 5K softi saab Indias lasta teha 2K-ga, millel on special pluginad sinu jaoks:)

yo-yo võimalik fedi+lisade pärast :)

dow ja es - tundub natuke ajuvaba, kuid mul on miskipärast tunne, et infotehnoloogia kiire arengu järelmõjud on "monopoliseerimise" palju raskemaks muutnud, koos hüppelise kasumi teenimisega ja seega ka buumimise. teiseks, vana staff on turu ära tüüdanud, aga nüüdsel segasel-selginemise ajal ei leia mass enam piisavalt häid ideid (firmasid) kuhu investeerida. -

Cool. Miks?

1) Paanika

2) VIX jälle 20 lähedal

=>

Ma laen paadi septembri QQQ calle poolenisti täis. -

väike alternatiivtõlgendus oli vahele:)

suffiks, miks sa tahad vägisi oma paati nii leninistlikult tüürida? huvitav mõte pole kohe ülihea. et sa valdad kunsti nii hästi, et teise aeruga teed 90+% tõenäosusega tootlust septembri poole peale 100% ja rohkem? see tähendaks aga callidelt ütleme 200% kasumi ootamist. leninistlik ikkagi. optsioonid ise on juba stalinid. -

Abesiki, miks leninistlik? Mingi Sinu väljamõeldud sõna? Leninlik kõlab palju ilusamini :-))