Börsipäev 15. september

Kommentaari jätmiseks loo konto või logi sisse

-

USA aktsiaturud on avanemas miinuses, futuurid on suuremast miinusest üle saanud. Suurimaks negatiivseks üllatajaks oli Coca Cola (KO), mis andis kasumihoiatuse.

Naftaministrite kokkutulekul Viinis on taas üleval küsimus naftatoodangu suurendamisel. Sellel aastal on nafta tarbimine suurenenud üle 3%, mis on viimase 25 aasta kõrgeim näitaja.

Oracle (ORCL) kvartalitulemused olid kasumi osas oodatust paremad, lisaks on firma järgmise kvartali prognooside täitmise osas positiivselt meelestatud. Aktsia kerkis eilsel järelturul 10.9 dollarini.

Coca Cola (KO) teatas, et teise poolaasta majandustulemused jäävad oodatule alla ning peamine põhjus on nõrgem müük Põhja-Ameerikas ja Saksamaal. Aktsia on eelturul langenud üle 3 protsendi.

Rev Shark:

Only the most foolish investor fails to recognize the potential for surprises to occur in the stock market. Most everyone prepares for it in some way, but typically the strategy is uncreative and ineffective, such as adopting a long-term holding period or being highly diversified.

What separates the great investor from the mediocre one is the ability to capitalize aggressively on surprise when it occurs. The ability to move quickly and decisively when a sudden shift occurs is what produces outsized profits.

Those who quickly embraced the bounce that started in mid-August have profited handsomely, but now there are a number of warnings signs that tell us that we should start thinking about the potential for a surprise to the downside.

The biggest problem for the indices is that the recent bounce has taken us to areas of overhead resistance on the charts. The S&P 500, for example, is right at the downtrend line that commenced in March and the NDX is bumping its head on the 200-day simple moving average.

The biggest problem is that the last part of the market advance over the past week or so is primarily a product of an oversold bounce in the semiconductor sector. The news has not suddenly improved in the sector; sentiment simply became so negative and the momentum shorts so confident that there was no selling pressure left when the news wasn't dramatically worse than expected. As Xilinx (XNLX:Nasdaq) demonstrated last night with it poor guidance, there are still inventory and demand problem in the sector.

The question for the market is whether it can continue to rally on this rather flimsy foundation. Is there sufficient buying interest to keep this move going? Are the bulls content that the worst is over as we enter the seasonally weakest period of the year?

One worrisome sign yesterday was that even though the market was mostly flat, it appeared that there were big buyers chasing high-beta stocks, especially in the Internet sector. Some of the big movers included EBAY, NTES, SINA, AMZN, YHOO, GOOG, INSP and AKAM. The action had the aroma of funds trying to play catch-up after missing much of the recent move. That sort of desperation is a warning sign that bullishness is becoming too pervasive.

We are setting up for a weak open this morning. The Xilinx warning is putting some pressure on technology stocks and a warning from Coca-Cola (KO:NYSE) is casting a pall. Overseas markets were mixed with technology lagging and financials showing relative strength. We have a couple of economic reports due out today but nothing major.

The market is looking tired this morning. It may just be taking a rest, but it won't take much for a pullback to gain a little steam. Be ready for a surprise.

-

KO on ikka väga kallis aktsia, 30 usd kandis tasuks mõelda selle soetamisele

-

Tunne on, et Tech-ralli hakkab momentumit kaotama. Täna hommikul juba TASR ei hüpanud tavalised 8% hype-uudise peale. Ka RIMM ei tõusnud selle peale, kui UBS tõstis FY06 EPS prognoosi üle konsensuse. Võibolla CLS oma halva uudisega tappis meie pisikese pulli?

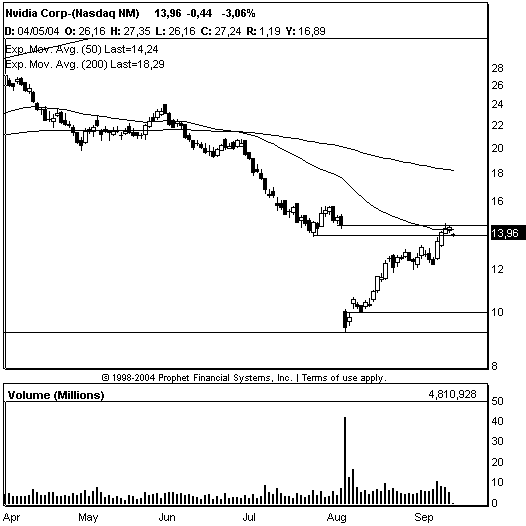

NVDA näeb huvitav välja. Lühikesest otsast.

fwiw,

sB -

Kuna tech-pullid tunduvad veidi väsinud, proovime alustada väikest short-positsiooni Nvidia (NVDA) aktsiates. Aktsiad on täna all, kuna UBS Warburg tõmbas alla oma reitingut, öeldes, et peale kasumihoiatust pole asjad eriti paranenud. Viimasel ajal on NVDA päris tublit tõusu näidanud, täites olulised gapid. Jõud on tulnud üldisest positiivsusest, millele on tuge andnud raportid insaiderite aktsiaostudest. Hinnasihti ei paku, kuid STOP asub $14.50 kandis.

SureBet, SideKick, Jim -

Gapping Up

ORCL +3.1% (reports AugQ, beats by a penny and on license revs), CYBX +14% (ANSI proposes merger discussions; prepared to offer $22/share), CPTS +9% (Humana approves Essure birth control procedure for reimbursement), TASR +1.3% (launches TASER X26C Citizen Defense System), BBY +0.5% (beats by a penny), SSFT +5.6% (expands portfolio of text-to-speech software), IDNX +3.4% (receives purchase order), SONS +1.7% (initiated with Buy, $10 tgt at WR Hambrecht).

Gapping Down

CLS -10.4% (guides Q3 lower), Down in sympathy: FLEX -3.6%, SANM -3.3%.... Other News: KO -5.1% (lowers second half expectations), ANSI -6.9% (proposes merger with CYBX), XLNX -3.9% (guides lower, Wachovia downgrade), NVDA -2.4% (UBS downgrade), ALTR -2.4% (in sympathy with XLNX), CSCO -1.7% (co is a large CLS customer, Goldman cuts Hardware), LU -1.8% (co is a large CLS customer). -

Turg ei suuda kuidagi jalgu leida, üsna oluline on tänane päeva lõpp - kui suutakse miinusest kosuda, siis pilt edasiseks positiivne. Vastasel juhul on oht pöörata nina allapoole.

-

TASR hype-uudise peale veel täiendavad 12% tõusnud ja kokku 20% püsinud. Tasub jälgida momentumi hindamiseks kuidas TASR edasi liigub.

11:43 TASR TASER Intl confirms that U.K. authorized Taser to be used by police force (38.03 +2.68) -- Update --

Co announces that U.K. Home Secretary David Blunkett authorized the TASER M26 to be used by police forces throughout England and Wales. "Five police forces have been trialing the use of Taser since April 2003 on a strictly limited basis. In the light of results of the trial, I have authorised chief officers throughout England and Wales to deploy Taser for use in the same strictly limited circumstances... Chief Officers can now make the M26 Taser available to Authorised Firearms Officers in their force as a less lethal alternative for use in situations where a firearms authority has been granted in accordance with criteria laid down in the ACPO Manual of Guidance on Police Use of Firearms. The Defence Scientific Advisory Council Sub Committee on the Medical implications of Less Lethal Weapons (DOMILL) was invited to provide a Second statement on the medical implications of the use of the M26 Advanced Taser. The DOMILL statement confirms that the risk of death from the M26 Taser is very low..." (See also 10:04, 10:01, 7:54, 7:50 comments.) -

Jah, kes eile ostis 40 sept calle pööras 3000% niksnaks.

-

Kusjuures, olles TASR'i jälginud pikema aja jooksul, toimub tema puhul alati koti pähetõmbamine järjekorras: shorts-margin longs-option traders. Kui vaadata septembri (50 tunni pärast aeguvate, seega ultraspekulatiivsete) optsioonide käivet ja open interesti on täielik hämming õigustet. Ma ootaks, et TASR'i harilikku mitmepäevast momentumit seekord ei lasta tulla, sest reede õhtuni on vähe aega ja ilmselt juba homme muutub ostupool loiuks. Igipõlise optimistina aga jätsin igaks juhuks pooled callid kätte, äkki siiski :)

Aga huvitavalt spuuki igal juhul.

Ja TZOO on mõnusalt pask aktsia, ma väga loodan, et ta põrutab nii kaua otsejoones üles kuni talle välja kirjutama hakatakse. Kui TASR'it õigustab veel võibolla see, et tal on unikaalne tehnoloogia, siis TZOO on ju lihtsalt üks järjekordne MAMA. -

Mis MAMA-l häda on:) Sama võiks öelda ,et GOOG on pask ja miks seda küll nii palju ostetakse.:)

-

Piper Jaffray maintained an "outperform" rating on Xilinx (XLNX) but lowered its earnings estimates and target price based on the chipmaker's revised guidance for the quarter. "We are somewhat surprised by the magnitude of the lower guidance," Piper Jaffray said, "especially compared to competitor Altera (ALTR)." The research firm lowered its 2005 earnings estimate on Xilinx to $1.02 per share from $1.19 per share, and its 2006 earnings estimate to $1.29 from $1.48. Piper Jaffray also lowered its target price on Xilinx to $33 from $38. The lowered guidance stemmed from weakness in the communications end market and slower domestic sales, Piper Jaffray said. "Now that most of the negative preannouncements are likely out of the way, investors are likely to start looking out a little further," Piper Jaffray said. "Longer term, we view Xilinx as one of the safest ways to achieve sales growth and stable margins in the semiconductor industry."

-

privador,

1) Ma ei väida, et GOOG ei ole pask

2) Küll aga on tema valuationit toetavad tegurid need, et nende näol on tegu turuliidri, suure innovaatori ja tugeva brändiga.

Nagu võrdleks GE'd ja Uralvagonzavodi :) -

Korraks veel kiire pilk pooljuhtide tulevikku.

Morgan Stanley analüütik Mark Edelstone langetas 2005. aasta ülemaailmse käibe kasvu prognoosi 8 kuni 12 protsendini (varem 13%-18%), põhjendades seda fundamentaalnäitajate järsu halvenemisega. Seejuures kardetakse nii varudest vabansemise kui aeglustuva majanduskasvu negatiivseid mõjusid. Siiski jäeti selleaastane kasvuprognos 23 kuni 28 protsendi juurde ning lisati, Morgan Keegani arvates on suurem enamus negatiivsust juba aktsiahindadesse sisse arvatud.

Kasvu aeglustumist näeb ka JMP Securities, kes prognoosib 2004. aastaks 25% ning järgmiseks aastaks 10 protsendilist käibe kasvu.

-

Täna hommikul (16.09) avanes turg veidi kõrgemalt ning hype sentiment tundub jätkuvat. RIMM on suutnud murda uuele kõrgemale tasemele. Ka NVDA avanes plussis ning on hetkel veidi allpool sisenemistasemeid.

Jätkame NVDA positsiooni hoidmist, kuna usume, et korrektsiooni algus on lähedal. STOP ikka 14.50 kandis, mis annab piisavalt hingamisruumi.

Kristjan hüppas ka läbi, öeldes, et läheb sööb enne ning hakkab siis lühikesi positsioone peale panema :).

sB -

NVDA läks tõusule. Midagi kuulda ei ole (uudised, upgreidid), mis tähendab, et gap ilmselt täidetakse ära vähemalt. STOP 14.50!

sB -

STOP käigus @ 14.50

sB