Börsipäev 24. sept - Tech vs vana majandus

Log in or create an account to leave a comment

-

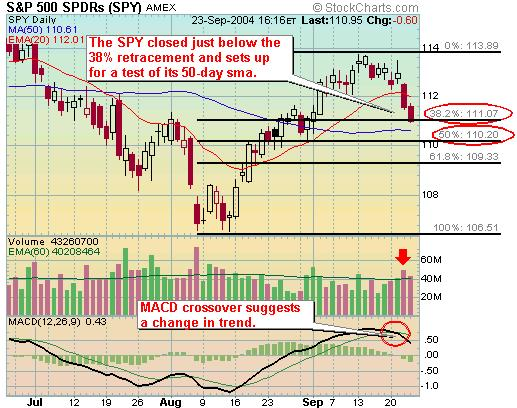

Mõned graafikud (Briefing.com):

Vähemalt hetkel läheb tech-aktsiatel vana majanduse omadest paremini: -

1 käibehoiatus Euroopa pooljuhtide sektorist

AMSTERDAM (Dow Jones)--Royal Philips Electronics NV (PHG) Friday slightly

downsized its prediction for the semiconductor market in 2004, following a cut

of its third-quarter chip sales guidance.

For 2005, Philips expects semiconductor industry growth to slow down to single

digits.

The company believes the global chip market will grow by 26% in U.S. dollar

terms in 2004, it said in a presentation posted on its Web site. Earlier in the

year, the company had predicted 28%-29% growth.

-

Forbes avaldas täna usa rikkamate inimeste 2004.a. edetabeli

http://www.forbes.com/home/forbes400/2004/09/22/rl04land.html

-

USA turud on avanemas plussis, kestvuskaupade orderid kasvasid augustis 0,5% (tsiviillennukite orderid kukkusid 42,8%), ilma transpordisektori orderite 6,8% languseta kerkis indeks 2,3%, mis on märtsist alates suurim tõus. Paar kasumihoiatust pooljuhtide sektoris on turule vähe mõju avaldanud.

Euroopas hoiatas Philips Electronics (PHG), pooljuhtide müük on oodatust väiksem. Teise kvartali osas andis hoiatuse ka Cirrus Logic (CRUS), firma probleemiks on oodatust väiksem DVD-de mängijate nõudlus.

Boeingu (BA) juht teatas, et nende ootused tööstusharus nõudluse taastumise osas ei ole nii roosilised kui rivaal Airbus eeldab. Täpsemalt avaldab firma oma 2006 ja 2007 aasta prognoosid järgmisel kuul koos kvartalitulemustega.

Nafta hind langes veidi peale Vladimir Putini teadet, et Vene riik ei kavatse Yukost natsionaliseerida.

Rev Shark:

If you listen to traditional Wall Street advice the action to take when the market looks shaky or weak is to simply ignore it. Caution simply means not buying more rather than selling. The justification for this advice is that timing is futile and that if you sell you will invariably do so at the wrong time.

This attitude is based on the incorrect premise that being overly cautious is worse than doing nothing. It is human nature to sit on our hands and cower when the going is tough but the real problem is that traditional Wall Street encourages that sort of behavior.

Unfortunately, most investors simply don't know how to shift back and forth from a cautious stance to a bold and aggressive one. They have been brainwashed for so long into thinking that if their timing is off then they are doomed to a lifetime of investing underperformance.

The truth is that the market is extremely forgiving of an excess of caution. That doesn't mean that you can run and hide forever and still expect to do well, but if you are capable of aggressive action when you feel the time is right, then long periods of caution may actually produce outperformance.

After the ugly technical breakdown in the indices on Wednesday the inclination of many folks is to look for reasons why they don't need to be cautious or concerned. They take comfort in Wall Street's disdain of market timing and ignore warning signs. Maybe things will turn out just fine for them but the exercise of a little caution could greatly enhance their returns.

The key thing to remember is that caution can easily and quickly be reversed. The cost of selling and rebuying positions is minuscule. If you end up buying higher simply consider it the cost of insurance.

What you need to keep in mind is that having some sort of money management plan in place is far more important than being a great market timer. If you are prepared to act when things start to slip and are willing to be aggressive when the picture looks promising, your chances of superior returns are far higher than if you simply sat and ignored the signals of the market.

Right now the market is flashing some very strong warning signs. We have cracked uptrend lines and support levels, we are at the weakest time of the year seasonally, and many investors have some recent profits to protect. The economic picture is mediocre at best. The August durable goods report just hit and looks stronger than expected but the pundits are digging into it now and looking for flaws.

We have a slightly positive start to the day. Overseas market were lackluster. Oil is down slightly and bonds are sitting unchanged.

Proceed with caution.

-

Ostsin eile õhtul Select Comfort'i (SCSS), millest Oliver LHV Pro all on pikemalt kirjutanud (loe siit).

Põhjused, miks ostsin:

- Ettevõte omab kindlat nii

- Uus juhtkond on suutnud kasvatada efektiivsust ning firma kaubamärgi eelised esile toonud

- Omab väga tugevat mainet

- On ostmas oma aktsiaid tagasi

- Demograafilised trendid

- Konkurentidel ei ole kerge turule siseneda

- "Hallituse probleem" ei oma pikaajalist mõju firma tegevusele

- Nende tegevus on lihtne ja arusaadav

- Bilanss tugev

Peamine põhjus on just ettevõtte efektiivsusel. Keskmiselt on firma suutnud toota 28% netovaradelt, mis on väga hea näitaja. Mida see näitab? Peamiselt seda, et ettevõte kulud on kontrolli all ning juhtkond on tasemel. Minu jaoks ongi peamine juhtkonna ja ettevõtte hindamise mõõdupuuks efektiivsuse näitajad.

Miks just eile ostsin? Ootasin juba ammu sobivat sisenemise hetke ning eile tundus, et toimus kiire lühikeste positsioonide katmine ning aktsia murdis vastupanu. Juhul, kui ettevõte 3Q tulemused peaksid negatiivsed olema just "hallituse" tõttu, siis olen juurde ostmas.

Hoidmisperiood: kui kõik jätkub nii, nagu praegu, hoian aktsiat väga kaua ehk ei sea mingeid tähtaegu ega hinnasihte.

-

Gapping Up

CNLG +23% (introduces communications link), NTMD +8% (started with a Buy at UBS, started with an Overweight/Focus List at JP Morgan), CLST +22% (announces partnership with INTC), ECSI +15% (to be acquired by STJ), AGIX +5% (AG Edwards upgrade), CKCM +4.3%, INTV +4% (reports AugQ, beats by $0.03), MSO +4% (renews Martha's contract), PSFT +3% (EU set to clear Oracle bid for Peoplesoft), SWIR +2.3% (Fidelity buys additional 153K shares), BOBJ +2.2%, ASPM +2.2% (mentioned in BusinessWeek)... Air Cargo stocks continue momentum: AIRT +5%, WLDA +3%, VEXP +15%.

Gapping Down

PSRC -10% (reports AugQ; disappointing guidance; Deutsche downgrade), ESIO -11% (guides lower), CRUS -8% (guides revs below consensus; lowers gross margin expectations), AVNX -6% (auditor resigns), SGMS -5% (compeitor GTK chosen as provider of online lottery in Thailand), SINA -2% (comments at ThinkEquity conference, see 17:00 comment). -

10:46 Hearing a rumor that a Russian plane is missing; no confirmation yet

-

LHV Pro all üks värske kauplemisidee, üsna volatiilne ja kaubeldav aktsia.

-

Suur klient tuli ja noppis just 800K QQQ,

fwiw,

sB