Börsipäev 18.oktoober

Kommentaari jätmiseks loo konto või logi sisse

-

Elcoteq tõstis kolmanda kvartali kasumi ja käibeprognoose, aktsia 7% plussis.

-

Tänane hommik toob endaga kaasa mõned uudised. Naftahind on ootuspäraselt teinud uue tipu ülalpool $55 taset, surudes USA futuurid punasesse. Lisaks sellele on analüütikud väljas oluliste negatiivsete arvamusavaldustega:

- Merrill Lynch arvab, et Texas Instrument (TXN) tuleb Q3 prognoosidega toime, kuid Q4 ning 2005 prognoosid on nende arvates liiga kõrged. Analüütik langetab oma puhaskasumi prognoosi Q4 ning 2005 jaoks allapoole üldist konsensust.

TXN on pooljuhtide seisukohalt väga oluline ettevõte ning Merrilli call lisab üldisele negatiivsusele tublisti.

- Lehman Brothers on negatiivsete arvamusavaldustega väljas nii eBay (EBAY) kui ka Amazon.com (AMZN) suhtes. EBAY kohta arvab analüütik, et Q3 head tulemused on juba hinnas sees ning 2005 prognoosid võivad tulla allpool praegust konsensust. Amazon.com (AMZN) puhul usub analüütik, et Q3 võib tulla oodatust nõrgem.

- Positiivsest poolest PalmOne (PLMO) saab JP Morgani käest upgreidi Overweight peale varasema Neutrali pealt.

Graafik (Briefing.com):

-

Raisio teatas, et on lõpetanud töösuhte 39 juhtivtöötajaga. Aastane kokkuhoid 2 miljonit eurot.

-

Rev Shark:

"Any fact facing us is not as important as our attitude toward it, for that determines our success or failure. The way you think about a fact may defeat you before you ever do anything about it. You are overcome by the fact because you think you are."

-- Norman Vincent Peale

As we start the busiest earnings-report weeks of the quarter, the facts facing the market are a bit troubling. The one fact that is receiving most of the attention now is the stubbornly high price of oil. Over the weekend it breached the $55 per-barrel level. It has pulled back this morning, but overall there are few signs it is moderating. Alan Greenspan helped ease fears a little with some comments Friday, but the fact that we may not see the same problem we faced in the 1970's is cold comfort.

Aside from oil, we have a number of other troubling facts to contend with. The economic stats lately have been lackluster at best. There are quite a few market commentators, including Doug Kass over on Street Insight, suggesting that we may be falling back into recession. I have no idea if that is the case, but the bears are certainly becoming more vocal about that scenario.

Iraq remains, at minimum, a distraction for the market. It's obviously a very important issue in the presidential race and folks also are mindful of the possibility of some sort of terrorist attempt to affect the elections. Most of the latest polls continue to show President Bush with a very slight lead, which is generally considered a market positive.

Earnings season so far has been unimpressive: With the exception of Apple Computer (AAPL:Nasdaq), there have been few if any outstanding reports. We have plenty of chances for that to change this week, especially because expectations are low.

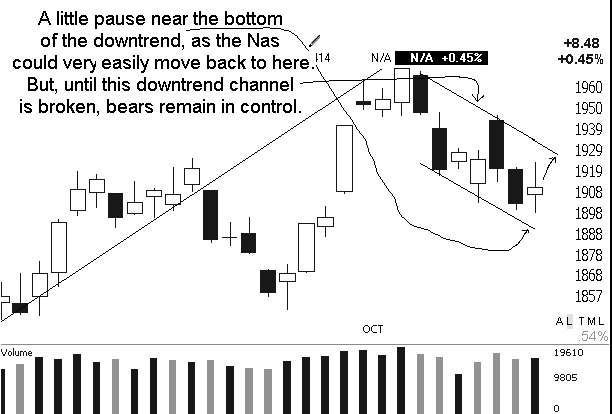

The most troubling fact from my standpoint is the technical condition of the indices. For a while a couple weeks ago, it looked like we were going to make a run at breaking the downtrends that have been in place since the start of the year. However, we failed miserably in that attempt and have some hard work to do to regain upward momentum. The Nasdaq has some support here at the 1900 level but it faces a major hurdle at the 200-day simple moving average and the downtrend lines, which are coming together at around 1965.

The facts facing the market paint a rather bleak picture but the flood of earnings this week does have the capacity to change the market mood at least momentarily. Right now the bears have the edge but we should expect some upward forays by the bulls. One of the big problems that this market has right now is that there still is a high level of bullishness despite the many negatives affecting this market. That is worrisome and suggests upward moves will be limited.

We have a negative start to the day as worries about oil continue unabated. Overseas markets were mostly trading down overnight. The good thing about earnings is that it generally leads to good trading opportunities. So even if the market remains tricky I expect we will find plenty to do.

-

G. B. Smith:

-

Gapping Up

CHKP +6% (beats by $0.02, guides higher on conf call), ISON +9% (3 accredited investors convert preferred stock into common stock), ELN +5.4% (an Irish paper reports that Biogen is considering bid for co), TASR +5% (gets node of approval from Dept of Defense study), SIRI +4.6% (expands relationship with Ford), PLMO +3.9% (JP Morgan upgrade), CNLG +10% (introduces comm link to expand into European utility mkt), IWAV +51% (co andf ALVR amend amalgamation agreement), JDAS +7.4% (selected by Sears), NFLX +2.9% (stock finally looks cheap - Barron's), GTW +2.6% (news report that co will also use AMD chips).... Under $3: DFIB +18% (new state laws mandate AED deployment), ASTM +6.7% (plans to expand bone graft study).

Gapping Down

ODSY -34% (DOJ begins investigation under the False Claims Act, CEO resigns, lowers guidance), MMC -6.7% (postpones conference call), HRLY -5.1% (misses by $0.07), INTT -5% (Wells Fargo cuts to Sell), ECSI -4.6% (announces patent infringement lawsuit against it), PFGC -4.2% (lowers Q3 & Q4 EPS guidance), CAAS -3.9%, ASD -3.8% (reports Q3), MMM -3.5% (meets guidance, misses consensus by a penny, guides Q4 & Y04 below consensus), X -2.9% (CSFB downgrade). -

Päevasisese ralli põhjus? Peamiselt nafta kiire kukkumine 1.5 punkti võrra $53.5 juurde.

-

Tänase päeva koledaim graafik? Check SGU.

-

Ilus graafik,mis tal viga on:)

-

SGU volume hüppab vähe naljaka koha peal.

-

Tehvlon, enne oli kauplemine peatatud, alustati alles 21.15.

-

Kas keegi on Raisio dividende saanud? 12. kuupäev ammu möödas - ei kippu ega kõppu...

-

Laekus 12.10.

-

puhkuse

Kõik kliendid on RAIVV dividendid juba 12. oktoobril kontole saanud, palun vaata oma rahakonto väljavõtet. -

mina sain kätte. vaata rahakonto väljavõtet ;)

-

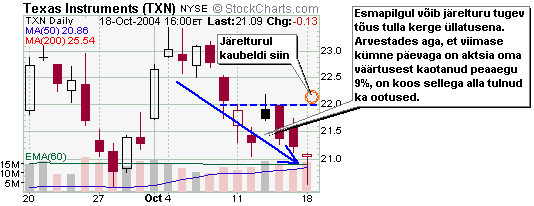

Eile pärast turgude sulgemist avaldas kolmanda kvartali tulemused Texas Instruments (TXN). Vaatame need kiiresti üle, täispikkuses on tulemused aga kättesaadavad siin.

Firma ületas ootusi nii kasumi kui käibe osas: EPS $0,32 (oodati $0,28) ning käive $3,25 miljardit (oodati $3,17 mld).

Nii roosilised ei olnud aga prognoosid järgmiseks kvartaliks: EPS $0,24-0,28 (oodati $0,26) ning käive $2,96 kuni $3,2 miljardit (oodati aga $3,22 mld). Käibest moodustab pooljuhtide müük prognoositult $2,63 kuni $2,83 miljardit (lõppenud kvartalis laekus $2,78 mld).

Pooljuhtide müük, mis moodustab firma käibest umbes 85%, püsis eelmise kvartaliga võrreldes peaaegu muutumatuna ning aastasel baasil kasvas 31%. Firma sõnul korrigeerisid kliendid ning edasimüüjad lõppenud kvartalis varusid ning see on jätkunud ka neljandasse kvartalisse. Reaktsioonina on TI järsult vähendanud tootmiskoormust ning peaks aasta lõpetama väiksemate varudega.

Orderid kahanesid eelmise kvartaliga võrreldes 7 protsendi võrra $3,019 miljardini. Põhjusteks peamiselt nõrgem nõudlus pooljuhtide järele kui ka sesoonne langus E&PS (Educational & Productivity Solutions) nõudluses.

Mõnevõrra üllatuslikult kerkis aktsia järelturul üle 5 protsendi.

-

TXNi 5% tõus järelturul on kahtlemata võimas liikumine, kuna tegemist ikkagi väga suure aktsiaga.

TXN mõjutab oma tugevusega ilmselt kogu pooljuhtide sektorit, täna peaks avanemine olema kindlasti plusspoolel. Oluline kuidas seda hoida suudetakse.