Börsipäev 26. okt

Kommentaari jätmiseks loo konto või logi sisse

-

Tänane hommik toob endaga kaasa enam vähem nulli juures kauplevad futuurid. Euroopa turud avanesid veidi üles, kuid ei tõusu jätkata. Nafta on tippude juurest veidi alla tulnud ning dollar konsolideerub peale nädal aega toimunud kukkumist euro vastu.

Mõned uudised:

- Kindlustusmaakler Marsh & McLennan (MMC) teatas, et uue CEO valimisest. Huvitaval kombel on tegemist Eliot Spitzeri vana sõbraga.

- EMS sektori suurim tegija Flextronics (FLEX) ei tulnud eile õhtul välja investoritele meelepäraste prognoosidega. Nõrkus eelkõige mob.telefonides. Ericsson (ERICY) oli vist FLEXi suurim klient. 15% käibest.

- Nvidia (NVDA) tõstis kvartaliprognoose! Siiski nii vähesel määral, et analüütikud kahtlevad pressiteate mõttes. Väidetavalt püüdis NVDA ennetada täna avaldatavaid turuosa numbreid, mis peaksid näitama edasist kukkumist. ATI Tech (ATYT) on turuosa võtmas.

- Silicon Labs (SLAB) oli küll kole, kuid suuremas plaanis siiski non-event. Nõrkus Aasias. Nothing new.

Mõned tehnilise analüüsi järgijad väidavad, et eilne suuremate indeksite paigalseis oli hea. Väidatavalt näitas, et karud on võhmal, mis lubab pullidel turgu ülespoole suruda.

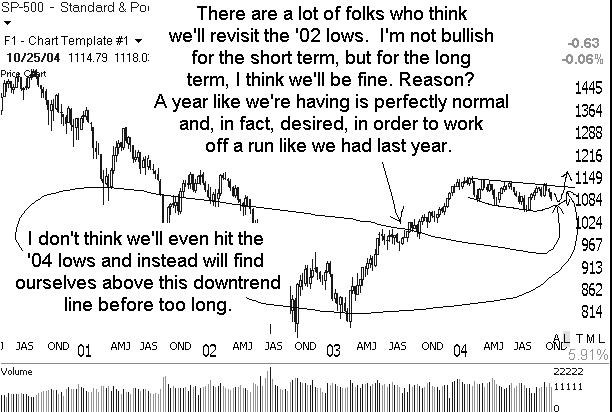

Graafik (briefing.com): -

Suurima lepingulise pooljuhtide tootja Taiwan Semiconductor Manufacturing (TSM) lõppenud kvartali tulemused vastasid küll igati ootustele, kuid samas hoiatati vaiksema IV kvartali eest. Lõppenud kvartalis kujunes kasumiks ADSi kohta $0,18 ning käibeks $2,06 miljardit.

Tuleviku osas räägiti aga madalamatest käibenumbritest ja kasumimarginaalidest (põhjuseks septembrist-oktoobrist alguse saanud nõudluse vähenemine) ning tootmisvõimsuse vähendamisest (lõppenud kvartalis 103%, prognoositakse aga langemist 80. aastate keskpaiga tasemetele). Kui viimati ennustas Morris Chang, et 2005. aasta kapitalikulutused võivad 2004. aasta omi kergelt ületada, siis nüüd nähakse nende kerget vähenemist. Kuigi langus ei pruugi tulla suur, siis 2004. aasta $2,4 miljardi taset peetakse pisut kõrgeks.

Järgmise aasta osas oli Chang tagasihoidlik ning pooljuhtidele erilist kasvu ei prognoosinud. Pikemas perspektiivis (10 aastat) on mees aga optimistlik ning näeb pooljuhtide töötstusele 7 kuni 8% aastast kasvu. Ja mis 2005. ja 2006. aastal tegemata jääb, tuleb korvata järgmistel aastatel.

-

Kel huvi, siis ka tänase börsipäeva alguses chat, vaatame kust ISSX ja SLAB kinni panna.

-

Rev Shark:

"Small opportunities are often the beginning of great enterprises."

-- Demosthenes, Greek Orator, circa 383-322 BC

After two dramatic reversals last week we started off the final week of the month with rather quiet action. The indices danced around somewhat out of tune with crude oil prices but generally followed their lead. The senior indices continued to look a bit ill but there were some pockets of upside action, particularly in the small-cap stocks.

The market, like the vast majority of polls and pundits, is uncertain how the presidential election is going to turn out, and that is likely to keep us pinned in a trading range. The market simply can't price in the election results, be they good or bad, until it has inkling as to what they will be. So the likelihood is that the indices stay stuck.

That doesn't mean there aren't some good opportunities in this market, particularly in the smaller stocks. In a benign trading range market environment it is often easier to identify unusual action and potential opportunity. There are always aggressive traders looking for action and when things are quiet this "hot money" often creates some good trading for the nimble trader. A good example yesterday was the stem-cell stocks, which made big moves as traders piled in all day long.

Adding a little further interest to this trading environment is the October year-end. Quite a few funds use an October fiscal year-end and that means we may see some window-dressing games the rest of the week. Since the smaller stocks are easier to manipulate, they are obviously more susceptible to end-of-month games and that may also create some trading opportunities.

A third reason smaller-caps are offering more potential now is that there were and are some pretty good earnings reports among the small guys, unlike the majority of bigger-cap stocks. If you are looking for stocks that posted good growth and gave some guidance, you have no choice but to dig into the thinner issues.

I have often found some of the best trading in rather quiet markets, with a slight upside bias, which looks like what we have at the moment. However, as we saw last week, we have to be on guard for quick reversals. If crude oil is pressured down a bit and the dollar stabilizes, we are likely to see some buying interest.

Overseas markets edged up overnight and oil is down. Gold is pulling back after a breakout move yesterday but there is obviously some momentum in the metals. We have the consumer confidence report due out at 10 a.m. EDT, which may produce a jiggle or two, and plenty of earnings reports to keep us on our toes although few have broad market impact.

Be ready to trade. I suspect there should be some opportunities in smaller stocks for the aggressive.

Gary B. Smith:

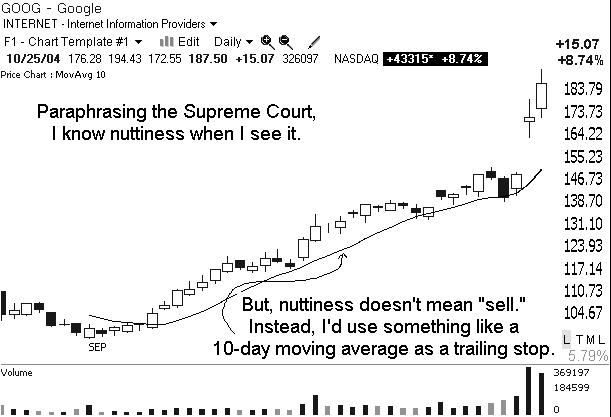

Smith @ GOOG

-

Gapping Up

NVDA +9.5% (raises Q3 sales guidance), LVLT +13% (Comcast likely to call on co for services - WSJ), DAL +10% (JP Morgan upgrade, short squeeze), WRLS +10% (announces contract with Cellpoint), CRGN +9.2% (co and Bayer advance investigational compound for diabetes to preclinical phase), MMC +9.1% (analysts incrementally more positive; Spitzer will not prosecute MMC after the co agreed to name a new CEO), CSGS +8.7% (reports Q3, beats by $0.03), LCAV +8.1% (beats by $0.04, ups guidance), HGSI +7.5% (signs deal with GSK, reports Q3), GIVN +7.4% (receives marketing clearance for PillCam ESO video capsule), ISSX +6.6% (FBR upgrade after reporting Q3), VISG +4.4% (reports Q3, revs well above consensus), AIG +4.4% (in sympathy with MMC), CIT +4.3% (in sympathy with MMC), SEPR +4.2% (reports narrower than expected loss), SIRI +1.8% (radio to be offered in BMW sedans).... Under $3: INSG +30% (to work with QCOM to expand the platform support), EMRG +3.3%.

Gapping Down

Stocks down on weak earnings/guidance: SLAB -17% (also two downgrades), FLEX -8.3% (also multiple downgrades), ATRS -7.5% (also Jefferies downgrade), SMTC -4.7%, FLSH -4.6%, INSP -3.5% (also Pac Crest downgrade), TLAB -2.6%.... Other News: DVA -15% (receives DOJ subpoena), PPHM -15% (Tarvacin IND update), APOL -5.5% (Piper downgrade), AH -4.3% (to issue $300 mln convertible notes), GBTS -4.2%, QCOM -3% (Morgan Stanley downgrade), .... Stem Cell stocks are weak: STEM -17% (reports Q3, offers 7.5 mln shares at $3 each; profit taking from 51% move yesterday), Down in sympathy: GERN -3.5%, ASTM -3.5%. -

11:48 REDE RedEnvelope -- Small Cap Profile (8.83 +0.02)

Shopping.com (SHOP 26.85 +8.85, +49%) is the trading stock of the day as this IPO is flying out of the gate (see InPlay 10:06 ET for write-up). Price action seems to be driven largely by GOOG carryover momentum. One name that seems to have been largely forgotten (avg volume only 22K now) but seems to have as good or better name recognition is RedEnvelope, which focuses on upscale gifts. This gift retailer offers a wide assortment of high-quality, thoughtful gifts, many of which are difficult to find elsewhere and are not easily replicated. Its merchants travel the world, sourcing unique products and often commission artists and vendors to create exclusive gifts just for RedEnvelope shoppers. Gift-wrapped products are delivered to the recipient in a branded, high-quality red box with a hand-tied ivory ribbon.... Granted, REDE is not yet profitable on a yearly basis but that's expected to change next fiscal year. However, on a price/sales basis, REDE trades at less than 1x current yr sales while SHOP trades at nearly 5x sales (even assuming SHOP's 2003 sales growth rate of 131%, which is likely optimistic as the co's base grows). Briefing.com cautions that REDE reports Q2 (Sep) results after the close tonight and a seasonal loss is expected. If co posts decent qtr, may see traders take a look at the name in the near future, especially given the approach of the holiday selling season and should SHOP continue to find momentum interest.

LHV Pro all lisainfot REDE kohta. -

IBM teatas $4 mld eest oma aktsiate tagasiostmisest. Turult väga leige reaktsioon. Pullidel võhm väljas?

Tuletan meelde, et mid-term oleme ikka allatrendis...

sB -

Neljapäeval on oodata Dreamworksi börsiletulekut. Kas analüütikud ennustavad samuti "kiiret" starti?

Kas ja kuidas saab IPO-sid osta enne börsi? -

Bettie

Mida sa veel ET-st arvad, mul juba 1,5 aastat aktsiad käes. Tookord kiitsid ja kandis vilja, aga praegu? -

Stocker,

Palju õnne, et on kannatust olnud nii kaua hoida. Ma arvan, et E*trade (ET) on siiani hea firma ning ka praegustel tasemetel allahinnatud. Usun, et paari-kolme aasta persp ei ole veel 100% hüpe välistet.

Ma tahaksin ET puhul näha edusamme korralikuma treidimisplatvormi ehitamisel sest everyone's a trader these days. Vastasel juhul lähevad kõik aktiivsemad kliendid konkurentide juurde üle. Üks aktiivne treider võib olla rohkem väärt kui 500-1000 tavainvestorit.

Minu portfellis on ET asemel praegu EELN. Rohkem leverage. -

Bettie,

Ka minu portfellis leidub EELN - ausalt öeldes juba peaaegu aasta otsa. Sai vist ikkagi veidi liiga vara sisse hüpatud, aga see juba tagantjärele tarkus...

Kui õieti mäletan, pakkusid kunagi prognoosiks 5 dollarit(võin ka eksida). Tahaks teada, kas aja jooksul on su prognoos muutunud või on ka praegu samal tasemel? Ise loodan leida kannatust umbes pool aastat või ka vajadusel siis veidi rohkem veel hoida. -

Värskendan Su mälu joel2,

... teemal, kus ta nägi praegustes tingimustes õiglast hinda $5-7 vahel ning olukorra paranedes üle $10. Minu enda hinnasiht poole aasta eest oli seal $7 kandis ning on sama ka praegu. Ajahorisont aga suht ähmane 11/05/04

aga eks me kõik oleme inimesed -

ET-ga olen rahul küll, ajahorisont teised 1,5. Stopp praegu 9.5 juures

-

Joel2, pikaajalise investeerimise puhul peabki kannatust olema ja ei saa öelda, et sa liiga vara sissehüppamist saaksid veaks lugeda - aktsia oleks võinud ka juba varem suuna ülespoole võtta. Seetõttu pean väga mõistlikuks fundamentaalsete positsioonide soetamist osade kaupa (mida ka Oliver väga korduvalt välja toonud).

-

Olen ka see kes aasta tagasi soetas EELN 4$ tasemelt. Lisa tahan juurde võtta peale 4.nov, kui tulevad tulemused. Arvan, et midagi väga head oodata ei ole. Parem lakmus oleks see, kui tulevad halvad tulemused ja aktsiahinda enam alla ei suudeta suruda, siis võtan ligi juba kordi rohkem.

Aga, et suund juba ülesse on võetud? Ehk väike kommentaar? Ise näen tehnilist vastupanu 2,15 tasemel ja mitte päevasisest, vaid nädalalõpu sulgemishinda. -

Pole ise EELNi eriti jälginud, kuid praegu paistab positiivne, et $2.00 kohale on suudetud püsima jääda. Kui $2.30 murtakse, siis võib juba võetakse selgemat suunda ülespoole.

-

Samad sõnad. Kui $2.00 tase püsib ka peale 4.nov, siis perspektiivis on vastupanu $2.50, kus praegu asub ka 200 päeva keskmine.

-

Minu arvates on EELN selline aktsia, mille puhul ei tasu eriti tehnilist analüüsi teha. Leverage on suur ja piisab ka väikesest summast, et õnnestumise korral head raha teenida. Ajad on hetkel firma jaoks ebasoodsad (vt kasvõi CFC pidevad kasumihoiatused) ja sellepärast seal $2 juures ka ollakse. Firma vajab praegu aega, et käivet kasvatada. Mingil hetkel kulud enam käibega samal kiirusel ei kasva ja siis tuleb välja netibusinessi tegelik eelis. Iga lisadollar käivet kukub suurema hooga kasumireale.

Tsükli pöördudes ilmselt $10+ aktsia.

sB -

Kristjan,

Tänan kommentaaride eest. Ja ausalt öeldes olen ka kasutanud nõuannet mitmes osas soetada. Seetõttu ei saa nagu eriti kurtagi, sest hetkel küll vaid kahes osas soetatud, aga keskmine hind umbes 2,8. Võrreldes velvoga ikka omajagu madalamal..

Bettie,

Samuti tänud vastamast. Ja pean sinuga igal juhul nõustuma. Olen jälginud EELN-i ja püüdnud tehnilist analüüsi rakendada edasiste liikumiste prognoosimisel, kuid... kuidagi ei taha see aktsia ''tehnilise analüüsi reeglistest'' kinni pidada. Jälgisin ka CFC tulemusi, kui need välja tulid - tuleb tunnistada, et asi ei tundunud just roosiline (kaugel sellest). Ei jää vist muud tõesti üle, kui tsükli pöördumist oodata.. Prognoos on igati kindlust sisendav.

Tänud

Velvo,

Ega midagi muud ei olegi soovida, kui - kannatlikku meelt ja eks vaatab, kes kauem vastu peab ;) -

Mehed, ärge armuge aktsiatesse. Selline soovitus Teile - cut the losses , let the profits run

-

Mina vaatan graafikut nädala lõikes, seal annab ilusaid jooni tõmmata. Ka ise olen juurde ostnud, kuid enam ei kiirusta. Edaspidi võtan lisa siis, kui minu jaoks olulised tasemed ületatakse.

-

rick12,

Olen sellest varemgi kuulnud ja iseenesest nõus. Aktsiatesse armuda ei tohi, see tähendab asju enda jaoks ilustama hakata on jabur jne. Aga pikaajaline investeerimine on minu arust ikkagi teine asi... -

Miks keegi dreamworksi IPO-t ei taha kommenteerdai?

On see ju filmiäris üks lähiaja olulisemaid sündmusi. Ja sellest ipost võib nii ulmet kui draamat pikemas perpektiivis tulla. Ise olen tuline dreamworksi edusse uskuja.

Paar shrekitaolist edulugu veel ja annabki tugevalt computer-generated animafilmide konkurentidele tugevalt kinga. -

Ise ei oma arvamust DreamWorksi IPO kohta, kuid siit üks WSJ artikkel:

Hype greets DreamWorks' IPO. Will it last?

THE PLANNED PUBLIC OFFERING of shares in DreamWorks Animation is generating Hollywood-style buzz. That's not surprising, given the box-office success of the studio's Shrek 2, and the company's high-profile shareholders, including founders David Geffen, Jeff Katzenberg and Steven Spielberg, as well as Microsoft co-founder and billionaire Paul Allen.

Behind the hype, however, is a less glamorous reality: DreamWorks generally operated in the red until this year's release of Shrek 2, its sequel about a lovable ogre, and Shark Tale, its current box-office hit. Shrek 2 is the No. 3-grossing movie ever, with $437 million in domestic revenues, trailing only Titantic and Star Wars. Shark Tale, has taken in $94 million domestically just since its Oct. 1 release.

DreamWorks Animation, which is being carved out of DreamWorks Studios, plans to sell 29 million shares at a price ranging from $23 to $25 a share. With 105 million shares outstanding, Dreamworks Animation will be valued at $2.5 billion, about half the market value accorded Pixar Animation Studios, the digital animation studio founded by Steve Jobs.

In the five years ended in 2003, DreamWorks Animation lost a total of $269 million, including $187 million last year, when its Sinbad movie bombed. Pixar, on the other hand, has been consistently profitable, thanks to hits such as Finding Nemo and Monsters Inc. Its shares are up 15%, to 80, this year, buoyed by hopes its forthcoming movie, The Incredibles, will be another hit.

This year DreamWorks is firmly in the black, largely due to Shrek 2. It netted $67 million, or 86 cents a share, in the first six months of 2004.

The current quarter also should be strong, given Shrek 2's November video release. The DVD stage is the most lucrative period of a movie's life, because production and marketing costs largely are expensed prior to the video release. If DreamWorks sells 30 million copies of Shrek 2, that alone could mean $200 million in pretax earnings.

Aside from the Shrek franchise, DreamWorks hasn't had any blockbusters among its nine animated movies. One potential concern: its ambitious release schedule. The company plans to turn out two movies next year, and three in 2006, including Shrek 3. It needs to produce winners because it will have hefty operating expenses of $370 million in 2005.

Pixar has done well, in part, because it takes its time. The Incredibles will be released 18 months after Finding Nemo.

Some investors say they're cautious about DreamWorks because of its spotty financial record and aggressive release schedule. But animated movies probably are the surest thing in the film business because of limited supply, strong video sales and a large audience of kids. Theater owners like them because they typically run 90 minutes, allowing more show times per day than live-action features. But competition is growing from Lucasfilm, Sony and Disney.

Katzenberg and Geffen will control DreamWorks Animation, with a combined holding of 48 million super-voting class B shares. Katzenberg is DreamWorks' CEO. The company will emerge from the offering with a decent balance sheet, with $175 million of cash and about $300 million of debt. Tangible book value will be about $5 a share.

Expect strong investment demand for DreamWorks given Shrek 2's and Pixar's success. But the company needs to generate profits consistently if it wants to ensure sustained applause. -

DreamWorks Animation, the creator of "Shrek" and "Shark Tale", priced its IPO at $28 per share (above the $23 to $25 range the company had previously indicated) with the help of Goldman and JPM in raising $812 mil.

-

ja dreamworks (DWA) avanes 38 pealt :-D