Börsipäev 28. oktoober

Log in or create an account to leave a comment

-

Täna enne börsipäeva tulevad tulemustega nii ANDW kui PNRA, chatis siis kajastame sündmusi kõige kiiremini. Alustame ca. kell 14.15.

-

PNRA numbrid väljas, tõmmati järgmise aasta kasumit allapoole (oodati $1.60 EPS, uus number $1.50-1.55). Hindu hakkame nägema kella 14.00 paiku, siis ka kommentaarid.

-

Turud tegid naftahinna languse toel eile karudele päris kenakese üllatuse. Indeksid viidi endiste tippude juurde ning üldpilt muudeti tehn. perspektiivist küll päris kenaks. Futuurid on täna hommikul jälle rohelises. Ainuke pullide tuju rikkuv asi on dollari jätkuv nõrkus euro ning seekord ja jeeni vastu (kuigi see trend tundub ka viimaste minutite jooksul pöörduvat).

Suuri uudiseid täna hommikul ei ole:

- Panera Bread (PNRA) tuli välja tulemustega, mis jäid ootustele alla. FY05 prognoosid 1.50-1.55 EPS vs 1.60 konsensus. Down we go.

- Ask Jeeves (ASKJ) tuli välja tulemuste ja prognoosidega, mis jäid allapoole ootusi. Siiski on tegemist ilmselt muust internetisektorist isoleeritud looga. Google (GOOG) moodustab 70% firma käibest, mis tähendab, et tegemist on põhimõtteliselt edasimüüjaga. Miks selliseid üldse vaja on?

- MarketWatch (MKTW) paneb ennast müüki ca $400 mln eest. Sellel aastal peaks firma genereerima $75-80 mln käivet. Erilist preemiat see $400 mln ei sisalda.

- Barrons soovitab müüa Overstock.com (OSTK) aktsiad ning osta sama raha eest Amazoni (AMZN) omasid. Siiski, esimesel on vähemalt suur short interest. AMZNi viimase kvartali tulemused olid väga nõrgad.

Graafikud (briefing.com):

-

REUTERS China central bank raises interest rates

BEIJING, Oct 28 (Reuters) - China's central bank raised interest rates on Thursday, lifting the benchmark one-year yuan lending rate to 5.58 percent from 5.31 percent, and the rate on one-year deposits to 2.25 percent from 1.98 percent.

Futuurid paugust miinusesse. -

Dendreoni (DNDN) fännidele täna uudis:

he pre-specified 36-month final survival analysis of the double-blind, placebo-controlled study of Provenge in 127 patients with asymptomatic, metastatic, androgen-independent prostate cancer showed a statistically significant survival benefit in the overall intent-to-treat patient population, defined as all patients randomized in the study regardless of their Gleason score. This survival benefit is greater than that observed with any type of treatment in any published Phase 3 study in late-stage prostate cancer. In addition, at the 36-month final follow up, the percentage of

patients alive in the Provenge-treated group is substantially greater than the percentage of patients who received placebo.

Mitte just hiiglaslik üllatus aga kindlasti väga positiivne.

sB -

PNRA tulemused allpool, raske öelda palju kukkumisruumi, sest erinevaid mõjutavaid tegureid (nt. short interest), kuid usun, et 10% ikka, mis peaks kasumiks piisav olema. Ootame hindu.

07:09 PNRA Panera Bread reports in-line; guides FY05 below consensus (40.10 )

Reports Q3 (Sep) earnings of $0.28 per share, in line with the Reuters Estimates consensus of $0.28; revenues rose 32.4% year/year to $113.8 mln vs the $116.6 mln consensus. Company expects Q4 (Dec) EPS of $0.42-$0.44 vs. Reuters Estimates consensus of $0.44; sees FY05 $1.50-$1.55 vs consensus of $1.60. -

ANDW tuli keerulisemate tulemustega - antud kvartal löödi võimsalt üle, kuid järgmise kvartali prognoos mitte väga tugev. Näeks kerget liikumist ülespoole.

07:25 ANDW Andrew Corp beats by $0.05, beats on revs; exiting automotive and mobile antenna market (12.70 )

Reports Q4 (Sep) earnings of $0.10 per share, excluding $0.10 in charges, $0.05 better than the Reuters Estimates consensus of $0.05; revenues rose 41.4% year/year to $487.8 mln vs the $459.8 mln consensus. Co sees 1Q05 EPS of $0.07-0.10, ex items, Reuters consensus is $0.09, expects revs in the range of $440-470 mln, Reuters consensus is $470 mln. Co also announced that it is exiting its automotive and mobile antenna product lines and selling the mobile antenna product line to PCTEL, Inc., for $10 mln in cash. -

ANDW conference call täna vahetult enne börsi ja PNRA oma peale börsi. Praeguseid liikumisi kommenteerime chatis.

-

Ajalooliselt käesoleva nädala taustast natuke. Lisaks fondide toetusele ja naftahinnale tahtsid kindlasti paljud turuosalised aasta ühest "kuumimast" nädalast osa saada, mis võis tuua omajagu lisajõudu.

The Best Week

Change in the S&P 500 in the last five trading days of October, by yearSPX Year Open Close Change % 2003 1028 1053 2.43% 2002 884 897 1.47% 2001 1073 1104 2.89% 2000 1395 1429 2.44% 1999 1293 1362 5.34% 1998 1072 1098 2.43% 1997 876 903 3.08% 1996 697 701 0.57% 1995 576 584 1.39% 1994 460 472 2.61% Source: Bloomberg -

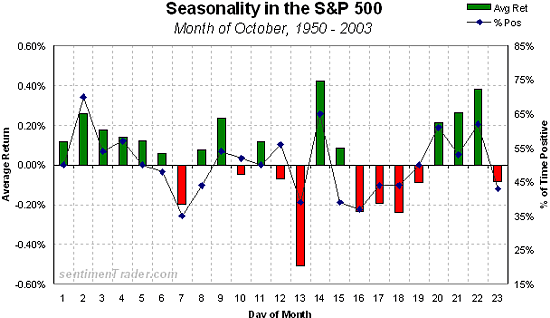

Lisan ka uuesti graafiku, mille Avalöögis välja tõin - ka siin on näha tugevus oktoobri lõpus. Tähele tasub panna, et viimane päev on siiski enamasti negatiivne.

-

Kui statistika jagamiseks juba läks, siis veidi pooljuhtide kohta:

*** The performance of the SOX is up 70% of time in Q4 over last 10 years with an average gain of 32% in positive years

*** Only negative Q4 years were after HUGE 1st half gain

*** The results are even more dramatic in those years with negative 1st half performance -

Rev Shark:

"Life is a perpetual instruction in cause and effect."

-- Ralph Waldo Emerson

Stock market participants are always looking for simple explanations as to why the market did what it did, and market commentators are usually happy to oblige. If the market is up it usually isn't too difficult to find some positive news to explain it in a sentence or two.

Our desire for clarity and simplicity about the stock market often obscures what is really happening in the market. For example, virtually everything written about yesterday's market action attributed the move to the drop in crude oil prices. It is a very logical and easy cause-and-effect relationship to explain what happened: oil down, stocks up.

The reality of what moved the market is much more complex. Certainly the drop in oil was a positive development but it probably merely accelerated the prevailing inclination rather than caused it. End-of-the-quarter portfolio adjustments, rotation into technology and a number of other less obvious factors were probably major reasons for the move as well.

To a great extent the market doesn't move because of news. It moves because it is ready, and we simply conform the news so that it fits with what the market does. For example, in recent months there were many days where the market was strong even though crude oil prices were rising. The cause-and-effect relationship didn't exist on many days but that doesn't stop us from concluding that it exists on other days.

In Jeff Cooper's columns his primary focus is on the "rhythm" of the market. He looks at cycles and angles and numerical relationships and other things that I don't really understand. I often am mystified by the way he arrives at his conclusions but the conclusions themselves can explain why the market is doing what it is doing far better than parsing the news flow.

The market will do what it wants when it wants and the news is just a much more convenient explanation for what happened than something that seems almost mystical, like Cooper's wheel of price and time. Yesterday, market conditions were ripe for an upward move and that is what we got. Don't be too quick to jump to conclusions as to what news may have caused it.

We have a weak start to the day even though crude oil continues to drop. Earnings reports last night were generally mediocre and news is hitting right now that weekly unemployement claims ticked up a bit higher than expected.

The market has not had much success with follow-through in recent weeks and I'm sure many are considering that today. If profit-taking persists beyond the opening 30 to 60 minutes we could see yet another nasty reversal. I'll be on the defensive this morning until we see what sort of mood the market is in.

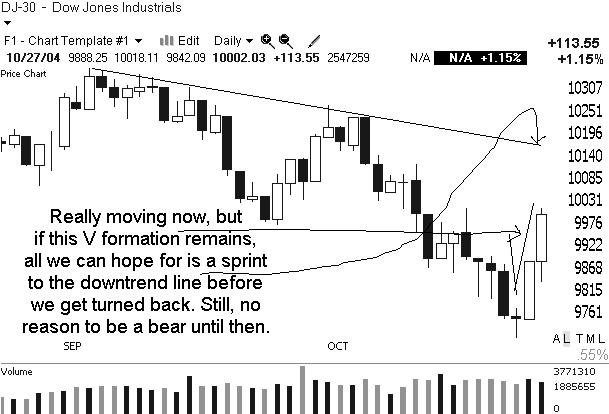

Gary B. Smith:

-

Gapping Up

Stocks up on strong earnings/guidance: KOMG +14%, MVL +13%, ARBA +10% (also RBC upgrade), DYN +10%, WRLS +8%, IMAX +8%, PTEK +7.7% (also Roth upgrade), FHRX +7.3%, SWIR +5%, QSFT +4.7% (also Legg Mason upgrade), NWL +1.9%..... Other News: DAL +27% (reaches tentative agreement with pilots on cuts, Bear Stearns upgrade), DNDN +23% (provides Phase 3 data), AAII +17% (momentum from 59% move yesterday on allergy drug approval, also a short squeeze as 50% of float is short), ENCY +15% (PFE's Viagra shows promise in treating hypertension; ENCY is developing an experimental treatment called Thelin, Brean Murray upgrade), ISON +13% (momentum from 18% move yesterday on huge volume), HEPH +6.8% (co appeared on CNBC this morning, also 22% of float is short), CVTX +5.7% (First Albany upgrade), AMR +5.1% (in sympathy with DAL), RD +2.3% (will merge its Dutch and British holding firms).... Stem Cells are strong ahead of California vote on Tuesday: STEM +4.6%, ASTM +4.1%, GERN +4%.... Under $3: STKR +24% (reports Q3), DDDC +6.5% (reports Q3), ZTEL +2% (momentum from 129% move yesterday).

Gapping Down

Down on weak earnings/guidance: ASKJ -25% (also downgrades from Pacific Growth, AmTech, OpCo and Susquehanna), ESST -16%, ABB -13%, KG -11%, IMCL -9.4% (co beat but Erbitux sales disappoint, also tax rate is ramping quicker than analysts expected), JDSU -8.3% (also Roth downgrade), AKAM -7.6% (also Stanford downgrade), FEIC -5.4%, SWKS -2.7% (expects "modest" sequential rev growth).... Other News: SHOP -5.7%, TOMO -7.4%, AAUK -4.5%. -

Straddle peaks ka täna kõiki rõõmustama, APCC +25%

-

APCC puhul katan pool positsiooni järelturul aktsiatega - kindlustame pea 100% kasumit.

(müüa 100 aktsiat 1 lepingu kohta kindlustab kasumi). -

APCC reitingu alandamise peale veidi madalamal ($19.50)

07:02 APCC American Power downgraded at First Albany (17.08 )

First Albany downgrades APCC to Neutral from Buy following strong Q3 results, based on valuation. While Q3 exceeded expectations, firm says the stock was already trading above the $20 level in the after mkt, which is ahead of their tgt of $17.